The past five years have seen an explosion in the streaming sector with growth seemingly coming effortlessly.

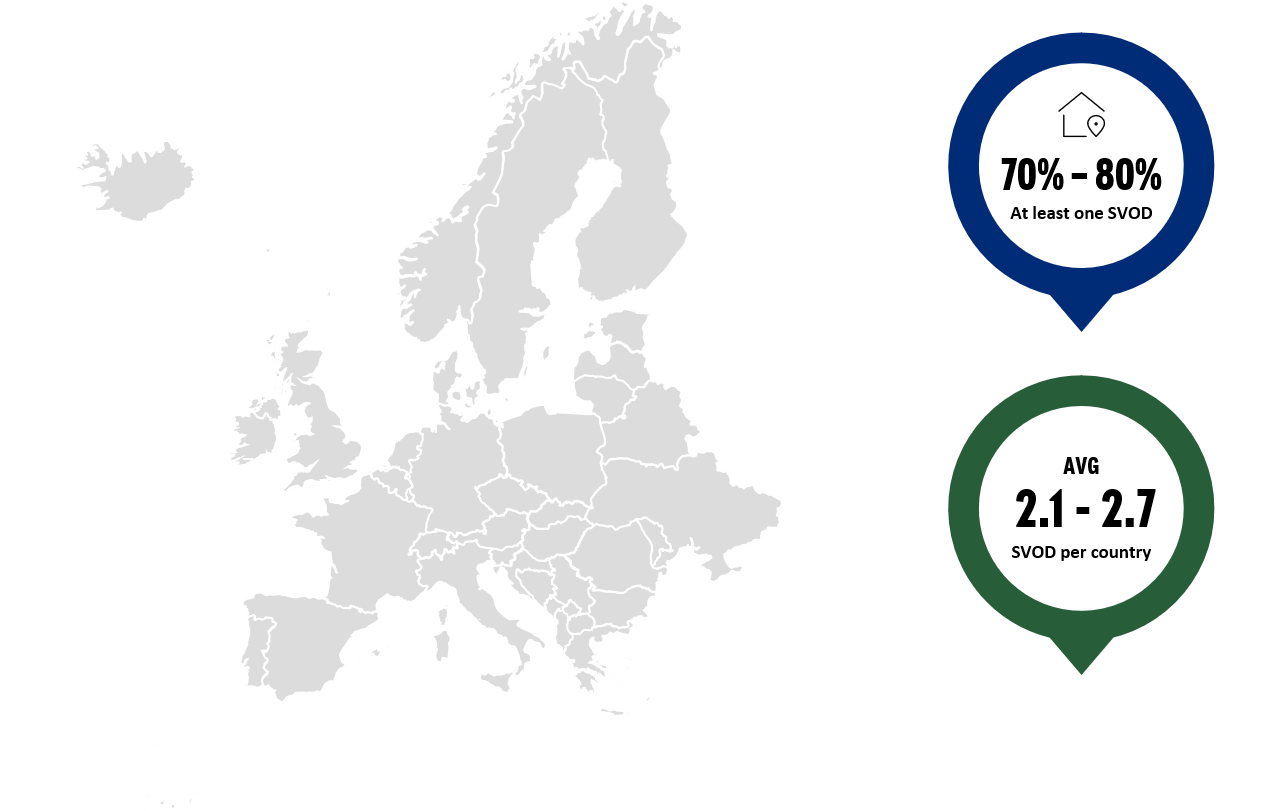

But SVOD (subscription video on demand) has been a victim of its own success, spawning intense competition. SVOD providers were until recently unaffected by the cost of maintaining multiple subscriptions. Our own research shows that between 70 to 80 percent of households in Europe subscribe to at least one streaming platform with the average number of subscriptions per household ranging from 2.1 to 2.7.

Presently, however, growth seems to have flat-lined for some. To maintain growth and relevance will require that the industry seize the opportunity presented by some key trends that are changing the media landscape. One such trend is focusing on less general entertainment and more on a segmented approach.

Demographics, it’s said, is destiny. We’d modify that statement: niche demographics are destiny. When a market is growing, it makes sense to follow the mass audience. Given the strong growth in streaming in the past, most players sought to satisfy the tastes of the broader public.

That was then, though. Now, with a saturated market in advanced economies, it’s important to segment the audience.

And those segmented audiences represent enormous buying power. While most mass offerings have been tailored towards a white audience, non-white viewers such as Asian Americans, African Americans, and multi-racial audiences have seen their economic buying power soar. Moreover, the appeal of diverse casts and storylines cuts across niche/demographic lines, attracting more and more eyeballs.

Digital, unlike linear broadcasting, is unlimited in its ability to reach smaller, yet highly significant markets. All sorts of passionate fans are finding SVOD providers to their taste.

Besides, with digital there is more than one “channel” to reach the user, therefore there are more options to support diverse audiences, allowing access to smaller, niche audiences.

By targeting niche demographics, it is possible to achieve higher penetration rates (and lower churn), as viewers relate to the content more strongly due to cultural similarities. Secondly, it may be able to cheaper to produce this targeted content. Finally, consumers may be willing to pay premium rates for providing that content.

When implementing this strategy, some companies have focused on exclusive platforms for this content. This has the challenge of likely needing distribution partners (and paying them for this). Others have added niche content to their larger library. The challenge here is ensuring other groups are not alienated (e.g. in some countries, mainstream VOD platforms have been banned because of the content shown). Either way, there needs to be sensitivity to the audience’s needs. That is, the nature of the ads and content must be appropriate for them.

Usually, the challenge with niche markets is they quickly reach their limit. But in times when mainstream may have surpassed the saturation point, serving a high number of smaller segments may be an interesting alternative. The question will be if this will cause more friction or more collaboration in the SVOD landscape: Friction, as entry barriers are low and various smaller challengers compete with established players, or consolidation as players enter strategic alliances to reach more diverse audiences.