Editor’s Note: This article is a continuation of Oliver Wyman’s recent series on the future of “Digital-X” systems in the United States, focused on how this digital transformation may impact Asia. For more information, read Part 1 (Reassessing Virtual Needs in a Digital World) and Part 2 (Unexpected Players are Rethinking Healthcare). Read our full point of view here — Asia's Digital Hospitals Of Tomorrow.

In many Asian countries, the public healthcare system is typically hospital focused. There is a parallel primary care system run by the private sector, which often lacks scale and in which quality varies significantly. As such, many patients view hospitals as their first-line site of care for symptoms like minor coughs and colds and routine preventive care and up to severe catastrophic accidents and illnesses. Amidst the pandemic, some traditional hospitals face a revenue decline of up to 50 to 70 percent – a figure even more pronounced in Asia where medical tourism (primarily elective care) accounts for roughly 50 percent of private hospital revenue in some markets.

At the same time, healthcare systems in Asia were considered to be in the early stages of technology adoption and development even before COVID-19. “Many health players are behind on technology investments,” Vincent Quah, Amazon Web Services’ Regional Head (Healthcare) for Asia Pacific and Japan, told Oliver Wyman late last year. “There is a lot of technical debt and trying to put in additional investment may be a challenge for them.”

These two trends – an over-dependence on hospital care and under-developed technology development – have exacerbated revenue decline in the pandemic and accelerated the need for digital options. The growth of digital healthcare services in the Asia region may become a silver lining like it has in other parts of the world. There may be an opportunity now for Asia’s providers to consider how their portfolios may need to adapt to this reinvention of care delivery, especially as many of the routine care taking place in hospitals today can instead be done virtually. We are already seeing this drive China’s journey and its rapid acceleration of telemedicine, remote monitoring, and digital therapeutics, with the online medical market expected to grow over 20 times by 2026.

Taking Digital Acceleration Levers from Clinics to the Cloud

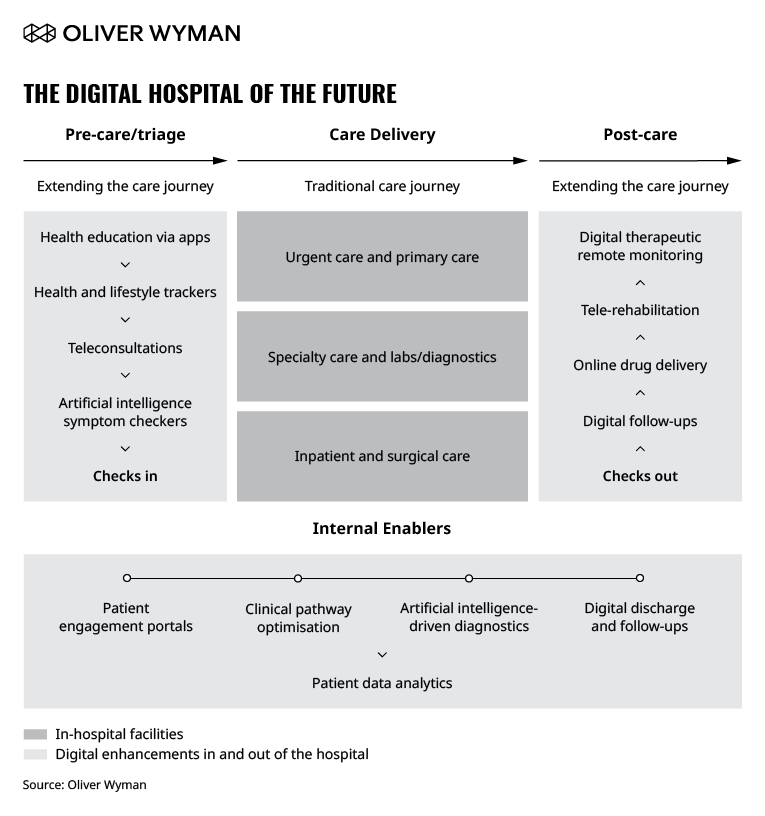

Patient journeys now begin and end outside of a hospital’s four walls. For hospital operators, this means internal enablers will help them channel patients and workflow in effective ways and augment capabilities (such as enterprise telehealth systems to link specialists across facilities), as shown in Exhibit 1.

