The vulnerabilities of global supply chains have been highlighted recently by events such as the COVID-19 pandemic, climate change-induced natural disasters, cybersecurity threats, logistics obstacles, and geopolitical conflicts. Industries across the spectrum have been forced to grapple with production delays, shortages, price increases, demand growth, and unexpected bottlenecks.

In this article, we discuss the importance of the industrial sector in the supply chains of several sectors, the levers to enhance supply chain resilience and how to deploy those levers, and the need for GCC countries to develop resilience strategies and the required enablers to safeguard their industrial growth.

Industrial sector supply chains — meaning the steps covering raw materials sourcing and processing, components manufacturing, and assembly, as well as the movement of these goods — are particularly exposed to such vulnerabilities. This is due to the concentration of resources and manufacturing activities in specific countries combined with the global nature of most industrial supply chains.

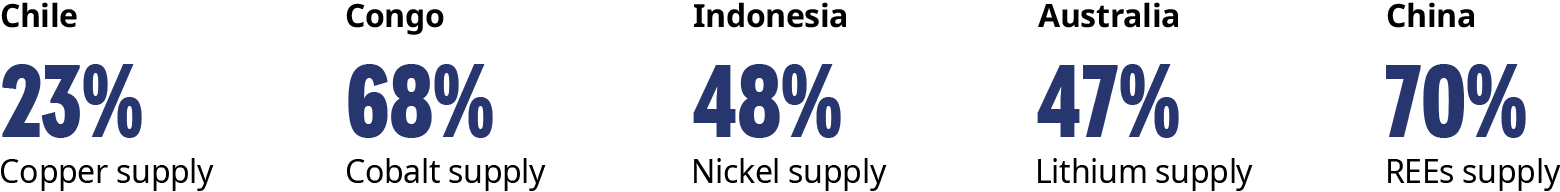

For example, in terms of critical minerals, Congo supplies 68% of the world’s cobalt and Chile 23% of global copper, while China is dominant across all 17 rare earth elements (REEs), representing 70% of global supply. Also, Indonesia contributes 48% of the world’s nickel, and Australia accounts for 47% of global lithium mining.

