This article was first published by Caixin Global on November 9, 2021, with the headline, China Is in a Unique Position to Finance the Green-Tech Revolution.

While the world is looking to new breakthroughs at the Glasgow Climate Summit, China is committed to strengthening its “3060” climate target, peaking emissions by 2030, and achieving net-zero by 2060. Despite the 10-year lag compared to most Western countries’ “net-zero by 2050” goal, we genuinely think China may be the best positioned to lead this global change for good given its unique economic structure.

Achieving net-zero will require tremendous innovation for both energy transition and industrial decarbonization. The technologies under development will be responsible for reducing over 40% of global greenhouse gas (GHG) emissions by 2050. Unfortunately, these new technologies are sometimes less attractive to the market-driven economy, considering the significant externality they embody and the longer-term payback cycle (since the real impact of combating climate change only kicks in in the long run).

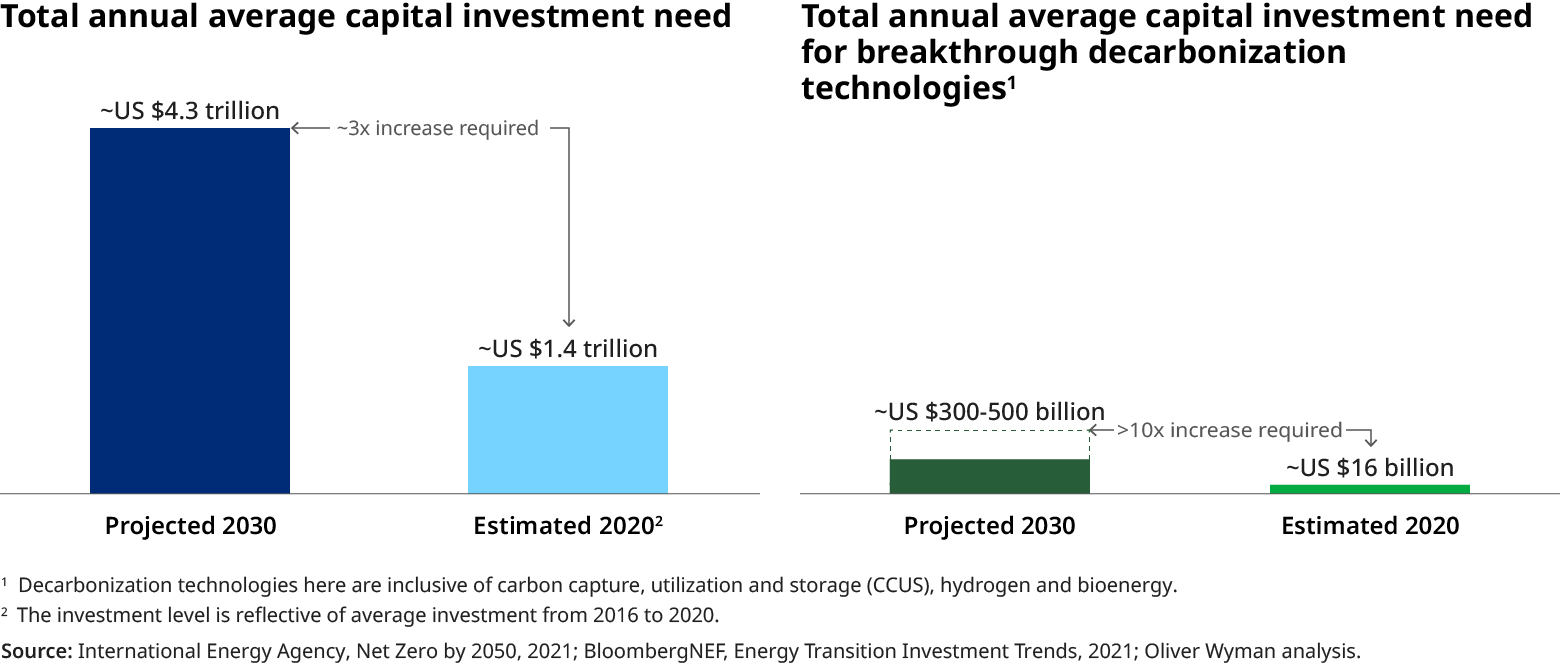

In the lead-up to the summit in Paris in 2015, the focus was on estimating the research and development (R&D) needs across sectors and technologies. We have now moved past early-stage R&D through successful venture funding, but still lack the maturity for market-based financing. Therefore, funding for commercial-scale deployment and testing is urgently required. According to our latest analysis in collaboration with the World Economic Forum, approximately US$50 trillion in incremental investments is required by 2050 to transition the global economy to net-zero emissions and avert a climate catastrophe (see Exhibit 1). However, most countries cannot easily provide such support, and it will remain a global challenge unless a more inclusive stakeholder capitalist model is adopted.

