Life is rapidly becoming more expensive. Rising food prices are affecting consumers every day. Comparing prices has become a necessity for those who want to save costs. Half of the Dutch consumers who switched their main food provider in 2022 did so because inflation and the cost of living take up most of the household budget. The end of the year brings little hope for change: inflation will not pass by the food industry in 2023 either.

The specter of inflation is scaring the entire food chain

Suppliers, retailers, and consumers are all feeling the price increases. For example, food suppliers see that raw materials, energy, and transport costs are becoming more expensive. As a result, production costs also rise.

This is felt by the retailers, who must buy food at higher prices from the suppliers. The price increase for some products is in the double digits. The stores also deal with higher labor costs and an increased energy bill. Together it has a drastic impact on the profit margin. Which is one to two percentage points lower. That is a considerable decrease since the margin in this industry in good economic times is 3-5%.

To reduce costs, some retailers have already decided to work with shorter opening hours. By reducing these costs, they try to limit price increases for the consumer. But because the margins are already small, there is little room for improvement. The Netherlands is a competitive market for retailers. In a densely populated country with many shops, the battle for customers is fierce. More than four out of five Dutch consumers can choose between three or four supermarkets within cycling distance.

Almost 1 in 3 consumers switch supermarkets

Oliver Wyman took a closer look at consumer behavior with the Consumer Allies Survey. About 7000 respondents in six European countries participated in the survey. The Netherlands had 1000 participants. Of these, 33% changed their main supermarket in the past year. Half did so because inflation and the cost of living forced more attention to finances.

Personal changes in life can also be a reason to watch spending more and switch supermarkets. This applies to about 17%, who, for example, because of a new job or investments, are paying closer attention to their spending.

Inflation is making victims throughout the entire food chain

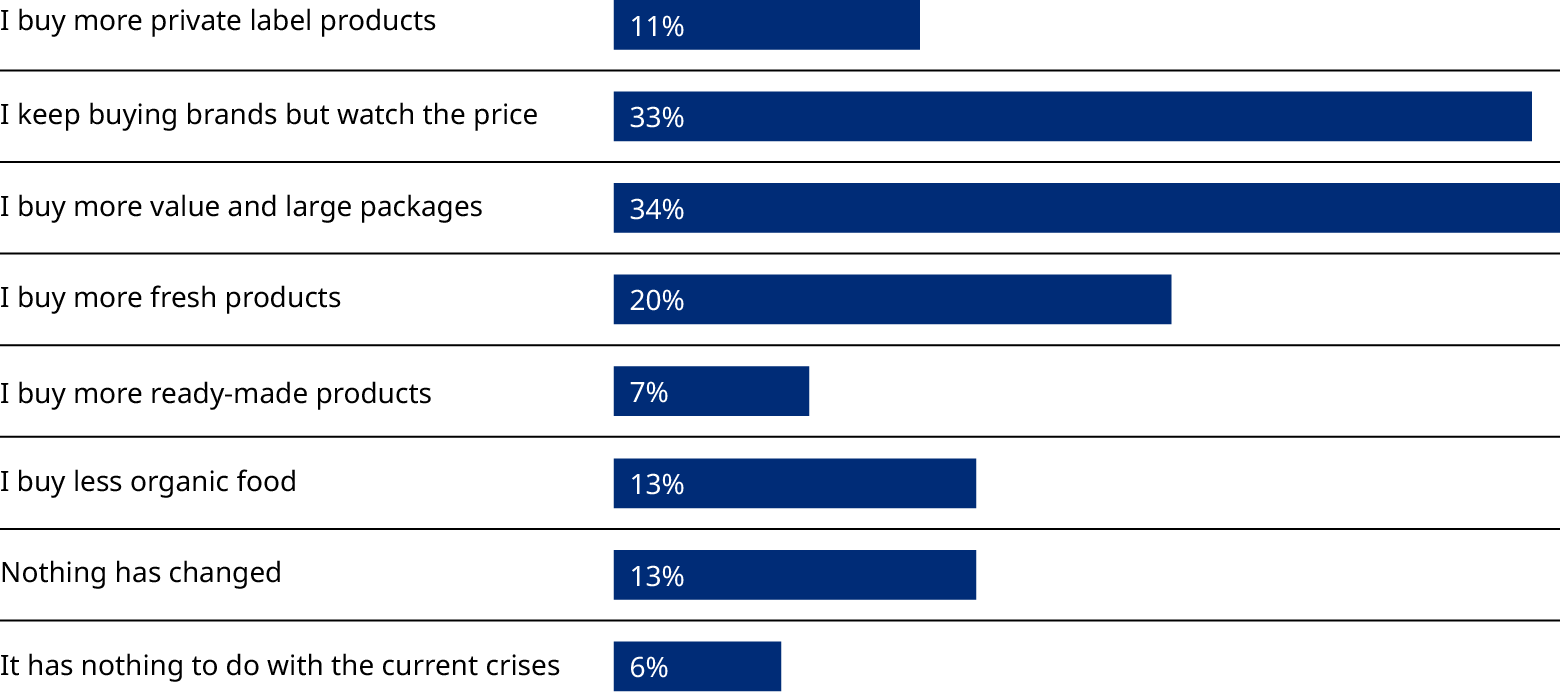

Due to the crises, a third of Dutch consumers are now buying larger packaging. What is striking is that consumers seem to allocate the price increases more to retailers than to suppliers. That perception is understandable but incorrect, says Marco Kesteloo, Partner in Retail and Consumer Goods: “Suppliers are taking advantage of the situation to raise their prices and increase their profit margins. Retailers are trying to slow down price increases to remain competitive. As a result, their profit margin becomes smaller.”

