The “Levelling Up White Paper” emphasized significant imbalances in the UK’s socioeconomic fabric. Although these discrepancies are multifaceted (for instance poverty, education, or healthcare outcomes), many of them ultimately come back to economic challenges, and in particular to businesses. Small and medium-sized businesses are a mixed population that includes a small group of high growth and innovative companies that are poised to be tomorrow’s economic leaders, as well as larger groups of companies that account for the majority of employment in the country and which have struggled to increase productivity over the last couple of decades. These businesses all contribute significantly to local and central government revenue.

The Oliver Wyman Government and Public Institutions team conducted a study for the Levelling Up Advisory Council to understand whether businesses face regional challenges and disadvantages in accessing the finance they need to innovate and grow. We collected the data and convened experts and leaders across government, local authorities, banking and investment, and SMEs themselves. The data was probably more limited than we anticipated, but the evidence was still sufficient to confirm what businesses, experts, and officials had observed.

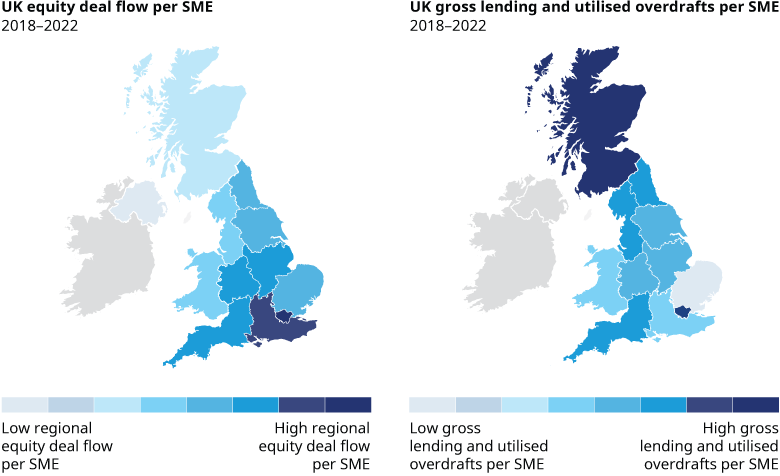

Our analysis shows that, while bank lending is mostly aligned with business profitability and ability to repay their loans, equity finance is characterized by more of an exponential relationship.

We identified three “effects” that explain that behavior: network effects, where areas with a high density of businesses benefit from a disproportionate amount of equity financing; cluster effects, where equity financing tends to concentrate in areas that are specialized in certain technologies; and wealth and proximity effects, where areas with wealthier households tend to receive more financing.

Despite some leading market actors already moving in (for instance investment funds focusing on underserved areas), we believe that closing this financing gap will require additional support and intervention across local and central government. Local government will play a central role in channeling private sector investments into credible, holistic plans, and designing place-based investment opportunities that are attractive to investors. This, however, requires local authorities to join forces, coordinate efforts, and share resources and capabilities.

Central government and its policy-driven arm’s-length bodies (ALBs) can also support and channel funds in the places that need it the most, in coordination with local authorities. This will also require close collaboration across the many departments and bodies involved, and possibly the creation of new products (for example place-based) or services (for example advisory) that may require the capabilities of multiple organizations. Finally, the data is really lacking, and it will be difficult to track progress without more visibility, especially on local lending and deposit data.

Regional imbalances won’t go away overnight but better financing businesses in the UK is a key first step in that direction, strengthening the socioeconomic fabric and laying the foundations for faster growth and full employment across the country.