While many countries are marshalling their financial institutions to adequately support industry innovation, China is advantaged given the state’s vital role in both the financial sector and beyond. This offers China a unique opportunity to champion the green-tech revolution through homegrown yet globally appealing innovations and strong financial sector support. To foster this revolution, China will need to consider:

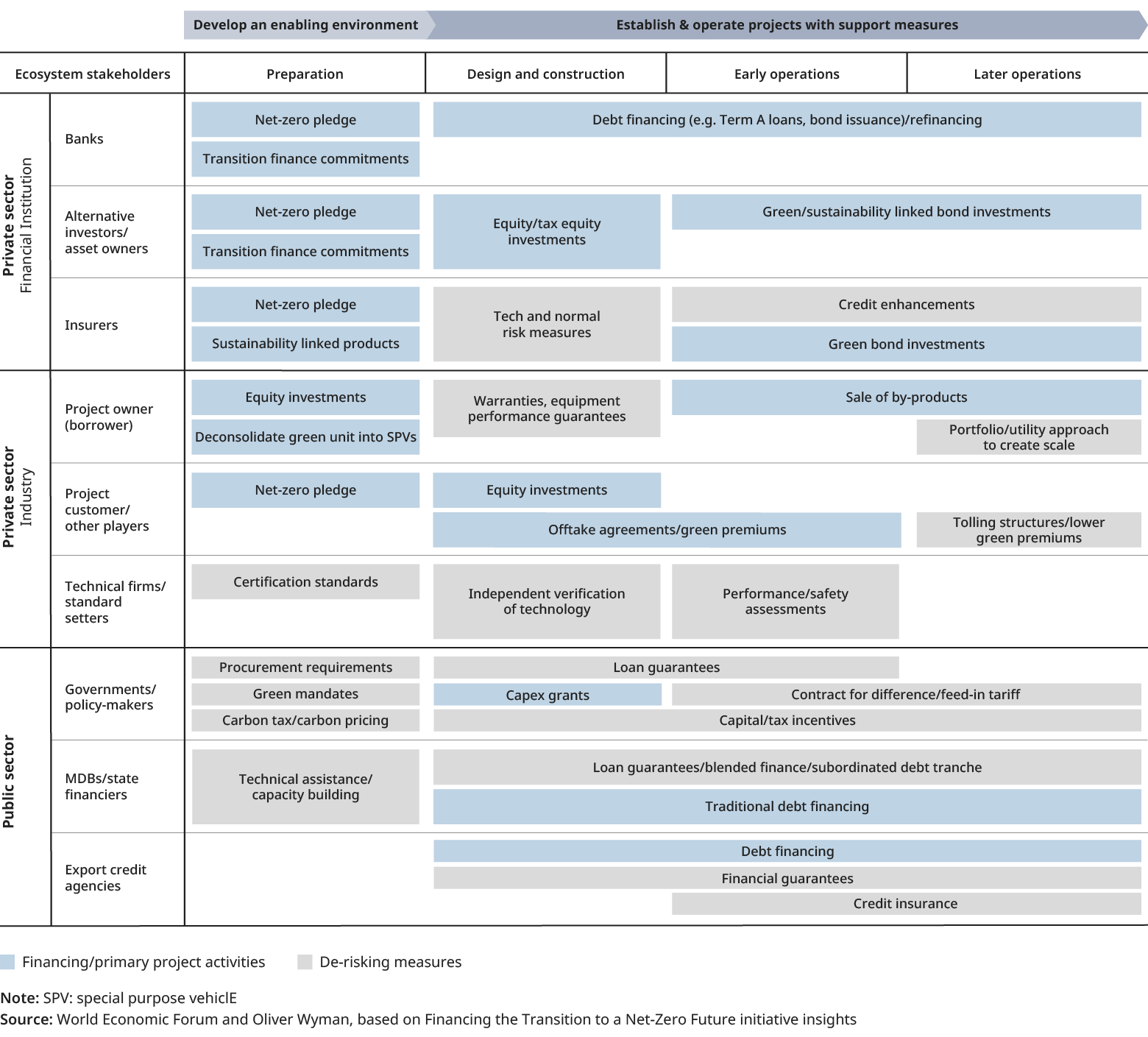

How best to ensure innovative companies have access to both public and private capital via technology-specific financing blueprints. To do this effectively, mechanisms that activate collaboration among multiple stakeholders are necessary, and the way China has modernized its infrastructure is a good case study of “Public-Private Partnership” that can still be applied. This will require all parts of the financial services sector to work together – investors (insurance, pension funds, private equity), side by side with banks, regulators, and the private sector.

Transformative business models are essential, where industry participants and capital providers work together to establish new contracts and ways of doing business to increase the probability of commercial success. Transformation can be achieved through measures to stimulate demand and establish reliable, scalable supply. This could involve guaranteed pricing and off-take contracts to ensure viability in the early stage in addition to access to viably pricing funding and access to industry expertise.

Targeted public intervention is critical. The key is to design incentive schemes rewarding early movers adopting innovative carbon-removal technological solutions, and de-risking schemes mitigating the investment risks unique to these innovative solutions. Key here will be to ensure policy/regulation activities do not unintentionally divert capital away from “greening” of hard-to-abate sectors. Here the government will need to set clear expectations and timelines to ensure clarity on outcomes aligned to outcomes.

Financial institutions will need to take a more strategic approach to risk allocation for innovative solutions that will help deliver on decarbonisation goals vs conventional projects. Current risk appetite and underwriting approaches, for both banking and insurance will need to evolve. First movers could be future leaders driving local and global “green” growth. However, this will require banks to establish clear views on future growth sectors and over time steering funding towards these sectors; regulators will also create accommodative support for priority sectors driving decarbonisation efforts.

If China gets it right, it could emerge as a green-tech leader vital to not only its domestic GHG goals but also those of its global peers. Who’s to say the next “green” Alibaba, Tencent, JD, or Huawei isn’t right around the corner. With the support of the state, governance model, and financial sector, China is uniquely positioned to lead the charge on solving this truly global challenge.