The semiconductor shortage has taken a toll on the automotive industry for more than a year. Until now, however, the steps undertaken by original equipment manufacturers (OEMs) to reduce the impact of the chip shortage have been mostly reactive and operational. To secure profitable growth, OEMs must shift their focus to strategic changes, as the semiconductor shortage could last years. To change the game, carmakers need strategic control over the semiconductor value chain: aligning product and technology strategies, building up semiconductor design capabilities, proactively initiating and driving chip production capacity increases, and changing collaboration models with semiconductor manufacturers.

Since the start of the semiconductor shortage, automotive companies have taken a series of steps aimed at reducing the effects of the chip shortage. They’ve sought greater transparency into the supply chain to understand suppliers’ production capacities, output, and bottlenecks. Some have tried to deepen their relationships with existing suppliers and/or establish new supplier relationships. Others have asked semiconductor manufacturers to better allocate products to OEM needs and have agreed to price increases.

Many OEMs have adapted production facilities to ensure as many vehicles can be built as possible and allocate the chips they have to their highest-margin vehicles. To conserve chips, others built vehicles with non-essential modules (such as entertainment systems) missing, and added them as the chips became available. Finally, some carmakers shuttered entire vehicle lines, temporarily shut down production, and cancelled hard-to-fill vehicle options. The actions taken served to mitigate the supply challenges. But while some automakers managed to eke out profits, the majority of players have experienced hits to their bottom line.

Moreover, the crisis has become worse: According to IHS Markit, global production loss of light vehicles was 1.4 million in Q1 2021, 2.6 million in Q2, and 3.4 million in Q3. For the full year 2021, market observers expect a global production loss in the range of 10 million to 11 million vehicles! Plus, vehicle delivery times and prices in many cases have increased.

Placing a band-aid on the crisis?

Most actions taken by companies have been reactive, aimed at fixing symptoms rather than addressing the root cause of the chip shortage. At the beginning of the pandemic, OEMs strongly reduced production orders. Subsequently, semiconductor manufacturers shifted their freed-up production capacity to other customer industries with strong demand. They were undertaken under the assumption that the semiconductor shortage was an outcome of the pandemic and might be over soon.

But while Covid-19 may have accelerated the semiconductor crisis, the underlying reasons for the shortage are multifaceted and predate the pandemic.

A demand/supply imbalance

Demand for semiconductors has been rising for years, driven by consumer electronics needs (more and more powerful smartphones, faster computers, larger data centers driven by cloud services) and non-consumer applications (more connected devices/ Internet of Things (IoT), introduction of 5G, electrical vehicles, and autonomous driving).

Meanwhile, semiconductor production capacity has grown at a snail’s pace. Moreover, much new capacity has been driven by leading edge sectors such advanced logic and memory chips catering to smartphones, computers, and data centers. These investments were of limited help for automotive companies, as the majority of semiconductors used in vehicles are tailing-edge chips focused on established technologies.

So, despite production capacity increases planned by fabs (semiconductor manufacturers), capacity utilization will remain at very high levels in the next years, according to an analysis conducted by Oliver Wyman. (See Exhibit 1.)

What’s good news for chip manufacturers, though, is bad news for their automotive customers. To avoid a permanent fight for capacity and allocation slots resulting in potential production losses and price wars, automotive companies need to focus on more long-term actions aimed at achieving strategic control over the supply chain.

