As pressure on companies to decarbonize continues to mount, sustainability transition efforts are quickly shifting gears from if to when and how.

A growing number of companies are setting targets and defining objectives for their decarbonization, but it is no longer enough to make empty declarations. Once targets are set, stakeholders are looking immediately for translation mechanisms to turn objectives into action.

Internal Carbon Pricing is an important tool that allows companies to assign financial value to greenhouse gas (GHG) emissions for use in strategic, commercial, and risk-related decision-making processes. Fundamentally, it enables companies to assign an economic value to emissions in the absence of external pricing signals.

Internal Carbon Pricing essentially levels the playing field between new low-carbon economy investments and ones relying on fossil fuels, by charging the latter for the cost of the carbon they emit. While the benefits of Internal Carbon Pricing are multi-faceted, the key impacts are to expedite the transition to a low-carbon operating model. For companies operating across markets with vastly different operating environments and climate regulations, in particular, utilizing a structured tool such as Internal Carbon Pricing is necessary to arrive at a congruent internal viewpoint on the value and cost of carbon across business units and regions of operation.

Internal Carbon Pricing challenges for Asian companies

Internal Carbon Pricing as a concept started to win traction with companies in the United States and Europe a decade ago in response to increasing clarity regarding regulatory carbon pricing. Today, carbon pricing has become a straightforward tool to reduce carbon emissions. Prices for most countries are set through the European Union Emissions Trading System, with numerous analyst forecasts on how prices will develop. The picture in Asia is far more complicated, given fractured markets, low and unclear pricing levels, and the contentious future development of prices:

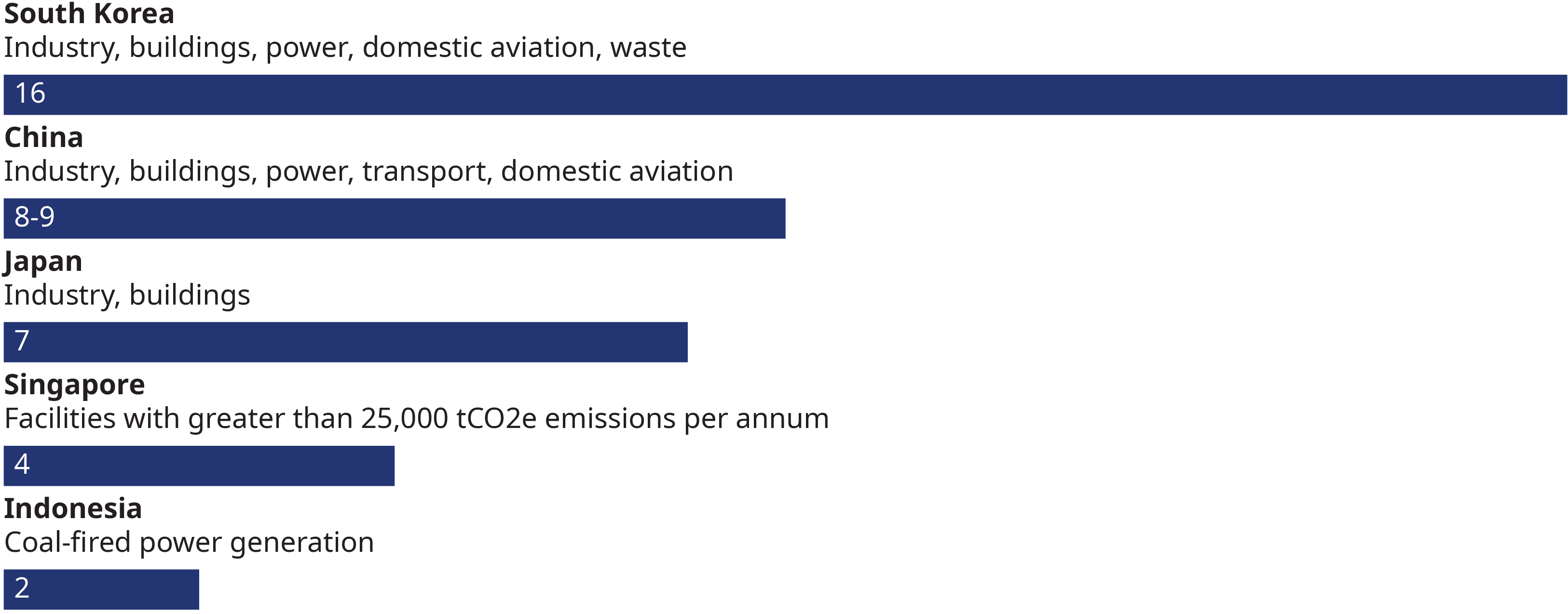

- Markets are highly fractured, with pricing levels and approaches differing significantly across the region. So far, only five countries have introduced mandatory carbon pricing mechanisms. Even among these markets, the specific levels, scopes of application, and choice of carbon tax or trading schemes vary. For example, while China uses an exchange trading scheme that is only mandatory for the power sector at present, India imposes an implicit carbon tax through excise duties on fuels.

