Last year, it seemed that the chemical industry would emerge from the COVID-19 crisis with a shift in focus to its longer-term strategic challenge — driving sustainability and accelerating decarbonization. However, the Russian invasion of Ukraine in February 2022 sparked unprecedented volatility in energy prices, gas supply shortages, ongoing supply chain disruptions, rising political tensions, spiking inflation, and growing signs of recession. The disruptions in the global energy market have exposed structural weaknesses and the chemical industry has been forced back into crisis management mode.

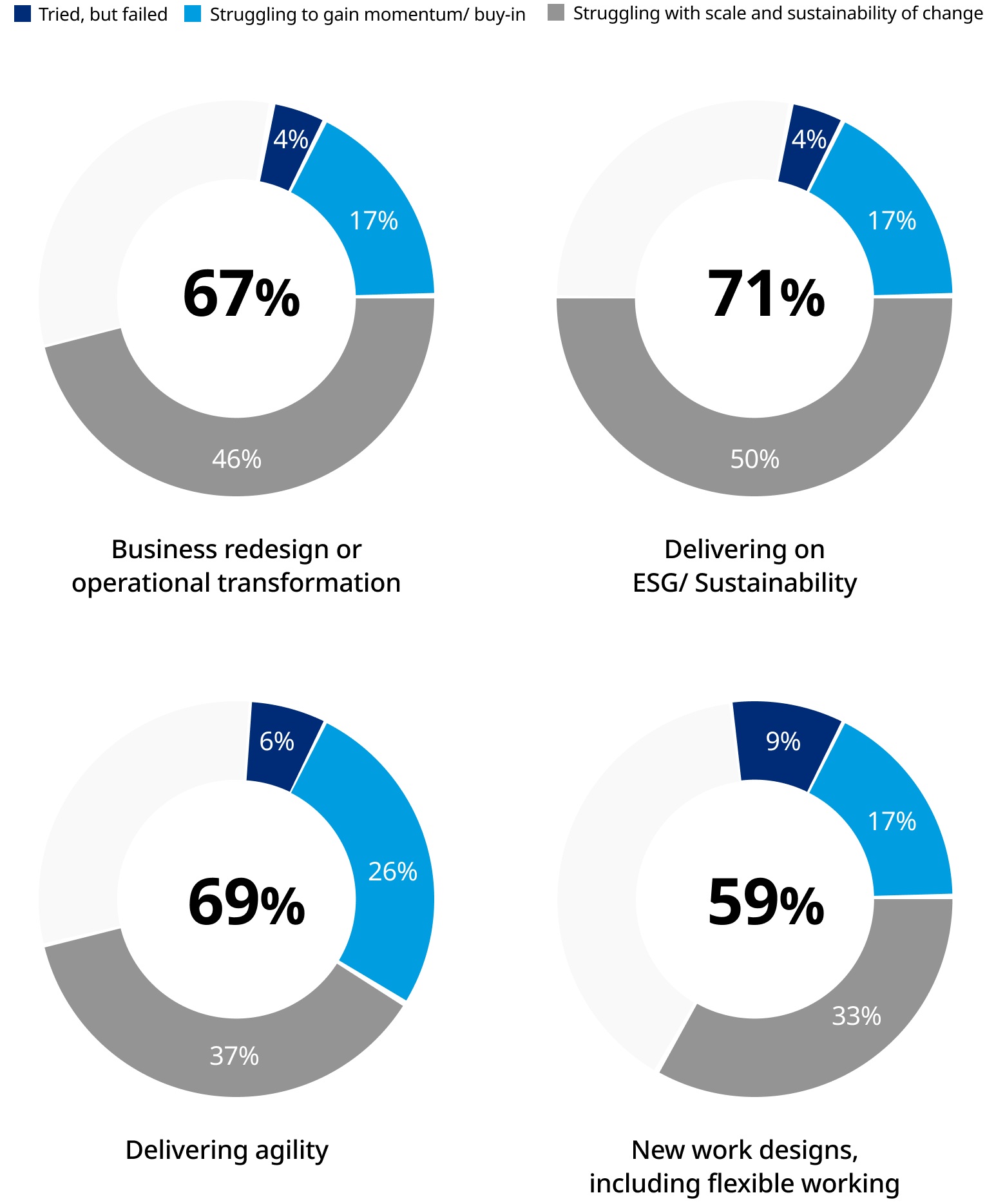

In this environment, businesses must be willing and able to adapt. Yet the latest research by our sister company Mercer shows that chemical executives find limited success in increasing organizational agility and fostering redesigns of business models and processes, with most initiatives falling short due to a lack of momentum and buy-in or because they struggle to achieve scale. Likewise, delivering on an environmental, social, and governance (ESG) agenda also seems particularly challenging, given the corporate cultural change, strong leadership, and consistent reinforcement of new priorities and values that are required (Exhibit 1).

With market volatility remaining, there is no doubt about the urgency to balance short-term solutions with long-term strategy to build resilience and ensure future viability of business models. And while transformation is certainly not a new theme in the industry, emerging trends are forcing business leaders to create lasting change if the industry is to weather the storm in 2023 and beyond.