Role of semiconductors in cars

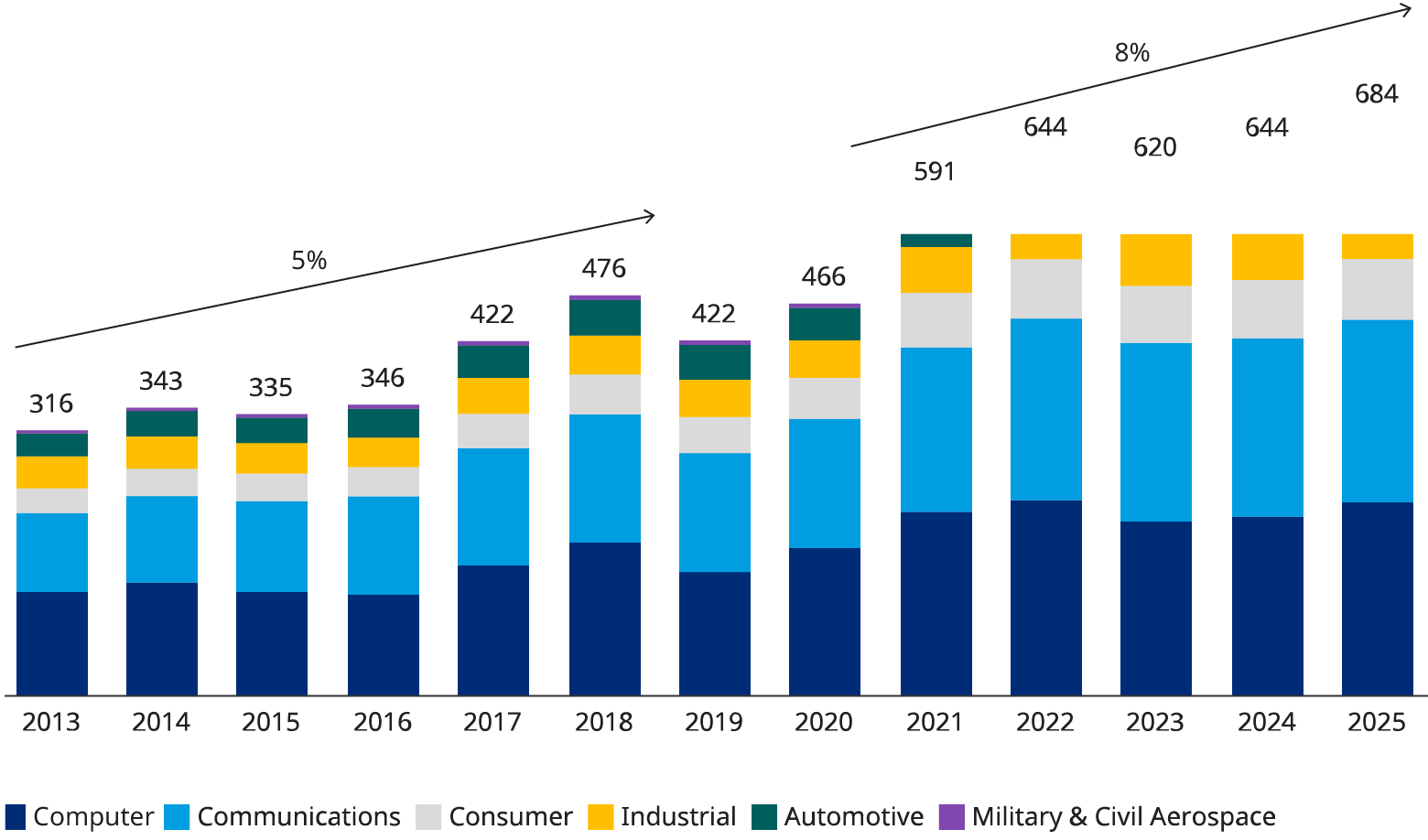

Before outlining specific strategic initiatives, it’s useful to take a closer look at the semiconductor market and the role of automotive: While automotive OEMs and their suppliers are large and well-known companies, automakers do not play a dominant role in the semiconductor industry. Total semiconductor sales in 2020 were $466 billion, only a fraction of which were automotive-chip sales (~8%). (See Exhibit 2). Most of the semiconductors were designed, produced or aimed at the vast electronics industry: communications industry (such as smartphone manufacturers, and mobile network equipment makers catering to the 5G rollout), giant computer manufacturers, data center operators, as well as other IT-related equipment.

From the perspective of semiconductor manufacturers, not only are automotive companies less attractive customers because of their smaller sales volume, but they also tend to buy trailing edge technology (such as power or analog chips). Compared to smartphones, cars have less advanced semiconductor content – although the picture will change once electrification and autonomous vehicles take hold, when the semiconductor content in vehicles is expected to increase tenfold.

Moreover, automotive companies tend to commit to relatively low purchasing volumes and shorter timeframes, typically a few months out. In contrast, leading computer and smartphone companies – thanks to greater product standardization and due to their control over the intellectual property and design of relevant chips – can commit to long-term contracts with semiconductor manufacturers, which enables them to strategically control the entire supply chain and establish maximum transparency on orders across all tier levels. This approach is also much more conducive to the needs of the semiconductor business where the construction of a new production facility takes years, production lead times are on the order of 8-10 months, and even a simple change to existing production lines can take several months due to allocation of production slots one to one and a half years in advance.

How to change the game

To change the game and secure profitable growth, automotive companies must achieve a breakthrough. Here are some strategic options that ought to be considered:

- Define an area of differentiation as part of your product and technology strategy that’s based on hardware-related and software-related semiconductor competencies.

- Develop and design your own core microchips for key components (such as the electric powertrain and autonomous driving) in partnership with strategic supplier. IP ownership enables you to exercise greater control over the supply chain across multiple tiers down. This step will require an integrated approach to both hardware and software as well as chip design capabilities.

- Agree to capacity build-up with chip fabs and in return for long-term contracts.

- Establish semiconductor joint-venture fabs, e.g., with semiconductor manufacturers, other semiconductor buyers, financial investors or the government to co-invest into most critical applications.

There is no silver bullet to solve the semiconductor shortage, and specific solutions vary from player to player. However, the general direction is clear: Automotive companies need to strengthen their strategic control of the semiconductor value chain.