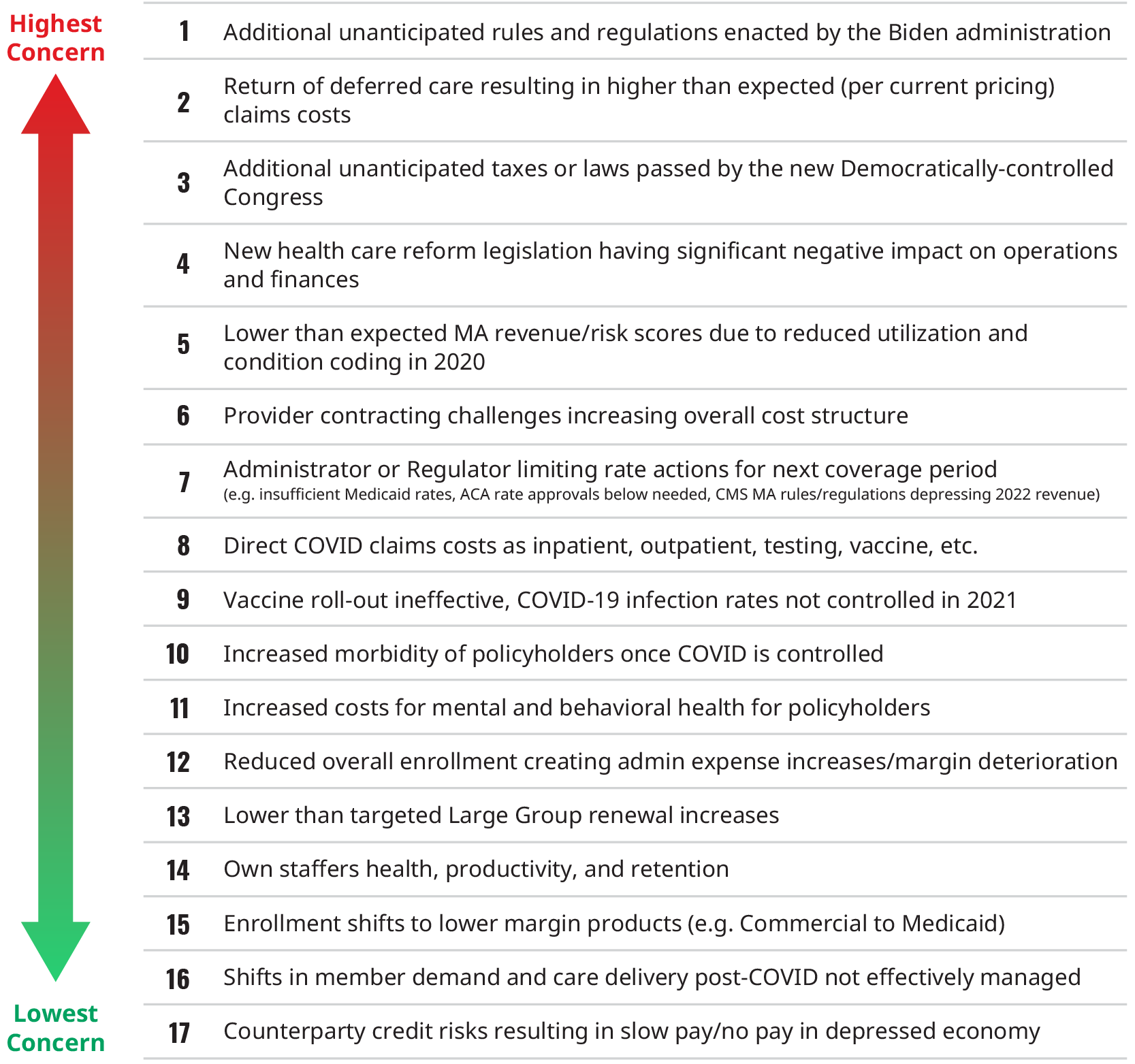

Oliver Wyman Actuarial surveyed health plan executives to gauge their overall level of concern related to 17 statements that could impact overall health plan profitability in 2021. Respondents were requested to respond to each statement with their level of concern that it will impact profitability in 2021 using the following responses:

- Not Concerned

- Somewhat Concerned

- Concerned

- Very Concerned

Overall, we found that respondents were not overly concerned with any specific item, with the highest proportion of respondents indicating a “Concerned” or “Very Concerned” response to any of the statements only being 59%.

