This report was written in collaboration with Planixs and Infor. The authors of this piece are Francois Franzl, Jai Sooklal (Oliver Wyman) and Peter McIntyre (Planixs).

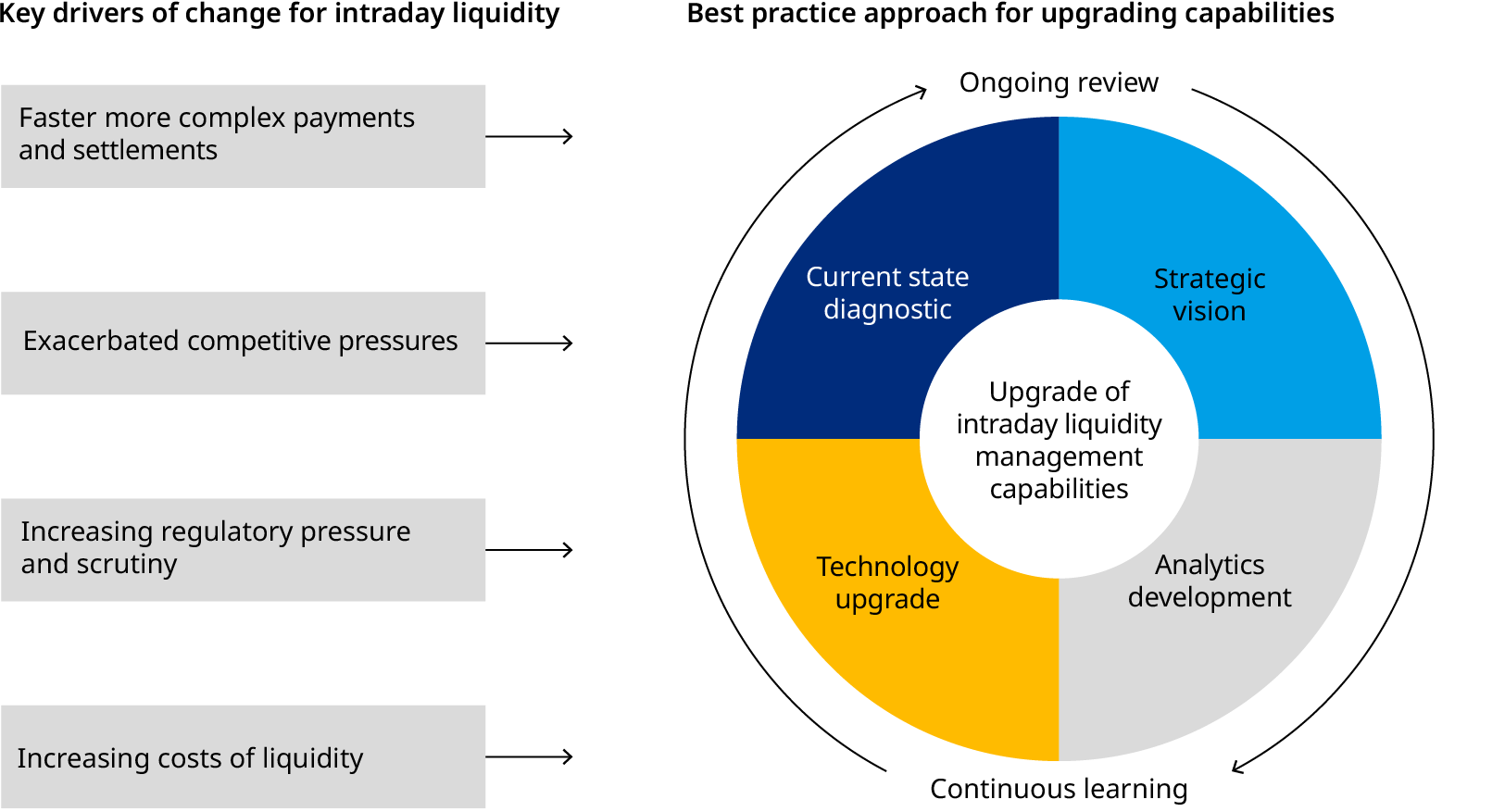

Most large banks worldwide have spent significant efforts and time enhancing their intraday liquidity management capabilities over the last 10 years on the back of significant regulatory scrutiny. The payment and intraday liquidity universe though keeps evolving and the pace of change is accelerating: payment systems are evolving rapidly and new ones emerge, new fintech competitors are entering the payments industry and challenging established practices, regulatory expectations keep evolving and increasing and the cost of liquidity has started and will likely continue to rise.

To successfully manage through these changes, banks will need a set of strong capabilities to understand their intraday liquidity footprint and risks, rapidly manage it down when appropriate and importantly, partner with clients on business practices. Frontrunners are looking to take advantage of the disruptions to create new business opportunities and consolidate or expand market share. Despite significant investments in the past 5–10 years, many large banks will need to continue adjusting and enhancing their intraday liquidity capabilities in response to those disruptions. Even smaller and less complex banks that have not prioritized investments in intraday liquidity management, will be incentivized to upgrade their capabilities in the face of increasing customer demand for instant payments, payments modernization efforts (as seen for example in the US, Canada and the UK), and increasing costs of intraday liquidity.

Given the rapid pace of change and the risk of rapidly increasing intraday liquidity costs, now is the right time for banks to have a fresh look at their intraday liquidity capabilities. Performing a diagnostic of the current state and defining a clear and shared strategic vision is a key first step to ensure organizational alignment behind established goals. The strategic visions should define a firm’s risk appetite for intraday liquidity, its key business objectives in terms of payments services offered to clients, and whether/how to charge for them. Finally, it should define a clear operating model across the various stakeholders involved with intraday liquidity management. Once those foundational elements are defined, they can inform key priorities in terms of technology, data and analytics development. We typically see firms adapting their plans as they build capabilities; periodically reviewing priorities and technology plans based on the learnings from their latest analytics developments to maximize return on investment.

This paper draws on the deep experience and expertise of Oliver Wyman and Planixs in the intraday liquidity space to provide an overview of the most prominent trends in this space and key suggestions for institutions looking at future-proofing their intraday liquidity capabilities. In a first section, we describe both disruptive factors already at play in the industry as well as further disruptors anticipated in the short to medium term. Drivers of change cover trends in payment infrastructure, competitive environment, regulatory landscape and market evolution. In our second section, we suggest a step-by-step approach for how banks should define their ambitions for intraday liquidity and how to address implementation challenges.

Below is the full version of the report available for download.