K-12 After-school Training ‘To Business’ Market Set for Rapid Growth

July 27, 2020

Nearly RMB one trillion in market size, K-12 training businesses see positive outlook despite COVID-19 impact

SHANGHAI, July 28, 2020 – The market size of China’s K-12 after-school training businesses has grown dramatically over the past three years and is expected to reach RMB 1.4 trillion in 2025, according to the “China K-12 After-school Training ‘To Business’ Market White Paper 2020”. Driven by enormous demand, the “To Business” market, which provides products and services to the country’s nearly one million K-12 after-school training institutions, is expected to exceed RMB 100 billion by 2025. With the accelerated application of 5G, artificial intelligence and other educational technologies, the market will improve the quality of training institutions and empower China’s educational training businesses.

The White Paper, published by Oliver Wyman in collaboration with China’s National Institute of Education Sciences and the Tomorrow Advancing Life Group (“TAL Group”), provides a detailed overview of the history, including the dynamic of supply and demand, and outlook of the future development of China’s K-12 after-school training “To Business” market.

Demand will bounce back robustly despite the short-term impact of COVID-19

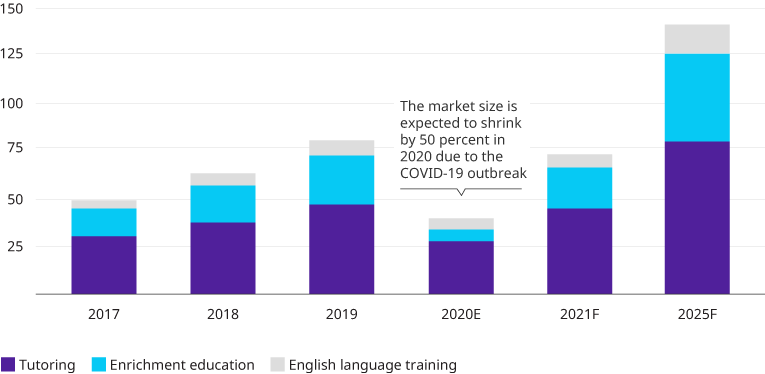

China’s K-12 after-school training industry mainly includes tutoring, enrichment education and English language training businesses, and the overall market size grew to reach roughly RMB 800 billion in 2019 (see Exhibit 1). “The industry has been negatively impacted due to the COVID-19 outbreak, but the demand from parents and the fundamentals of the market remain unchanged. We expect the market to exceed RMB 1 trillion in a few years,” said Claudia Wang, Partner of Oliver Wyman. “Additionally, nearly 70 percent of offline enrolled students moved online during the COVID-19 outbreak, spurring a wider awareness of distance learning.”

EXHIBIT 1. THE MARKET SIZE OF CHINA'S K-12 AFTER-SCHOOL TRAINING BUSINESSES (2017-2025F, IN RMB 10 BILLION)

Source: National Institute of Education Sciences, TAL Group, Oliver Wyman

The White Paper divides China’s nearly one million K-12 after-school training institutions, which are also the clients of the “To Business” market, into five groups in terms of their scale1. Oliver Wyman estimates that the large and very large institutions account for 10 percent of the total market share, and the medium-sized institutions account for 20 percent. Meanwhile, the small and micro institutions account for the remaining 70 percent. In the long run, the industry will see consolidation and elimination, leading to an increased market share for the large and very large institutions, and a stable market for the small and micro institutions. However, the medium-sized institutions will find themselves in an increasingly squeezed space. The landscape of the industry will change from a “pyramid” to an “hourglass” dynamic.

Embracing the online-offline merge trend, after-school training institutions are seeking empowerment from the “To Business” market

In recent years, different types of offline training institutions in China have been facing universal and specific pain points in terms of customer acquisition, center operation and management, according to a survey conducted by Oliver Wyman. During the COVID-19 outbreak, more than 70 percent of these businesses began having severe cashflow shortages due to a sharp drop in student enrolment. Moreover, more than 60 percent of business heads said they expect the negative impacts of the outbreak to extend to the end of 2020.

Nevertheless, the COVID-19 outbreak has led to a breakthrough in online education, with its market share expected to rise rapidly from 5 percent in 2019 to 20 percent by the end of 2020. To cope with the impact of the pandemic and embrace the online-offline merge trend, after-school training institutions have actively sought providers of tools, content, complexes, communities training and intelligent technology to complement their organizational capabilities and shortcomings, resulting in a rapidly expanding ‘To Business’ user base.

