The Generative AI Tipping Point is our 2023 global wealth and asset management report with Morgan Stanley. We explore the industry outlook, strategies for gaining market share, and the impact of generative AI on wealth and asset management.

The generative AI (Gen AI) revolution is well underway and is already transforming the way asset and wealth managers operate and are delivering significant efficiencies. With that said, it is important to recognize that Gen AI is just one piece of an integrated strategic approach that asset and wealth managers need to adopt to drive sustainable growth.

In our 2023 global wealth and asset management edition with Morgan Stanley, we discuss how the revolutionary power of Gen AI can be implemented to drive better investment decisions, engage clients more effectively, and enhance productivity across the value chain. We also put this revolution in the broader context of major industry and macroeconomic trends that will force asset and wealth managers to take specific actions to capitalize on growth opportunities and reimagine their operating models to build greater resiliency in their businesses. Our report has been informed by interviews with senior executives of asset and wealth managers with approximately $21 trillion in combined assets under management (AUM). Below is an excerpt of our report, please click here for the full version of "The AI Tipping Point."

In this report we cover:

Global asset management outlook

Despite the market rebound in 2023, the asset and wealth management industries still face a long-term shift in the macroeconomic environment. The continued shift toward protectionism, nationalism, and multipolarity has further exacerbated macroeconomic challenges, ushering in a world order characterized by more restrictive central banks, less fiscal flexibility, and greater geopolitical instability that will likely take a toll on global growth and wealth creation.

In working with leading asset and wealth managers around the globe, as well as in our interviews with senior industry executives for this report, one thing has become clear, however: Leading managers are embracing these challenges and using them to galvanize their firms’ commitment to reexamining their strategies, reimagining their operating models, and embracing new capabilities like generative AI (Gen AI) to drive value and build resiliency in their businesses.

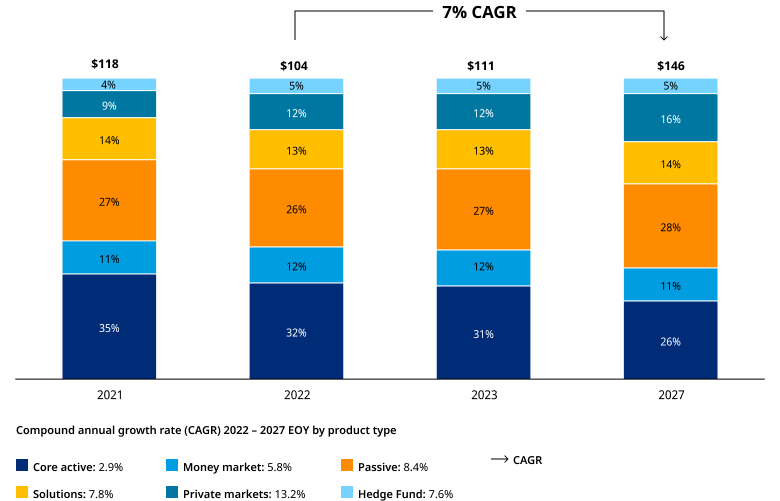

Given the macroeconomic backdrop, our outlook for the asset management industry is for modest growth. We forecast total externally managed assets to grow at 7% from 2022 to 2027, or a more normalized rate of 3.6% when measured from 2021, driven mainly by private markets.

Despite these headwinds, we expect that the asset and wealth management industries will continue to be among the most profitable in the financial services sector, generating relatively attractive returns on equity

Despite these headwinds, we expect that the asset and wealth management industries will continue to be among the most profitable in the financial services sector, generating relatively attractive returns on equity

We expect private markets to continue fueling global AUM growth, but at a slower rate relative to past years (the compound annual growth rate (CAGR) was 19% from 2017 to 2022, and it is projected to be 13% from 2022 to 2027) as signs of private equity fundraising struggles have emerged in 2023 and as institutional allocation slows from peak. Nevertheless, it should still outgrow other segments, ultimately accounting for 16% of global AUM by 2027 versus 12% in 2022.

The growth will not be equally shared by each market segment. Exhibit 1 shows our five-year projection of assets under management (AUM) across main product categories of hedge funds, private markets, solutions/multi-asset class, passive strategies, money market funds, and core active strategies — taking into consideration our view on expected relative flows across products and industry consensus forecasts for market returns.

