A version of this article appeared in the World Economic Forum.

The recent volatility of the steel markets in pricing and demand, especially after the all-time high set in 2021, offers global producers — particularly in Europe — a window of opportunity to distinguish themselves as leaders in decarbonization. This will require a shift in production to green steel — that is, steel produced without using energy from fossil fuels — and that will take quite a bit of investment, starting now.

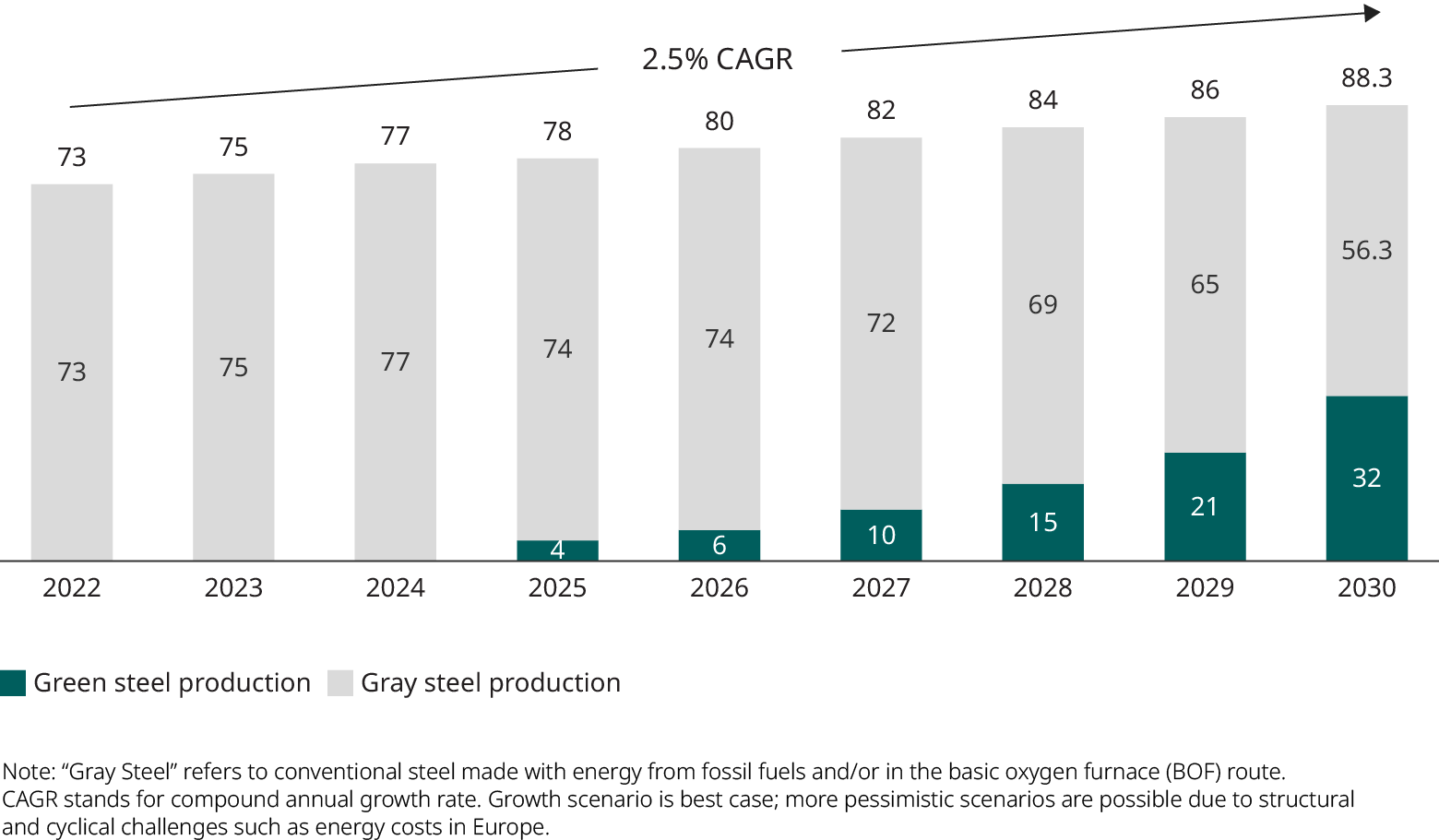

Still, with the strong post-pandemic demand for this building block of the global economy and ever more policies and regulations pushing green technologies, the situation is ripe for steel producers willing to commit the necessary resources to redefine the industry. We anticipate the push for green steel to produce 700% growth in total production between 2025 and 2030.

Cross-industry partnerships are key

Steel producers cannot change the industry alone. The key to the transformation in steel will be partnerships, joint ventures, and alliances with other industries, including energy, mining, chemicals, private capital, and end users such as automotive and construction companies. The future leader in steel will be the producer that can create and manage new industrial ecosystems that can build the necessary infrastructure to help the global supply chain transition from carbon-intensive steel to green.

While most of the technology needed to produce green steel already exists in pilot form at least, decarbonized steel production still needs the infusion of sizable capital expenditures (capex) in excess of €2 trillion to €3 trillion for capacity to reach commercial scale. That amounts to an average investment of €1,000 to €1,500 per ton of steel produced annually.

It is unlikely that any steel producer or even the entire industry en masse would be willing to supply the magnitude of capex necessary. But by joining forces across industries, steel can pool resources with deep-pocketed industries that also will benefit from steel’s conversion.

To facilitate a ramp up in green steel, the industry must also deal with the shortage of renewable energy — probably the biggest immediate obstacle to steel’s efforts to decarbonize.

The International Energy Agency (IEA) has stressed that the period between now and 2030 must become one of unprecedented clean energy investment, requiring the addition of some 630 gigawatts (GW) of solar photovoltaics and 390 GW of wind by the end of this decade. That would be four times the record levels set in 2020 and would require trillions more investment dollars to build the necessary renewable energy capacity. But this effort will need the support of the global economy, not just one industry.

Urgent need to act

The next seven years will be make-or-break for steel, given how long it will take to build these ecosystems and transition the industry. To be a survivor over the long run, a steel producer will need to be a part of one of these networks. Otherwise, it would likely go out of business or become so peripheral to what will eventually become a global green steel market that it might as well be.

This is not only because the demand will increasingly shift to green steel. Banks and institutional investors — on their own quests to decarbonize portfolios — are already raising the cost of capital to carbon-intensive businesses, meaning growth or even operational improvements may come at a steep price.

There are opportunities available for green steel providers, with a little boldness and willingness to break the industry’s mold, to transform steel into a global economic model for decarbonization.

Read the original article here.