The US economy is displaying multiple signs of slowdown, including an inverted yield curve, slowing consumer spending, and tightening liquidity. More than 60% of global CEOs expected a recession in their primary region of operations in the next 12 to 18 months, according to the Conference Board’s June 2022 C-Suite Outlook, and 15% said that their region was already in recession.

Watch Head of the Americas for Restructuring Tim Hoyland and Partner Adam Chonich discuss the four C's of recession readiness.

Business leaders across the globe learned a lot about downturns from the recessions that followed the financial crisis and the COVID-19 pandemic. Notably, the companies that navigated these downturns successfully were the ones with leaders who were well prepared, adapted quickly, and took bold action. Preparation will be key to weathering the next economic storm too, and it’s essential to take proactive action now to prepare organizations to weather a recession.

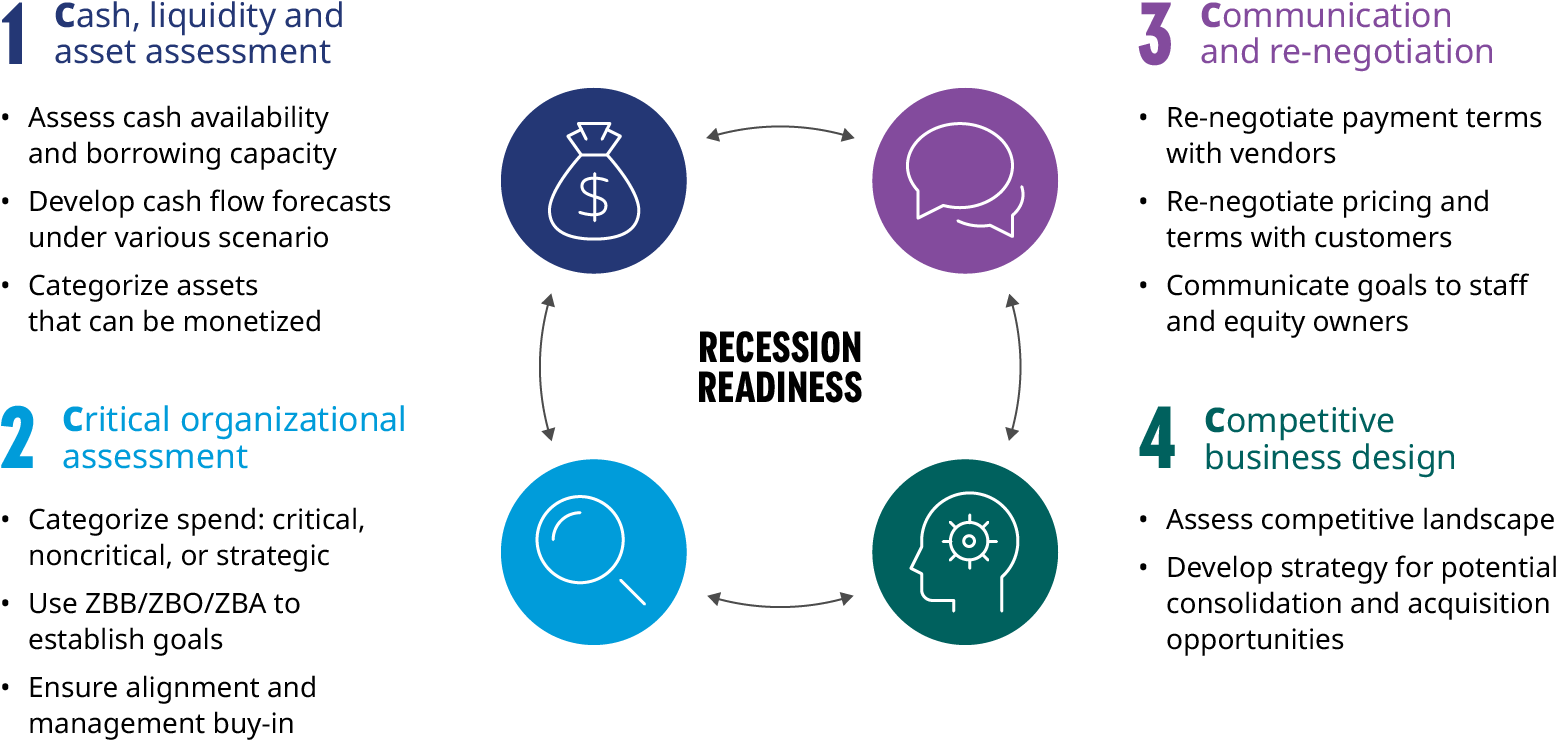

We suggest the following four C’s framework to focus efforts to become more resilient:

Assess Cash, Liquidity, and Assets

In times of stress, cash is king, so it is vital for a company to have a thorough understanding of its cash position and future cash needs. Cash management tools and processes can maximize available liquidity and preserve cash.

Assess cash availability and additional borrowing capacity: Starting with an assessment of their company’s current and forecasted cash needs, business leaders should develop an annual budget followed by short- and long-term direct cashflow forecasts. These will provide a thorough understanding of cash inflow and outflow on a weekly, monthly, quarterly, and annual basis. The forecasts should be updated frequently as the economic situation changes.