Sustainability will become standard

While most chemical companies have made sustainability a board-level priority, integrated the topic into their corporate strategy, and established dedicated units to oversee strategy and roadmap development, further steps are needed. And although there is some acceptance of jeopardizing net-zero commitments in exchange for energy supply security — for example Germany bringing back 12 idled coal power plants back online — the pressure to deliver on ESG commitments will prevail.

The industry is exploring alternative solutions for feedstock and power — with biogas, hydrogen, and electric heating being considered as replacements for natural gas (as outlined in this Oliver Wyman article). However, many of these technologies are immature or lack scale, and so understanding material pathways, engaging with suppliers, and getting access to relevant reliable data will be the new challenges for chemical businesses. Furthermore, anchoring the ESG agenda across all levels, integrating a sustainability risk and opportunity lens into daily business and decision-making, and having a clear organization and governance in place to steer execution and address new regulatory requirements will be essential.

Companies also must undergo a cultural shift. There is still limited understanding in the broader management and employee base of what ESG means to company operations and stakeholders. Also, the topic is often driven via ad-hoc interventions instead of repeated engagement to change behaviors.

Sustainability needs to become embedded within functions — similar to health and safety. For instance, reducing Scope 3 emissions requires procurement to emphasize its focus on supplier relationships in markets with fast-changing technologies, being able to pragmatically judge the state of the market and lock in emissions reductions while realizing cost savings as technologies mature. Building a data-driven backbone — based on an early analysis of the type of data needed and honest discussion on the availability and quality of data — is a key element to building future-proof ESG organizations.

The need for speed in transforming businesses and portfolios will continue driving chemical companies to explore mergers and acquisitions (M&A) as a strategic means to catalyze change.

Sustainability is driving deals in two ways. First, by adding to the net-zero agenda through acquiring innovative technologies, gaining a position in emerging ecosystems such as the recycling or bio-based space, and by achieving scale in activities that shrink carbon footprints. Second, companies need to apply an ESG lens throughout the M&A process. Executing ESG due diligences and having transparency on a target’s (or divestment’s) impact on the company’s emissions, ESG risk exposure, or net-zero roadmap will become a normal element of deal execution.

Regional dynamics will impose structural challenges

Across the globe, we’re witnessing pressure on chemical value chains – with Europe facing supply-driven inflation, and North America dealing with demand-driven downturn due to consumer sentiment and a decrease in willingness to pay. To ensure future competitiveness, chemical players are taking a closer look at their geographic footprints. Over the last few years, the industry has seen a shift in where production takes place — with Asia, and especially China, increasingly becoming the go-to region due to the lower labor and energy costs combined with high demand growth from customer industries in the region. Some leading industry players have already decided to downsize “permanently” in Europe due to its structural cost disadvantages. However, in light of increasing geopolitical tensions and the resulting supply chain risk for the industry and its customer value chains, chemical players need to thoroughly scrutinize their large-scale investment plans in regions beyond Europe so that they are managing the overall enterprise risk and not replacing one market dependency with another.

As we move into 2023 and beyond, energy intensive industries, such as the chemical sector, will concentrate their investments in regions with reliable and competitive energy supply more than ever before. While this might not work in Europe’s favor in the short term, the increasing supply of renewable energy and advancements of green technologies could strengthen European players’ competitiveness in the long term as low renewable energy costs spark activity and ESG regulations regarding emissions or human rights move up the agenda. Likewise, North America could be a strong contender for business investment in the future — particularly following the introduction of the Inflation Reduction Act.

Meanwhile in the GCC, the move of national oil companies into chemical value chains could result in a significant structural decrease in petrochemical margins in the years to come, with a knock-on effect on the makeup of the base and petrochemical industry across the globe. As a result, players will look to either alter their cost position by having access to advantaged feedstocks or investments — possibly in conjunction with GCC players to protect their current positioning in the base and petrochemical value chain — or move further downstream and restructure their business models.

Building resilience will become imperative

As a result of inflation and the volatility in energy prices, cost structures for varying product segments have seen dramatic changes. And while companies have built procurement and analytics capabilities to better monitor and manage raw material prices, the increased cost share of energy for production is putting their competitiveness at risk. Building resilience and safeguarding competitiveness becomes an imperative for chemical players. In the short term, traditional commercial excellence levers such as pricing models need to be re-examined to reflect the energy index of products toward customers (as outlined in this Oliver Wyman article). Passthrough rates will differ by chemical segments, with specialty chemicals showing higher resilience due to value-based price models and commodity and base chemicals being more susceptible due to alternatives from global markets. The most effective protection from volatility will come from creating a capability that integrates margin management around sourcing, risk management, pricing, and product and technology development levers.

In the medium and long term, margin resilience requires doubling down on activities the crisis has accelerated, such as securing alternative feedstocks and supply routes (both energy and raw materials), as well as cost efficiency and technological innovation. More strategically, chemical companies will look at their portfolios and geographical footprint to match the demand shifts.

While the key themes of the transformation in the chemical industry remain, the developments of the past year have put additional emphasis on risk mitigation measures and significantly accelerated the need for action around new energy and feedstock supply efforts. To succeed in 2023 and beyond chemical companies must build resilience, accelerate investments in new and greener technologies, and develop M&A and margin management as core capabilities.

Stephan Struwe and Niklas Steinbach also contributed to this article.