Business is facing shocks on multiple fronts these days, from COVID-19, and inflation to the war in Ukraine and the waning of a decades-long trend toward more globalization. In the face of these challenges, business leaders are urgently seeking ways to bolster supply chain resilience. Often, the first port of call has been to increase the level of stock in company warehouses. This has led to a dramatic rise in inventory levels across the globe. But while it is often a very useful short-term tactic, other solutions can be more sustainable for the long term.

In our consulting work with industrial clients around the world, we have examined many different approaches companies are taking and studied how they can be combined into resilient, longer-term supply chain strategies. What has emerged is a decision-making matrix that companies can use to think through these choices.

Trade troubles

In his book, The World is Flat: A Brief History of the Twenty-First Century, Thomas L. Friedman describes how traditional sources of competitive advantage all but disappeared due to technological change, economic liberalization, and globalization. But the recent past looks increasingly like a golden age. Over the three decades from 1970–2000, global trade increased at a spectacular rate, more than doubling, to account for 60% of world GDP by the end of the century. Even in the United States, which has historically been less dependent on international trade than most other countries, the share of trade in GDP grew to 61% by 2008.

Continued trade growth can no longer be taken for granted. In recent years, the resilience and durability of international supply chains has been severely tested, sometimes to breaking point. The global financial crisis of 2007–08 left many suppliers with payment issues. They adapted and the financial system ultimately recovered — but global trade remains down by 8 percentage points from the peak (see Exhibit 1). On top of slowing global trade came the introduction of trade sanctions between the United States and China, followed by COVID-19 and the challenges of maintaining supply when much of the world shut down.

This series of shocks has led many to question globalization itself. Oliver Wyman’s international survey of consumer attitudes in the electronics industry, The Way Back Home, reveals that in countries such as France, Germany, and India, the majority of consumers now say, “I believe the world is too globalized.” While those in China and the United States remain more positive on globalization, it is by a margin of just 4% and 6%, respectively.

The experiences of the past two years have also led consumers to take much stronger interest than before in questions about the origin of products and the location of company headquarters. Interest in these matters is up 29% in the United States, for example. When buying electronics, 65% of consumers focus on domestic brands, and 74% on locally produced devices. This is especially the case when issues of quality and trust are involved.

Recent events are also raising questions about companies' continued dependence on China and its lengthy supply routes. The share of trade in China’s economy is on the decline, falling from a high of 35% before the financial crisis to less than 20% today (see Exhibit 1).

Exhibit 1: Evolving economic landscapes

Russia's invasion of Ukraine could prove the biggest test of all. The war has already pushed up prices of oil and gas significantly. Low fuel prices have correlated historically with periods of high economic growth. The recent surge in commodity prices is adding to a dangerous inflationary spiral.

Even if peace comes soon, sourcing commodities or components from Russia and Ukraine will remain out of the question for the foreseeable future. Climate change will only magnify these uncertainties.

Three strategies for increased supply chain resilience

In response to these challenges, many leading companies are stockpiling inventory. Some are going further, developing longer-term strategic solutions they hope will enable supply chains to ride out future storms. We have identified three key strategic components that can help companies increase robustness and supply flexibility.

Build up and plan inventory. The quickest and simplest way to increase resilience is to increase inventory. This acts as a buffer between demand and supply — but it comes at a cost. Economists have suggested the recent rise in inventory costs is equivalent to 1% of global GDP. Clearly, this is a price many companies view as worth paying. However, careful inventory planning will be needed to contain costs over the longer term.

Find local suppliers. Regionalization or localization can limit the risk of a major shock impacting all regions simultaneously. It also provides companies with the opportunity to up their game in applying the sustainability criteria of environment social, and governance (ESG) programs.

Regionalization allows companies to view the supply map as a series of interconnected but largely independent ecosystems. It has led companies to source commodities, such as textiles, wood products, and metals, closer to their customer base, from locations such as India, Mexico, Poland, and Vietnam (see Exhibit 2). The impact of regionalization by numerous firms has had such a big impact that it has increased the GDPs of these countries.

Exhibit 2: Nearshoring increases exports for developing economies

Among those regionalizing their sourcing is the world's largest semiconductor chip manufacturer. Previously, it produced about 70% of its semiconductors in Asia (in Malaysia, Vietnam and China). It now views reliance on a single region as inherently risky. A large furniture and home goods company is also set to move part of its production to Turkey to supply its European and Middle Eastern markets.

Nearshore production. Nearshoring is closely allied to localization. Relocating production (and not just supply) closer to home gives companies greater control.

Among numerous recent examples of nearshoring, one US toymaker recently announced that it would invest $50 million in a manufacturing plant in North America; as recently as 2012, it had manufactured almost its entire production in Asia. Likewise, in December 2020, the world's largest semiconductor chip manufacturer announced it will invest hundreds of millions of dollars in nearshoring production.

As with the other approaches, ensuring new supply chains are more robust than the ones they replace is a key to success.

