ETFs To Account For 24% Of Total Fund Assets By 2027, Reveals New Study

April 26, 2023

London, April 27, 2023 – Exchange-Traded Funds (ETFs) will account for 24% of total fund assets by 2027, up from 17% today, according to a new report published today by Oliver Wyman, a global management consulting firm and a business of Marsh McLennan (NYSE: MMC). The report was independently authored by Oliver Wyman and commissioned by Waystone.

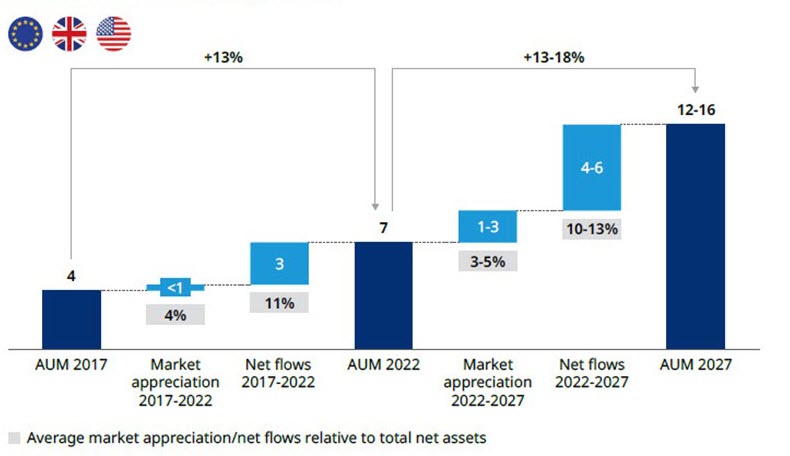

As of the end of December 2022, total ETF assets under management reached $6.7 trillion globally, growing at approximately 15% compound annual growth rate (CAGR) since 2010, almost three times faster than traditional mutual funds.

With the unprecedented growth of ETFs, The Renaissance of ETFs finds that the ETF landscape is just embarking into the next stage of growth — this time fueled by the rise of active ETFs, which are gaining traction amongst investors looking for differentiated strategies to beat the market.

The report provides a detailed view of growth trends across the last decade and finds that the recent surge in innovative ETFs is driving small fund providers and individual ETF initiators to launch new products.

While trends such as increased retail investor demand, cost and tax advantages, favourable regulation, stronger demand for thematic ETFs, and direct indexing will all impact the growth outlook for ETFs positively, those who want to launch an ETF face several challenges. These include the high cost of setting up infrastructure and the high risk of failure. These challenges have given rise to white-label ETF providers, a relatively new business model that allows fund providers to quickly bring their strategies to market.

Kamil Kaczmarski, Partner, Insurance and Asset Management, Oliver Wyman said: “The explosive growth in ETFs has been the single most disruptive trend within the asset management industry over the last 20 years. We expect them to make up about a quarter of all fund assets in the next five years. This could become a strategic opportunity for the industry to either build an active ETF franchise or rely on support from white-label platforms, which provide a cost-efficient infrastructure for fund initiators to launch their ETFs.”

Exhibit 1: ETF market forecast

2017-2027 $ Trillion AUM, Europe and US

©2023 Morningstar. All Rights Reserved. The information contained herein is proprietary to Morningstar and/or its content providers. See report for full disclosure.

-ENDS-

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in more than 70 cities across 30 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm has more than 6,000 professionals around the world who work with clients to optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a business of Marsh McLennan [NYSE: MMC].

For more information, visit www.oliverwyman.com. Follow Oliver Wyman on Twitter @OliverWyman.