Editor’s note: This is the second article in a series on creating a more retail-like payment experience for patients, payers, and providers. The first article explored the fractured nature of patient payments, made more complicated by an increased reliance on high-deductible health plans. In this article, we look at how virtual care can pave the way for more seamless healthcare payments.

Consumer expectations have shifted. People are ordering and paying for more things online. By some estimates, the pandemic boosted ecommerce sales by $218.5 billion, hitting a total of $870 billion in 2021. Healthcare has seen its share of upheaval during that time. For instance, 64% of broadband households reported using telehealth services between 2020 and 2021. In a Harris Poll, 84% of people who used telehealth said they planned to continue doing so and 58% wanted to have more online access to their provider.

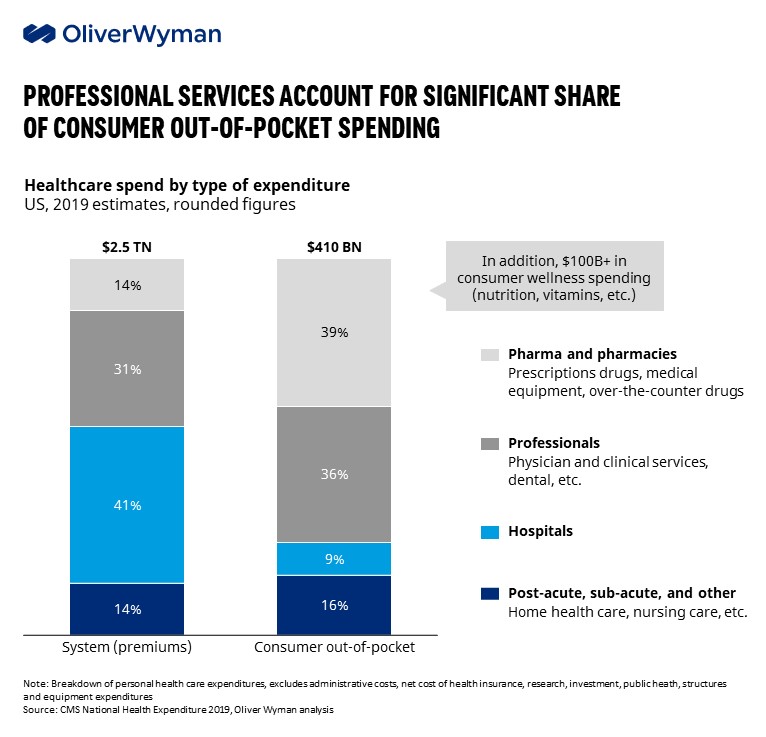

We see an opportunity for healthcare to capture this momentum and deploy seamless payment tactics, such as setting up payment plans and storing patient payment credentials more systematically. Virtual care is a natural place to start, but these approaches are transferable to a host of services and brick-and-mortar channels. That’s especially true if we think about the amount of money that comes from out-of-pocket spending. As consumers take on a larger share of spending, creating easy-to-use payment options would improve their experience and create more financial predictability.

Virtual Care as the catalyst for new payment opportunities

While there’s been a leveling off since the initial surge, we expect utilization of virtual care to remain above pre-pandemic levels for the foreseeable future. In fact, employers plan to offer more benefits, according to Mercer’s 2021 survey of employer-sponsored health plans. For instance, 20% said they were considering offering targeted solutions around such specific health conditions as diabetes. And 10% were looking at offering virtual primary care.

Consumers regularly cite convenience as a top reason for choosing virtual care. As we illustrated in the first article in this series, healthcare has a burning platform to make it easier for consumers to pay for services. Beyond convenience and the digital native features of virtual care, telehealth may become the catalyst to broader industry change because of several unique characteristics:

- It is confined to a set of well-defined and relatively simple medical visits and CPT codes, offering opportunities to trial new and improved billing models.

- Several telehealth ecosystems are offered by payers in a closed network that concentrates and aggregates more data than traditional brick-and-mortar care and provides opportunity for real-time adjudication and a simpler patient payment model.

- Virtual care is often the front-door to brick-and-mortar visits and can play a unique role in collecting, packaging, and transferring patient payment information to facilitate seamless payment experiences downstream.

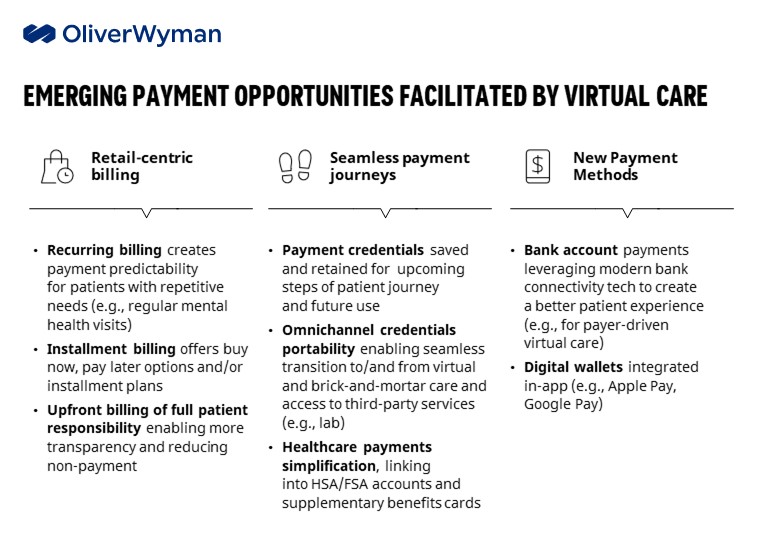

The industry is already showing signs of adopting retail-driven models as key players like Walmart, in tandem with Included Health; Carbon Health; One Medical; and others are adopting concierge models that offer virtual care subscriptions. As a result, virtual care is fertile ground for new payment opportunities to emerge and gradually spread to other corners of healthcare:

Taking the first step

Three essential building blocks need to come together to capture these opportunities:

- In operations, providers must build internal payments capabilities to enable new models. This may require dedicated personnel, instead of split responsibilities within finance; cross-functional coordination with other such enterprise functions as IT, patient experience, and marketing; and attaining new expertise needed to deploy and manage these payment models.

- Technology enhancements must enable new types of journeys outside the traditional payer rails that will require some lighter integrations — enabling subscription type recurring payments — but perhaps more involved integrations for ambitious solutions — omnichannel, referral of patient credentials, etc. The integrations will need to be API-driven and allow services to be consumed by other enterprise functions and by third-party vendors.

- Deploying retail-centric solutions will require modern payment partners: a sophisticated payments gateway that’s easy to integrate and has existing bridges to EHR systems to facilitate future use-cases and modern third-party fraud tools given the digital nature of virtual care payments. Payment partners will also need to interface with patient engagement solutions used by providers and payers to simplify patient onboarding and post visit engagement.

Leveraging these emerging payments opportunities, providers and payers will be able to unlock upside: increased patient loyalty and retention through a radically differentiated journey, potential monetization of payment credentials captured upstream in referral to downstream providers and reduced patient non-payment.