What follows is a Co-branded Oliver Wyman report with eBenchmarkers, now a part of Curinos. eBenchmarkers is a specialised benchmarking consultancy firm with over 20 years of experience, focusing on General Insurance. We explore observed market impacts following the implementation of the GIPP rules.

Following the announcement of the General Insurance Pricing Practices (GIPP) rules, much work was undertaken by market participants (brokers, MGAs, insurers and price comparison websites) to ensure compliance, to anticipate market impacts and to plan their responses.

Now that the rules have been in effect for most of this year, we are starting to better understand the immediate impacts and can consider how the market may evolve from here.

Big changes in persistency and new business volumes

As expected, at the start of the year we saw material increases in new business prices (~15% year-on-year for motor and ~5% for home) and decreases in renewal prices (~8% for motor and ~4% for home) as policies were repriced to remove the ‘loyalty penalty’ that the regulation was intended to address.

Whilst many anticipated that this removal of a ‘price walk’ at renewal would lead to increased persistency in the medium term, the immediacy and the scale of this impact since the start of the year has taken some by surprise, with market level renewal rates up by ~4ppt for motor and ~1ppt for home in H1 2022. A significant proportion of renewing customers are seeing flat or decreasing prices at renewal relative to their prior year’s price and as such are either no longer checking price comparison websites (as evidenced by lower quote volumes) or when they do check are often not seeing sufficiently cheaper prices to warrant switching.

This effect is not universal, however, with longer tenured customers in particular now less likely to shop and material shifts in the composition of new business customers, for example within motor, volumes are down ~17% for drivers >50 years old, down ~10% for ages 21-50 years, but up ~11% for drivers <21 years (as young drivers re-enter the market following COVID-19 disruptions).

As a result, in aggregate new business sales at a market level were down materially in H1 (~13% for motor and ~14% for home) which has made it difficult for many to realise their growth ambitions for this year and poses challenges for price comparison websites in particular, whose economics are linked to the volumes of switching customers. The situation on home is more pronounced year-on-year than the change in persistency might imply as a result of the high number of housing transactions in 2021 vs. 2022, whilst the opposite is true for motor with more young drivers re-entering the market in 2022.