We expect revenue CAGR to be slower than overall AUM growth (projected to be 5.2% CAGR in 2022-2027 versus 7% AUM CAGR), or a more normalized 4.7% revenue measuring from 2021 due to: 1. Some slowing of private markets AUM growth and slight mix shift to lower fee debt strategies; 2. persisting fee compression across most asset classes, particularly core active and passive, albeit at a moderated pace; and 3. additional mix shift impact from a rotation to lower-fee fixed income strategies.

We expect private markets to continue fueling global AUM growth, but at a slower rate relative to past years

We expect private markets to continue fueling global AUM growth, but at a slower rate relative to past years

Measuring from 2021 suggests a more normalized growth rate of 3.6%.

Looking ahead, we expect a 7% compound annual growth rate (CAGR) from 2022 to 2027 in AUM, when measured off a lower end-of-year (EOY) 2022 base.

Global wealth management outlook

For the first time in more than a decade, global household wealth shrank in 2022, but a rapid rebound is expected. Inflation, rising interest rates, heightened geopolitical tensions, and uncertainty regarding economic growth negatively affected wealth growth, leading to a decrease of approximately 4% in 2022.

After the long bull market, the wealth management industry is now encountering a more challenging market environment, with structural headwinds hitting both the revenue and cost sides. The recent decrease in revenues has been largely driven by drops in AUM and loan volumes, as well as a significant reduction in transaction volumes as clients have pulled back trading activities relative to the elevated levels during COVID-19. This revenue slowdown combined with the strong wage inflation driving costs up has intensified profitability headwinds.

Looking forward to 2027, we expect global financial wealth to grow at 6% (projected from 2022-2027) annually, with a strong rebound in 2023. We expect the Middle East and Africa, Asia-Pacific (APAC), and Latin America to lead, with growth rates of 8.2%, 7.4%, and 6%, respectively. Within APAC, Japan’s growth will remain slow relative to the rest of the region, at 2.9% (projected from 2022-2027). Furthermore, while China remains one of the main growth drivers in APAC, recent uncertainty has brought its outlook more in line with the rest of the region, at 7.6% (projected from 2022-2027). In absolute terms, North America and APAC are expected to drive more than 75% of worldwide new wealth creation until 2027.

In absolute terms, North America and Asia-Pacific are expected to drive more than 75% of worldwide new wealth creation until 2027

In absolute terms, North America and Asia-Pacific are expected to drive more than 75% of worldwide new wealth creation until 2027

In our next section, we discuss key actions asset and wealth managers can take to reexamine their strategies, reimagine their operating models and embrace new capabilities like Gen AI to drive value and build resiliency in their business.

Three actions for asset managers to drive profitable growth and operational resiliency

The combination of persistent stress on asset manager operating models, the fading of macroeconomic tailwinds that have benefited all firms, and revolutionary changes being ushered in by Gen AI has created a set of conditions that will raise the competitive bar and prompt a “big sort,” causing a large gap to emerge between leaders and laggards.

The leaders, for example, those that will end up being on the right side of the “big sort,” will be those that invest in and position their businesses to take advantage of faster-growing areas, and take specific actions to drive profitable growth and build operational resiliency. We see three main actions.

1. Fuel the active management engine to win share

The rise of passive investments at the expense of active management has been the single most disruptive trend to the asset management industry over the last 20 years.

The bright spots in core active management have been limited, and the relentless trend toward passive has been driven by many factors; chief among them is that active management has not been able to consistently demonstrate its value-add. That said, we see significant opportunity ahead for firms that can capture share despite persisting secular challenges.

Money-in-motion (reallocations within the active space) create a battlefield for active asset managers that cannot be ignored. According to our analysis, the flows between core active funds are estimated to be more than three times that of net flows into passive funds (Exhibit 2 below). In other words, for every $1.00 outflow to a passive fund from an active fund, approximately $3.00 in flows between core active funds are available to be captured by active managers.

While delivering investment outperformance (for example, performance alpha) will remain a critical driver of flows, it is not the only one: Managers that can deliver sources of “alpha” via product innovation, distribution and service, and fee structures will also be able to win share.

We see a large opportunity for active managers to capture share from flows among actively managed funds, which we estimate to be three times that of flows from active to passive

We see a large opportunity for active managers to capture share from flows among actively managed funds, which we estimate to be three times that of flows from active to passive

According to our analysis, the flows between core active funds are estimated to be more than three times that of net flows into passive funds.

