Based on 2020 Q4 earnings calls, Oliver Wyman made observations regarding the impact of COVID-19 on life insurance in the United States related to mortality, financials, operations, and sales.

Mortality Impact

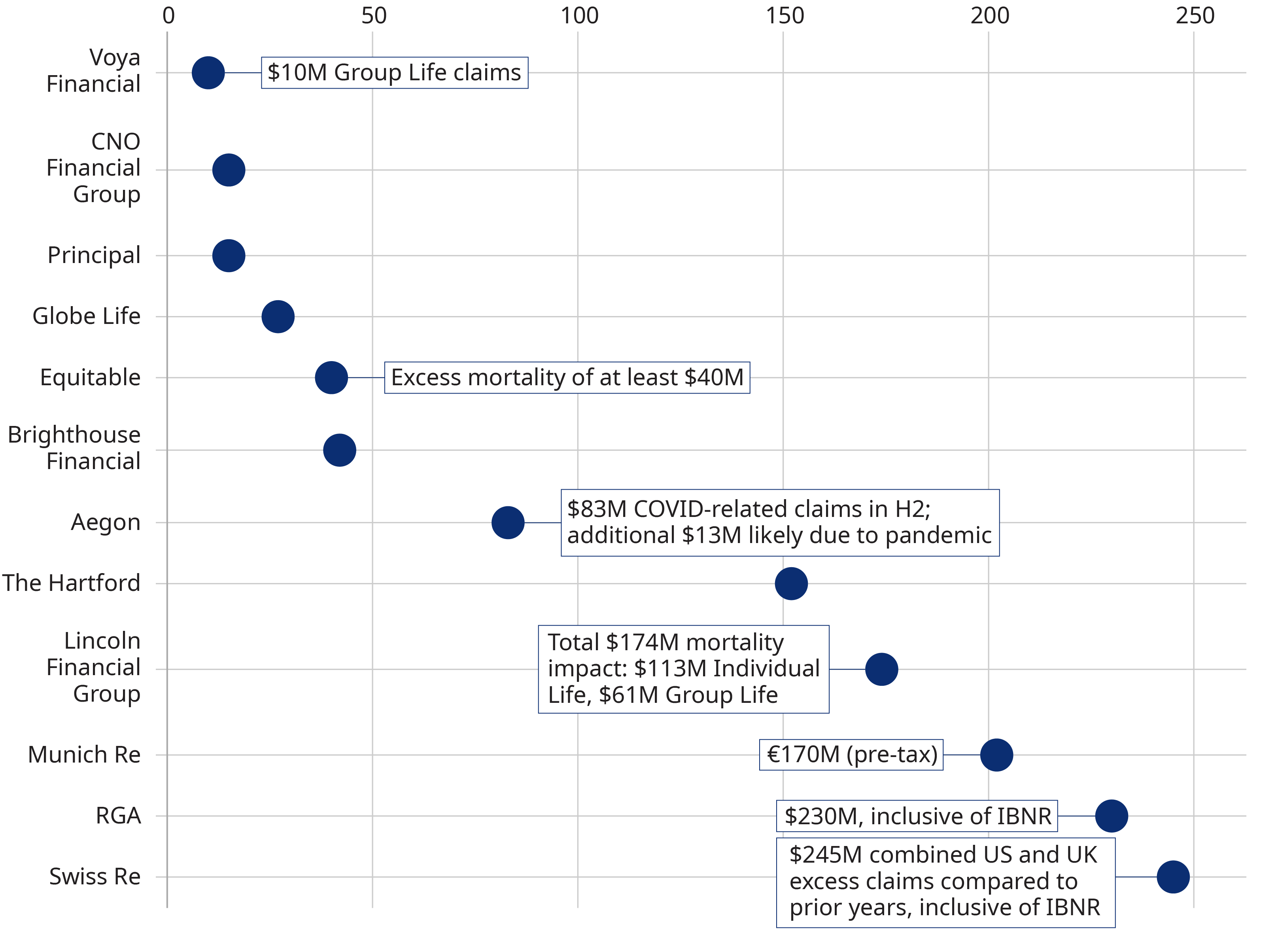

Reported 2020 Q4 Impact On US Life Insurance Companies

Q4 impact of excess US life claims ($M)

