Australian Financial Review: Opportunities Focused On Crypto

September 01, 2021

As the ASX prepares to list bitcoin-centric payment company Square, Australian cryptocurrency-related businesses are being forced offshore thanks to widespread paranoia.

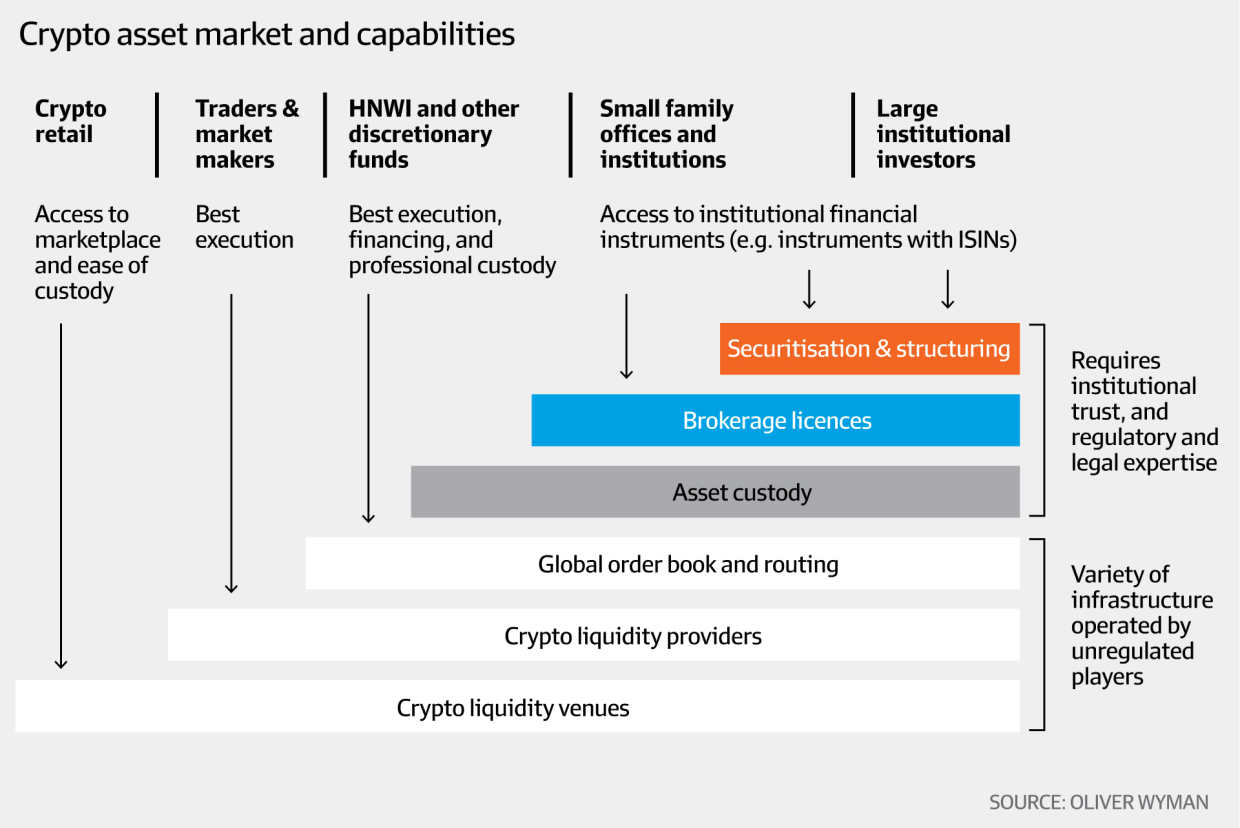

A report published this week by financial services consultant Oliver Wyman sets out the range of opportunities for traditional financial services companies involved in securitisation, financial structuring, broking and asset custody.

The report, Digital Assets Going Mainstream, identified six areas where opportunities exist for businesses focused on crypto assets.

“Custodians are important for the future of the crypto market infrastructure, and there is opportunity for firms with the right institutional trust, balance sheet strength, and legal and technical know-how,” it said.

“Developing trading venues and trading-related platforms and infrastructure is another area in which financial institutions can participate.

“One major opportunity that depends on how regulation evolves are wealth management products that provide exposure to the crypto market. The development of this opportunity would undoubtedly unlock a significant amount of capital.

“As more sophisticated trading firms access the crypto market, demand for crypto prime brokers will likely increase.

“Outside of trading and investment, payment and settlement solutions are another area where financial institutions can deploy digital assets. The potential here is for firms to deploy a fungible digital token that is an instrument representing a claim against an institution with a strong balance sheet and combining this with an open network into which participants can easily integrate.

“Finally, financial institutions can develop new financial products by combining the technical features enabled by digital assets with innovation in financial engineering.

“For example, tokenisation, a feature enabled by digital assets, can allow new derivative products to be created where counterparty risks are more visible and manageable, and liquidity potentially unlocked through fractionalisation and bundling.”