This is the 4th edition of the Oliver Wyman Mobility Start-up Radar. The Radar aims at identifying promising mobility players, highlighting new business models, innovation, growth and stories. It explicitly does not focus on the largest players with the strongest current market positioning, but emphasizes players with a promising outlook across four different mobility segments.

Mobility start-ups are complementing the offerings of traditional mobility providers while at the same time increasingly competing with them. Over the past five years, they have attracted an average of $37 billion in investment capital worldwide almost every year - a total of 183 billion dollars. The number of mega-financing rounds of more than $100 million each doubled to twelve in Europe in 2020. Start-ups in the field of sustainable mobility are becoming increasingly important and have been able to convince capital providers with a total investment volume of $15 billion. Investments in mobility start-ups worldwide actually grew by five percent year-on-year to $37.5 billion in 2020.

Mobility behavior is changing fundamentally and, for many, sustainably. This has implications for the attractiveness of individual business models and investment behaviorAndreas Nienhaus, Partner and Mobility Expert

Mobility behavior is changing fundamentally and, for many, sustainably. This has implications for the attractiveness of individual business models and investment behaviorAndreas Nienhaus, Partner and Mobility Expert

Source: Oliver Wyman, Crunchbase

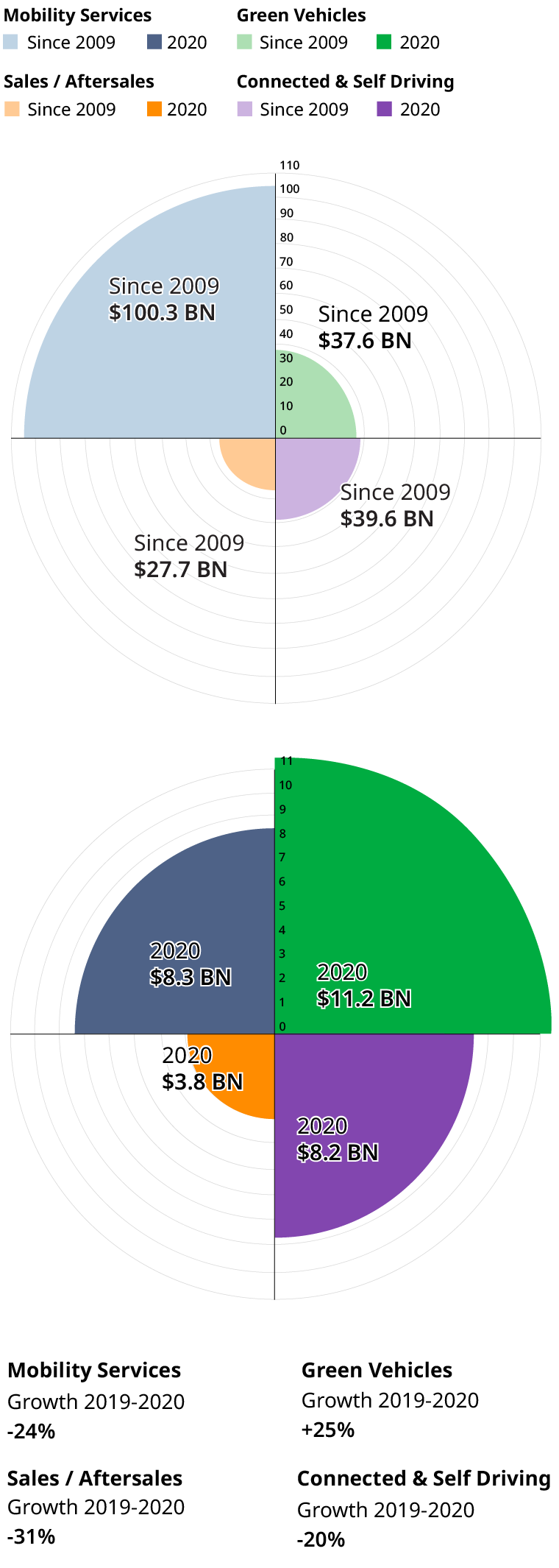

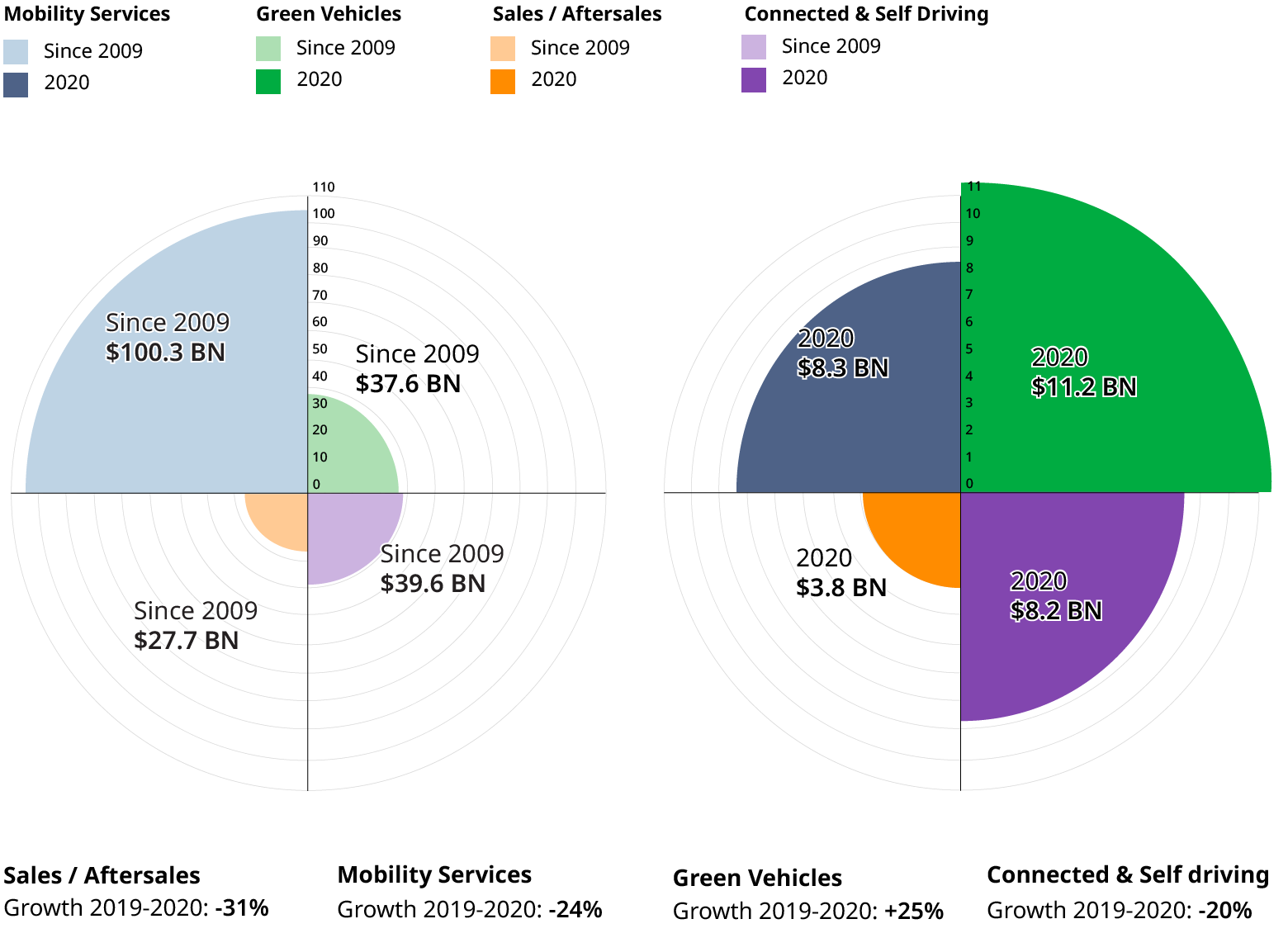

Electric car manufacturers ahead in venture financing

The trend toward sustainable mobility continues unabated. Last year, capital providers invested around $15 billion in young companies. The highest investments were made by green vehicle start-ups in the field of e-mobility - $34 billion worldwide in the last five years, of which more than $11 billion in 2020 alone, an increase of more than 25 percent compared with the previous year. The lion's share of this