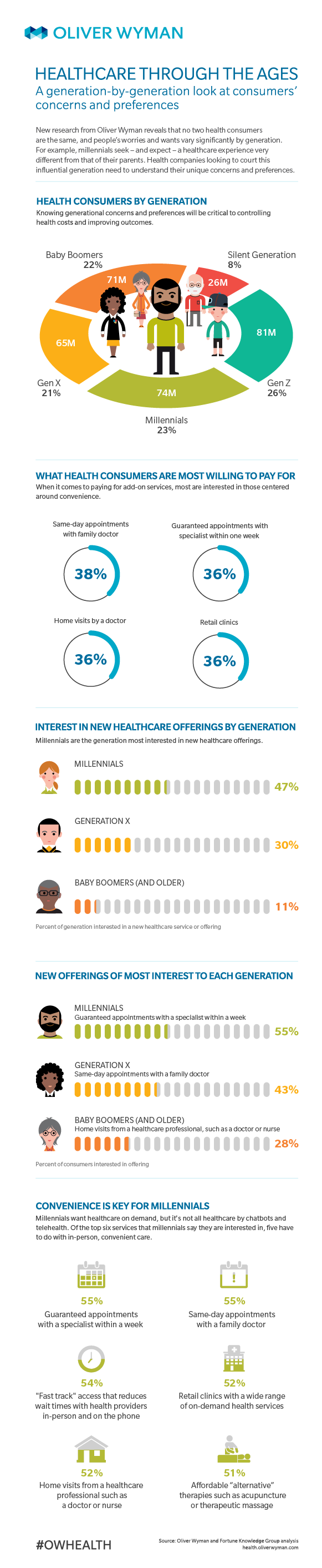

In this climate of change, understanding Americans’ attitudes toward the healthcare services they use, and also how services might be expanded or improved to better meet consumers’ wants and needs will be critical to controlling future health costs and improving outcomes.

Oliver Wyman, in collaboration with FORTUNE Knowledge Group, conducted an online survey of 2,016 US consumers in October and November 2016. The survey is one of the largest of its kind, and the findings are highly relevant for policy makers, industry leaders, and the general public. Our research provides a nuanced view into the concerns and the needs of US healthcare consumers. Health consumers’ experiences, expectations, and concerns are as diverse as the country itself, and the survey data reveal a wide variation in what forms of healthcare consumers value and prioritize. What people want and what they’re willing to pay for vary significantly by segment.

And yet, one view is consistent: Consumers want a better healthcare experience. The system doesn’t work as it could (or should) for many people. They’ve told us what they want and need, and now it’s up to us to deliver.

Report Insights

- The cost of healthcare is a concern for all consumer segments, and most find the medical system complex and confusing. However, some segments (young people and caregivers, in particular) are more open-minded about paying more for additional services.

- Millennials, who recently surpassed baby boomers as the nation’s largest generation, are the age group most interested in new healthcare offers.

- Millennials’ responses indicate that they expect to engage with the healthcare system in a routine, potentially pleasing way, rather than only during crisis. They are seeking health and wellness services that can be incorporated into everyday life.

- Interest in new offers is highest among millennials with chronic diseases (60 percent have a high degree of interest). Interest then declines steadily with each age group.

- Baby boomers express more anxiety about increasing costs than other generations. They also are less optimistic that their care will get better over the next five years—just 21 percent of boomers think their care will get better over the next five years compared with 44 percent of millennials.

- Organizations that address boomers’ specific concerns around maintaining their health and independence will have greater success with new solutions—even if those solutions are not on boomers’ current want/need list.

- Caregivers are about twice as likely as other respondents to be interested in paying for access to medical professionals via a 24-hour help line or from a home computer. This indicates which types of additional services will be most in demand as more health consumers take on caregiving responsibilities.

There is no single strategy that will meet consumers’ desires and needs; winning means understanding the market’s complexity and tailoring solutions accordingly.Sam Glick, Partner, Health & Life Sciences, Oliver Wyman