Strategic levers to enhance industrial supply chain resilience

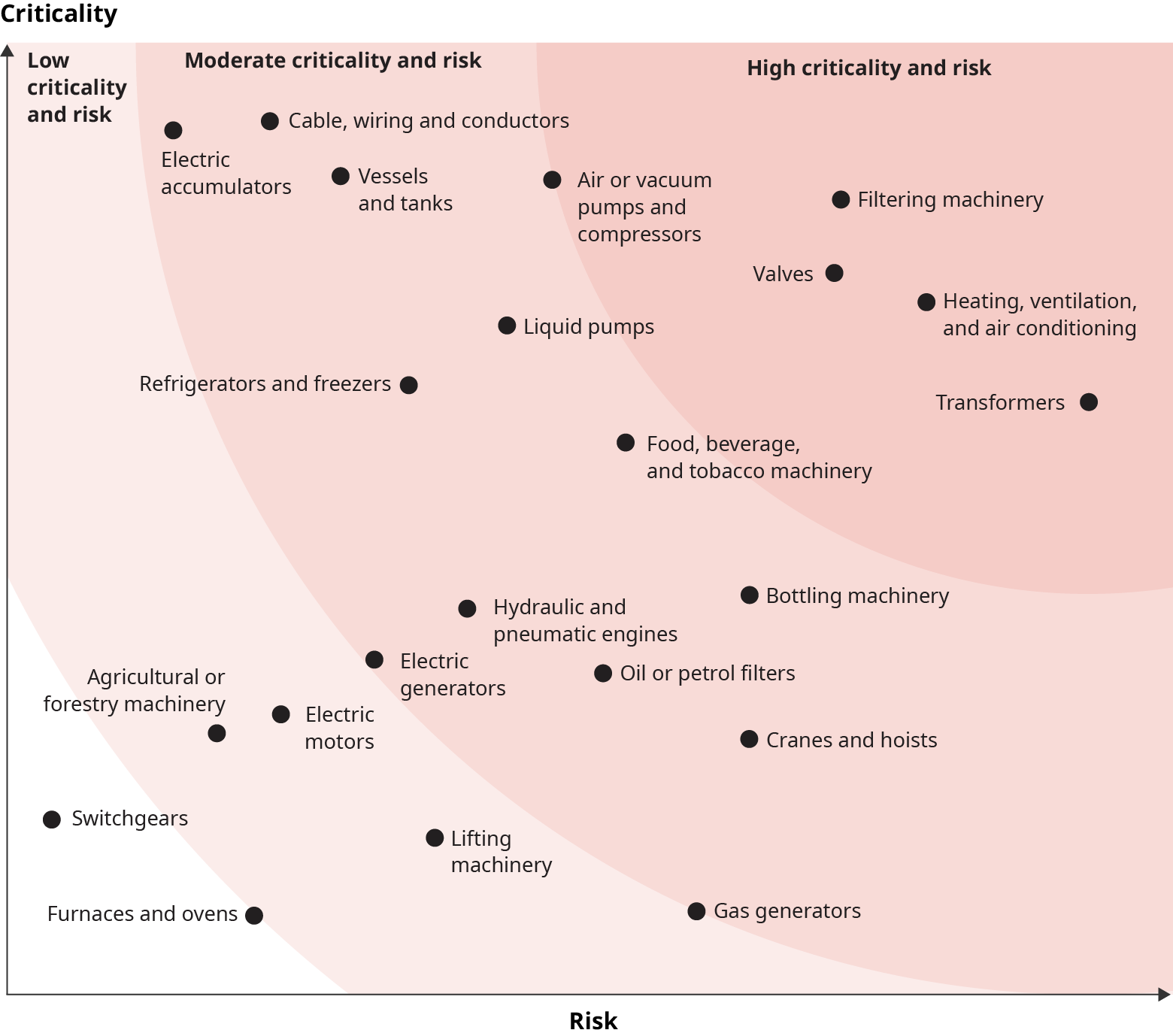

Achieving supply chain resilience in the industrial sector is not a one-size-fits-all endeavor. The levers that fortify supply chains must be applied to supply chain components of products with high criticality and risk. Such products must be first identified, and then their supply chain must be analyzed. Lastly, the appropriate resilience lever should be deployed for each supply chain component , depending on its criticality and risk.

The criticality and risk profiles for the products within a sector, as illustrated for the machinery and equipment sector in Exhibit 2, are assessed based on two dimensions. The criticality dimension covers both the impact the product has on national resilience (such as national security, safety, well-being, and environmental impact) and its market significance (including current and future market size).

The risk dimension covers the likelihood of disruption (import market concentration, localization levels, global supply concentration, and the share of high-risk countries in the global supply mix). It also includes the expected impact of disruption, including the number of core services impacted, the size of economic sectors impacted, the product’s life expectancy, and how substitutable the product is).

Governments can wield five main levers to influence and fortify the supply chain resilience of their industrial sectors: strategic storage, localization, near shoring, friend shoring, and international partnerships. These levers collectively shape the landscape of supply chain resilience and are instrumental to navigating the complexities of an interconnected global economy.

The need for a comprehensive GCC supply chain resilience strategy

Developing supply chain resilience strategies and the required enablers is critical for GCC countries given their dependence on supply chains across various categories of products. For example, of all the electrical machinery and equipment imported to both Kingdom of Saudi Arabia and the United Arab Emirates, 60% and 65% respectively is imported from just three countries. Similarly, for excavation machinery and valves, KSA and the UAE import 50% and 55% of the total from three countries.

