In this edition we focus on areas of banking that are going through a period of almost constant transformation and disruption.

First, we take a holistic look at the European payments market, finding an industry going through a period of change driven by intensive M&A activity.

Next, we analyze how technology and other players are making a move in retail banking , thanks in part to the introduction of Payments Services Directive 2 (PSD2). In this landscape new “Life Coach” intermediaries are emerging, offering assistance on all aspects of everyday life and advising customers to spend more intelligently. We argue that banks are well-placed to serve this function.

Corporate banking is not immune from the technology threat, either. Wholesale payments and cash management (PCM) generated $250 billion of revenue last year, but is under threat as technological advances reduce the cost of market entry. We believe that corporate banks need to follow large technology firms in order to defend their payments businesses and, like retail banks, need to begin to understand customer needs, pain-points, aspirations and feelings in order to defend their PCM businesses.

Finally, we take a look at the market infrastructure (MI) industry, finding that despite a decade of strong growth, core MI groups (exchanges, CCPs, and CSDs) face a revenue gap of ~US$6-10 billion by 2022. We outline five ways MI groups can meet that threat head-on and achieve breakthrough growth.

The Future Of European Payments

The European payments market is going through a wave of consolidation with intensive M&A activity, which raises questions about the impact on banks and merchants.

As our article explains, a number of banks have sold their payments businesses because they are not able to sustain and adapt to numerous challenges, including the commoditization of traditional payment activities and the need for strong technological skills and agility.

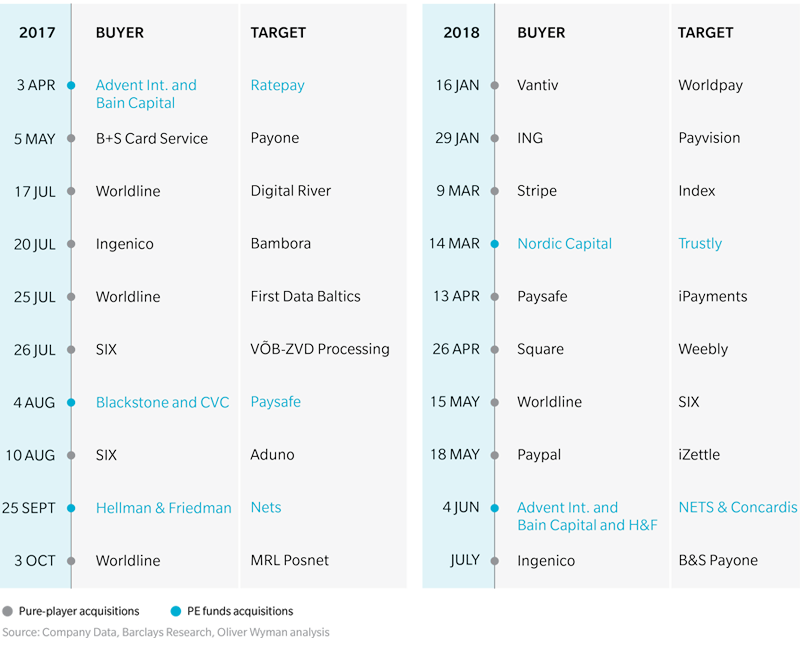

Two types of player are driving the M&A activity: payment players and PE funds. Players want to increase the volume of transactions to grow and amortize the cost of platforms and expand along the value-chain by becoming complete service providers. We class these as expanders.

Exhibit 1: Overview of European payments M&A activity

Despite the volume of M&A deals (above) banks are not the ones driving them and, as a result, are not leading the market anymore. Examples like Adyen (NL 2006) show that organic growth and innovation can be successful. These companies are able to develop from scratch from relatively small markets with no major volumes. Given their success and growth, these players can be classed as innovators or disruptors because they focus on new value enhancing services for merchants.