was accounted for by funding from U.S. and Chinese start-ups for electric cars. Developments in the direction of online retail have also been further strengthened in the wake of the pandemic, as evidenced by the enormous inflow of funds totaling $2.6 billion. Online car retailers in the used car market, which generated 80 percent of these fundings, are among the clear winners of the crisis.

By contrast, the picture is different for mobility services. After the hype surrounding micromobility providers in 2017, with an investment volume of $29.1 billion, financing has declined steadily since then, to most recently $8.3 billion last year.

Total Funding

Source: Oliver Wyman, Crunchbase

Total funding since 2009 ($ BN)

Large funding in Mobility services driven by ride-hailing start-ups and young micro-mobility start-ups (bikes, e-scooters). Funding in Connectivity driven by start-ups developing self driving technology

Total funding in 2020 ($ BN)

Green Vehicle fundings focused on five companies. Connected & self driving funding driven by rounds in USA.

Funding growth 2019–20 (%)

Green vehicles still growing on a high level, while all other segments have slowed down. Growth in Green Vehicle funding driven by American and Chinese EV manufacturers.

GREEN VEHICLE

Green vehicle start-ups are constantly increasing their funds, driven by emerging American and Chinese EV-start-ups in the light of increasing environmental and sustainability targets

MOBILITY SERVICES

After a strong hype around micro-mobility in 2017, fundings for Mobility service start-ups have declined continuously

SALES / AFTERSALES

Continuous decline of Sales/ aftersales funding since 2018 after main players have received significant fundings in 2018 and sector evolves to higher maturity

CONNECTED & SELF DRIVING

Decrease in funding of Connected & self driving vehicles in 2020, yet funding increases expected going forward

Europe is much more competitive as a start-up location today than it was a few years ago