Estimated flows between active funds as a percentage of total fund AUM

2021-2022

Managers that can deliver sources of “alpha” via product innovation, distribution and service, and fee structures will be able to win market share

Managers that can deliver sources of “alpha” via product innovation, distribution and service, and fee structures will be able to win market share

2. Optimize institutional pricing to capture significant revenue uplift

Fee pressure, most notably on traditional strategies, has been relentless as institutional investors continue to switch core exposures to passive while consolidating the number of managers they utilize — giving them additional leverage to negotiate larger, volume-based fee discounts.

Managers are not helping themselves, with many having large pricing dispersions across their managed accounts, leading to massive profitability skews. Asset managers are leaving money on the table. Taking the example of a generic $500 billion manager that has an unnecessarily large dispersion, and extrapolating a subset of the manager’s mandate data to cover its entire portfolio, suggests that applying a more disciplined, optimized approach could yield an approximately $50 million revenue uplift.

Managers, particularly those with larger institutional client bases, who have faced persistent price deflation and service-level inflation, need to adopt more analytical and systematic approaches to help them counter these challenges. Below we offer actions to implement a best-in-class pricing capability for your business (click through below for more details on the six levers from pricing strategy thorough data and optimization).

- Clear understanding of value-for-money and pricing proposition

- Pricing strategy aligned with sales narrative and strategic priorities

- Dedicated price and discount management tool to support decision making and impact simulation process

- Good understanding and application by sales staff and beyond

- Dedicated process to support front staff in reviewing fees and discounts on regular basis; identify cross-sell and upsell opportunities

- Detection of low performing accounts and root-cause identification

- Centralized governance framework for discount approvals

- Disciplined pricing process with clear KPIs and close involvement of investment managers, finance and sales

- Established dedicated pricing team

- Dedicated trainings to embed pricing philosophy

- Incentives aligned to client relationship profitability

- Full transparency on margins, client and product profitability

- Systematic collection of data on clients’ value drivers and/or willingness-to-pay and negotiation budgets

3. Reset your operating model to build resiliency and provide platform growth

The 2022 market downturn once again showed that asset managers continue to face tremendous downside exposure to markets on the revenue side, but with stubbornly high/growing cost bases.

Asset managers will always be beholden to market performance to some extent; however, a key question for managers is how to construct their operating model so that for any level of the market, operating margins remain as high and as resilient as possible. Therefore, it is not surprising to see many organizations announcing ambitious operational efficiency and cost programs with cost saving targets of 5–15%.

We contend that asset managers adopting more aggressive strategies can achieve cost savings of 20–40% by making difficult choices to trim their structural cost base, such as exiting underperforming markets and segments, and by embracing a “virtual” model, relying more on remote work and technology to power the business.

While a key benefit is operational efficiency, these programs will also allow asset managers to reinvest some of the savings in growth areas, like building out private market capabilities or investing in nascent technologies like Gen AI that have the potential to further boost efficiency and free up capacity to drive incremental revenue.

We see four primary sets of “levers” that asset managers can pull to improve operating margins and free up resources to invest in growth: 1. de-scoping, 2. organizational effectiveness and simplification, 3. workforce management, and 4. third-party cost management.

Our report provides estimates of the potential that each of these primary sets of levers can have in optimizing the respective cost base, based on our experience working with asset managers.

Within these four sets, there are specific actions that asset managers can take to achieve targeted operational efficiencies and cost improvements. Some of these are firmwide (for example, exiting underperforming business units/products/regions), while others are targeted to specific areas of the business (for example, reducing discretionary roles, such as project portfolio management — PMO, change, and business management).

Three levers for wealth managers to drive profitable growth

The market downturn in 2022 revealed vulnerabilities in the operating models across most wealth managers. While market cycles will always drive AUM and profitability, leading managers are taking matters into their own hands by identifying attractive sources of growth. This involves a strategic focus on capturing or winning a larger share of net new money (NNM) and revenue pools to offset the adverse effects of market downturns. Concurrently, leading wealth managers are investing in capabilities to enhance advisor productivity, enabling advisors to capitalize on market upswings and effectively navigate the challenges posed by downturns. We see three initiatives that wealth managers can take to unlock net new money and drive profitable growth.