Around 65% of Dutch consumers are in support of government intervention through a price cap on basic products or a maximum on average price increases. When asked what retailers should do during negotiations with suppliers, consumers are divided. A third of the consumers say stores should fight for low prices but without the possibility of certain products becoming out of stock. The same percentage say they would understand if that did happen, as long as it leads to better prices in the medium term. Those consumers do not mind empty shelves for a while.

Inflation will force creative solutions in 2023

The future will show what the government will do to curb food price increases. Inflation will continue to spread in 2023, including in the food industry, due to high prices of energy and agricultural products.

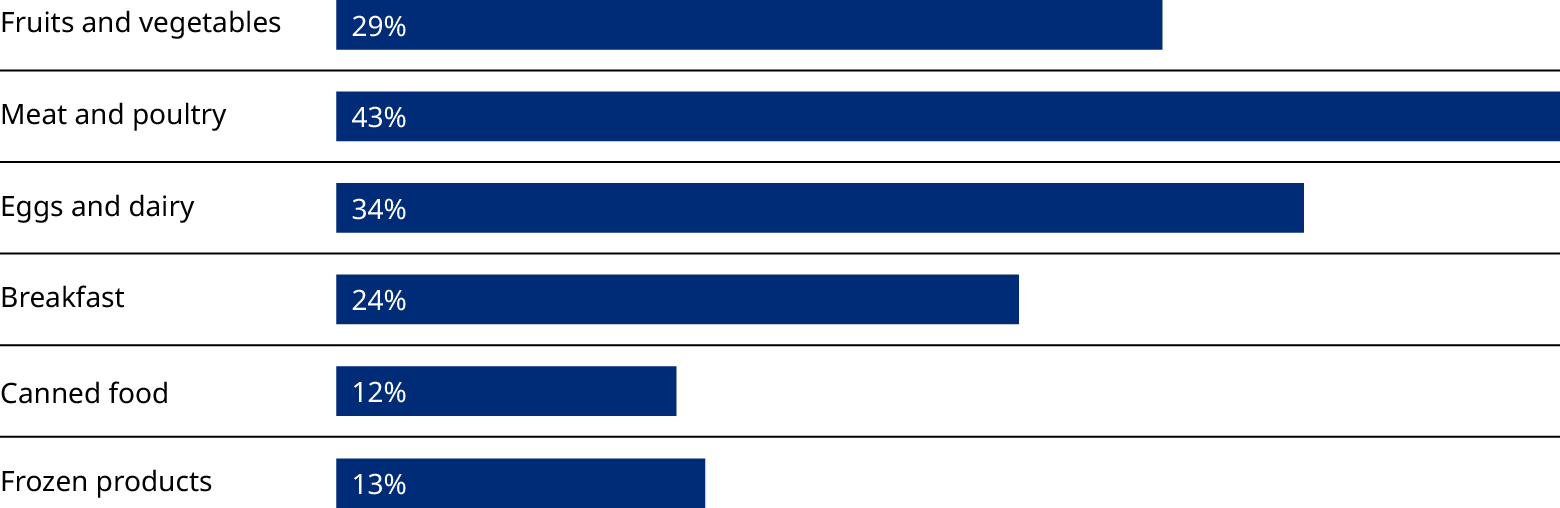

It is important to reflect on the psychology of the consumer. They rightly conclude that the price of meat and dairy is rising the fastest. Many consumers also indicate that they feel large price increases in fresh fruit and vegetables, while the real increase is more limited there. Consumers are very sensitive to higher prices of fresh products (more than in other categories). Retailers should keep that in mind when setting their prices. They can improve their image by making fresh items less expensive while earning back on other products.

In addition, price negotiations between suppliers and retailers can help spread the pain, but according to Kesteloo, this is not a sustainable solution. He explains: “The supplier is tied to the retailer, who is tied to the consumer. The solution cannot come from one of them without affecting the other two parts of the supply chain. What they should do, is work together on efficient and creative solutions.”

Oliver Wyman already has several ideas for this, says Kesteloo: “At higher prices, consumers tend to buy more of the large and discount packages. Retailers can respond to this by displaying it more prominently. You can also involve consumers more in the way they buy products at the store. An example: supermarkets can offer consumers the possibility to purchase, for instance, muesli in their own container which they will bring from home. This way, the costs of packaging will disappear. Also, you can avoid putting some products on the shelves in the season when they are most valuable. For example, strawberries are expensive in November. Another possibility is to save on the design of labels on products. They could be expensive, because of the design and printing costs. A price-sensitive consumer may also be fine with a simple label with basic information.”

The tipping point of the food industry

According to Kesteloo, the food industry is at a crossroads. Never have suppliers and retailers been forced to put their heads together to contain prices.

Kesteloo speaks of a 'tipping point', a moment at which solutions other than cooperation in the food industry no longer work. He, therefore, hopes that the entire chain is willing to do so, although that may feel uncomfortable: “ZARA and IKEA, for example, work very closely with suppliers. This provides benefits throughout the entire chain. In the retail sector, the distance between suppliers and retailers is greater. That has to change now. So, the question is: do suppliers and retailers dare to peek behind the scenes and work closer together to slow down inflation?”