Some regulatory concerns

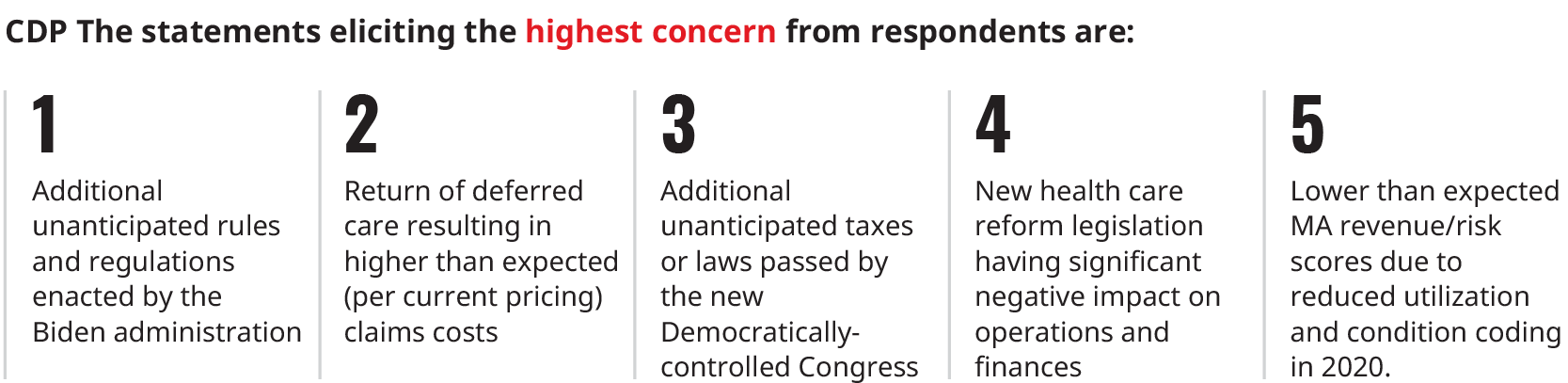

Three of the top five statements reference regulatory concerns. Additionally, the seventh-highest concern was “administrator or Regulator limiting rate actions for next coverage period (e.g. insufficient Medicaid rates, ACA rate approvals below needed, CMS MA rules/regulations depressing 2022 revenue).” Therefore, respondents have some concerns about adverse changes to the state and federal regulatory environment. A couple of relevant timely examples include:

- Washington State Senate Bill 5149 would impose a per member per month (PMPM) fee of $1.54 in 2022, increasing to $3.07 in 2026. The bill would prohibit plans from reflecting this assessment in their individual or small group rates.

- The Biden Administration has recently extended the open enrollment period for plans sold on the federal exchange, HealthCare.gov, until August 15, 2021, roughly 90 days beyond the extension to May 15, 2021 that was included in the American Rescue Plan Act. Obviously, these extensions of open the enrollment period until August 15 were not anticipated in plans’ 2021 premiums.

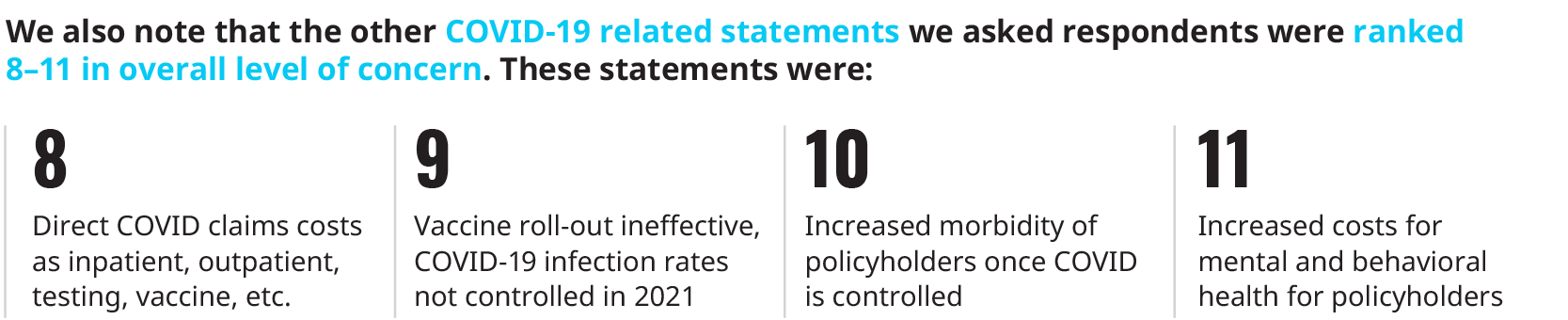

Some COVID-19 cost concerns

The second-highest concern was “return of deferred care resulting in higher than expected (per current pricing) claims costs.”

The healthcare industry expects some degree of care that was and continues to be deferred during the COVID-19 pandemic, but the timing and magnitude of the returning care will not be known until well after the pandemic ends. Some examples:

- In their fourth quarter 2020 earnings calls, Anthem, CIGNA, and UnitedHealthcare all noted that utilization in fourth quarter 2020 was at or above seasonal baselines, suggesting that some level of deferred care could already be coming back.

- The Kaiser Family Foundation reviewed over 100 2021 Affordable Care Act marketplace filings that had specific COVID-19 impacts indicated in their pricing methodology, which includes direct COVID-19 costs, vaccine administration, changes in morbidity due to COVID-19, and potentially other impacts, in addition to the return of deferred care. While the range of impacts varied from a 3.4% decrease to an 8.4% increase, the 75th percentile plan included only a 2.0% impact on 2021 due to COVID-19. This is a relatively low margin for the high degree of uncertainty that continues to impact insurers during the pandemic.

And some COVID-19 revenue concerns

The statement that elicited the fifth-most level of concern by respondents was “lower than expected MA revenue/risk scores due to reduced utilization and condition coding in 2020.” Because 2021 Medicare Advantage (MA) plan revenue is largely driven by 2020 risk scores, any reduction in utilization, and thereby diagnosis coding, could result in plans receiving less plan revenue per member from Centers for Medicare and Medicaid Services (CMS) reimbursement.

- We expect that this decrease could be between 1% and 5%, with the areas less impacted by COVID-19 lockdowns, such as in the Midwest, impacted the least, while the areas more impacted by COVID-19 lockdowns, such as New York, impacted to a greater degree.

- In addition to geography, the range of the risk revenue impact varies depending on a few key considerations such as nature of the risk revenue programs, tele-medicine capabilities, and chronic risk capture procedures.

Should MA utilization return to normal levels in 2021, or even exceed normal levels due to the return of deferred care, MA plans could find their 2021 profitability squeezed on both the revenue and claims expense sides.

The lowest level of concern was indicated for “Counterparty credit risks resulting in slow pay/no pay in depressed economy,” suggesting that respondents are largely confident that the economy is or will be strong enough in 2021 to minimize counterparty credit risk.