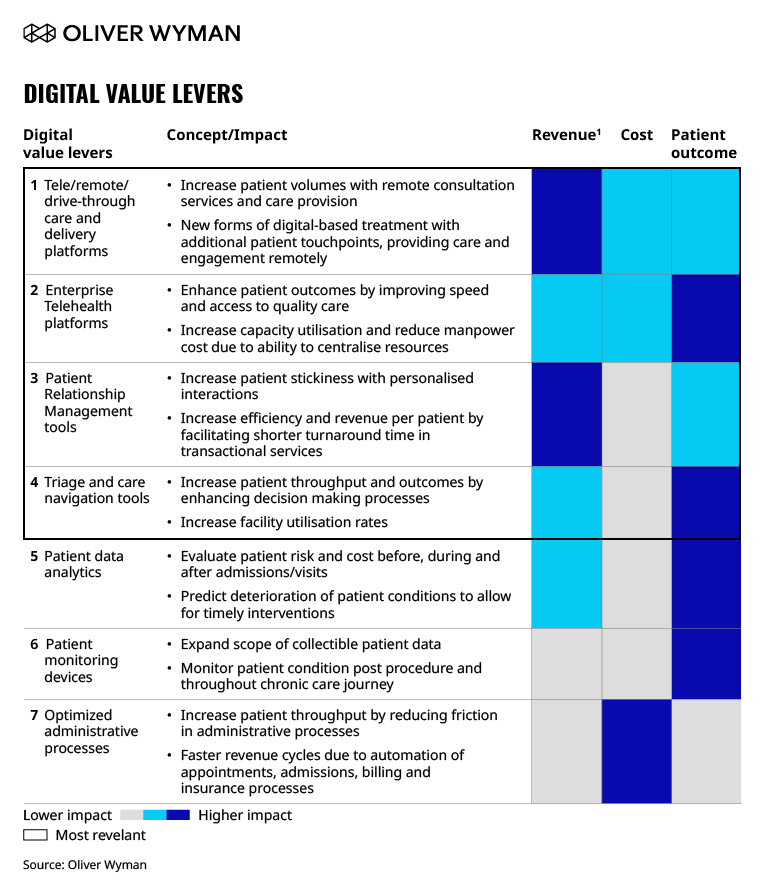

There are seven main digital levers based on their support for revenue acceleration, their potential for cost savings, and their impact on patient outcomes.

According to Exhibit 2 below, there are substantial benefits of digital healthcare solutions in addressing existing business challenges and achieving enhanced revenue capture and patient experience. (For more information on four of these most relevant digital levers and applications for Asia, see our article, Asia’s Digital Hospitals of Tomorrow.

Some Asian healthcare providers have accelerated their adoption of digital levers during the COVID-19 pandemic. In early May, IHH Healthcare rolled out its telemedicine service across key Asian markets, including Singapore, Malaysia, India, and Hong Kong. One example is in Singapore, where patients can book virtual consultations with doctors from IHH’s Parkway clinics through the MyHealth Connect phone application and can retrieve their medical certificates digitally and have medicine delivered to their door.

In the Philippines, Metro Pacific Hospitals announced that is expanding telemedicine to offer its patients full services while keeping foot traffic to a minimum. Telemedicine is also expected to enable operational efficiencies across the group, including facilitating stronger collaboration across its hospital network and optimizing bed capacity for patients with urgent needs.

Enhancements like these offer patients a more connected ecosystem and greater access to their physicians, records, and additional support such as remote monitoring, which they can enable from their homes.

