This article was first published by the World Economic Forum.

Since 2006, China has been the world’s largest emitter of carbon dioxide (CO2). The 11 billion metric tons of CO2 the nation released in 2020 accounted for about 30% of global emissions that year.

China is also an active participant in the global discussions on how to curb climate change. The country’s latest five-year plan, covering 2021 through 2025, placed decarbonization and the “construction of a green development engine” at the center of policymaking.

To achieve its ambitious carbon peak and carbon neutrality goals, China needs to close an annual funding gap of about RMB1.1 trillion ($170 billion). It can only do so if it manages to develop far-more sophisticated green financing schemes.

In China, bank lending is the backbone of corporate finance. Because of their risk-averse nature, banks tend to target large state-owned and private enterprises, meaning small and medium enterprises (SMEs) miss out on funding — despite accounting for 65% of the country’s CO2 emissions. Public funding must play a more significant role in China to close the substantial gap in net-zero financing.

Four Challenges for Net Zero

To generate the funding required for such a seismic transition away from fossil fuels, industry leaders and policymakers must address four major challenges:

1. Data granularity and quality

Tracking and reporting emissions is fundamental to China’s net-zero transition. China has established national-level Carbon Emission Accounts and Datasets (CEADs). However, further efforts are required to be able to collect and make available all the granular, standardized data that is necessary. For example, regarding emission measurements, further clarity is needed if China’s data are to match the requirements of international standards such as the Partnership for Carbon Accounting Financials and the Paris Agreement Capital Transition Assessment.

2. Funding mismatches

Funding support for net-zero transition efforts has thus far been primarily offered through bank loans, characterized by shorter tenors and rigid collateral requirements and pricing mechanisms. To support net-zero targets, the market needs to respond with longer-dated, blended equity and debt structures. Providing adequate financial support for the net-zero transition of SMEs will also be key, given their significant emissions and role in the economy.

3. Lack of clear policy support

Systemic coordination will be needed from government and industry to develop standards that are aligned across regions, business types, and sizes. For example, production limits for blast furnace steel vary widely, with large-scale state-owned enterprises in East Chinatending to have more flexibility than SMEs in the country’s northeast. Currently, many steelmakers are reluctant to invest in mini mills because of concerns about possible future caps on production.

4. Lack of cross supply chain collaboration

The indirect emissions in a company’s value chain, known as Scope 3 emissions, can be significant in certain industries. Reducing these emissions requires collaboration along a company’s value chain. Scope 2 emissions arising from purchasing electricity, heat, and steam will also need to be addressed through partnerships with power generators. Most companies, however, are focusing mainly on cutting their Scope 1 emissions, those generated directly by sources controlled or owned by the organization.

What is Needed?

Due to the scale of change needed, China’s major carbon-emitting sectors won’t be able to complete their transition journeys themselves. They need support from the government and financing providers. They also need active collaboration from firms in their value chain.

