Stakeholders across the industry are pouring over the latest release of Medicare Advantage Star ratings. The data, posted by the Centers for Medicare and Medicaid Services on Friday, Oct. 13, are intended to measure the quality of available plan offerings and give seniors guidance on picking a plan that best fits their needs. For insurers, this year’s release was a stark reminder that ongoing regulatory adjustments can have a dramatic impact on their ratings and, ultimately, CMS bonus payments.

We’ve crunched the numbers and gleaned five key takeaways that can help inform Medicare Advantage plans as they put in the final push for this measurement year and fine-tune their offerings for the coming years.

Star ratings continue to decline…

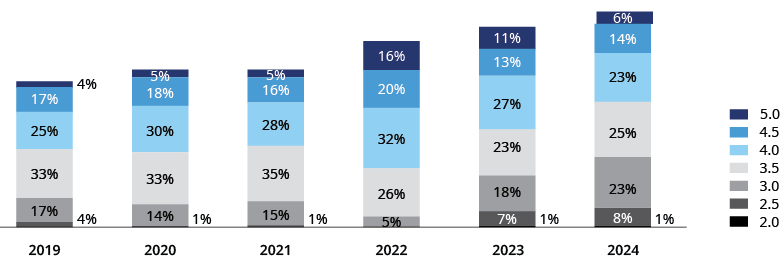

Overall, there was a downward movement across contract categories. The largest group of contracts are now rated 3.5 Stars, something we haven’t seen since 2021. The number of contracts earning four or more stars fell to 42% for Star Year 2024, down from 51% last year and 68% in SY2022. That means fewer contracts and payers will be receiving bonuses in their 2025 payments.

In terms of contract-level changes, nearly 200 contracts received the same score in SY2024 as they did in SY2023, 176 contracts experienced a decline, and only 100 improved their rating.

Notably, some of the most significant changes occurred at the highest and lowest ends of the rating scale. The number of contracts earning five stars slipped to 31 in SY2024, down from 57 last year. Meanwhile, the number of low-performing contracts — those earning an overall score of fewer than three stars — rose from two in SY2022 to 50 in SY2024.

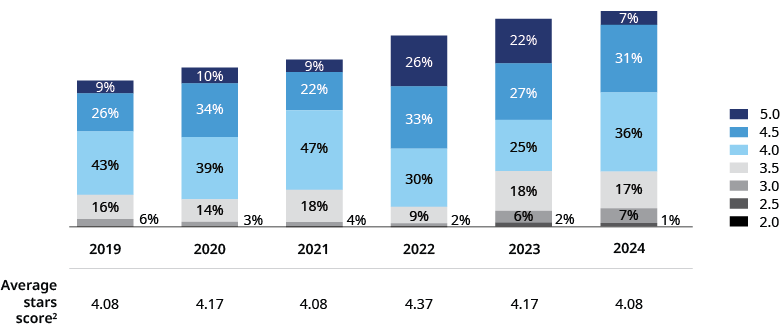

… but the percentage of beneficiaries in 4-plus Star plans stabilizes

The percentage of Medicare Advantage members covered by bonus-earning contracts held steady for SY2024. That’s good news for plans and beneficiaries following a steep drop between SY2022 and SY2023 when the percentage of members in four-plus Star plans fell from 90% to 74%. Reflecting enrollment trends toward plans with higher Star ratings, 74% of members are enrolled in a four-plus Star plan again based on SY2024 rankings. However, the percentage of members enrolled in five-star contracts dropped to just 7% in SY2024, down from a high of 26% in SY2021.

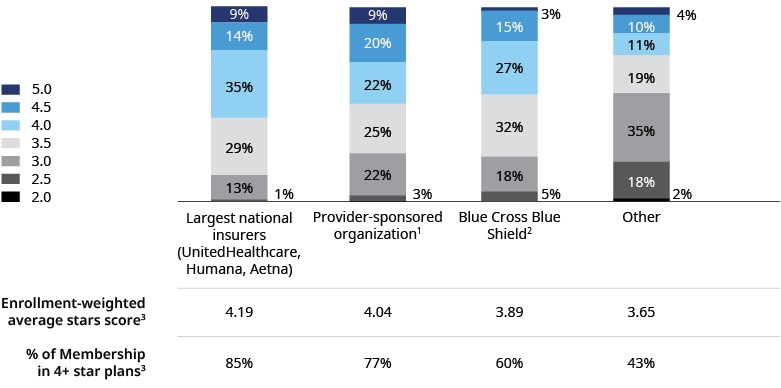

National insurers maintain strong Star performance

The strong Stars performance of large national players is putting pressure on smaller and regional plans to improve their scores. The big three — UnitedHealthcare, Humana, and Aetna — combined account for more than 50% of Medicare Advantage enrollees, and, impressively, an estimated 85% of their members will be enrolled in four-plus Star plans.