A wide range of outcomes but comparing relative performance is difficult

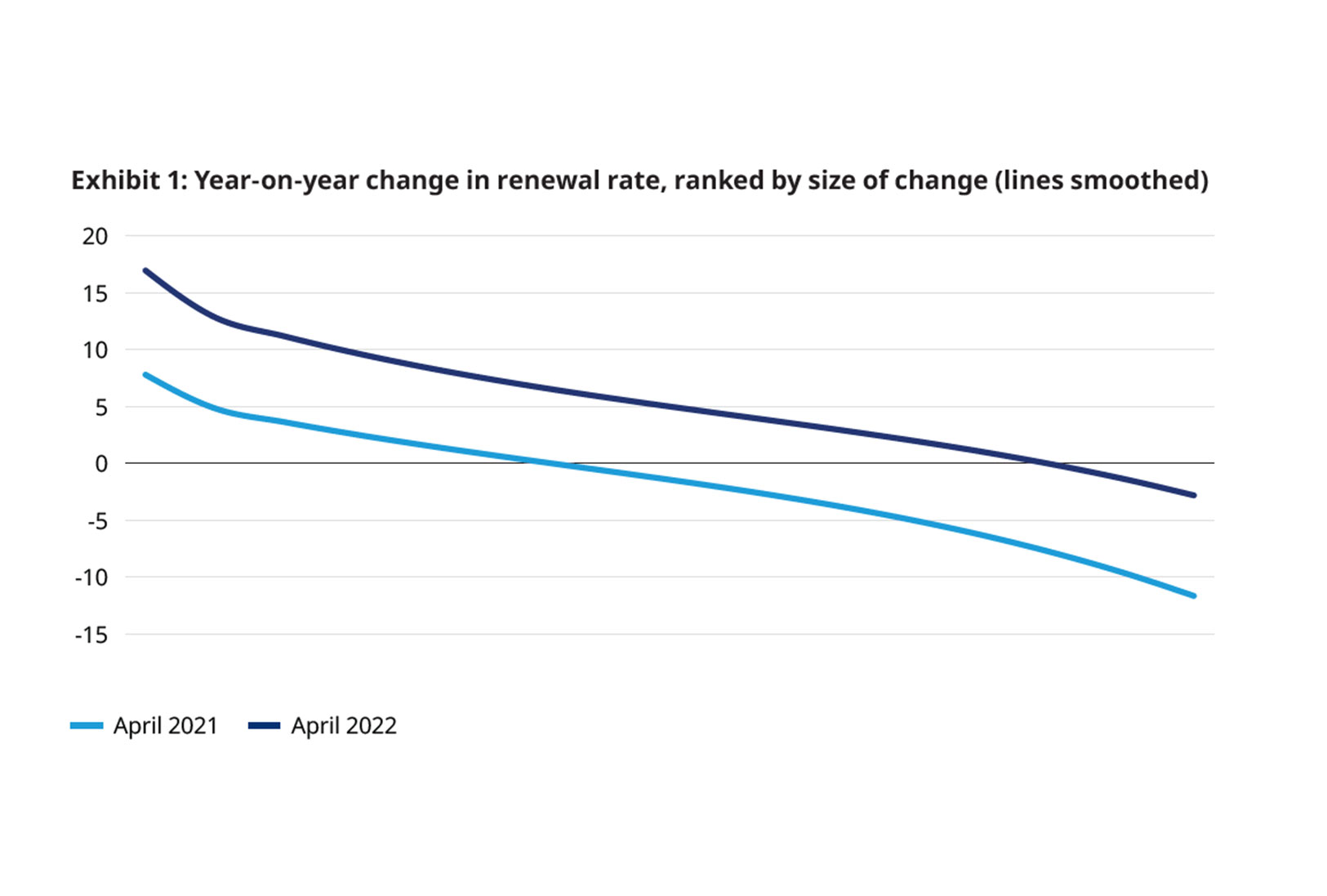

Market level impacts only tell part of the story, however, as in practice there has been a wide range of outcomes across participants both in terms of their renewal performance and their ability to remain competitive at new business. The interquartile range for year-on-year changes in total book renewal rate varies from -3ppt to 9ppt across a representative sample of market participants, with a clear shift from April 2021 to 2022.

There are a variety of complicating factors that make like-for-like comparison difficult across the industry, for example, differences in business mix where a variety of customer characteristics can have an impact (e.g. tenure, channel, age, claims experience) or differences in commercial decisions taken on where to set pricing (e.g. balancing new business competitiveness and back book profitability, or as a result of different underwriting performance).

Whilst insurers or brokers will have a good sense of their own performance, it can be hard to contextualise and interpret this without a good understanding of how competitors are performing.

Shifts in new business channel and products

Since the start of the year price comparison websites have continued to gain share of new business sales (even if these are down in absolute terms) at the expense of primarily direct sales including those via cashback websites as almost all participants have abandoned these since the start of the year.

Whilst new business volumes have shrunk at a market level, the volume of new business telematics policies has continued to recover from depressed levels through the pandemic as driving schools and test centres reopened and young drivers entered the market. At the same time, some players have either launched new telematics products or have been pricing these competitively as they look to expand their underwriting footprint or look to drive growth in areas where they have been less competitive historically. This has resulted in telematics products representing a larger share of new business volumes than has historically been the case, now ~5.5% up from ~4% in 2019.

More broadly, we have seen an acceleration of new products and new brand launches, in many cases these have been a lower tiered product that will naturally be more competitively priced and as such rank more favourably on price comparison results pages. This trend is more pronounced in motor than in home, given the relative size of the new business markets and the differences in customer behaviours, i.e. higher price elasticity.

We have also seen a sharp increase in the proportion of new business sales that are paid monthly, in particular in motor where the proportion of monthly sales is up ~3ppt year-on-year to April 2022, potentially as a result of rising new business prices, the wider inflationary pressures and cost of living challenges that customers are currently facing, and an increased proportion of sales to younger drivers.

