Telecom companies have garnered the most trust among consumers on issues to do with data protection and privacy. This is according to our annual Telco Survey presented at this year’s Mobile World Congress, which provides an overview into the state of the industry and changing consumer preference towards the likes of connectivity, data privacy and customer support.

With respondents from France, Germany, Spain and the United Kingdom, this year also confirms that the Covid-19 pandemic has brought about a number of changes in preferences in those countries, most notably an increase in price sensitivity and a decrease the importance held for service quality.

In a context where GDPR requires consumers to give explicit consent to the use of their data, increasing declared trust is essential to enable hyper-personalisation of offers and expand and consolidate the new ecosystems of services - telemedicine, home security, energy - that telcos promote in alliance with other sectors.Maarten de Wit, Communications, Media and Technology Partner

In a context where GDPR requires consumers to give explicit consent to the use of their data, increasing declared trust is essential to enable hyper-personalisation of offers and expand and consolidate the new ecosystems of services - telemedicine, home security, energy - that telcos promote in alliance with other sectors.Maarten de Wit, Communications, Media and Technology Partner

Telcos set to become the most trusted providers when it comes to data protection and privacy

The telecoms sector gained most ground in terms of trust between 2019 and 2021 and, is now the second most trusted sector in the eyes of consumers when it comes to protecting their privacy, only behind banks.

In particular, 43% of Spaniards said they believe that telecommunications companies protect their privacy and personal data, similar to that recorded in the United Kingdom (47%), Germany (46%) and slightly above France (36%).

Consumer preferences shift as a result of the pandemic

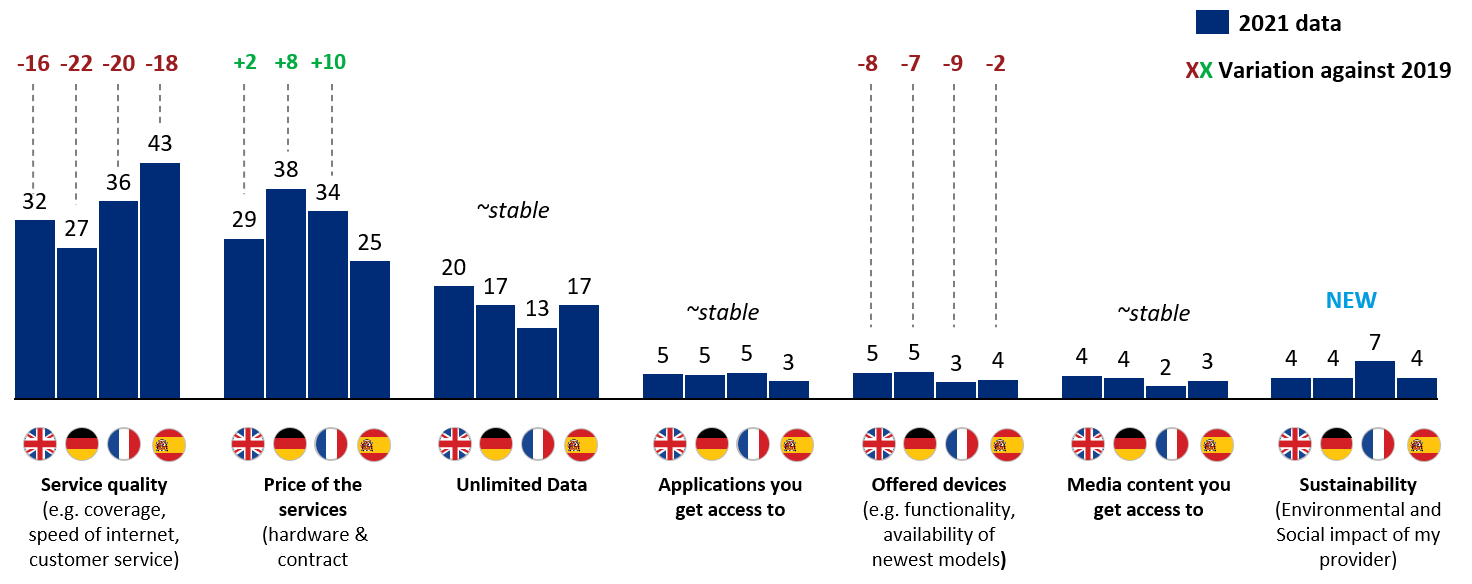

The survey also shows that consumer preferences towards the features from their services providers have changed. Despite service quality remaining the most valued feature across the countries surveyed, pricing has gained ground, followed by unlimited data, which has remained stable.

The quality of service offered by providers—including coverage, speed, and customer service—has lost between 16 and 22 percentage points compared to 2019. Meanwhile price sensitivity has increased, gaining between two to 10 percentage points. Germany is the only outlier, where consumers still put price before quality (38% vs. 27%, respectively).