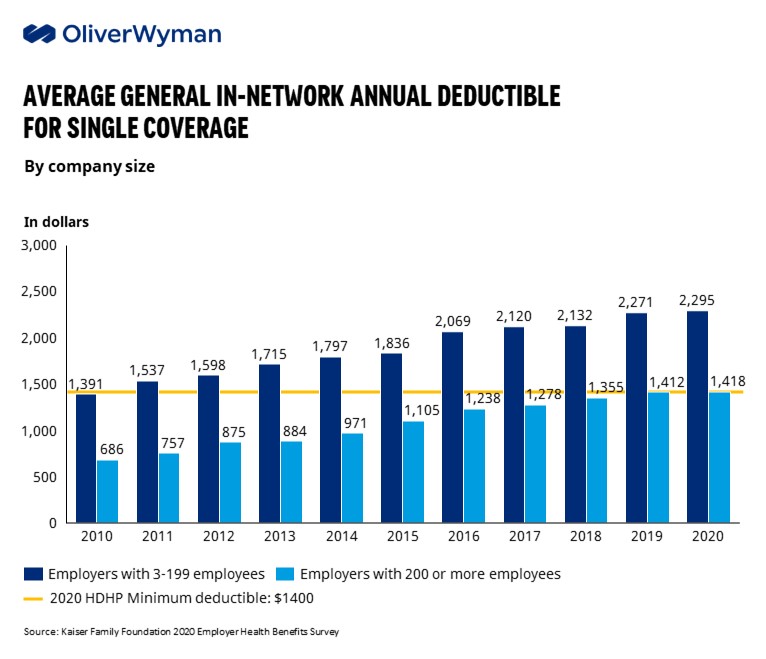

Healthcare has long struggled to come up with consumer-friendly processes for billing and payment, areas that have become more complicated and critical to address as patients shoulder an increasingly larger share of the financial burden. Roughly one-third of Americans were covered by a high deductible health plan in 2020, up from 24% in 2015, according to the Kaiser Family Foundation, with the minimum deductible climbing every year.

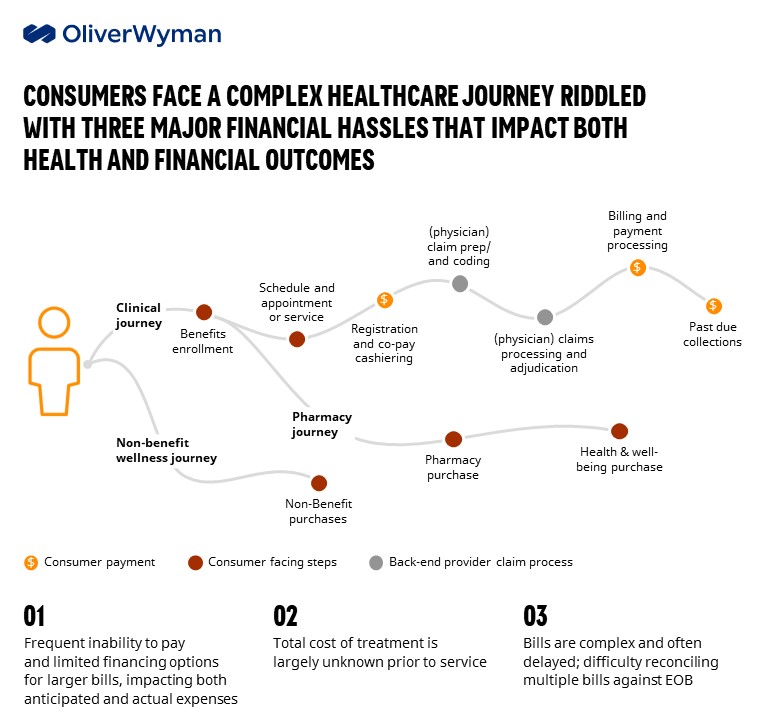

That cost shifting comes with a hefty price tag — 25% of insured adults under the age of 65 reported issues paying medical bills, a KFF survey found; 12% said that had a major impact on their lives. Additionally, 46% of adults said they had difficulty affording out-of-pocket costs not covered by insurance. As a result, 17.8% of Americans had medical debt in collections in June 2020, totaling an estimated $140 billion, a JAMA Network study reported.

