Our focus in this issue is on business model transformation. First, we outline what banks can learn from the business models of Big Tech innovators. Next, we look at the NPL workout space, which is undergoing a transformation into “NPL ecosystems,” with a new wave of solutions making increasing use of digital tools, technology, and collaborative approaches.

We also consider the theme of consolidation. In the recent European Banking Report, we noted the significant economic differences between various geographies. Here, we explore two markets in greater detail: business models that may help German banks survive domestic consolidation, and how French banks can position themselves for further European integration.

We then turn to regulatory issues and discuss the challenges banks face in transitioning from LIBOR to alternative reference rates. We outline the actions firms can take immediately, as we believe this exogenous shock will require a great deal of hard work, comparable to that demanded by other major regulatory programs. Thus far, however, the transition to alternative reference rates has received little attention from senior management at most firms.

Finally, in light of recent volatility in the equities markets and the accelerating trajectory of easing monetary stimulus, we discuss the outlook for the wholesale banking market in EMEA.

The Customer Value Gap – Learning from Big Tech

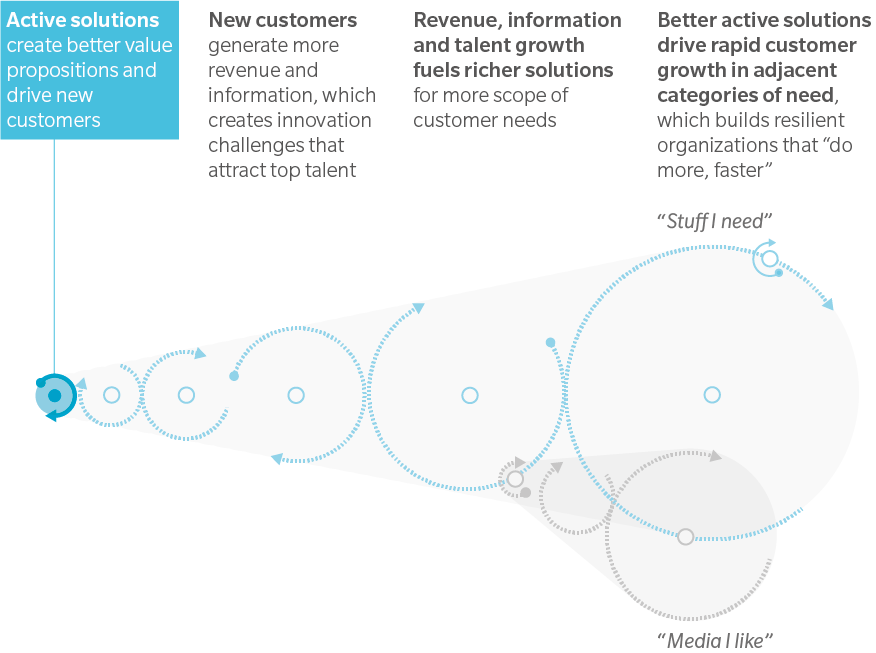

Our State of the Financial Services Industry 2018 report describes a customer value gap among financial services – clients are willing to pay for financial solutions that improve their lives, yet the landscape has remained relatively static over the past 10 years. During this same period, Big Tech market leaders have made enormous gains. Their success can be attributed to a “flywheel approach” – identify big customer problems and create solutions that evolve with customers’ evolving needs. This generates a kind of flywheel momentum that sustains growth through continuous improvement, based on data and algorithms.

We argue that financial service incumbents shouldn’t aim for large-scale solutions (in the vein of Amazon today), but should instead focus on first getting their flywheels going.

