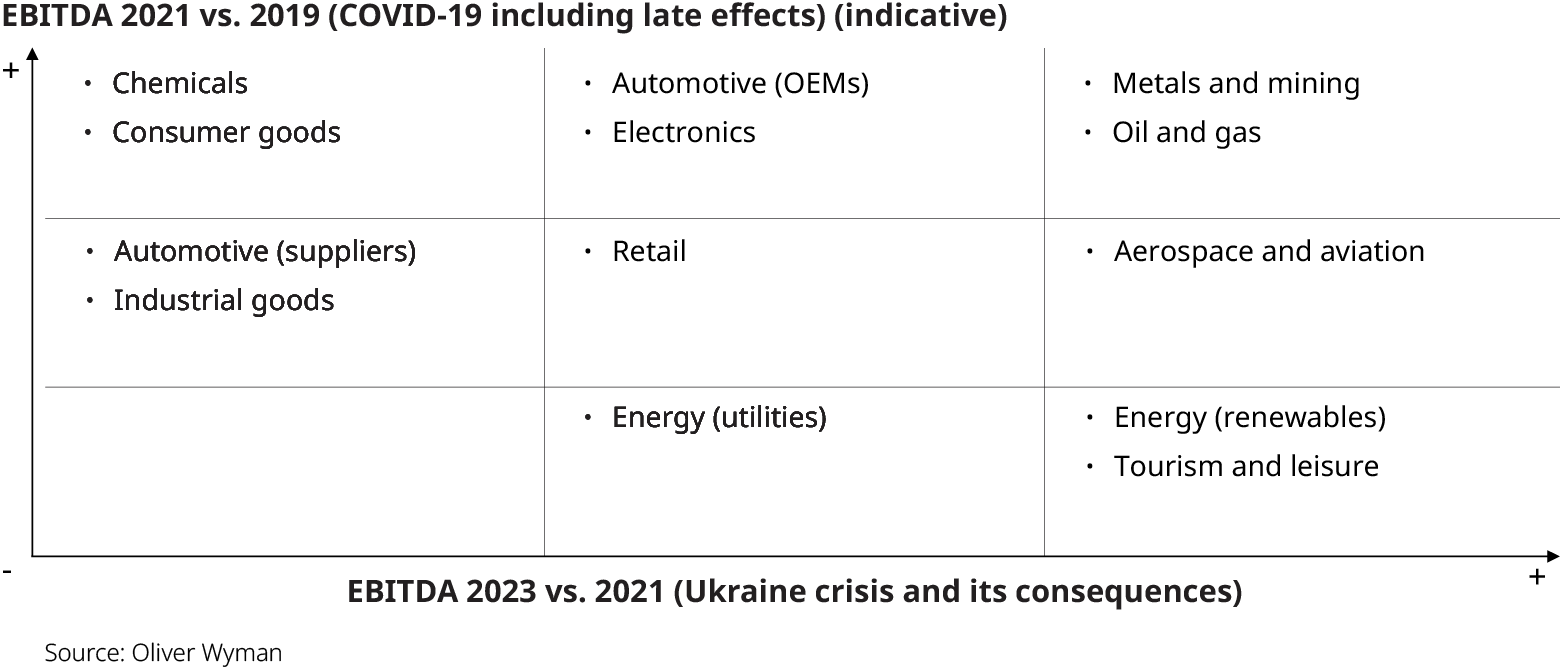

Europe’s industrial sector emerged from the pandemic with higher revenues and profits thanks to government-launched stimulus packages that kept the economy going. (See Exhibit 1.) Thus, most sectors grew, and firms were able to increase prices. And given generally modest wage increases, profits in most sectors have risen significantly, albeit such exceptions as the travel, tourism, and hospitality segments and related sectors like aerospace.

The economic system is changing

That said, the sector in which a company operated had an impact on performance during the COVID-19 pandemic. Even within the same sector there was a wide divergence in outcomes between firms. Some of the drivers of performance included: the extent to which COVID-19 affected the sector or sub-sector; the firm’s strategic position (its ability to raise prices, regional mix revenues in countries more or less affected by COVID-19); supply-chain resilience; and its ability to act rapidly in managing risk.

But the current crisis arising from the war in Ukraine is likely to have even more far-reaching implications for European industries, given rising energy prices, inflationary pressures on goods, and geopolitical risk. While the first priority has rightly been a human one: concern for, and outreach to, those directly affected by the unfolding humanitarian crisis, we also see the impact in the form of a supply side crisis disrupting Europe.

A European supply-side crisis with structural implications

The supply side crisis emerged even before the war in Ukraine. During lockdowns consumer demand shifted significantly. The consumer goods industry grew for instance in the US by 20% from 2019 to 2021, while the services industry shrunk by 5-15%. The supply side – which had experienced low investment in energy infrastructure, shipbuilding, and expanding the capacity of ports well before the pandemic – was hit by COVID-19 lockdowns and could not cope with increased demand for goods. The pandemic has been particularly severe in sectors with strong underlying trends such as autonomous cars requiring more chips and environmental, social, and governmental (ESG) policies creating demand for more “green” energy sources.

