Household Income Down Globally But Grocery Spend Currently Increasing

April 11, 2020

- 78 percent of consumers believe the crisis will impact their grocery consumption through the summer.

- Grocery retailers are faced with fewer visits and significantly larger purchases per consumer posing a real challenge.

- While we are currently seeing increases in grocery spending across many countries, it is trending downward in Italy and Spain where the lock-down has been going on for longer and incomes have been harder hit.

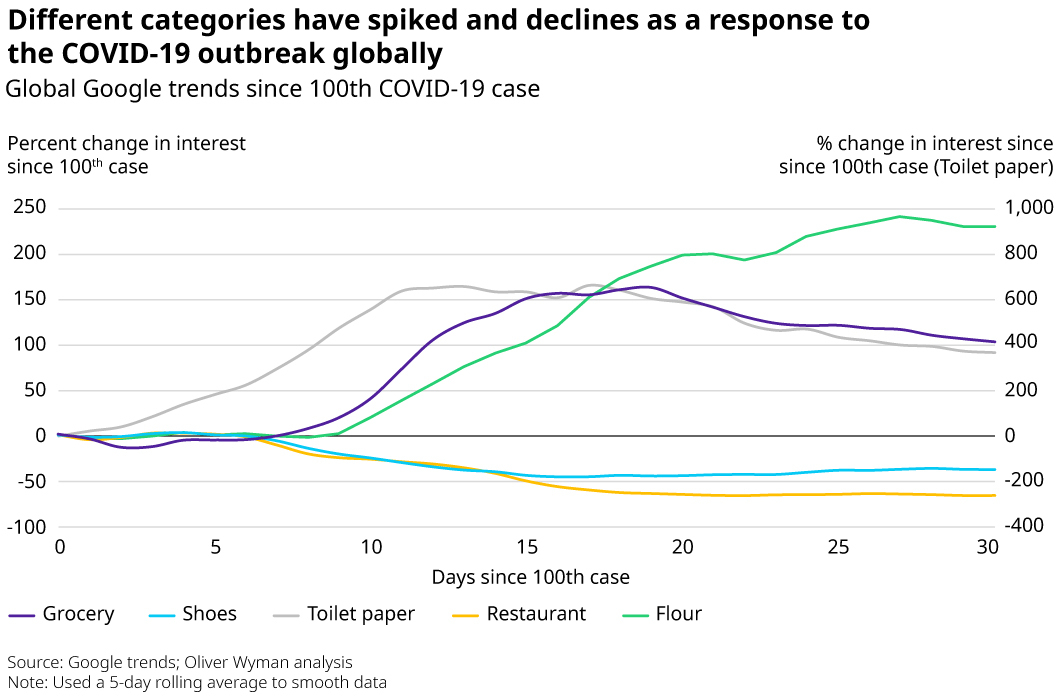

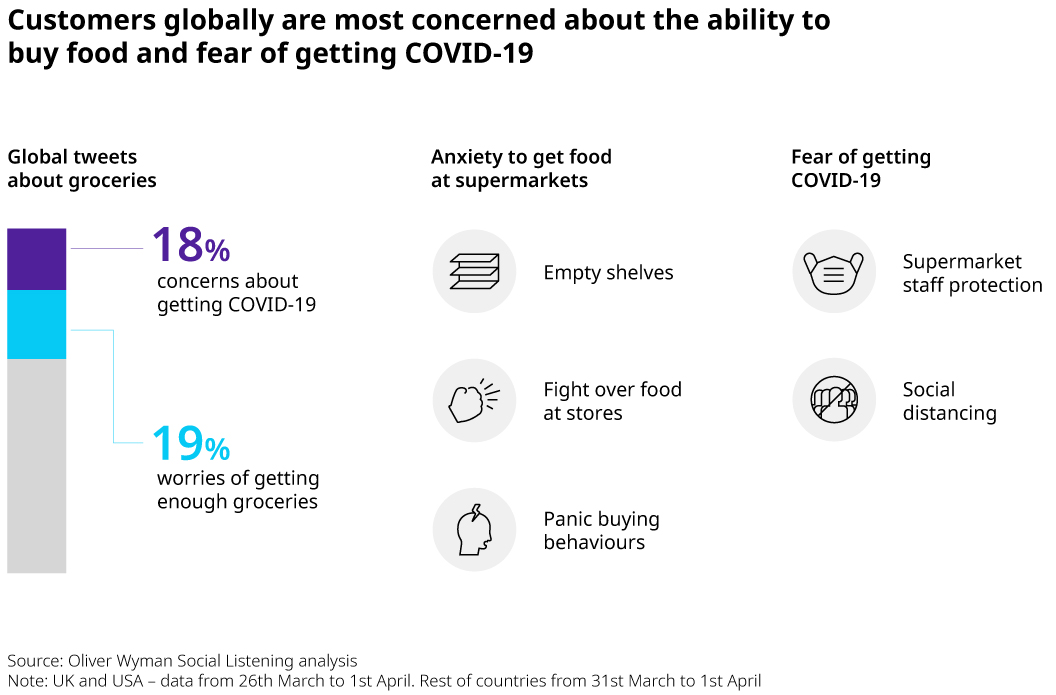

More customers are anxious when grocery shopping than ever before because of COVID-19 according to social listening analysis by consulting firm Oliver Wyman. Oliver Wyman also found that personal circumstances and purchasing behavior have changed fundamentally since the crisis started.

More than one third of consumers have seen their household income decrease with Italy (47 percent) and Spain (58 percent) reporting to be the most impacted countries in our survey. While household spending is falling, grocery spend continues to increase. Thirty-seven percent of US respondents – up from 29 percent two weeks prior – and 31 percent of UK respondents – up from 18 percent prior – said they are spending more on groceries. This could indicate that some countries are in the peak of the crisis and moving toward an initial spending spike.