- Additionally, current price levels are too low to effectively impact carbon emissions. Although the International Monetary Fund (IMF) recommends minimum carbon prices of US$25 and US$75 per metric ton of carbon dioxide equivalent (tCO2e) for emerging and developed markets, respectively, prices in Asia are currently well below US$20 per tCO2e, even for developed markets such as South Korea.

- Finally, the future development of carbon prices is a contentious issue in most markets, with the planned introduction and expansion of carbon taxes or trading schemes riddled with postponements and lacking transparency on expected price levels. For example, while the introduction of a carbon tax in Indonesia and the expansion of China’s Emission Trading Scheme to include other sectors were both initially planned for 2022, both have been delayed to 2024 at the earliest. The only notable exception is Singapore, where the carbon tax will increase five-fold in 2024.

As evidenced by the numbers, the initial implementation of Internal Carbon Pricing in business units in Asia is a challenging process. When the internal carbon price is set according to observed carbon pricing levels in the operating markets, heavy penalties for businesses operating in transition-oriented markets with clearly announced carbon prices are implied. The result, invariably, is ongoing resistance from commercial teams on the applicability and utility of such an approach.

Translating decision-making objectives into a carbon pricing mechanism

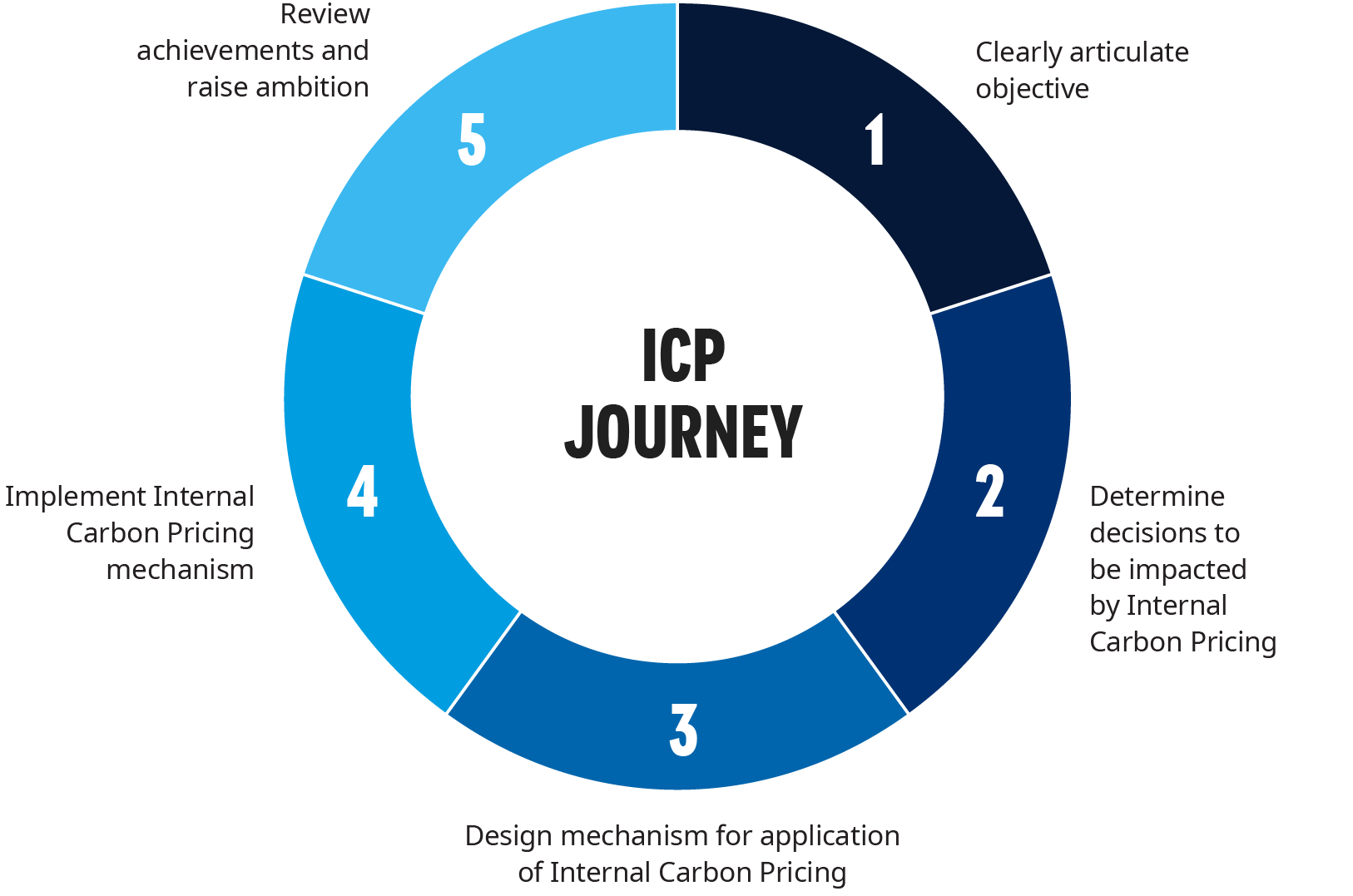

The operating environment and the expectations of stakeholders differ widely by country and company. In trying to structure and shape an Internal Carbon Pricing scheme, sustainability teams need to start with a clearly defined objective. To ensure traction of the internal carbon price, both its structure and mechanisms must be aligned with the objective it is supposed to achieve. In this regard, Exhibit 3 illustrates two exemplary objectives.