Three geographical focal points have emerged in the funding of mobility start-ups: North America with the U.S. ($15.6 billion), Asia with a dominant China ($8 billion), and far behind India, Japan, Korea and Thailand, each with no more than $0.5 billion. Singapore is an exception, with fresh growth capital of at least $1.3 billion (2020). Europe will receive a total of $5 billion in funding, of which the following will account for $1.9 billion to German mobility start-ups, followed by the UK with $1.4 billion and Estonia, Hungary, Sweden and Spain, each with well under $0.5 billion.

The high potential for mobility funding in Europe is indicated not only by the observed increase in mega-financing rounds with a volume of more than $100 million each, but also by the increasing competitiveness of European, especially German, start-ups that benefit from municipal frameworks for sustainable mobility.

In 2020, there were twice as many mega-financing rounds in Europe as in the previous yearSteffen Rilling, Engagement Manager

In 2020, there were twice as many mega-financing rounds in Europe as in the previous yearSteffen Rilling, Engagement Manager

Eight start-ups raised the equivalent of $2.4 billion in twelve rounds. We therefore see Europe moving up into the top group in terms of e-mobility solutions, mobility services and also online car retailing. The market is on the move, and Covid-19's changes in mobility patterns will provide additional support for new business models.

There are two main reasons why Europe is much more competitive as a start-up location today than it was a few years ago. One is the availability of skilled workers: In the key regions of the U.S., salaries for IT specialists have risen rapidly in recent years, and strict regulations are making it increasingly difficult to recruit specialists from abroad. At the same time, the talent pool of specialists in Europe has grown. On the other hand, access to growth capital plays an important role: Today, significantly more is being invested in start-ups in Europe than was the case a few years ago; in addition, US venture capitalists are also increasingly investing in Europe.