There remains a high degree of uncertainty over the short to medium term

As evidenced by announcements made around half year results, the market is currently experiencing significant levels of above expectations claims inflation from a variety of underlying drivers, including higher used car prices, higher car hire costs, longer repair times, and inflation in the cost of car parts, building materials and labour costs. As a result, profitability has dropped sharply, and prices are likely to increase as insurers look to pass on increasing claims costs to customers. We are already starting to see some evidence for this in the market with increases in new business pricing and decreasing renewal rates, however, the extent to which competitive tensions in the current smaller new business market will prevent insurers from fully passing on claims inflation remains to be seen.

This, in combination with the removal of price walking at renewal, and the change to auto-renewal rules, means there is a high degree of uncertainty around the impact on persistency and therefore new business volumes in the short to medium term. Whilst the level of auto-renewal opt-out has not fallen as much as was potentially anticipated, we have yet to see the impacts of this hit the market. Similarly, the extent to which price increases driven by claims inflation offset the impact of the removal of price walking and therefore prompt increased shopping is unknown and it may take multiple years and renewal cycles before the market reaches a new equilibrium.

If market new business volumes remain at depressed levels relative to historical experience, this poses tough questions for new entrants or high growth businesses as conventional strategies which have worked well in recent years may not deliver the same levels of growth in the future. Excellence in the capabilities required to retain existing customers and product or proposition innovation, both at new business and at renewal, are likely to become more important tools or differentiators than has historically been the case.

The effects of climate change are also starting to be felt, with more extreme weather events becoming increasingly frequent, expected to result in increased claims for flooding, subsidence and even wildfire. Changing customer attitudes will impact the market, for example, through adoption of electric vehicles materially impacting the insured vehicle pool and having implications for downstream claims fulfilment, and potential shifts in customer driving behaviour depending on the future balance of in-person vs. virtual working.

The Renewal Outcomes benchmark provides unique market comparison insights by on a policy level by risk/market

To address the challenges posed by the rapidly shifting environment post-GIPP implementation, eBenchmarkers have developed the Renewal Outcomes benchmark. The benchmark compares granular policy-level data from numerous scale players in the market and uses this to create benchmark retention KPIs which can be analysed and customised by specific customer characteristics to fit an individual business’s mix or to drill down into the performance of sub-segments.

The benchmark is created using data gathered directly from insurers covering their entire back book, providing greater depth and breadth than other sources of price data or a purely internal view. Using the tool’s filter enables you to control for differences in business mix, and better contextualise performance, and as such provides a real comparable view of retention performance and pricing relative to competitors. It enables participants to better understand business performance relative to competitors, the value-add of brand, and the trade-offs between price and retention.

The Renewal Outcomes Benchmark adds value by providing:

- Monthly actionable retention performance insights, allowing you to react quicker to market volatility, changes in consumer behaviour and gain better insight into competitive strategies to finetune/validate pricing models.

- Better understanding of segment performance at renewal and profitability optimisation.

- Understanding how payment types, continuous payment authority and autorenewals impact on outcomes.

- Full visibility on what’s driving trends through access to over 50 unique data points (i.e. tenure, age, premium) across millions of policies in coverage.

Further information on the Renewal Outcomes Benchmark can be found here: https://pages.financialintelligence.informa.com/ebenchmarkers-renewal-outcomes

About Curinos, eBenchmarkers

eBenchmarkers, now a part of Curinos, is a specialised benchmarking consultancy firm with over 20 years of experience, focusing on General Insurance. The renewal outcomes benchmark covers over 20 brands, including some of the largest insurance providers. We work with over 100 retail financial services providers in the UK, providing our clients performance insights across business critical KPIs.

About Oliver Wyman Insurance And Asset Management, Europe

Oliver Wyman is a global leader in management consulting that combines deep industry knowledge with specialised skills to solve our clients’ hardest problems. Our insurance and asset management practice is at the forefront of the UK personal lines industry, supporting clients in strategy, pricing and commercial effectiveness, cost and digital, technology, finance, risk and organisational effectiveness issues.