The mid-market, with annual revenues of €0.5 to €5 billion, is a business opportunity for the IT service provider sector as their IT budget will grow more than the market as a whole as they seek external support to execute their digital transformation plans, according to a new report from the Communications, Media & Technology practice of strategic consultancy Oliver Wyman.

The firm's experts estimate that investment by companies in this segment will increase by 8.8% at an annual rate between 2021 and 2026 (above the 7.6% annual rate of increase for the market as a whole), meaning that aggregate spending on IT services in the European mid-market will grow by 52% to €99.6 billion by 2026, whereas the market as a whole will grow by 44%.

In the aftermath of the pandemic, many companies have decided to catch up with key investments to accelerate the transformation to the cloud, address growing cybersecurity requirements and, ultimately, modernize their application landscape. Until now, about half of mid-market customers have opted to manage IT primarily in-house, due to concerns about protecting sensitive data and the cost advantage. However, many of them now face difficulties in managing the full extent of the transformation journey with in-house resources. As a result, they are increasingly turning to external providers for help, especially mid-market clients, who are finding it more challenging to attract talent in an environment of a general shortage of IT resource experts.Hendrik Willenbruch, Partner Communications, Media and Technology

In the aftermath of the pandemic, many companies have decided to catch up with key investments to accelerate the transformation to the cloud, address growing cybersecurity requirements and, ultimately, modernize their application landscape. Until now, about half of mid-market customers have opted to manage IT primarily in-house, due to concerns about protecting sensitive data and the cost advantage. However, many of them now face difficulties in managing the full extent of the transformation journey with in-house resources. As a result, they are increasingly turning to external providers for help, especially mid-market clients, who are finding it more challenging to attract talent in an environment of a general shortage of IT resource experts.Hendrik Willenbruch, Partner Communications, Media and Technology

