The COVID-19 pandemic disrupted global supply chains and business operations, forcing businesses to rethink how they plan, manage, and execute core business operations, manage supply chains and their overall investment strategy on technology & software to support these processes. Customer needs are changing. Deal markets have slowed, but valuations have adjusted in ways that suggest future opportunities. This deal environment, combined with Covid-driven disruptions, have made the resilience of Industrial Software as a sector, more readily apparent.

Deal activity in Industrial Software heated up significantly from 2019-2021. Nearly sixty $100 million-plus deals with private equity involvement were completed in 2021, driven by the pandemic and by a secular increase in software investment, versus just ten in 2019. The fastest- growing subsector for deal activity was supply chain and logistics software, which saw three billion-dollar deals in 2021 (Blue Yonder, BluJay Solutions, QAD).

Although deal activity in 2022 has slowed down across the board from all-time highs in 2021, we expect investors will continue to watch this space closely because the category remains a

critical spend priority for companies and in the long-term, as product lifecycle, supply chain and daily business operations are likely to become more digital and complex.

Companies have also recognized after the experience of the pandemic that investing in the latest Industrial Software pays off and that getting it right will mean positioning themselves to better exploit the opportunities the next global expansion will present. So even as the risk of a global economic slowdown becomes more tangible, we expect businesses will continue to invest in Industrial Software in order to digitize product lifecycle management, business planning and supply chain risk mitigation even as they seek to cut costs elsewhere.

Overview of the Industrial Software Landscape

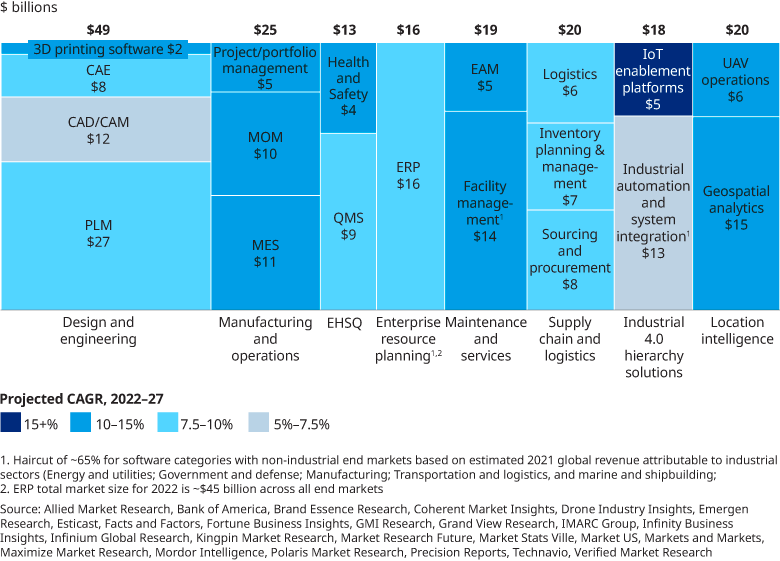

We think about the key industrial software landscape as splitting into eight categories, with some being more mature and dominated by entrenched incumbents (e.g. ERP) while others are growing rapidly with more fast-growing upstarts (e.g. Location Intelligence, Industrial 4.0).

We estimate that these key Industrial Software categories are a roughly ~$180 billion market, with a long-term growth outlook of ~11% annual growth. We expect to see fastest growth in smaller categories like Location Intelligence and Industrial 4.0, though deal-making has accelerated fastest in the last two to three years in Supply Chain & Logistics, Manufacturing and Operations and Location Intelligence.

We believe Supply Chain & Logistics Software and Environment, Health, Safety & quality (EHSQ) Software are likely to be of particular interest to operators and investors:

1. Supply Chain And Logistics Software

We estimate the market size for Supply Chain & Logistics Software at ~$20B in 2022. Of that, about $7.6 billion is spent on Sourcing and Procurement technology, which helps users to coordinate and integrate production flows of goods and services. Another $6.6B is spent on Inventory Planning & Management software that tracks and monitors inventory levels, sales, deliveries, and orders (key to facilitating quality assurance and organizational control). Logistics software accounts for the remaining $6.1B to ensure that goods are trackable, delivered, and accounted for between stages of the supply chain process. Oliver Wyman estimates that these three sub-segments are growing at ~9% on average per year.

These solutions are crucial to clients’ productivity and profits—and solving inflation-causing logjams. Unlike EHSQ and other key Industrial Software segments, Supply Chain & Logistics has historically been dominated by legacy incumbents (SAP, Oracle, Epicor) but there are a few promising upstarts that are likely to gain share in the mid-market (GoFreight, RFP360, AirSpace, FourKites) as companies re-evaluate how they plan and manage their supply chains to drive more reliability and efficiency, particularly in labor savings from smarter operations planning and execution.

2. Environment, Health, Safety and quality (EHSQ) Software

We estimate the market size at ~$13.1B, growing at ~10% annually. Key functional areas include Risk & Compliance Software to manage and monitor regulatory compliance and enterprise risk activities, Quality Management Software (QMS) to automate monitoring of product quality and defect reporting based on specific quality and industry standards and Health & Safety Software to manage and monitor occupational health risks, workplace incidents, and overall employee safety.

The tasks managed by EHSQ products have become increasingly important due to the growing focus by regulators on reporting ESG metrics. Firms in countries with weak regulatory frameworks are less likely to pay the high upfront costs of many EHSQ products.

The historical incumbents in EHSQ have been GenSuite and Enablon, but the space is relatively fragmented. A number of promising upstarts (Tulip, Auditboard, Mapistry, etc.) make EHSQ an area of particular interest for investors, because we expect the category to become increasingly important over time and there is likely to be more consolidation in the mid-term.

Key Drivers of Industrial Software Spend Growth

We believe most of the key historical drivers of spend growth in Industrial Software will persist over the mid- to long- term. Some of the most important historical drivers that are likely to persist are:

- Increasing complexity in product lifecycle and supply chain management: Companies want to improve their agility and visibility, and to digitize product lifecycle management.

- Proliferation of industrial internet-of-things (IIoT) endpoints: The IIoT, combined with 5G connectivity and other tools, are driving adoption of a wide range of devices that need to be managed with software.

- Near-term supply chain disruptions: Increasing geopolitical tensions, parts and product shortages and inflation have demonstrated to companies that they need to modernize and digitize their supply chains. This incentivizes customers to spend more on industrial software to manage more complex supply chains, and to prepare for a wider range of contingencies.

- Other key factors include the ongoing shift to cloud-based computing and evolving regulations that have prompted businesses to invest more in Industrial Software.

This brief report is intended to introduce readers to our view of this important, emerging and potentially resilient market during a period of significant disruption. Our full 2022 report on Industrial Software please contact Apurva Nair or Prasan Srinivasan.