Exhibit 1: Focus for getting on the growth flywheel

The Road Ahead for the Non-Performing Loans Ecosystem

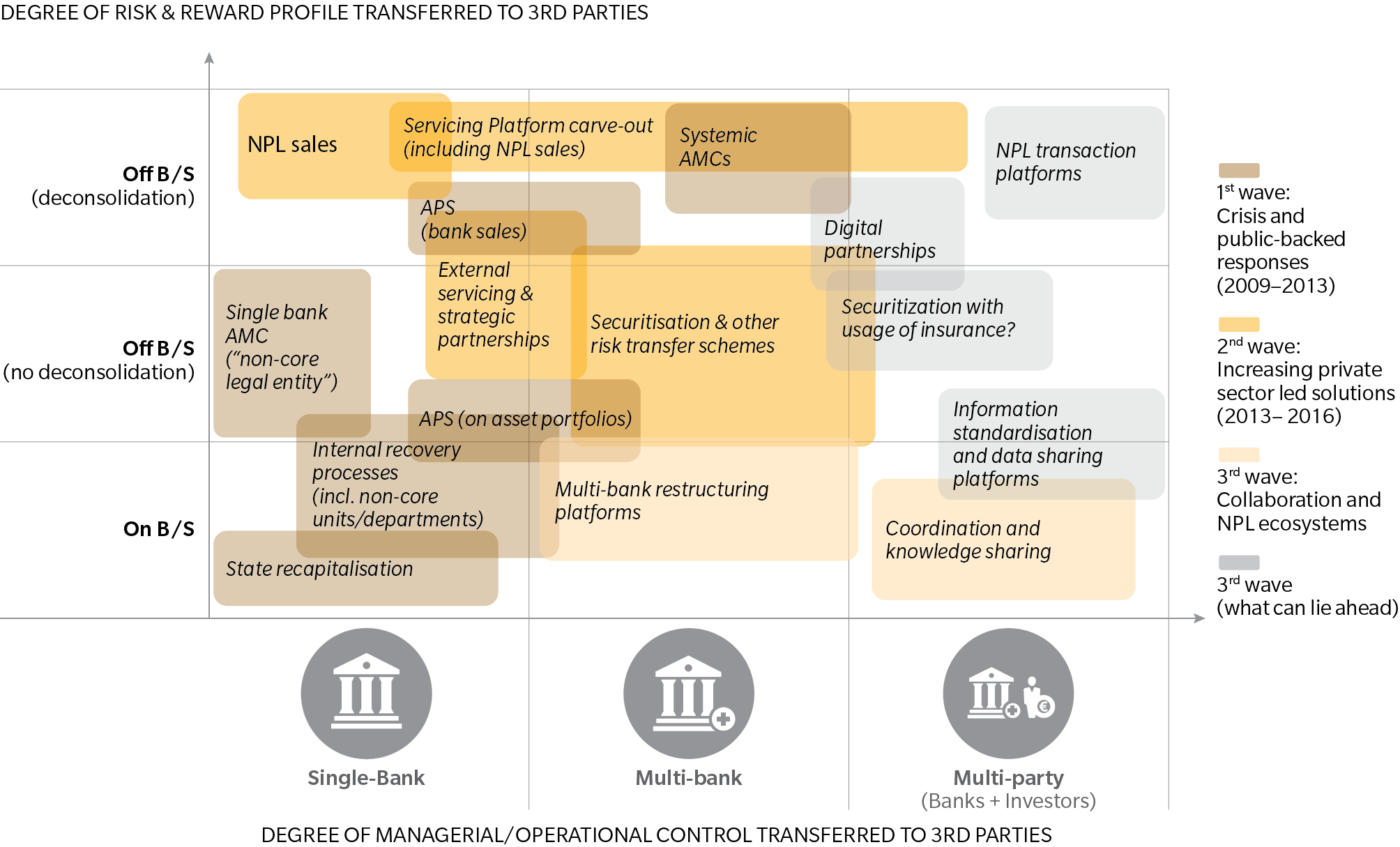

In our report The Non-Performing Loans Jigsaw: Pieces Starting to Fit?, we noted the progress in non-performing loan (NPL) workout management in much of EMEA to date. At the same time, we explored the emerging innovative and collaborative approaches that will fundamentally change the way banks work out current NPL volumes and manage (and prevent) future NPL build-up.

Exhibit 2: Overview of NPL solution set

We see the current wave of solutions evolving in two key ways:

- Increased use of digital tools and technology, both to enhance decision-making and management capabilities over NPLs and to drive platform businesses in the industry

- Increased collaborative approaches defying the traditional business model with partnerships among banks, servicers and investors (possibly even public sponsors)

We are already seeing some of these utility-like solutions being considered in the market and by policy makers, including information sharing platforms (consolidating data across banks and increasing comparability) and transaction platforms (marketplaces incorporating an information sharing platform and a standardized process for bringing buyers and sellers together).

Banking Consolidation and Integration – German and French Perspectives

In our Banking Report Germany 2030, we noted that while approximately 40 banks disappear each year in Germany through consolidation, that still leaves another 1,600 banks in existence (as compared to roughly 600 in Italy). Increasing competition from foreign banks, FinTechs, and global technology corporations means, however, that in another 10 to 15 years the current business models will no longer be viable. In the report, we lay out two visions for the German banking market – an evolution scenario and a disruption scenario. In our estimate, by 2030 the number of German banks will decrease significantly, thus raising the question: “How to remain one of Germany’s 150 to 300 banks?”. We outline the key characteristics of a sustainable business model to help banks make better choices and align their capabilities, investments, and operating models in a targeted manner.