More than €65 billion invested in IT by European upper mid-market in 2021

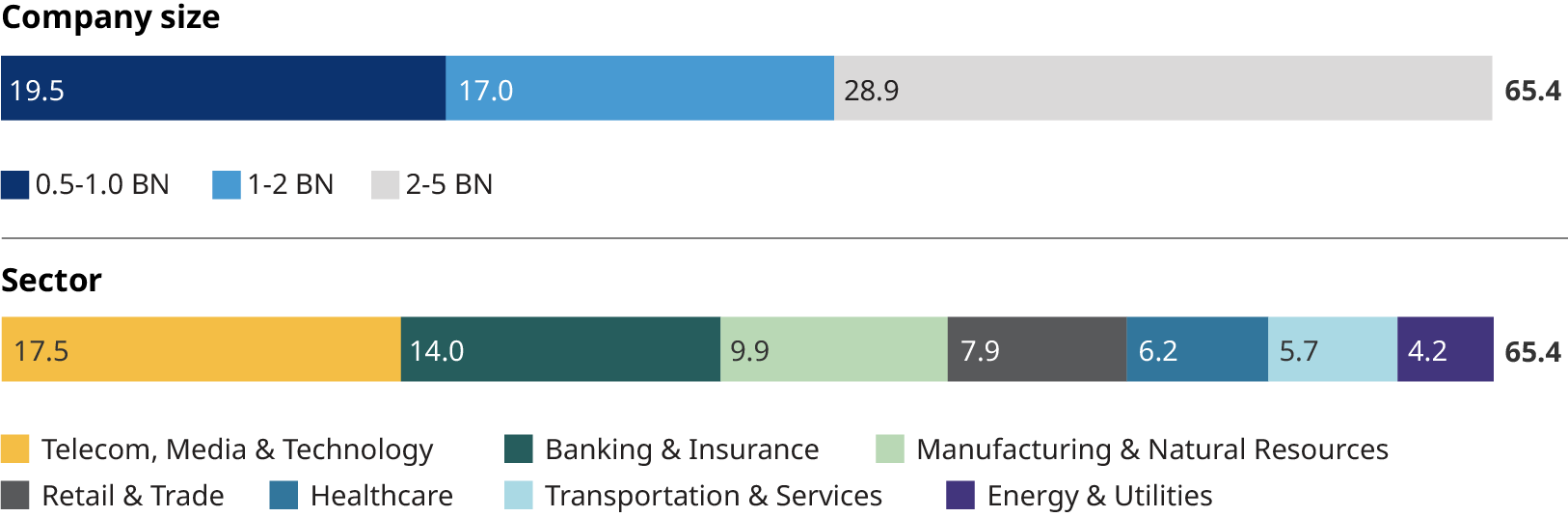

Spending on IT services in Europe for the upper mid-market by company size and sector, 2021

In billion Euros, excludes public sector

In 2021, the European mid-market spent more than €65.4 billion on IT services - representing 28% of the almost €230 billion spent on IT services by all companies in Europe (excluding public sector).

By sub-segment, the smallest companies (€0.5 - €1 billion) spent almost €19.5 billion (30% of the total), firms with €1 billion to €2 billion annual revenues spent €17 billion on IT in aggregate (around 25%) and the largest, the €2 billion to €5 billion sub-segment, spent close to €29 billion.

By sector, telecommunications and technology companies invested the most in IT (27%, over €17.5 billion), followed by the banking and insurance industry (21%, €14 billion) and manufacturing and natural resources (€9.9 billion or 15% of the total).

Upper mid-market preferences for it service providers

We divide IT services players into five broad categories, according to their size and core positioning in the broader ICT value chain:

According to the Oliver Wyman study, mid-size companies are traditionally served by large traditional systems integrators or local mid-size players and system houses, which have become a strong foothold for smaller companies thanks to the physical proximity and cost competitiveness they offer.

The picture changes for the large corporate or multinational segment, which tends to favor large global IT service providers.

In terms of purchasing behavior, medium-sized companies prioritize suppliers that offer tailored and industry-specific solutions, as well as quality of service. These two factors are even more relevant than price, which only appears in third position in the results of a survey carried out by Oliver Wyman for this study.

This pattern is consistent across all sub-segments of the mid-market, although smaller companies generating between €0.5 and €1 billion in annual revenues appear to be more price-sensitive, especially when choosing large global IT service providers.

In addition, upper mid-market companies show a higher level of adherence to their IT service providers. In fact, the lower end of the mid-market segment (with annual revenues between €0.5 and €1 billion) tends to be very loyal to their IT service providers: only 4% of them have changed their top two providers in the last two years. Meanwhile, larger companies (€2 billion to €5 billion annual revenue) are more likely to switch vendors: 20% report having switched one of their top two vendors in the last two years.

The reasons highlighted by midsize companies tend to be the trusted relationship with their IT service providers over the years, as they have often started with hardware procurement before extending to more complex one-stop-shop services. This translates into opportunities for large global players who haven’t focused a lot on this segment in the past, as well as newcomers such as the cyber and cloud space.Hendrik Willenbruch, Communications, Media and Technology Partner

The reasons highlighted by midsize companies tend to be the trusted relationship with their IT service providers over the years, as they have often started with hardware procurement before extending to more complex one-stop-shop services. This translates into opportunities for large global players who haven’t focused a lot on this segment in the past, as well as newcomers such as the cyber and cloud space.Hendrik Willenbruch, Communications, Media and Technology Partner

Implications for it services providers

Partnering: The complexity of mid-market customer requirements is not far from large enterprise but comes at a significantly lower service cost expectation. At the same time, the lower in sub-segments we look, the higher the customer stickiness. Therefore, providers stand in between maintaining customer intimacy and managing for complex service delivery and will thus need to partner with each other to be successful, whether it’s for local delivery resources, niche solutions or hyper-scaling computing power.

Portfolio choices: As workloads increasingly move to the cloud, providers need to carefully assess their future service portfolio to support their customers, as well as taking critical steps to plan and execute the transformation. Margins associated with non-differentiating infrastructure ‘run’ services will vanish especially for large global providers, requiring dynamic, expertise-related service models, which tend to come at significantly lower contract sizes.