UnitedHealthcare and Humana maintained strong four-plus Star performance for SY2024 and Aetna regained that status for its largest contract. Each of the large national carriers saw several of their contracts move up and down in Star ratings — UnitedHealthcare had 14 contracts increase and 25 contracts decrease scores; 23 stayed the same. Five Humana contracts increased scores and 10 declined, while 24 maintained their score. For both of those carriers, however, their weighted average Stars score stayed roughly stable. Aetna had 15 contracts increase scores, including its largest contract, five declined, and 18 contracts did not change — netting them a significant increase in weighted average SY2024 performance relative to last year.

Provider-sponsored plans continued to be good performers, with over 75% of membership enrolled in four-plus Star plans. These results are consistent with the strengths that provider-sponsored plans offer, specifically greater alignment between the payer and provider clinical care teams. That integration has the potential to drive better performance on provider-driven measures, including HEDIS and select CAHPS; Health Outcomes Survey; and Part D measures, including medication adherence.

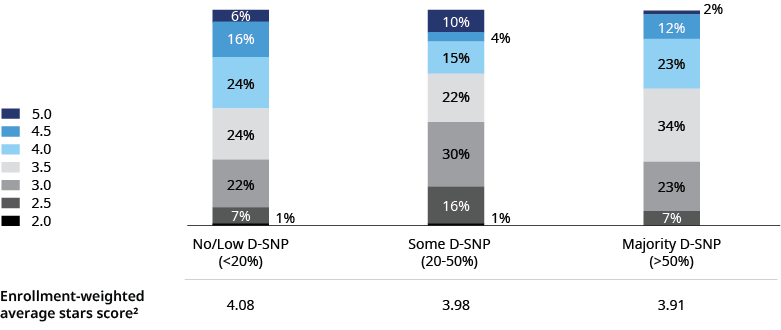

Impact of dual eligibles on Star ratings

Contracts with no or low dual-eligible special needs plan membership tended to outperform other plans in terms of quality bonus qualification. However, there may be some advantages for contracts with a high level of D-SNP enrollment, potentially a result of greater focus on the dual population or purpose-built capabilities to better serve that group.

Contracts with a middling level of dual eligibles performed worse than either those with few or those with many duals, indicating the challenges of trying to serve both the general enrollment MA population and the unique needs of dual eligibles.

Breaking down performance further, contracts with higher dual-eligible membership scored lower in such areas as medication adherence; HEDIS, specifically screenings and preventative care; complaints; and members choosing to leave the plan. By contrast, contracts with a higher concentration of dual eligibles tended to outperform those with low/no duals in CAHPS. This proved particularly helpful for plans given the relatively high weighting of this category, although that will decrease beginning in the measurement year 2024.

While the Health Equity Index will not impact Star ratings until SY2027, performance measurement will begin in 2024. As a result, the focus will increasingly be on both growth and quality improvement for these most vulnerable members. Increased analysis and awareness of trends in this space will be critical for plans mapping out their path forward in Stars.

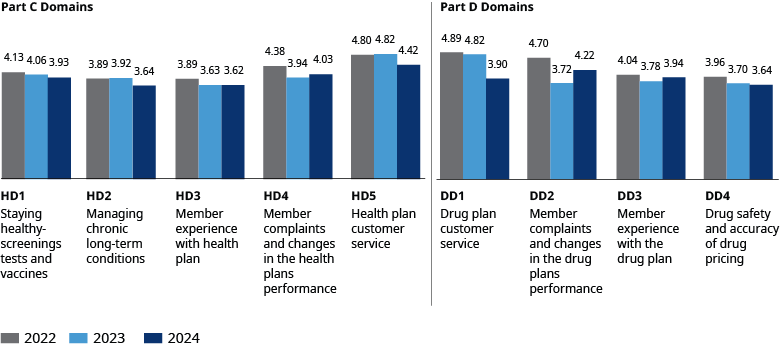

Health and drug domain scores dip

Most health and drug domains continued the downward trend that we saw last year, except for complaints and member experience. This is likely due to meaningful payer investments and efforts to stabilize these heavily weighted measures. The downward trend aligns with CMS’ efforts to raise the bar for performance to achieve higher ratings.

The most substantial declines included health plan customer service, particularly for reviewing appeals decisions and appeals timeliness, and drug plan customer service, mainly for foreign language TTY measures for drug plans.

While SY2025 will be fairly stable in terms of measure weighting relative to SY2024, CMS will continue to move the goalpost for plans – shifting the relative importance of key measures for SY2026 (measurement year 2024). Specifically, CAHPS measures will be resetting to double-weighted instead of quadruple-weighted. Thus, although the focus on member experience will remain important, the resulting increase in the relative weight of HEDIS, medication adherence, and other key measures will require Medicare Advantage plans to adjust strategies and tactics accordingly.

Looking ahead

The net result of the SY2024 ratings appears to be overall good news for beneficiaries, with many four-plus Star plans to pick from this open enrollment, which closes out Dec. 7. It is largely good news for plans as well since continued bonus revenue will fund innovative benefits for many. Still, there’s a need for continued efforts around Stars performance and quality improvement – not only for plans who might have lost or missed bonus eligibility for 2024, but for all plans as cut points rise and the Stars program gets more competitive. With the assessment period for the SY2026 program two months away, there’s no shortage of work to both close out this measurement year successfully and start 2024 on a strong footing.