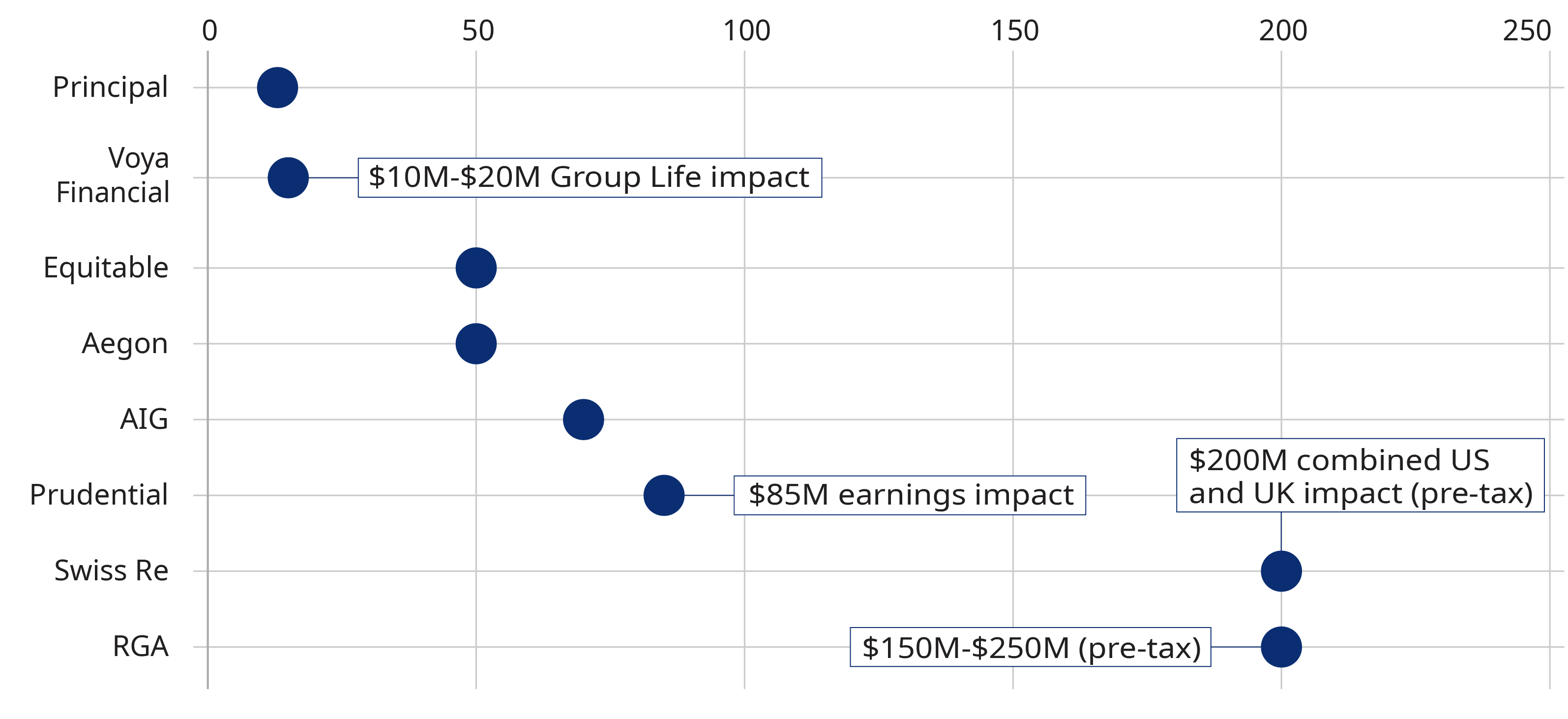

Projected US life claims impact per 100,000 excess US deaths ($M)

Companies quoted impacts in various formats, some pre-tax vs post-tax, some gross vs net of reinsurance, and some with vs without IBNR reserves

Ranges of projected claims have been converted to midpoints

- Most companies reported higher COVID-19 claims in Q4 in comparison to Q3, and in most cases, Q2

- Projected 2021 impacts

- Companies generally expect elevated claims in the first half of 2021, with levels decreasing later in the year

- Principal, SCOR, and VOYA estimate between 280,000 and 300,000 COVID-related deaths in the U.S. in 2021

- Munich Re projects €200M in COVID-19 related life and health claims in 2021. This is greater than their €170M 2020 Q4 impact, but less than their €370M total 2020 impact

- AIG estimates up to 40% of reported COVID-19 claims reflect an acceleration of claims they would otherwise expect in the next 5 years

- Non-COVID mortality

- Lincoln and Principal experienced unfavorable non-COVID-19 claims, which may be indicative of disruptions to normal healthcare and under-reported COVID-related deaths

- RGA realized favorable non-COVID mortality experience driven by lower large claims

- SCOR recognized a positive impact from reduced flu claims in the U.S.

Economic Impact

- Rebounding investment yields

- Munich Re, RGA, SCOR, and Swiss Re noted higher investment yields over Q3

- 10 year treasury has risen more than 50bps since the start of 2021, as of February 26th

- As yields have risen, most major US Life insurer stock prices have increased between 10% and 20% YTD, as of February 26th

- Impairments

- Aegon had very low impairments in 2020, and expects residual impairments post-COVID

- RGA impairments remain below the low end of their previous stress scenario ranges; Q4 net impairments and change in allowances of $3M pre-tax

- Swiss Re had net realized losses from impairments of $27M; no increase from first half of 2020

- SCOR had limited impairment charges of €42M pre-tax

- Principal realized $70M of capital impacts from credit drift and losses, significantly lower than initial estimates at pandemic onset

Operational Impact

- Companies will likely wait until at least the second half of 2021 before bringing people back into the office

- Insurers are likely to allow 30% of their workforce to remain remote permanently

- Employee sentiment is still split, with half wanting to return to office and half wanting to stay virtual

- 98% of Nationwide’s employees pivoted to WFH at the start of the pandemic (compared to 18% pre-pandemic)

- Data shows that many insurers have a lower lease obligation for 2022 than 2021

Sales Impact

- Sales rebounded for younger issue ages, while older ages rely more on in-person sales and are slower to recover

- SCOR Global Life gross written premiums are up 1.4% YoY at constant exchange rates

- RGA traditional net premiums for both Q4 and full-year 2020 increased 2% YoY

- AIG sales have improved from the first half of 2020

Additional Resources