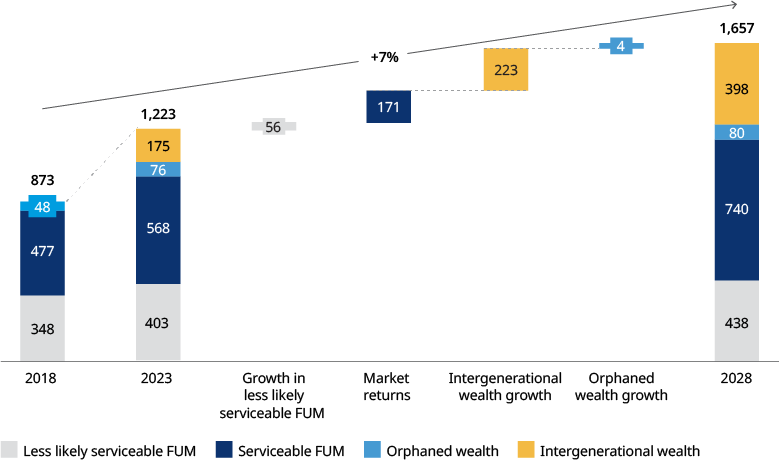

Through the COVID-19 pandemic and into 2023, the Australian wealth management market experienced a modest growth of 3%. This growth was largely driven by fair stock market performance, a rebound of asset values, and substantial savings deposits. Since our last publication, “The Future Of Financial Advice”, we have revised the market size to $1.2 trillion in assets under management (excluding superannuation). Over the next five years, contestable funds under management (FUM) are estimated to increase by $400 billion, indicating a significant growth opportunity in the wealth space.

This sector has the potential to serve the financial needs of nearly 75% of the Australian population, who are currently underserved. For firms and regulators to be optimally positioned to capture growth, they must address three primary challenges in the sector:

- The current offerings not well suited to mass market customer needs

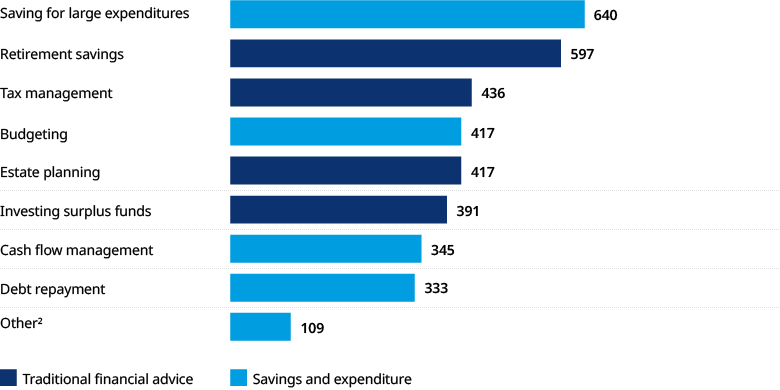

Existing channels, risk profiles, and product offerings are largely one-dimensional. Recommended investments fall into high-risk alpha or low-risk guarantee categories with few middle-ground options. Furthermore, customers can only access these through a qualified adviser, as digital tools are either unavailable or only designed for sophisticated investors. The needs of the customers extend beyond the realm of “traditional financial advice,” with many requiring solutions to manage other challenges such as savings and expenditure.

- The sector’s regulatory and compliance mindset requires a reset

The Quality of Advice Review (QAR) in 2022 marked a positive step towards addressing the financial advice gap. However, only a subset of the recommendations has been endorsed by the Australian government. Regulators can make further advancements such as allowing other financial institutions (like banks and insurers) to offer guidance or assistance to customers, and adopting international best practices as observed in the United Kingdom and New Zealand by establishing a specific regulatory provision for digital advice. Firms must also update their risk culture and governance frameworks to enable decision-making that more effectively balances customer and shareholder outcomes.

- Large incumbent players should strive for increased adoption of digital and data

Digital leaders such as Direct-to-Consumer (D2C) wealth management platforms deploy a mix of technology and data opportunities to differentiate themselves through experience and impact. This includes streamlining their user journey to minimize friction, utilizing predictive investment models and behavioral analytics, and gaining deeper customer insights to effectively conquer inertia and boost proactive engagement. These capabilities are becoming more cost-effective to deliver and are expected to generate faster ROI, particularly as generative artificial intelligence (AI) gains traction. In fact, global IT spending in 2023 was expected to grow by 4%, with the priority being client onboarding, digital channels, and client acquisition tools.

