In this edition, we take a longer-term view, focusing on four topics that will have an enduring effect on the state of banking in EMEA. First, we build on the topic of LIBOR transition discussed in our last Spotlight, considering the future of two other critical benchmarks for the eurozone: Euribor and Eonia, which are both currently non-compliant with the EU Benchmarks Regulation (BMR), with a 1.5-year window until the BMR transition period ends to make remedies or find alternatives.

We then discuss the future of current accounts – a product that for many customers most closely determines who “their bank” is. This market is in a state of flux as incumbents face significant challenges from eroding revenues and stubborn legacy cost bases, while technological advances are opening possibilities for new banks (or greenfield propositions within old ones) to enter with slicker offerings at much lower costs.

Next, we look towards a perennial issue: climate change. We recently supported the UN Environment Programme – Finance Initiative in assessing the credit risk implications associated with climate change and review the results of this work here.

Finally, cyber: very much a here and now topic, but we take a forward looking view on what a mature approach to risk management might look like. We outline the building blocks for an effective, measurable, and actionable cyber risk appetite, as well as the key steps of the journey banks will need to go through to develop one.

The Future of Euro Interest Rates

The Euro Interbank Offered Rate (Euribor) and the Euro Overnight Index Average (Eonia) are critically important interest rate benchmarks for the eurozone, and together they are used as reference rates for >$175 trillion of wholesale and retail financial products. In A Tale of Two Benchmarks: The Future of Euro Interest Rates , we discuss that as neither reference rate currently complies with the recently introduced EU Benchmarks Regulation (BMR), both will likely need to be either replaced or transformed.

The race is on to reform Euribor so that it complies before the BMR authorization deadline of 1 January 2020. No attempt will be made to reform Eonia, however, and a transition to a new overnight reference rate will be required. A working group is looking to recommend possible alternatives to both while the ECB is developing ESTER (euro short-term rate), a new euro unsecured overnight interest rate that may serve as a replacement for Eonia and, potentially, as an alternative for Euribor.

Similarly to the issue of LIBOR transition (discussed in our last Spotlight), this means that a transition away from Eonia is inevitable. There are also plausible scenarios for a transition away from Euribor. (See Exhibit 1.) Given the volume of business involved, it would be a brave institution that relied on this happening without developing a Plan B.

Firms with exposure to Eonia must now shift gear to prepare for transition to an alternative rate. Firms need to also take action now to develop a credible Plan B for Euribor transition in the event that reform is unsuccessful or if the reformed rate is materially different. Delaying action will only increase the final transition costs and will amplify the financial, operational, and reputational risks. Indeed for some firms transition costs in excess of $100MM have been estimated.

Exhibit 1: Possible scenarios for Euribor reform or replacement

The Current Account Conundrum

If you ask a consumer whom they bank with, chances are they will give you the name of their main current account provider. The current account occupies a special place in banking – it’s the focal point of the customer relationship, the gateway to other products and services, and a source of rich transactional data.

Yet this market is in a state of flux: Incumbents face significant challenges from eroding revenues and stubborn legacy cost bases; technological advances are opening new possibilities for new banks (or greenfield propositions within old ones) to enter with slicker propositions and much lower costs; and regulatory changes are enabling new ways to facilitate banking without actually being a bank.

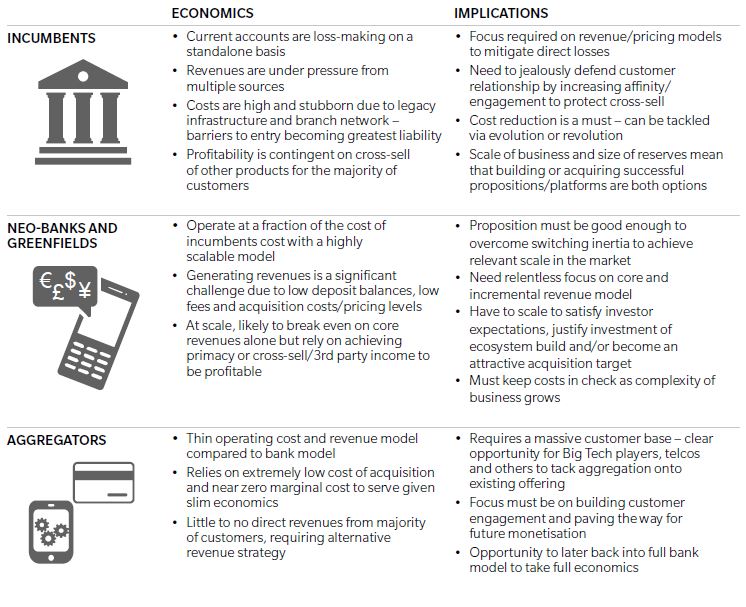

It is hard to predict exactly how these market forces will play out, but in our paper, The Current Account Conundrum: Follow the Money, we have drilled into the economics of current accounts to shine a light on the factors that will determine who succeeds and who fails, and to highlight priorities for decision makers.

Exhibit 2: Summary of economics and implications

Climate Change and Credit Risk

In Extending our Horizons: Assessing Credit Risk and Opportunity in a Changing Climate, we set forth a methodology to assess climate risk and help banks implement the recommendations of the Financial Stability Board’s (FSB) Task Force on Climate-related Financial Disclosures (TCFD).

