During the past few weeks, we have discussed extensively with our clients in the luxury and premium consumer goods sectors about the situation in China. As all of them are worried about the current situation, we felt it would be useful to collate collective intelligence on the “if, how, and when” of the recovery.

Obviously, there is limited visibility on the question of when China will reopen properly so that consumers can resume shopping as usual . The early pictures of Shanghai reopening on the first day of June were exuberance mixed with a great dose of cautiousness. Optimists expect a full recovery to occur as early as July, but pessimists don’t see this happening until next year. The neutral view puts an end to the restrictive policies to occur around October this year.

Our remaining focus then is on the “if” and “how” of the recovery. Will there indeed be a full recovery? How will it look versus time? Who will be the winners of the recovery?

To answer these questions, we have interviewed over 30 clients which collectively represent more than US$50 billion in retail sales across various premium consumer and luxury goods sectors. We have also weighted their answers in accordance with the size of their business in Mainland China, and have conducted qualitative interviews with additional players.

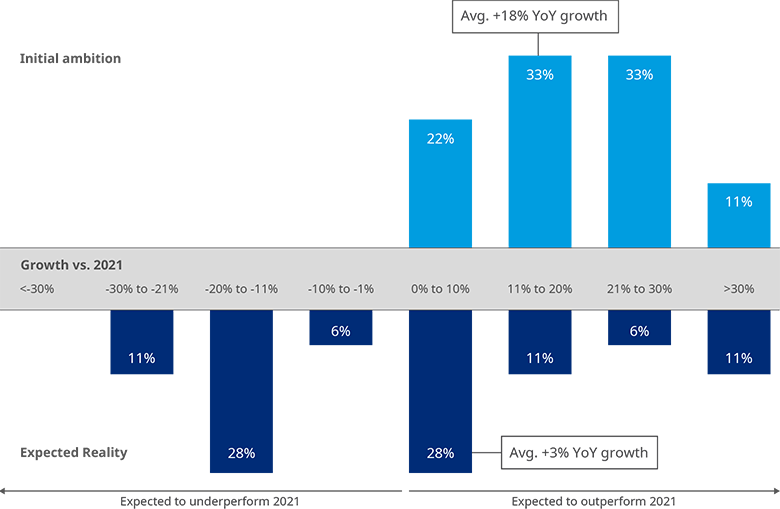

Expectations reset

Expectations have definitely been reset. As illustrated in the Exhibit 1, early budgets as planned in 2021 were on average expecting their Mainland China businesses to grow at 18% versus 2021, a strong year of recovery following the meltdown in 2020. Projected numbers clearly showed robust confidence in the ability of the Chinese economy to weather the global storms of inflation and geopolitics. The actual expectations for 2022 after the recent Covid-19 wave are now 15 percentage points lower. Forty-five percent of our respondents also believe their China businesses’ full-year growth will end in negative territory.

While the reset of expectations was expected, their magnitude was not, especially since the first quarter was still positive (when consumer spending rose by 3.3%, according to China’s National Bureau of Statistics). Of course, things were drastically different in April, with a significant decline of 11%. Anecdotal numbers from some clients indicate that in-store traffic, excluding lockdown areas, decreased by more than 50%, and the conversion rate was also up to 30% lower. Although the absence of fresh merchandise due to supply chain issues in Shanghai was a key driver, it was still less impactful than the overall consumer sentiment. In fact, when looking at consumer spending on a sector-by-sector basis, the more discretionary the purchase, the more significant the reset expectations. For luxury goods, for example, the reset expectations are for a close to 25 percentage-point decline (with some estimates going as high as 35 percentage-point), while for premium consumer goods, the weighted average expectations drop by close to 8 percentage points.

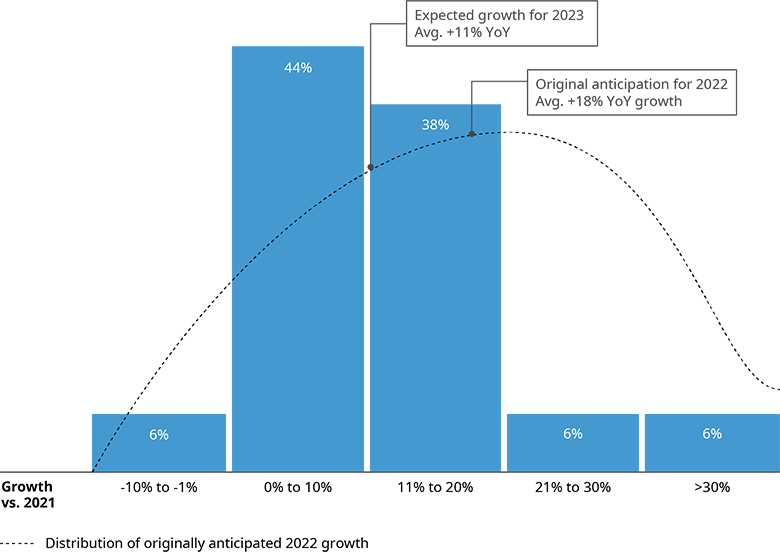

Outlook for 2023

From this pessimistic view for the rest of 2022, is there a silver lining for 2023? Most of our respondents believe the market will have regained its growth momentum by 2023. On average, they budget 11% growth for 2023, thus they are cautiously optimistic. Interestingly, all but 6% of our respondents will plan for growth, a strong sign of confidence in the long term. However, only 12% expect a buoyant comeback, with China business growth above 20%. Earlier this year, 40% of our respondents felt this way. This time round, they do not expect a repeat of the revenge buying with the scale close to 2021. When asked about the planned growth for the soon-to-be-set budgets for 2023, a great deal of cautiousness prevailed.