As a result of the disbalance between supply and demand side coupled with the stressed supply chains prices for energy and commodities such as steel, aluminum or oil have increased significantly.

The war in Ukraine, however, has brought the supply-side crisis to a new level: Russia has been a major supplier of energy and raw materials for Europe; Ukraine as a low-cost supplier particularly for the European automotive and manufacturing industry is closely integrated in the overall supply chains.

While it is unclear how much longer the war in Ukraine will go on for, a few things have become apparent: Firstly, the war in Ukraine will have the most impact on Europe, with European supply chains continuing to be under stress throughout 2022 (and into 2023). But the impact will reach far beyond energy and raw materials supply disruption. Train transport from Asia to Europe has already been disrupted because of the conflict, and the current shortage of truck drivers in Europe will be exacerbated by the absence of 100,000 Ukrainian truck drivers. Adding to already stressed supply chains, COVID-19 cases in China are on the rise and further lockdowns can be expected.

European energy supplies will be tight and more expensive in the coming years. And the investments needed in order to adapt to the scarcity are significant and will require time to be deployed. As a result, we can expect to see secondary effects in energy-intensive industries such as steel and fertilizers, with companies having to shut down production temporarily or else operate at less than full capacity.

So far, most companies have been quite conservative on adapting their pricing. This is likely to change significantly as most companies will try to avoid margin deterioration by passing the cost increases for commodities and energy to their customers (largely) through: Thus, prices across a broad range of products and services will increase.

Another area likely to see significant change is the political agenda at both the EU and member state levels: securing energy supply, greater autonomy on the supply side in energy and key technologies in Europe, and investments in defense and cybersecurity will all become more prominent and will provide business opportunities.

Steps to address structural imbalances

That said, it will take time for those structural measures to be implemented. Consequently, we can expect Europe’s supply side crisis to be with us for some time. And just as the pandemic affected industries in Europe differently, so too will the war in Ukraine have varying effects on different industries.

Industry sectors in Europe will be affected differently. (See Exhibit 2.) For example, sectors that were deeply affected by the pandemic – such as travel, tourism, leisure – will see a rebound, although the bounce-back is not likely to be as steep as expected. Other sectors, like defense, cybersecurity, renewable energy, and infrastructure, will benefit from increased government spending – though extended planning cycles and slow ramping up of production may present bottlenecks that limit growth.

Finally, those sectors that have been affected by ongoing supply-chain issues (such as automotive, engineering, and industrial goods) will need to stabilize their supply chains and may need to relocate production. Those companies that can successfully navigate supply chain logjams will be able to boost revenue and profits thanks to excess demand for their products.

Be prepared for the unpredictable

These are uncertain times. Scenarios differ significantly and potential black swan events are plentiful. Some of the factors that companies will need to scenario plan for, include the war in Ukraine and its economic fallout are:

Higher energy costs: From an economic standpoint, companies will need to assess impact on energy prices and other raw material prices, as well as the potential length and severity of supply-chain disruption.

Addressing secondary effects: Companies need to start thinking and preparing for dealing with the secondary effects. For example: Labor unions demand wage increases to compensate for the significant inflation. Governmental support through future crisis might be limited as financial leeway is limited as to the significant state aid programs in the COVID-19 pandemic.

Central banks: Inflation across major economics has and is rising strongly. Public and political expectations are rising that central banks intervene by increasing key interest rates. This bears the risk that US FED and its global counterparts are overreacting and thus send the economies into recessions. Firms will need to manage this risk accordingly.

Geopolitical risk: China is a global player and deeply interwoven with multiple supply chains. Their policy of zero COVID-19 tolerance led to multiple smaller lockdowns which resulted in supply-chain disruptions. The risk that is currently apparent is that China might tilt towards Russia which bears additional economic risk.

How to come out stronger

Companies will need to factor in these uncertainties and risks into their strategy. Clearly, firms must build up their financial resilience and flexibility by increasing liquidity and financial headroom under various stress scenarios.

Adapt your supply chain to a world of uncertainty: Reconsider localizing supply chains to reduce risk (if possible), move away from just-in-time inventory practices and maintain higher inventory levels for key components, reassess supplier risk and factor in how your company could survive extreme scenarios such as continued supply chain problems with China.

Focus on strategy and growth: This is a time to think about how to take market share, to implement price increases, and transition towards a sustainable business model that creates growth, has more pricing power and a more robust supply chain.

These uncertain times require confident and proactive leadership to prepare for a variety of scenarios and to navigate its company stronger out of the crisis.