In our report, Momentum for Further European Banking Integration: The French Case, we expanded our scope to cross-border integration. We considered the necessary ingredients for further European integration through the lens of French banking groups. Many of those insights are relevant to other markets as well. Considering the opportunities and headwinds, we see three paths toward greater Europeanization, each with distinct business model implications:

1. Europeanization driven by banks: Even if the European banking union remains incomplete, French banks can promote European expansion through, for example, new digital strategies – with three potential digital cross-border business models

2. Europeanization backed by legislators: Removing regulatory impediments and aligning legislative frameworks may open the floodgates for major M&A, and require banks to keep up with an evolving competitive environment

3. Internationalization driven by new entrants: Digital technology is transforming the banking industry and blurring national borders, with the business models of the new entrants premised on capturing client value cross-borders – bank incumbents may need to adapt, cooperate, or play catch-up

LIBOR Transition – Time to Get Moving

Today, tens of millions of contracts worth approximately $240 trillion, ranging from complex derivatives to straightforward residential mortgages, are underpinned by LIBOR. However, the significantly reduced volume of interbank unsecured term borrowing – the basis for LIBOR – is calling into question the reference rate’s robustness. The United Kingdom’s Financial Conduct Authority announced last year it would stop compelling banks to submit inputs to LIBOR beyond 2021, raising the possibility that LIBOR will not be available after that date. Market participants are already working on alternative reference interest rates across LIBOR currencies. Within the eurozone, while the Euro Interbank Offered Rate (Euribor) and Euro Overnight Index Average (Eonia) are outside the scope of the FCA announcements, these rates face similar challenges and uncertainties.

Exhibit 3: LIBOR – Notional outstanding balances by reference rate

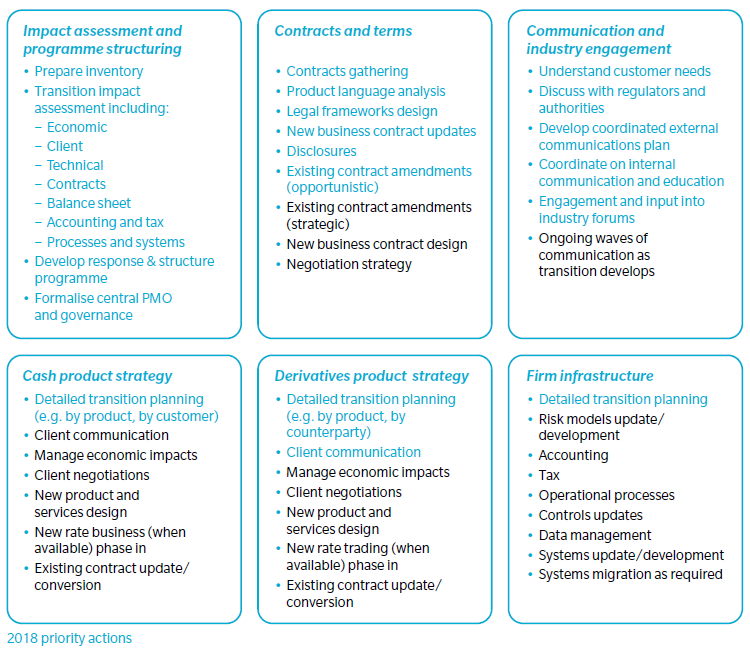

In Changing the World’s Most Important Number: LIBOR Transition, we outline the main issues firms face in the transition away from LIBOR, e.g.:

- Proposed alternative rates are structured differently from LIBOR and from each other, and thus entail different economic and risk impacts, while simultaneously necessitating changes to valuation tools, product design, and hedging strategies

- Fall-back provisions in contracts were designed for short-term disruption – relying on them for transition will change product economics and create operational risk if all contracts fall back on the day LIBOR is discontinued

- Sell-side institutions are increasing conduct risk with every new LIBOR contract priced beyond 2021, given the uncertainty regarding alternative rates and timing

- Large numbers of end users and counterparties with whom to communicate and organize through the transition

For firms, the first step in managing the transition lies in understanding how and where their organization is exposed to LIBOR. We believe preparation should begin immediately.

Exhibit 4: LIBOR transition high level book of work

Wholesale Banking Outlook

While an uptick in volatility through the first quarter of 2018 may offer some hope to Markets businesses following a dismal end to 2017, our recent report Wholesale Banks and Assets Managers - Winning Under Pressure (published jointly with Morgan Stanley) suggests that view may be short-sighted. The buy-side remains under significant structural pressure, as do their wallets for the sell-side. Growth in the corporate space can alleviate some of this pressure. But management teams at banks and asset management firms are stuck on delivering near-term growth – and, consequently, are missing out on longer-term opportunities. Technology and data will fundamentally change business models – yet most firms have no clear vision of their future role. We believe that tier 2 broker dealers and midsized active asset managers, in particular, have a lot of work to do in this regard.