Not So Patient Friendly

There have been attempts to improve the payment experience, from consolidated bills to online cost-estimators. And now we have federal price transparency rules that are intended to give consumers details about the cost of a procedure, although only negotiated rates between payers and providers are required to be made public, not a patient’s actual out-of-pocket cost.

Unfortunately, price transparency efforts have largely fallen short when it comes to influencing consumer behavior. Nearly 70% of adults polled by KFF last summer said they were unaware that hospitals were required to post prices. Even when consumers are made aware of such tools, they are not making huge changes in behavior. For instance, an outreach and marketing campaign promoting price transparency in New Hampshire increased traffic to a state website by an astounding 600%, but researchers writing for Health Affairs found that the information did little to sway patients to switch to lower-cost providers.

Beyond financial considerations, consumers say they are confused by the number of bills they get, don’t now how much they owe, and aren’t sure when a payment is due.

More Payment Options

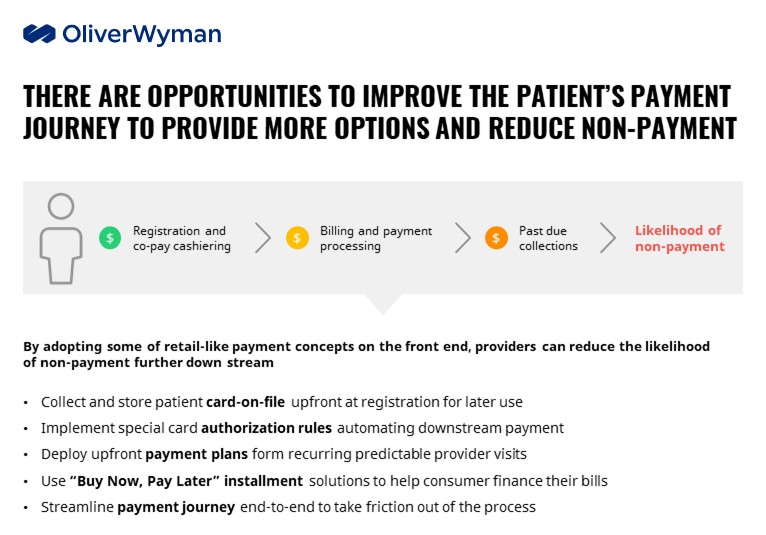

Where healthcare falls short is creating a more retail-like and seamless experience. Because of the fragmented nature of patient billing, providers should strive to ease the patient’s journey upfront to reduce future non-payment. Consumers are used to sophisticated and user-friendly payment models in every other part of the economy. The goal for healthcare should be to create an environment that mirrors those experiences and gives healthcare organizations more financial certainty. The industry can look to retailers for modern payment tools. Existing solutions such as card-on-file storage or specialized processing rules can facilitate a smoother payment journey downstream, but providers can also tackle financial vulnerability upfront by offering installment payments or buy-now-pay-later solutions upstream.

There’s been an uptick in healthcare organizations moving in this direction:

- UnitedHealthcare’s UCard, which executives discussed during their Investor Conference last year. The idea is to consolidate member benefits into a single card — member ID, over-the-counter and health food benefits, as well as any reward cards that members carry.

- Atrium Health Wake Forest Baptist, Geisinger, and Northwell Health are among the large health system embarking on programs to adopt such retail-like approaches as flexible payment plans, among other things.

- Startups like Cedar, Flywire, PayZen, and VisitPay, which offer digital billing and payment technologies that can be integrated into a health system’s existing platform, are gaining momentum with health systems and investors.

As healthcare organizations push toward a more consumer-centric model, they should figure out ways to better integrate financial engagement technology into their strategies. As we’ve seen throughout the COVID-19 pandemic — in healthcare and other industries — consumers expect organizations to innovate and provide reliable, accessible, and convenient services. Those that don’t risk getting left behind.

We’ll explore how organizations can build out proprietary payment offerings and cards to drive value for patients and reduce leakage in upcoming Oliver Wyman Health articles.