About the analysis

Oliver Wyman's Mobility Start-up Radar annually analyzes 5,000 start-ups worldwide in the innovation sectors of mobility services, green vehicles, autonomous and connected driving, and sales and aftersales. It analyses key KPIs such as funding, IPOs, acquisitions, no. of funding rounds to identify future trends and pin-down the most promising companies who will dominate the global mobility ecosystem of the future.

Contact us

For detailed information please reach out to our team at info-automotive@oliverwyman.com

Deep-dive: online car retail

Customers are frequently using online services to purchase goods – be it clothes, food, medicine, and many more. This also is true for the car industry: Customers want to inform themselves online, configure cars online, and about 60 percent of car shoppers are willing to purchase a car online (compared to only 32 percent pre-Covid-19). But even though two thirds of customers already decide online on their car purchase, about 99 percent of customers are not satisfied with the current buying process. So, it seems to be time for a digital change in online car retail which opens the floor for start-ups and established players.

Key figures on online car retail

99%

of customers are not satisficed with the current car buying process

60-80%

of car buyers starts theirreasearch online

80%

of buyers use third party sites when buying a car

58%

of car buyers are unsatisfied with how long the process took

66%

of customers already decide online on their car purchase

60%

of auto shoppers are willing to purchase car online (compared to only 32 percent pre-Covid)

Source: Oliver Wyman, CarGurus.com, Autotrader Car Buyer of the Future Study, Cax Automotive Car Buyer Journey Study, DAT Report 2018

As you can see below, the used car segment achieves by far the highest amount of fundings in the online car retail segments in 2020, while car subscription start-ups experience largest growth. The other segments in online car retail experience significant fluctuations from a lower funding level.

Source: Oliver Wyman, Crunchbase

In sum, Covid-19 has shifted customer purchase habits towards online car retail, leading to a sustainable change in customer behaviour and evoking potential for further growth; especially the online used car segment is gaining increasing customer interest and has presented itself as the shooting star in 2020’s fundings.

Deep-dive: sustainable mobility

It is evident that sustainable ways of mobility are key to fight climate issues, and there are various levers to pull.

Reducing transportation emissions represents a strong lever to fight the climate crisis and to reach the target of limiting global warming to 1.5°C as determined in the Paris Agreement in 2015, signed by 195 nations.

In the past years, congestion levels have continuously increased. Due to a global reduction in mobility in 2020, the congestions decreased by about one fifth globally. However, the positive trend is not expected to stay unless there is a deliberate change in driver mobility behaviour.

The pandemic has led to a massive reduction in use of public transportation and increase in car usage which is forecasted to persist in the long-term. This requires the design of new sustainable alternatives which provide similar convenience and safety levels like a personal car.

>25%

of green house gas emissions comes from transportation

2-3%

was an average congestions increase year-on-year (pre-Covid)

46%

of increase of car usage is forecasted even after the pandemic has ended

Source: Oliver Wyman, TomTom Traffic Index

Funding of sustainable mobility segments

Several start-ups from the sustainable mobility space are currently disrupting the landscape. Looking into it a bit more in depth, it is unsurprising that electric vehicle manufacturers still get a huge portion of funding in 2020. Their CAGR over the last 4 years has been high at 25 percent. However, start-ups in the charging infrastructure segments are receiving the strongest growth in funding with an average annual increase of 94 percent. The boom reflects the strong demand of expanding and improving EV infrastructure as well as providing related services to make EV usage more attractive. With -50 percent CAGR in funding since 2017 Car- / Ride-sharing start-ups recorded the strongest decrease in funding. The reduction reflects the decreased interest of investors on shared mobility services as it is still difficult to establish a profitable business in this segment.

In summary, EV manufacturers as well as Car- / Ride-sharing and Micromobility companies still received the highest funding in 2020, but the momentum is moving to charging infrastructure and battery as well as to smart city start-ups that build the backbone for a functioning electric mobility future.

Source: Oliver Wyman, Crunchbase