1. Win key client segments with integrated wealth management and corporate and investment banking coverage

Wealth managers possessing a premium brand and access to robust corporate and investment banking (CIB) capabilities have substantial opportunities within the high-net-worth (HNW) and ultra-high-net worth (UHNW) client segments.

Among these segments, family offices (FO) and entrepreneurs and executives (E&Es) have historically presented great growth potential. However, these client segments have complex needs that span beyond wealth management (WM) to include corporate and investment banking (CIB) services. Family offices serve complex investment needs and require customized investment solutions, as well as access to exclusive investment opportunities. Entrepreneurs and business owners present a sizable client segment and make up half of high-net-worth individuals (HNWIs) globally. This client segment is highly diverse and has unique needs, where personal and business financial needs are often interlinked. For instance, entrepreneurs of hypergrowth companies in the tech or healthcare space have a higher demand for corporate finance services, as well as financing solutions for themselves and their companies to fuel continued growth.

The intersection of wealth management and corporate and investment banking presents a range of revenue synergies and opportunities. Our analysis shows that wealth managers that can comprehensively serve these clients can unlock net new money of more than $200 billion across traditional wealth management and sophisticated wealth management and corporate and investment banking solutions.

To enable coverage of these client segments, a product range that combines best-in-class corporate banking and investment products is crucial. Additionally, the provision of linkages/relationships to potential investors, such as financial sponsors, is important.

Over time, collaboration approaches have evolved. Leading firms have found that joint capability and coverage teams that holistically address client needs are the most effective approach. By bringing together experts from both wealth management and corporate and investment banking, joint capability and coverage teams are able to provide a more comprehensive and tailored approach to serving the needs of family office and entrepreneur and executive segments. Some leaders are rolling out the next frontier, consisting of leveraging and monetizing CIB technology and capabilities with wealth management clients as the natural evolution to address more sophisticated lending, reporting, and risk management client needs.

2. Elevate employee workplace wealth capabilities to capture profitable growth

Estimated at $35–$50 trillion in assets, the modern workplace presents a significant opportunity for wealth managers to gain “early access” to a gold mine of retail clients. Once the workplace relationship is established, wealth managers can aim at the whole client relationship through its retail wealth management arm. Advising on defined contribution (DC) assets represents a revenue opportunity of $70–$100 billion on $16 trillion assets, and also the opportunity to advise on $15–$25 trillion assets held away by participants. Stock recordkeeping can be a different avenue to the same destiny: by recordkeeping part of the $6–$8 trillion vested and unvested assets worldwide, wealth managers can also aim to advise the $15–$25 trillion assets held away of the workplace. While in its early stages, providing liquidity to private stockholders accounted for $60 billion in transaction volume in the last four years, and can be differentiating for wealth managers with investment banking capabilities targeting private firms.

3. "Moneyball" for advisor growth

Wealth managers can gain a competitive advantage and tap into a $600 billion AUM opportunity by adopting a strategic, data-driven approach to enhance their advisor recruitment efforts, which we've termed "moneyball" for advisor growth.

In the US alone, advisors switching employers represent $2–$3 trillion in assets each year. With the potential of bringing $120 billion in new assets every year, wealth managers adopting a data-driven approach to enhance their advisor recruitment efforts can build a significant edge. By focusing on three areas: 1. establishing the right ambition; 2. prioritizing the right advisor cohorts; and 3. focusing on the right markets — wealth managers can improve the effectiveness of their recruiting efforts.

The Gen AI revolution and what it means for asset and wealth managers

Gen AI will fundamentally transform how we live and work. It is certainly the case for asset and wealth management, where leading firms have already invested heavily and started deploying Gen AI applications to drive tangible benefits in their businesses. Our report (pages 37-52) discusses the unique capabilities of the technology and specific use cases across the asset and wealth management activity chain where Gen AI is most suitable and can drive meaningful ROI. We also discuss the risks and the limitations of AI technology, and enumerate seven key success factors that organizations will need to adopt if they are to harness the full value of the technology.

The gen AI tipping point

Gen AI has rapidly transitioned from the realm of academic tinkering to practical testing and deployment in a broad array of industries, including asset and wealth management.

We believe we are now at a “tipping point” in terms of its ability to be deployed on a widespread basis across asset and wealth managers. The "tipping point” is driven by three key developments: 1. higher degree of accuracy (than previous generations of natural language processing (NLP), 2. broader range of Gen AI applications spanning across industries, business functions, and capabilities, and 3. better accessibility and user-friendly interfaces, with no technical background required to productively use the tools.