Rethinking the approach on customer segmentation

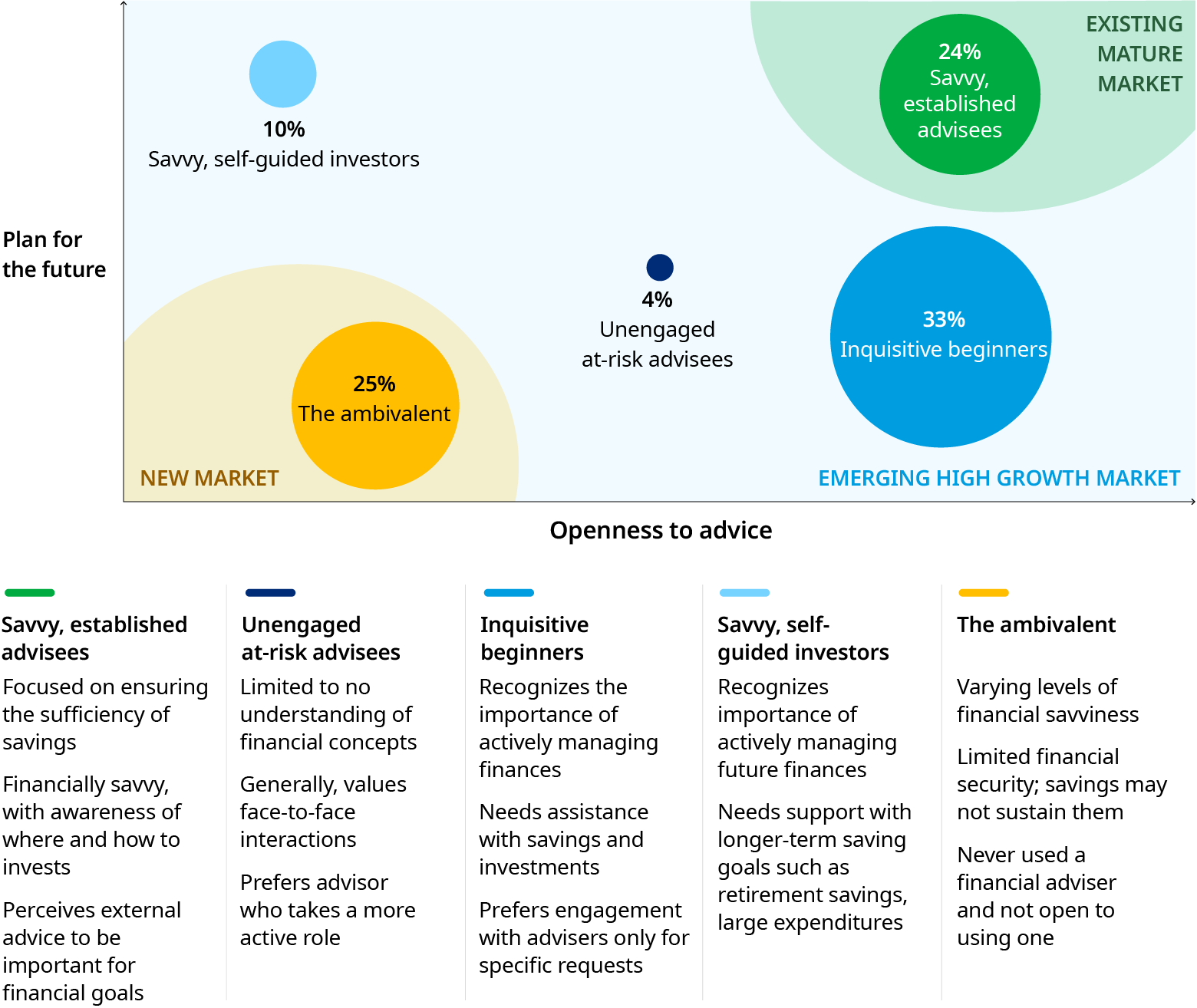

Oliver Wyman surveyed 2,000 Australian consumers to identify their needs and attitude towards seeking wealth management-related assistance and advice.

The survey revealed highly divergent views across various aspects such as attitudes towards wealth, financial savviness and engagement, financial goals, struggles, and preferences. In many cases, degree of wealth and age alone have little impact on these views. Therefore, we suggest that historical segmentation approaches are outdated. The sector first and foremost needs to rethink its approach to segmenting customers. By considering customers’ life stages, attitudes, and motivations that influence financial needs, providers can better tailor their offerings to meet the unique needs of each segment.

Our survey led to the development of five primary segments defined by psychographics and attitudes towards money. These segments have unique financial aspirations and struggles, with respondents consistently naming “achieving financial independence” — for example, being debt-free and having the ability to cover daily expenses comfortably — and “building an emergency fund” as long-term financial goals that are important yet difficult to achieve independently.

Our survey highlighted three key findings:

1. Consistent view of financial freedom and goals across all segments

Across segments, there is a consistent view on what “financial freedom” means, with the top three requirements including: being debt-free and having the ability to comfortably cover daily expenses, feeling financially secure to confidently handle unexpected challenges, and securing a comfortable retirement and future without financial concerns. Likewise, when asked about the importance of various financial goals in the short and long term, there were many similarities in priorities across all segments. Consumers tended to prioritize outcomes such as achieving financial independence or a milestone and building an emergency fund, all of which are aligned with attaining financial freedom. Consumers also largely felt that achieving these goals was challenging but feasible.

2. Limited confidence in sustaining current financial position long-term

While all segments have similar financial goals, their perceived ability to meet these goals varies. The majority believe they are in a financial position that enables them to meet short-term financial goals, with the unengaged at-risk advisees and ambivalent segments as notable exceptions. When it comes to longer-term financial commitments, very few believe their current savings are sufficient to sustain their current lifestyle post-retirement. This is particularly true for unengaged at-risk advisees, inquisitive beginners, and the ambivalent segments. The wealth sector can play a pivotal role in uplifting the overall financial wellbeing of consumers in these segments to ensure they are well equipped to realize their long-term objectives.

3. Lower levels of engagement and trust in financial advisers

Trust plays a pivotal role in driving engagement within the wealth management sector. Overall trust towards financial providers is relatively low, which may be attributed to the misalignment between financial advisers’ offering and the financial needs of inquisitive beginners and self-guided investors. Financial advisers are generally found to be less trusted than alternative providers, with only 20% of all consumers trusting them as a primary source. Consumers are more likely to consult their own family, friends, and personal network for advice on managing personal finances. Online research also emerges as a high trust source across most customer segments, which highlights an opportunity for all wealth players to re-evaluate their digital channels to support customer education. Evaluating the consumer-adviser relationship, it becomes evident that establishing trust is pivotal, given this is a key reason cited for changing or ending advisory relationships.

There remains a fundamental trust gap among both consumers and shareholders in the wealth sector’s ability to reinvent itself. Although the sector should be enthused by the upcoming growth opportunities, there are a few immediate priorities we can recommend to help bridge this gap and set a clear course to a better future. Read more in the full report below.