The report drills into the implementation of the TCFD recommendations for the banking industry, though many of the elements are relevant to asset owners, asset managers, insurers, and corporates in general.

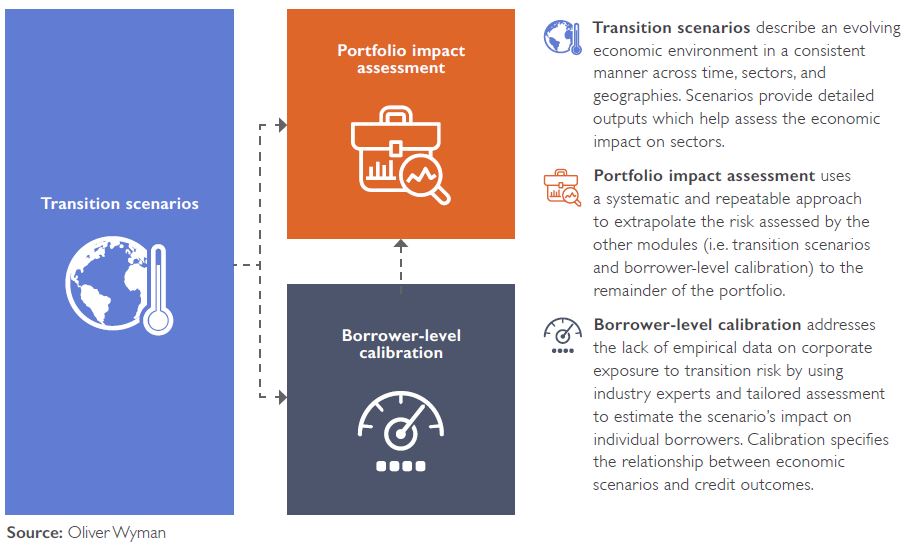

This report is the result of a collaboration of 16 of the world’s leading banks under the UN Environment Programme – Finance Initiative (UNEP FI) to pilot the TCFD. Through this collaboration, banks set out to develop and test a scenario-based approach for assessing the potential impact of climate transition risk on their corporate lending portfolios as recommended by the TCFD. As an inaugural exercise, the output of this process is intended to provide a first, but critical, step in a longer process of responding to the TCFD recommendations. The TCFD urges companies to use scenario analysis to assess and disclose the “actual and potential impacts” of climate-related risks and opportunities on their business, as well as how they manage them. This new methodology helps to build climate-risk awareness by setting the foundation for climate stress testing.

While parallels can be made between macro-economic stress testing and assessing climate transition-related risks, the latter presents several unique challenges, including:

- Extended time horizon, often focused over multiple decades

- Limited information to assess impact of climate transition on creditworthiness

- Substantial coordination required within organizations to execute an assessment

- Need to ensure that the methodology is repeatable, systematic, and consistent, while allowing for firm-specific customization, in order to enhance utility for both banks and the market

To address these challenges, the methodology developed combines portfolio-level and borrower-level risk assessment anchored by a set of transition scenarios. (See Exhibit 3.)

Exhibit 3: Overview of transition risk modules

Cyber Risk Appetite

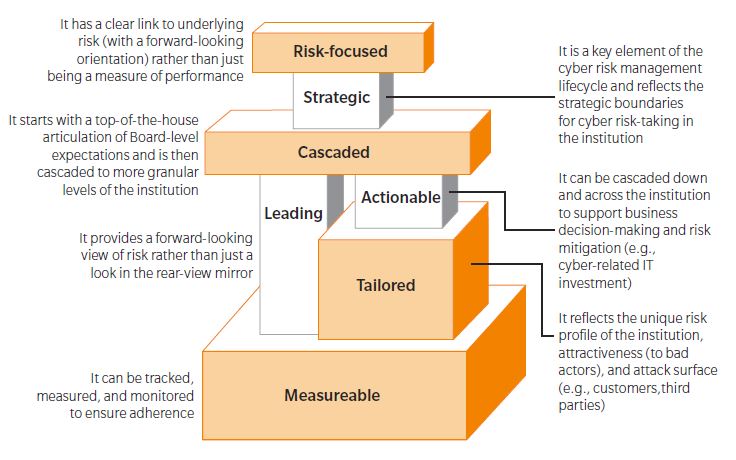

Coming back to the present for a moment, the scale of recent cyber attacks and resulting media attention, supervisory pressures to upgrade cyber risk management, and the pace of technology innovation to keep up are very much current issues. These factors are compelling financial institutions to have a clear understanding of the cyber risks they face, and to determine the level of cyber risk the institution is willing to accept. In our report When The Going Gets Tough, The Tough Get Going, we discuss what a mature approach to risk management might look like, particularly with respect to the issue of cyber risk appetite – the set of statements and metrics that articulate the views of the board of directors and senior management about the scope and level of cyber risk the institution is willing to accept. We outline how banks can build an effective, measurable, and actionable cyber risk appetite, as well as the key steps of the journey banks will need to go through to develop one. (See Exhibit 4.)

Exhibit 4: Building blocks for an effective, measurable, and actionable cyber risk appetite