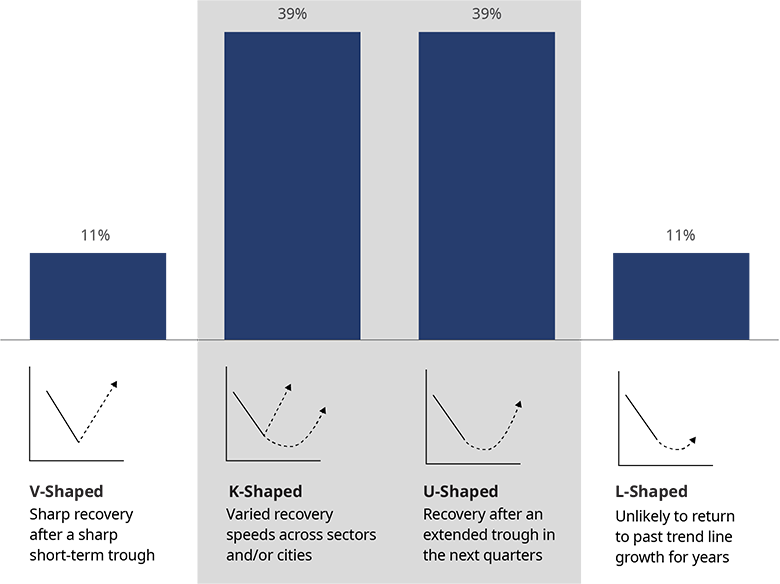

The shape of the recovery

For the shape of the recovery, most of the players fall into a mixed bag, primarily expecting either a U or K-shape. Those expecting a U-shape believe it will take time before consumers regain their confidence in spending, while those expecting a K-shape think that some consumer goods sectors will take longer to recover than the rest. Interestingly, when analysing the 2021 recovery, we found that the affluent Gen Z were a key growth driver of the recovery, representing up to 80% of the growth of the luxury market, and they also had very specific behaviour patterns (for more information, please read our 2021 Gen Z luxury shopper research paper on why RMB6,000 T-shirts were flying off the shelves in 2021). It seems that this time around, the affluent Gen Z may react differently, especially since a lack of job security may be something that they have to deal with for the very first time. Another common view from our interviewees is that the longer the restrictions, the longer the upcoming U-trough will last.

Saving over spending

It is expected that Chinese consumers will now save for a rainy day rather than spend as freely as they have in the past. According to a recent survey by the People’s Bank of China, 54.7% of Chinese households are inclined to save, the most on record since the third quarter of 2002, over 20 years ago. Household savings as a percentage of disposable income amounted to 43% in the first quarter of 2022, significantly higher than the 10-year average. The high level of savings has historically been a good predictor of future spending, as long as consumer confidence rebounds.

Tracking consumer confidence indices will indeed help navigate the uncertain future ahead. The Consumer Confidence Index (CCI) has historically remained well above 100, even during the height of the pandemic. The reading of over 100 indicates that overall consumer sentiment is more positive than negative. However, the CCI has been trending downwards since early 2021, signaling weakening consumer confidence, and the index dropped to a historical low of 86.7 in April, according to the data from the CEIC.

Domestic travel to benefit

Despite the rather grey outlook for the near term, there is strong consensus among our respondents that domestic travel will be a key beneficiary of the relaxation of policies. About 85% of the respondents expect a strong recovery of domestic travel as soon as the right conditions are met. According to our previous research on the same topic (please read our traveller perception of destination article, released in January 2021), Hainan and Macau are the likely winners of this large-scale travel within Greater China. The main hurdle for Chinese travellers to resume leisure travel overseas, beyond accessing passports and visas at present, is the quarantine period that they would need to enter upon their return.

Passenger traffic during the Labor Day holiday was expected to drop by 62% this year, as estimated in April by the Chinese Government. However, the actual figure was only down by 30%. Travel was already down in March, when the biggest Covid-19 outbreak in two years prompted officials to lock down major cities, such as Shenzhen, and block or restrict road traffic to halt the transmission of the virus. The number of domestic tourists decreased by 19%, compared to the same period last year. This is not as bad as it could have been when considering the difficult environment for travel.

As travel restrictions may remain for a while before returning to full normal (late 2024 is the accepted best guess), including traveling to and from Hong Kong, historically the primary destination, it is expected that domestic travel will strongly rebound, driven by an always-larger proportion of individuals. With this in mind, it would be a good time for all players to reconsider and/or refine their role and policies for their Hainan business.

Localize to succeed

Among the many concerns of our clients today, supply chain disruptions and the erosion of the talent pool (especially imported talent) are high on the agenda. Although inflation is widely expected to hit the market, most of our clients believe their pricing power remains intact and the faith of Chinese consumers on the whole with regard to premium products will continue to prevail. As such, localizing the China set-up will become even more important.

Despite China’s turbulent times at present, confidence in the country’s long-term potential remains high. Navigating the coming months will indeed require flexibility, and extra care to retain superior local talents will also be needed.