Leaders are already deploying and extracting tangible benefits for Gen AI

Firms that have already successfully implemented Gen AI solutions have focused on areas where it has the greatest “fit” potential, namely where there is abundant information to interpret and synthesize, a need to generate moderately customized or creative content, and where the activities involve routine tasks. When properly deployed, Gen AI can lead to significant productivity gains across the value chain. While it is still quite early in the adoption of this technology, our estimates of potential productivity gains reflect views of industry executives on the expected benefits of fully ramped-up AI tools over time. We expect these initial estimates to evolve as more asset and wealth managers adopt AI at scale and the range of the benefits become clearer. Our current views suggest the following:

- In sales and client service, Gen AI can enhance sales or advisors’ ability to engage existing clients and enable better identification and conversion of prospective clients. By freeing up time spent on administrative tasks, helping prepare more customized insights about clients and tailored answers to inquiries, we estimate that Gen AI can lead to potential productivity gains of 30–40% for advisors.

- In product development, Gen AI can accelerate routine tasks, such as report drafting and market research, potentially enhancing productivity for asset managers by 25–35% and allowing for faster time to market with products better tailored to market demand.

- In investment and research, Gen AI can empower portfolio managers in investment research and risk analysis by replacing information collection, summary, and data cleaning tasks with higher-value validation and idea generation activities, resulting in up to 30% productivity gains.

- For middle and back-office functions, Gen AI can improve efficiency for legal, compliance, and operational tasks, and democratize ability to code, saving 25–50% of employee time.

The initial focus for Gen AI is overwhelmingly focused on driving efficiency gains versus directly expanding new revenue streams or driving alpha. It is important to note, however, that efficiency gains free up time and resources that can be reallocated to higher-value activities to support revenue-generating activities, enable better investment decisions, improve client engagement and experience. It also helps form a virtuous cycle or “fly wheel,” whereby the efficiency enhancements from successful deployment of Gen AI frees up incremental budget and resources for funding yet more productivity-enhancing AI investments. As part of generating these efficiency gains, firms have not (yet) been utilizing Gen AI to replace resources. Rather, the technology has been used as more of a co-pilot, or a tool that enhances human capabilities, often by shifting the balance of activities away from creating and synthesizing to reviewing, validating, and further customizing outputs.

Using generative AI as a co-pilot can free up time and resources for higher-value activities. The technology can support revenue-generating activities, enable better investment decisions, and improve client engagement and customer experience in your business.

Deep dive on Gen AI capabilities for asset managers

Below, we share four generative AI applications across the value chain and a more detailed view of use cases can be viewed in the link.

Drafting of customized insights about clients and talking points for sales

1. Automatically draft talking points before or even during client conversations

2. Provide sentiment alerts based on records of prior interactions or live conversations

3. Allows advisors to prioritize client outreach

Impact potential: More than 20% upsell hit ratio for institutional clients targeted with tailored conversations; Up to +30% net new money (NNM) in wholesale based on successfully placed products on distributors’ fund buy list; -20% AUM attrition through proactive engagements.

Core capabilities and application areas:

Summary and comparison of market intelligence, including trends, competitor offerings

1. Scraping and summarizing market reports, competitor product prospectus and filing, news and social media posts, competitor offerings and pricing.

2. Helping product specialists identify gaps in the market and inform design of new products that meet market demand.

Impact potential: 60% of new product approval documentation automatically generated; Faster time-to-market for new product launches.

Core capabilities and application areas:

Synthesis of research and extraction of data from multiple sources, including data rooms to secure and share documents

1. Automatically synthesizing insights about a security from many digital transcripts, documents and data sources within a short timeframe.

2. Allowing Research Analysts to review and enhance the insights instead of spending time on gathering and cleaning information.

Impact potential: Productivity gain and discovery of niche insights in bigger volume that were not possible through human research before; Up to 30% productivity gains across research and analyst roles.

Core capabilities and application areas:

Code generation and debugging

1. Automatic writing and debugging of code as defined by human prompts.

2. Enable non-technical employees to automate workflows efficiently, saving developer resources for high-value tasks.

Impact potential: Up to 50-80% time saved

Core capabilities and application areas:

Learn more on generative AI use cases for asset managers

Deep dive on Gen AI capabilities for wealth managers

Below, we share generative AI applications across the value chain and a more detailed view of use cases can be viewed in the link.