A Decision Matrix

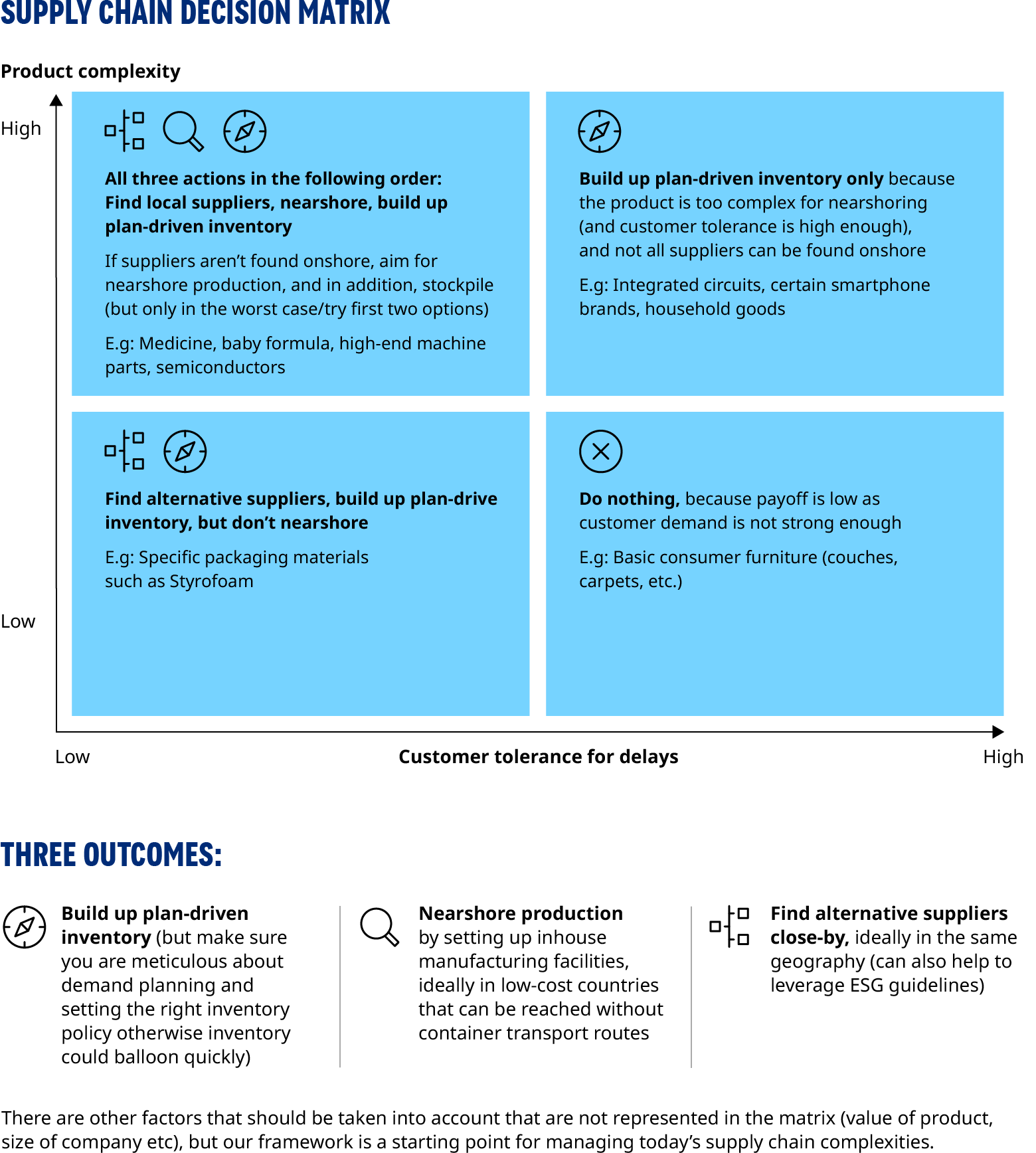

COOs recognize that future supply strategies need to be more flexible and resilient — but reshaping supply chains can be a complex and time-consuming task. To help speed the process, Oliver Wyman has developed a decision matrix to assist in thinking through these challenging decisions.

This matrix helps identify which combination of sourcing and warehouse management approaches is likely to be optimal for a company’s circumstances. It focuses on two key dimensions: the complexity of the product and the customers’ demand for the timeliness of supply. This produces four quadrants with distinctive characteristics. For each, the framework identifies which approaches can be combined to greatest effect.

Not every circumstance warrants such investment. For example, products of low complexity, where timely supply is less important, are unlikely to justify such interventions.

Longer-term strategy

While speed is of the essence in developing short-term tactical responses to supply-chain challenges, strategy is necessarily longer-term in nature. Companies need to incorporate tactical measures to ensure increased resilience during the implementation phase. But implementation itself is likely to be multi-staged, especially when the new approach entails both nearshoring production and localizing supply.

Assessing these short- and long-term possibilities isn't easy. But companies that can find the right mix of responses can build a supply chain that proves resilient over the long haul.

Eiman Eltigani also contributed to this article.