How Hospital Providers Can Prepare for the Future

What does this mean for traditional Asian healthcare providers and future business models? Recent consumer research suggests consumers in Asia are receptive and excited about this future. As with US systems, hospitals in Asia must rethink traditional parameters – such as the scope of services, scale, areas of innovation, and operating models. They must also consider what digital levers can be applied.

Let’s take a look at the hospital of the future archetypes that we previously envisioned in the United States and the potential applications for Asian healthcare:

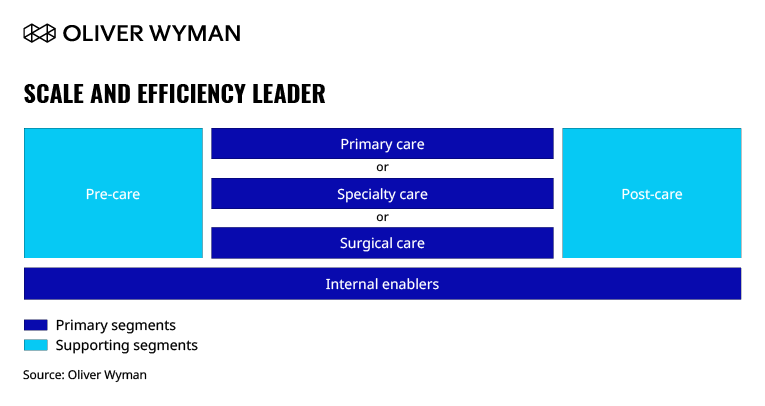

A Scale and Efficiency Leader enables low-cost proposition for patients through being a “focused factory” of standardized and efficient operations at scale.

This archetype relies heavily on technology to optimize clunky administrative processes and upend traditional labor costs in the back and front office. It maximizes the use of technologies like enterprise telehealth platforms and triage and care navigation tools to optimize in-hospital capacity utilization and increase process efficiencies across a selective set of high-volume disciplines. This will fundamentally transform fixed versus variable cost dynamics, enabling healthcare providers to replicate at scale across multiple regions. One notable example is Narayana Health in India.

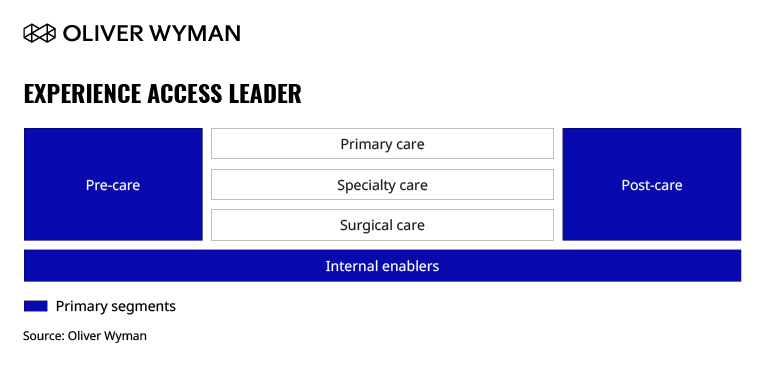

An Experience Access Leader provides a personalized, seamless healthcare experience across the patient care journey, with a wide range of patient access options.

Patient relationship management tools increase points of personalized interaction beyond hospital visits, while patient data analytics provide real-time insights on patients and enable improved clinical decision-making, personalized treatments, and predictive diagnosis.

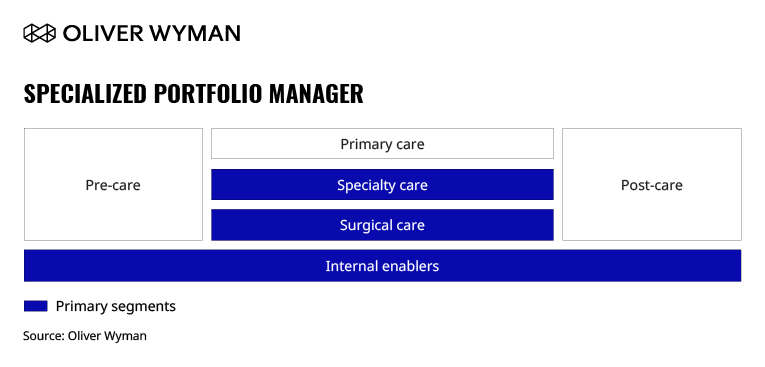

A Specialized Portfolio Manager manages a set of care brands specializing in a specific clinical need (such as oncology) and/or a sub-population (such as the elderly).