1. Drafting of customized porfolio review based on client requests and past conversations

Core capabilities and application areas:

2. Interpretation of inquiries, matching with similar questions from knowledge base, and responding in customized way

Core capabilities and application areas:

Proposing next-best investment ideas from a defined universe based on chief investment officer (CIO) guidelines and client goals

Core capabilities and application areas:

Searching and summary of legal and compliance documents

Core capabilities and application areas:

Learn more on generative AI use cases for wealth managers

Gen AI risks and mitigation

As the deployment of Gen AI becomes increasingly prevalent, organizations must carefully assess and mitigate the unique technological and usage risks and limitations inherent in the technology. Responsible deployment of Gen AI tools requires that all stakeholders understand that Gen AI is a capability in need of significant oversight. Asset and wealth managers must establish robust controls to ensure that Gen AI applications adhere to the specific regulatory requirements of each jurisdiction in which they operate, safeguarding investor interests and complying with local laws. Meanwhile, fundamental principles around “fit for purpose” and marketing suitability of financial products and services remain paramount, requiring significant human oversight in the decision-making processes that involve Gen AI.

Key success factors for deploying Gen AI

From our project work and conversations across the industry, firms are at very different points in terms of how well they are satisfying these success imperatives (Lagging, Following, and Leading players). Below we share seven imperatives for managers to effectively harness generative AI's potential (click through). We believe the first three will be potential sources of competitive differentiation for firms that can successfully execute on them. The next four we see as “table stakes” — any firm that wants to effectively deploy Gen AI across their business will need to adopt these actions.

Firms that are in different stages of implementing generative AI:

Lagging: Working on establishing foundational data infrastructure and data management practices

Following: Revisiting data management practices; in-flight initiatives to use proprietary data to finetune Gen AI models

Leading players: Coherent, robust data environment and management; proprietary data integrated within Gen AI models

Firms that are in different stages of implementing generative AI:

Lagging: Limited consideration of gen AI-enabled solutions

Following: Initial proof of concepts (POC) developed in silos by various functions

Leading: Harmonization of digital and AI initiatives across the organization to achieve synergy in benefits and effort

Firms that are in different stages of implementing generative AI:

Lagging: No change to business-as-usual (BAU)

Following: Existing workflows augmented with gen AI to achieve more efficiency

Leading players: Proactively exploring new workflows to exploit possibilities of AI

Firms that are in different stages of implementing generative AI:

Lagging: Trying to adopt off-the-shelf gen AI solutions on business problems faced with no prioritization or consideration of “fit”

Following: Some identification and prioritization of gen AI use cases with early proof of concepts (POC) being tested; but feasibility/ validation study is in progress

Leading: Carefully considered where gen AI is most suitable and feasible in the business and prioritized use cases; test and learn, and “tuning” ongoing

Firms that are in different stages of implementing generative AI:

Lagging: No talent model evolution plan or training offered

Following: Basic trainings offered on how to use gen AI tools properly

Leading players: Having strategic view on talent model evolution in the long run; starting to train of initial cohorts of key functions

Firms that are in different stages of implementing generative AI:

Lagging: Made internal communications that gen AI is on leaderships’ radar

Following: Published initial guidelines and FAQs around usage of AI tools within the organization

Leading players: AI and model governance framework established; “Human-in-the-loop” approach

Firms that are in different stages of implementing generative AI:

Lagging: Limited in-house data and model teams, and having preliminary discussions with external tech vendors

Following: Relying on limited in-house team and exploring collaboration with tech vendors on initial proof of concepts (POC) and use cases

Leading players: Active engagement between in-house teams and external tech vendors in co-creation of AI-enabled solutions, but driven by in-house expertise

Firms are at very different points in terms of how well they are satisfying these success imperatives, but everyone is trying to move as fast as possible given the range of constraints the asset and wealth management industries face. The bar to even compete – much less win – is being raised every day. Figuring out how to best deploy these capabilities will be a crucial determinant of an organization’s long-term success.

Unlock the power of Gen AI

At Oliver Wyman, we help our clients think critically about generative AI opportunities across the value chain, pilot and scale use cases, and set up programs and portfolios to deliver immediate and long-term impact. This includes value proposition development; solution design; bespoke application development; licensing and hosting;, operating model (re)design; talent and workforce training; and setting up and adopting best practice risk management and governance practices.