Several GCC countries have already initiated nationwide efforts to improve supply chain resiliency. For example, in 2022, KSA launched the Global Supply Chain Resilience Initiative as part of its National Investment Strategy. This aims to position the Kingdom as a location of choice for leading global industrial companies, attracting investments in supply chains to mitigate the impact of global disruptions. Moreover, the UAE is focusing on improving food supply chains through various programs such as those that support local and sustainable food production, as well as by establishing new logistics hubs and deploying cutting-edge technological solutions.

In addition to the ongoing efforts, five key actions, based on Oliver Wyman analysis, are recommended for GCC countries to ensure industrial supply chain resilience further:

Securing GCC industrial growth through supply chain resilence

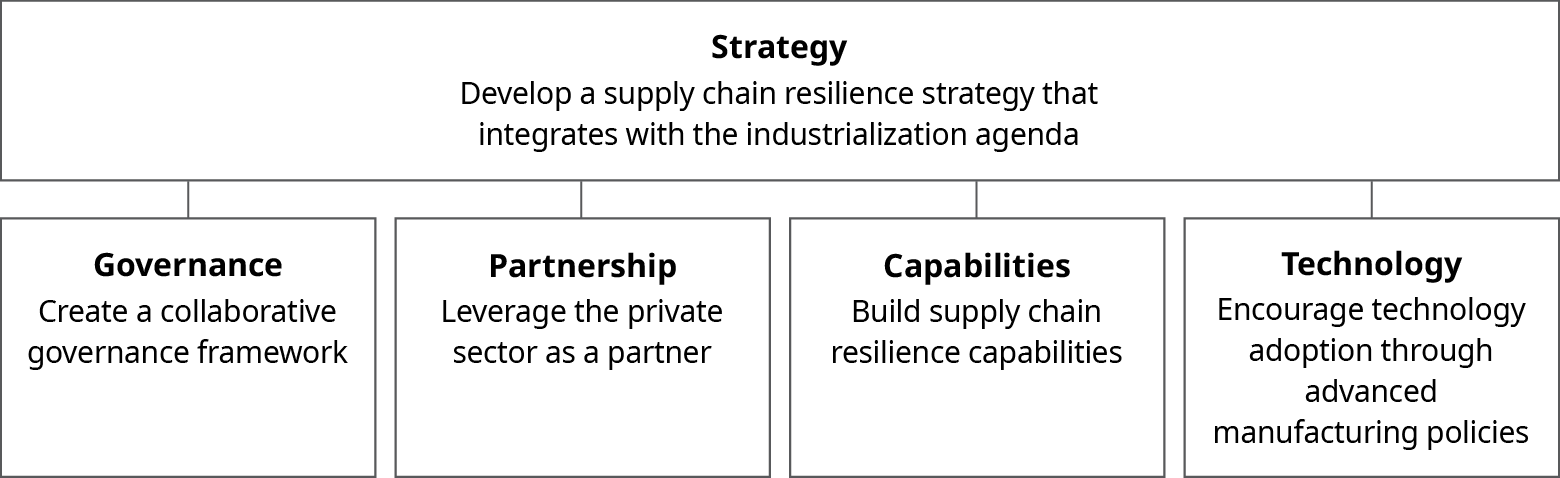

As GCC countries undertake ambitious endeavors to strengthen large-scale industrial development, it becomes clear that the cultivation of a robust supply chain is extremely important. The blueprint for this resilience must fit into current industrial development agendas and address supply chain resilience levers while also nurturing local capabilities and leveraging emerging technologies. It should also foster coordination across multiple government entities and involve the private sector.

By embracing a holistic approach that combines localization with other supply chain resilience levers, GCC policy makers can better safeguard the industrial growth of their nations, ensuring adaptivity and responsiveness in an ever-changing global landscape.

Although localization is a long-term vision, the reality is that short-term shocks and disruptions can introduce unpredictability. In an era defined by volatility and uncertainty, the ability to swiftly respond to supply chain disruptions is crucial for national safety and economic prosperity. Therefore, it is evident that supply chain resilience is not just a choice for GCC nations but a necessity, and one that will guarantee the sustainability of their burgeoning and all-important industrial sectors.