In this landscape, banks need to radically leverage their assets – such as an outstanding client base, security knowledge and especially a huge data from merchant and consumer transactions. They could drive the movement to digital payments and related merchant services, especially since with additional decrease of interchange it will be attractive for them to develop account-to-account payments.

But nothing will be possible without a real repositioning of banks and substantial technology investments.

Retail Banks: From Financial Advisors To Life Coaches

Although historically a monopoly for retail banks, payments is now attracting interest from technology giants. Thanks to the introduction of the Payments Services Directive 2 (PSD2) regulation, which separates account-keeping from access to accounts and initiation of payment, challengers beyond banks can now manage accounts or hold cards.

An environment this attractive will not go unexploited for long. New intermediaries will emerge, offering assistance on all aspects of everyday life: so-called “Life Coaches”. Capable of advising customers to spend more intelligently, these coaches will also be able to help them save money or pay back loans, ferret out unnecessary subscriptions, predict end-of-month balance, anticipate needs, issue alerts, provide support, and be “useful” partners in the day-to-day.

Exhibit 2: Oliver Wyman Financial Needs Hexagon

Banks appear to be in a strong position to serve this function, as they have access to information about their customers spending. But future success lies in their ability to rethink their mission and carve out a place for themselves in day-to-day assistance using digital. With digital, banks need to move from a “moments in life” to a “day-to-day” mindset. And, instead of pushing products, they will need to coach customers in their daily lives.

Should they shift their mindset in this way, our article argues, they will reach a position at the centre of their customers’ ecosystem.

Wholesale Payments: The $250 Billion Battleground

The threat of technology challengers is not only of concern to retail banks. Corporate banks face a similar threat to their payments businesses, as our report Wholesale Payments – Disrupt From Within argues.

Wholesale payments and cash management (PCM) generated $250 billion of revenue last year, and has long been a stable and comfortable business for incumbents. But things are changing. Similar to retail banking, technological advances are reducing the cost of market entry, and PSD2 regulation has now been introduced.

Corporate banks need to follow large technology firms in order to defend their payments businesses. Rather than designing products or features, our report argues they need to begin to understand customer needs, pain-points, aspirations and feelings, and then harness data and algorithms to sharpen the experience.

Applying this to PCM requires a different approach and, often, new capabilities. But making the change is difficult but necessary, if only because of the increasing demands on wholesale PCM customers. To do so, they will need to adopt a challenger mindset in three ways – by developing immersive solutions that delight customers, building next generation technology from the ground up, and shaping the emerging industry structure.

Exhibit 3: Example growth flywheel of next generation cash management solution

Lessons from big tech show that where there are unmet needs, or high margins, new and nimble challengers will find a way to provide compelling solutions. And as our report argues, incumbent banks need to rise to this challenge, and find ways to deliver a generational change in wholesale payments.

Achieving Breakthrough Growth In Market Infrastructure

Providing technology solutions is just one of the ways Market Infrastructure providers can achieve future growth, according to our Global Market Infrastructure: How MI Providers Can Achieve Breakthrough Growth report.

And doing so is of critical importance because despite a decade of strong growth, core market infrastructure groups (exchanges, CCPs, and CSDs) face a revenue gap of ~US$6-10 billion by 2022 versus market expectations.

Our report argues that core MI groups, custodians, and market data providers need to rethink their positioning in the broader capital markets ecosystem to tap into additional revenue pools and growth opportunities. Solving the big problems of capital market participants, both on the buy- and sell-side, for issuers and to some extent for regulators, has the potential to create the breakthrough growth needed.

To achieve that growth MI providers need to think and act more like big technology firms (such as Amazon, Facebook and Google). Five key success factors that will enable them to capitalize on innovation and to achieve breakthrough growth are:

Much like retail and corporate banks, MI providers need to promote an agile culture to increase the speed of innovation, as well as provide state-of-the-art technology solutions to overcome their legacy infrastructure burden. In some cases the need to do this from scratch with a Greenfield build offers a low-risk solution to innovate and accelerate growth at speed.