Take the TAL Group as an example. During the COVID-19 outbreak, the TAL Group quickly responded to the initiative of “ensuring learning remains undisrupted even though classes are disrupted” by launching the “Safe Harbor” program. The program offers free access to online tools, content resources and operation guides to the whole industry, aiming to provide all-round support for after-school training institutions. It has helped 140,000 teachers from more than 40,000 institutions across the country shift smoothly from face-to-face teaching to online teaching, benefitting tens of millions of students nationwide with tens of millions of hours of online teaching in total.

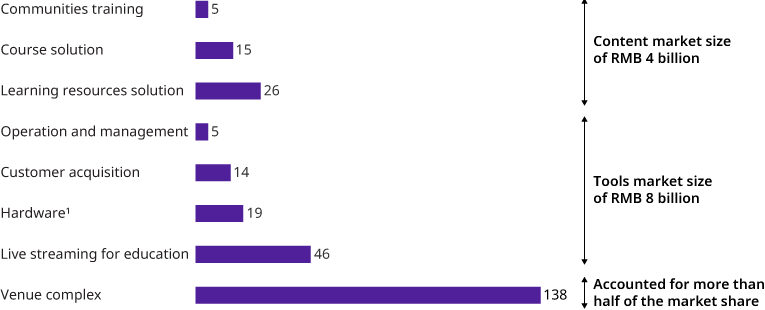

The “To Business” market is expected to usher in rapid development after the pandemic subsides. According to Oliver Wyman, the “To Business” market size reached RMB 27 billion in 2019, of which the venue complex segment, with income mainly from rentals, accounted for 52 percent. In other segments, the educational tools market accounted for about 31 percent, the content market for 15 percent, and the communities training market for 2 percent (see Exhibit 2). The market is expected to exceed RMB 100 billion by 2025.

1 Large and very large K-12 after-school training institutions are those with annual revenue above RMB 50 million, medium-sized institutions between RMB 10 million and 50 million, and small and micro institutions below RMB 10 million.

EXHIBIT 2. THE MARKET SIZE OF CHINA'S K-12 AFTER-SCHOOL TRAINING "TO BUSINESS" MARKET (IN RMB 100 MILLION)

Total ~270 in 2019

Note: 1. Hardware market refers to the market for hardware tools and does not include hardware devices for dual-teacher direct-recording, nor does it include hardware devices for the intelligent technology market.

Source: National Institute of Education Sciences, TAL Group, Oliver Wyman

The White Paper predicts that different segments will pivot their businesses around their core capabilities, integrate horizontally to cover the whole management process, and also integrate vertically to expand to a full array of products, thereby turning themselves into product-as-platform providers. In addition, Internet service providers, comprehensive education service providers, infrastructure service providers and cross-industry players will all make inroads and join the competition space with their own advantages.

The rapid development of technology is making education more flexible, convenient, efficient, personalized and equitable, says the National Institute of Education Sciences. With emerging technologies, training businesses can better innovate in educational philosophy, teaching methods and management models. Eventually, the industry will be able to practice personalized education at scale, expand the supply of quality educational resources, and promote the provision of more equitable education.

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in 60 cities across 29 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm has more than 5,000 professionals around the world who work with clients to optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a business of Marsh & McLennan Companies [NYSE: MMC]. For more information, visit www.oliverwyman.com. Follow Oliver Wyman on Twitter @OliverWyman.

About the National Institute of Education Sciences

The National Institute of Education Sciences (“NIES”) is an education research institution directly under the Ministry of Education and is recognized as the top education think tank in China. The NIES focuses on the strategic needs of national education and major issues of public concern and has initiated a series of major research projects and achieved significant results, which involve education evaluation reform, textbook planning for universities, primary and secondary schools, physical and health integrated education in schools, vocational and tertiary education reform and schools of the future. The NIES is committed to making contributions to the development and reform of national education in China.

About the TAL Group

The Tomorrow Advancing Life Group [NYSE: TAL] is a leading education and technology enterprise in China, and holds close the core development goals of being technology-driven, talent-centered, and quality-focused. Since its establishment, the TAL Group has been committed to integrating technologies and the Internet into education, to deliver a better study experience for children. The TAL Group continuously strives to promote educational progress through cutting-edge technologies. The TAL Group has many sub-brands, including Speiyou, xueersi.com, Izhikang, First Leap, Mobby, Lewaijiao, jzb.com, kaoyan.com, and gaokao.com.

On October 20, 2010, Xueersi, the predecessor of the TAL Group, was listed on the New York Stock Exchange, becoming the first Chinese education institution for primary and middle school students to be listed in the U.S.

The TAL Group invests in valuable projects that align with its mission and core values, including Babytree, Minerva University, guokr.com, Knewton, LTG, Sharkpark, Heyha, qijixue.com, changingedu.com, liuxue.com, xbl.youban.com, zxxk.com, and knowbox.cn.