New shopping habits – lower store visit frequency – fuller shopping carts

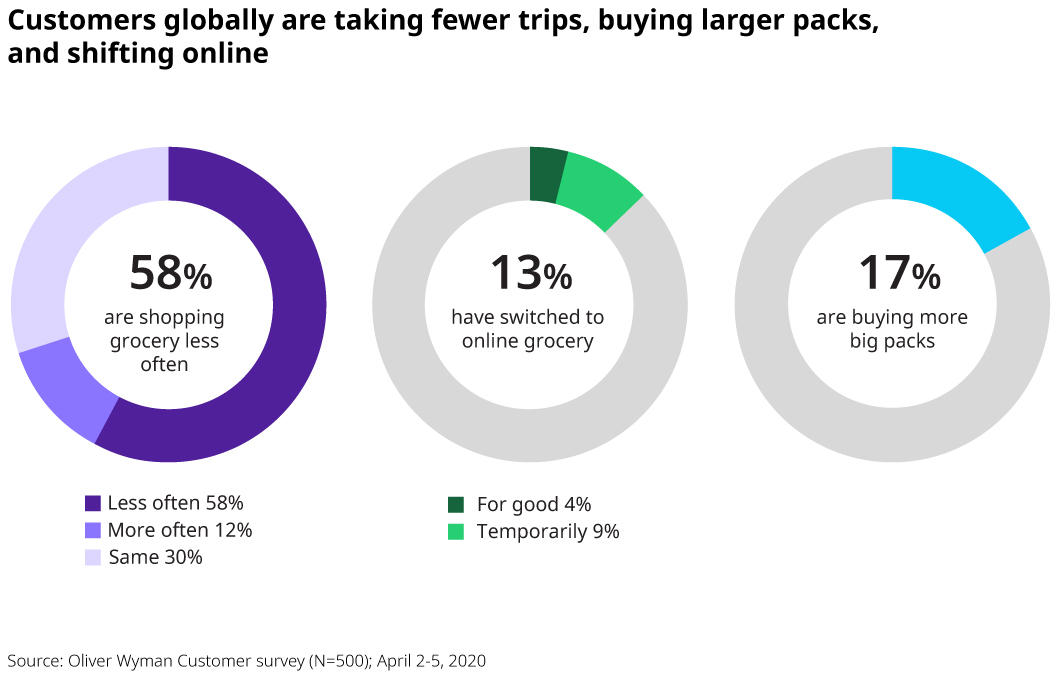

The crisis is affecting the daily and weekly routine of shoppers globally. Fifty eight percent of customers worldwide are continuing to decrease their store frequency due to concerns about being near others. We found between our surveys two weeks apart – 29 percent more of UK respondents are shopping less along with 15 percent of German consumers. This is posing a real challenge for foods retailers: "The problem is often not the supply but the demand, which is currently much more difficult to predict," explains Oliver Wyman Retail & Consumer Goods Partner Nordal Cavadini.

Additionally, consumers are generally less loyal to their preferred grocery stores, changing temporarily, and 7 percent changing “for good” due to proximity, hours of operation, and the ability to order online.

Further challenges for retailers’ concerns purchasing conditions in the shop:

- 69 percent of all respondents stated that they could not find a desired product in the store

- 29 percent said they felt uncomfortable due to long lines.

- 24 percent felt a lack of comfort of being inside a physical store

“Based on our social listening analysis, those who master these challenges are clearly recognized and dramatically increase their perception by the consumers,” said Cavadini.

E-food is gaining in importance but reveals limits

Consumers are also actively considering ways to not go to the physical grocery store and order online, based on our social media analysis. Retailers with an established online presence will have to continue investing in this area in order to meet the increased online demand. In fact, 13 percent of respondents have switched to online grocery shopping, at least temporarily. While 26 percent has bought online before the COVID-19 crisis. "We assume that more and more customers will do their grocery shopping online and that this phase will sustainably accelerate the growth of e-food," said Cavadini. However, this only if the industry finds a solution to the current capacity bottleneck:

- Lack of delivery slots are criticized by 57 percent of those surveyed who order online.

- 63 percent of respondents said the lack of product availability was an issue.

Our results reveal that countries with more click and collect such as France or Germany face less constraints than countries focused on home delivery such as the UK.

However, there may be some clouds on the horizon for food retailers

While we are currently seeing increases in grocery spending across many countries, this pattern is starting to turn in Italy and Spain, where the lock-down has been going on for longer and incomes have been harder hit with 47 percent and 58 percent of respondents saying their household incomes have declined, compared to an average of 40 percent.

A very large number of respondents are saying that they are buying more discount products in Spain and Italy. We expect this trend to continue in other countries as the economic pain of COVID-19 starts to affect household incomes and impacts discretionary spending which we have seen with many general merchandize categories such as apparel and beauty products already. Eventually, this will include grocery spending, and consumers will reduce their spending by trading down even further and cooking at home, which 38 percent say they plan to do more going forward.

Notes to editors

About the survey

The online survey was conducted in a total of nine countries (Germany, United Kingdom, Spain, Italy, France, USA, Switzerland, Netherlands, Australia). The first survey took place March 21- 23, and the second was conducted April 3-5. Respondents from the countries ranged from 500 to 1,000.

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in 60 cities across 29 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm has more than 5,000 professionals around the world who work with clients to optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a wholly owned subsidiary of Marsh & McLennan Companies [NYSE: MMC]. For more information, visit www.oliverwyman.com. Follow Oliver Wyman on Twitter @OliverWyman.