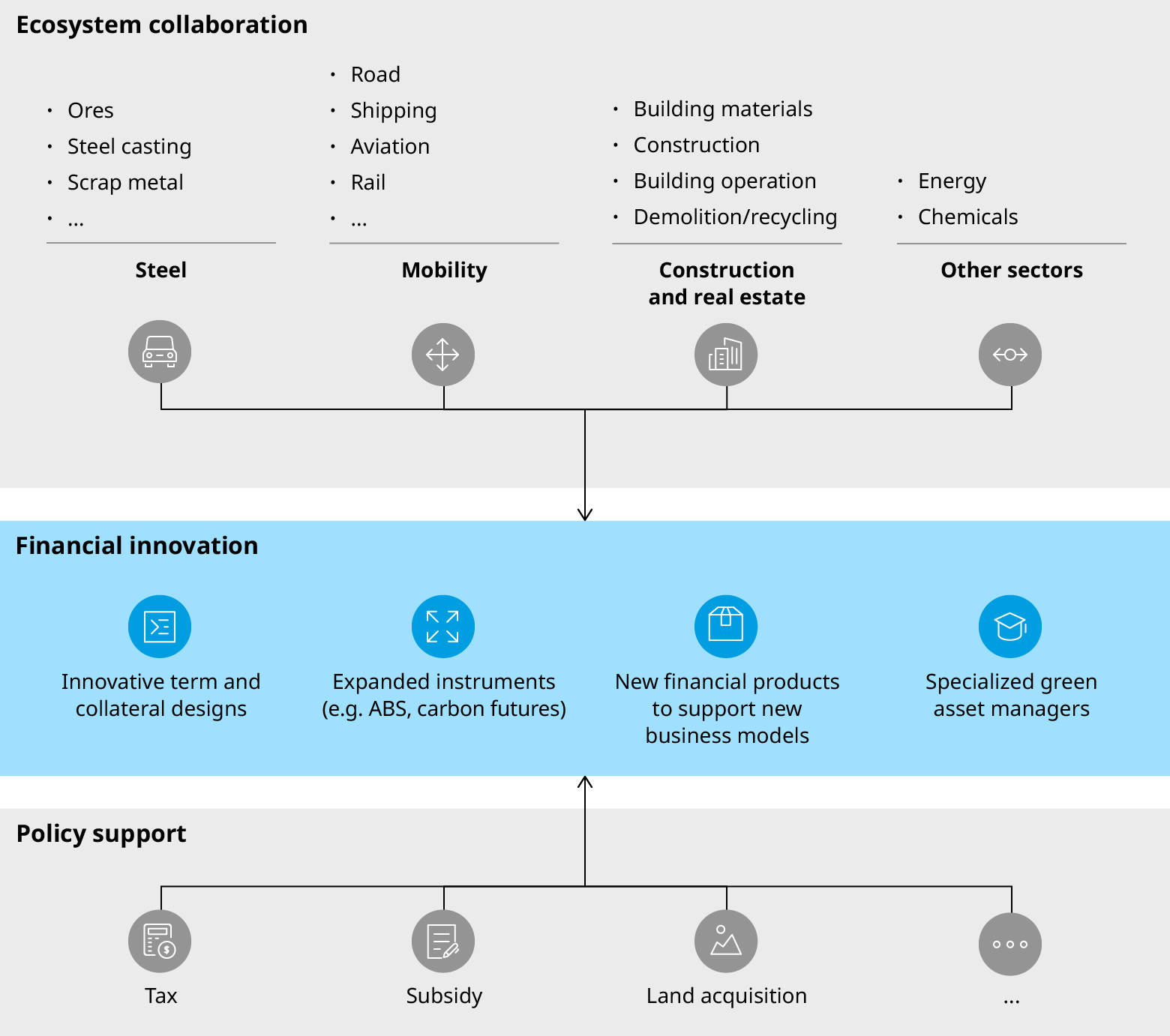

Policy support for net zero: Top-down support led by the Chinese government is crucial given its outsized role vis-a-vis Western economic models. The support can be both financial and non-financial: Tax incentives, such as European carbon taxes, are particularly power tools for accelerating the transition.

Underpinning these efforts should be an ongoing effort to develop and enforce consistent and unified rules and regulations in different regions and for different sizes of companies.

Financing innovation: Financial institutions need to introduce innovative new products and services tailored to the needs of Chinese corporations. Innovation will require new term structures, collateral requirements, instrument archetypes, and portfolio strategies to easethe shortage of green equity financing and long-term green loans in China.

Ecosystem collaboration: Industry players need to connect with their value chain to establish holistic emissions goals, especially for to Scope 3 emissions. This will require anchors that set standards and enforce them throughout their supply chains. Beyond standard-setting, there is also a need for more-tailored incentives andverification mechanics.

The New Champions Dialogue

While the road ahead is long, China could position itself to drive the next green revolution globally, using the country’s scale and position in the global economy and supply chain to its advantage. This will require a more innovative approach to financing, policy support, and industry collaboration.

The World Economic Forum continues to play a critical role in providing a platform for public-private partnership through its Financing The Net-Zero Transition Initiative. The project engages a multistakeholder community of financiers, industry stakeholders, philanthropists, and public institutions to identify policy interventions necessary to mobilize the private capital needed to achieve the net-zero targets.

During the 2022 New Champions Dialogue, technology and innovation were identified as major building blocks to achieve the deep cuts required in China’s carbon emissions. The financial services community plays a crucial role in bringing these technologies to life, and the participation of committed industry and public sector leaders means this dialogue could be pivotal.