While there is an emerging trend towards key specialization in Asia, a majority of healthcare providers still employ a generalist care model. This archetype implies pivoting to highly focused destinations of care by building dedicated, digitally-enabled facilities for end-to-end patient needs. This specialization focus lets healthcare providers find their competitive niches and deliver consistent, high-quality care to patients at scale in focused centers and more effectively cater to the medical tourism segment.

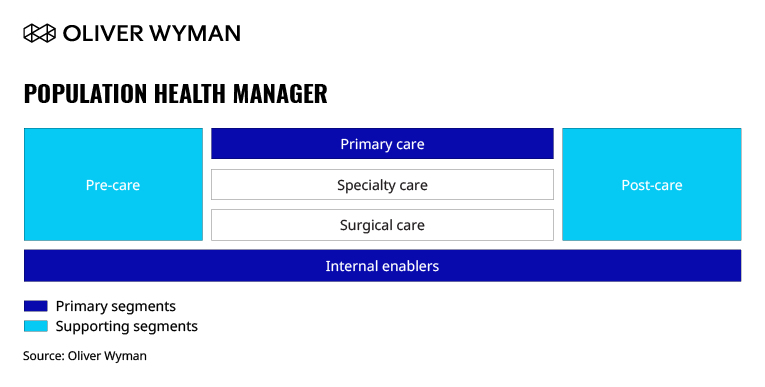

A Population Health Manager is an integrated delivery network focused on owning and managing risk for the total cost of care outcomes.

This archetype implies a dramatic shift towards strengthening primary care offerings, investing heavily in wellness and prevention, and potential changes in reimbursement (from volume to value). Digital levers will be an important enabler, disseminating pre-care prevention methods and post-care management, and reducing the patient occurrence and reoccurrence rates. A successful shift will drive down overall population risks and long-term costs of care for healthcare providers.

As the global pandemic continues to dampen traditional sources of value while also transforming patient demand (more virtual), there is potential for an even more radical reverse engineering of hospitals and care. While the earlier defined archetypes regard digital levers as enablers and still position physical hospitals at the center of care, we envisage a “digital-first, asset-light” model may become a viable future archetype for Asia.

In the US, we examined how such a system might continue to provide integrated, end-to-end medical care for patients across the care continuum. In Asia, we see an opportunity where healthcare providers could (i) diversify into ambulatory, digital and retail offerings, (ii) selectively outsource and sub-contract with partners to fill in any gaps in offerings, and (iii) focus hospital sites on the highest acuity and highest margin care. This kind of digital-first, asset-light model can continue to meet patients’ varied needs by expanding sites of care into community-based and cloud-based settings while limiting the need for capital intense assets and inefficiencies via traditional hospital facilities.

The Hospital of the Future – Implications for Patients and Healthcare Providers

Many providers have been rightfully hesitant to commit time and investment in the above ideas, least of all to reinvent themselves. Others have only added incremental enhancements to legacy systems. To bring about real transformation, however, healthcare providers need a more fundamental examining across three core elements:

1. Business strategy and synergies. Here, healthcare providers revisit the organization’s overall strategy and ambition across digital and identify potential synergies across the portfolio. This digital strategy must be grounded in both the needs of providers and consumers long-term.

2. Hospital archetype (or hybrid). As a next step, providers identify which suitable hospital archetypes may suit them. This should take into consideration its current hospital network structure, portfolio, and value proposition.

3. Digital value levers. Healthcare providers must select the ideal digital levers to invest, customize, and implement to achieve the selected hospital archetype.