Regulations protecting consumers in financial hardship have evolved substantially, increasing lender responsibilities to provide effective support and achieve positive customer outcomes. The journey to develop new hardship protections has occurred over almost three decades, accelerated by events such as the Financial Services Royal Commission, COVID-19, and current cost-of-living pressures.

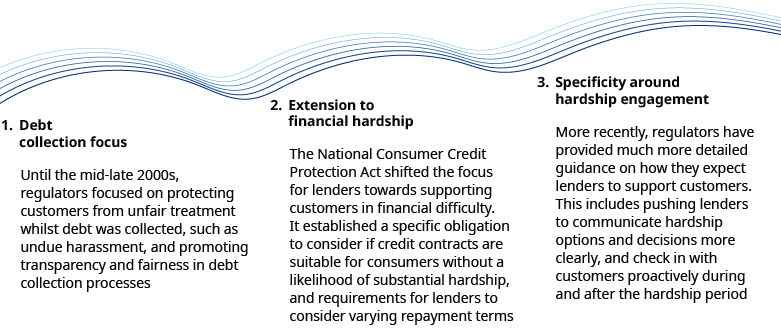

Australian regulators have implemented three waves of reform in how they expect lenders to treat customers facing financial hardship, with an increasing emphasis on customer wellbeing over time. Regulatory focus has shifted from debt collection, to defining when (and for whom) the hardship assessment process should happen, to being more specific about how lenders support customers and engage with them during and post-hardship.

The future of Australia’s hardship framework

To consider the potential direction of Australian financial hardship regulation in the next 12-24 months, looking to the UK can be helpful. Historically, the evolution of regulatory development there has paved the way for similar changes in Australia.

Following several high-profile fines, the UK’s Financial Conduct Authority (FCA) commenced the comprehensive Borrowers in Financial Difficulty (BiFD) review in 2021 to assess lenders’ policies and processes and found several instances where lenders could do more to support consumer outcomes. A series of reforms aimed at bolstering consumer protections are now in motion. The FCA introduced a new Consumer Duty, increased their interventions, and launched a consultation on strengthening regulatory frameworks. Whilst regulation rarely evolves in precisely the same manner across different jurisdictions, we see four themes for how this may influence Australian regulation:

Emphasis on customer outcomes

The Consumer Duty has an overarching ambition to deliver good outcomes for retail customers. Lenders in the UK have correspondingly transitioned their business practices from avoiding poor outcomes for customers to actively seeking good outcomes. New Australian regulations may take the spirit of Consumer Duty and reflect similar principles to put emphasis on the best interests of customer and achieving positive outcomes.

Heightened regulatory focus and action

Interventions with lenders have increased since the FCA released its BiFD project findings. The FCA stopped 627 lenders failing to meet minimum standards from operating in the past year, up 30% on the previous year. Australian regulators have already become increasingly active in keeping a close watch on lenders. We expect to see strong enforcement where obligations have been breached.

Shift from guidance to obligations

The FCA are consulting on embedding aspects of temporary COVID-19 guidance into consumer credit and mortgage legislation. Australian regulators may look to follow suit, embedding stated expectations and guidelines into legislative obligations. Lenders will need to review their financial hardship approach to ensure compliance with any new legal requirements.

Renewed support for customers experiencing vulnerability

The FCA have broadened their definition of customers experiencing vulnerability to consider a spectrum of risks, going beyond traditional definitions. Firms are also revisiting their policies to ensure they are placing a greater emphasis on identifying at-risk customers. The Australian Securities and Investments Commission’s (ASIC) latest Corporate Plan has already stated their priority for protection of high risk customers through their focus on scams and predatory practices.

ASIC has started down a similar path to the FCA, including articulating their expectations for lenders, and commencing a thematic review into the 10 largest home lenders akin to the BiFD review. ASIC’s review will be focused on lenders’ support for customers in financial difficulty; a final report is expected in mid-2024.

Priorities for lenders

Hardship management obligations may continue to change. Lenders will need to consider several areas in the short term, ensuring resourcing and processes are adequate to deal with customers seeking support. Beyond this short term focus, we see three main themes that will be key for lenders to prioritize in the medium to long term: early intervention, multichannel support, and improving customer outcomes. In most cases, this will require investment in data, analytics, and technology. Leading lenders will design now with that future expectation in mind.

Expectations and obligations in the lending industry will continue to evolve. To effectively navigate this changing landscape, lenders should make sure they are giving hardship the right degree of attention alongside other investments.

Additional contributors: Will Illingworth, partner, Maksim Ryabukhin, partner, and Catherine Downes, associate.