Establish a cash-focused culture: To establish a cash-centric culture in the organization, business leaders should conduct book-to-bank cash reconciliations at least monthly and, if possible, weekly. These will provide the C-suite with most current available cash and liquidity estimates.

Optimize cash collections, payments, and inventory management processes: Cash trapped as part of working capital should be assessed, and the company’s cash conversion cycle should be benchmarked against peers and industry averages. Working capital can be optimized through proactive actions, thus releasing trapped cash and minimizing the need for additional liquidity.

Assess all monetizable assets: Organizations need to understand their potential alternative sources of cash, such as raising equity and monetizing non-core assets. Valuation of all tangible and intangible assets should be conducted for normal and distressed economic environments.

Critically Assess the Organization

The organization should be assessed at the levels of process, people, assets, and technology. Related spend can then be prioritized in three categories: critical, non-critical and pause-able. The company will then be able to control its spend during distressed times.

Conduct a critical organizational assessment: An organizational and related spend analysis should be carried out across the organization using the following categories:

Organizational Assessment Categories

Such a predetermined assessment of which processes or assets are non-critical will allow a company to react swiftly in a downturn by curtailing cash outflows at times when cash inflows are expected to decline.

Take a zero-based budgeting, organization, and asset (ZBB, ZBO, and ZBA) approach to budget development: In addition to categorizing organizational spend, business leaders can optimize expenses using tools such as ZBB / ZBO / ZBA, along with historical trends and benchmarks, to develop budgets and establish goals.

Ensure management buy-in: Functional and process managers need to be involved in the assessment process, so that there are no surprises during the downturn. When categorizing critical and non-critical processes, assets, and personnel, consideration must also be given to managing an appropriate level of privacy, as not all levels in an organization are offered the same visibility on certain matters, especially when it may involve workforce reduction.

Conduct scenario analysis to develop mitigative actions: Scenario analyses can help to evaluate the company’s performance under various conditions of potential economic stress, such as recessions of low, medium, and high severity. The analyses must clearly identify early warning signs to monitor. An additional layer of scenarios should be developed that includes changes in the competitive environment, such as potential consolidation among or reactions by competitors. These scenario outcomes should form the basis for management’s choice of levers to help mitigate any degradation in performance.

Communicate and Re-Negotiate

Business leaders should cultivate good relationships with key stakeholders before a downturn, particularly by establishing clear channels of communication. If their company is in a healthy position, they should leverage this to re-negotiate terms.

Renegotiate with vendors: One of the most effective liquidity preservation levers is the ability to stretch payment timing without damaging vendor relationships. While paying vendors according to agreed terms, the company should also try to re-negotiate these to maximize credit availability and minimize the need for working capital. Negotiations conducted during non-distressed times often lead to favorable outcomes.

Renegotiate with lenders: Companies need to make sure they are in compliance with all lenders’ reporting and credit requirements. Notifying lenders of an anticipated deterioration in performance earlier – rather than presenting a surprise – is much more likely to result in a mutually beneficial solution involving forbearance or covenant relief. In addition, companies should work on a list of backup lenders to ensure they are getting the best possible credit terms and availability.

Talk to customers: To prioritize customers in case of a shortage of products, the company’s sales organization should conduct customer profitability and customer order rationalizations analyses. The company must also communicate anticipated product and service availabilities to its important customers. Lastly, where possible, it should re-negotiate pricing to pass through inflationary cost increases and re-negotiate payment terms, thus ensuring the fastest possible collection of cash.

Communicate with employees and equity holders: Companies should communicate mission-critical goals to employees and equity owners on a periodic basis. Business leaders and the board must assess compensation plans and structures to determine the potential deferral of cash outflows during a downturn. In addition, the company should reassess hiring plans to avoid non-critical hiring during a downturn.

Design a Competitive Business

A downturn often leads to consolidation in stressed industries, presenting some companies with opportunities for strategic acquisitions or sales. To take advantage of such opportunities, leaders must design their businesses competitively, which implies having a good understanding of the competitive landscape.

Assess the competitive landscape: Companies should conduct a competitive landscape analysis that includes a thorough study of industry players and an assessment of top potential synergistic partners. At a minimum, they should conduct a SWOT analysis (of strengths, weaknesses, opportunities, and threats) on key competitors.

Conduct potential transaction analyses: Business leaders need a thorough valuation assessment of the company, including sum-of-parts analysis and potential synergy analysis, to be able to evaluate any potential offers in a proper light. In case an attractive target turns up, business leaders must be prepared to source acquisition capital. To make the most of a potential sale, they must ensure that the company’s most profitable segments are optimized. Even if the company is not planning any transactions itself, it must still be prepared to evaluate the impact on its business of any other consolidation within the industry.

Preparation is Crucial

It is extremely hard to predict the timing, magnitude, and length of a recession. However, preparation will be key to weathering it. As former NCAA basketball coach Bobby Knight said, “The will to win is not nearly so important as the will to prepare to win.”

Thank you to Abbott Wootten for contributing to this article.