These examples indicate that as the direct bearing on both business development and commercial and operational decisions increases, companies’ scrutiny of the carbon price mechanism and pricing approach becomes increasingly rigorous. Companies will need to consider how their objectives translate into decisions subject to the Internal Carbon Pricing, and further consider the required accuracy when deciding carbon price levels and organizational execution efforts.

Common pitfalls of Internal Carbon Pricing

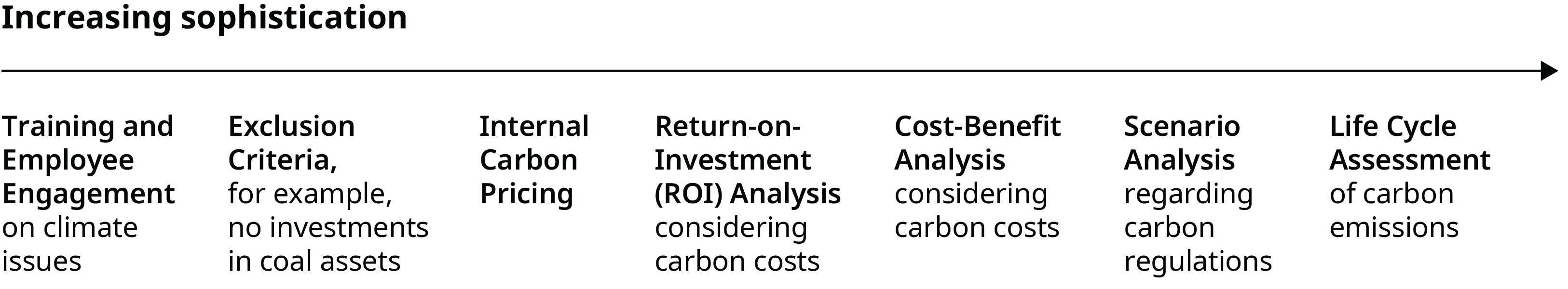

The first hurdle lies in setting an objective for the Internal Carbon Pricing. Companies tend to either act on the instinctive question of what the price level is or overly rely on peer practices without understanding their specific context. As a result, the initial implementations can be overly ambitious. To mitigate this, companies need to start from the fundamentals by doing the following: clearly articulating the climate objectives and strategy; determining the role of Internal Carbon Pricing towards these objectives; and identifying the decisions that will be subject to this framework. Companies should accept the adoption of such a framework as a journey, where increasingly ambitious climate objectives translate into increasing sophistication and impact.

The second challenge is the fact that price discovery in Asia is not straightforward. Only a few countries having adopted carbon prices at all. Moreover, the levels across these countries differ substantially and the concept’s future development remains unclear. Given the uncertainty of future regulatory and market prices in most markets in Asia Pacific, leading companies have utilized ranged price estimates and the archetyping of markets into broad categories to design the forecasting.

Getting companies comfortable with a carbon price

Given the pitfalls, for an Internal Carbon Pricing methodology to gain traction within the business units of an organization, the reasoning behind the methodology needs to be defensible and well backed.

Companies that are too ambitious in their Internal Carbon Pricing strategies and try to achieve a multitude of differing objectives may instead be left with an approach that is ill-suited to any singular objective. For example, while an Internal Carbon Pricing strategy for risk management may require a high-level Internal Carbon Pricing forecast that spans a longer time horizon, one tailored for day-to-day operations would require a shorter forecast that is more specific and accurate.

Separately, companies need to balance between ensuring the Internal Carbon Pricing is simple enough for ease of adoption and capturing the nuances across markets with differing operational complexity on the ground. Overcomplicating the Internal Carbon Pricing methodology may lead to business units choosing to ignore it. At the same time, an oversimplified approach which does not consider different market realities may not be relevant or useful in most business development and commercial or operational decisions.

Leveraging Internal Carbon Pricing for shift to net zero

Our next publication on Internal Carbon Pricing will discuss in more detail emerging views on the frameworks for Internal Carbon Pricing based on the organization’s objectives. It will also delve into the use of Internal Carbon Pricing in business framing, including internal capital allocation, pre-deal assessment, post-deal integration, and longer-term performance management.

Following that, the final publication will look into how Internal Carbon Pricing can facilitate a strategic shift towards net zero, and how companies are utilizing Internal Carbon Pricing alongside other decarbonization levers to gradually force a reprioritization of institutional mind-space and resources.