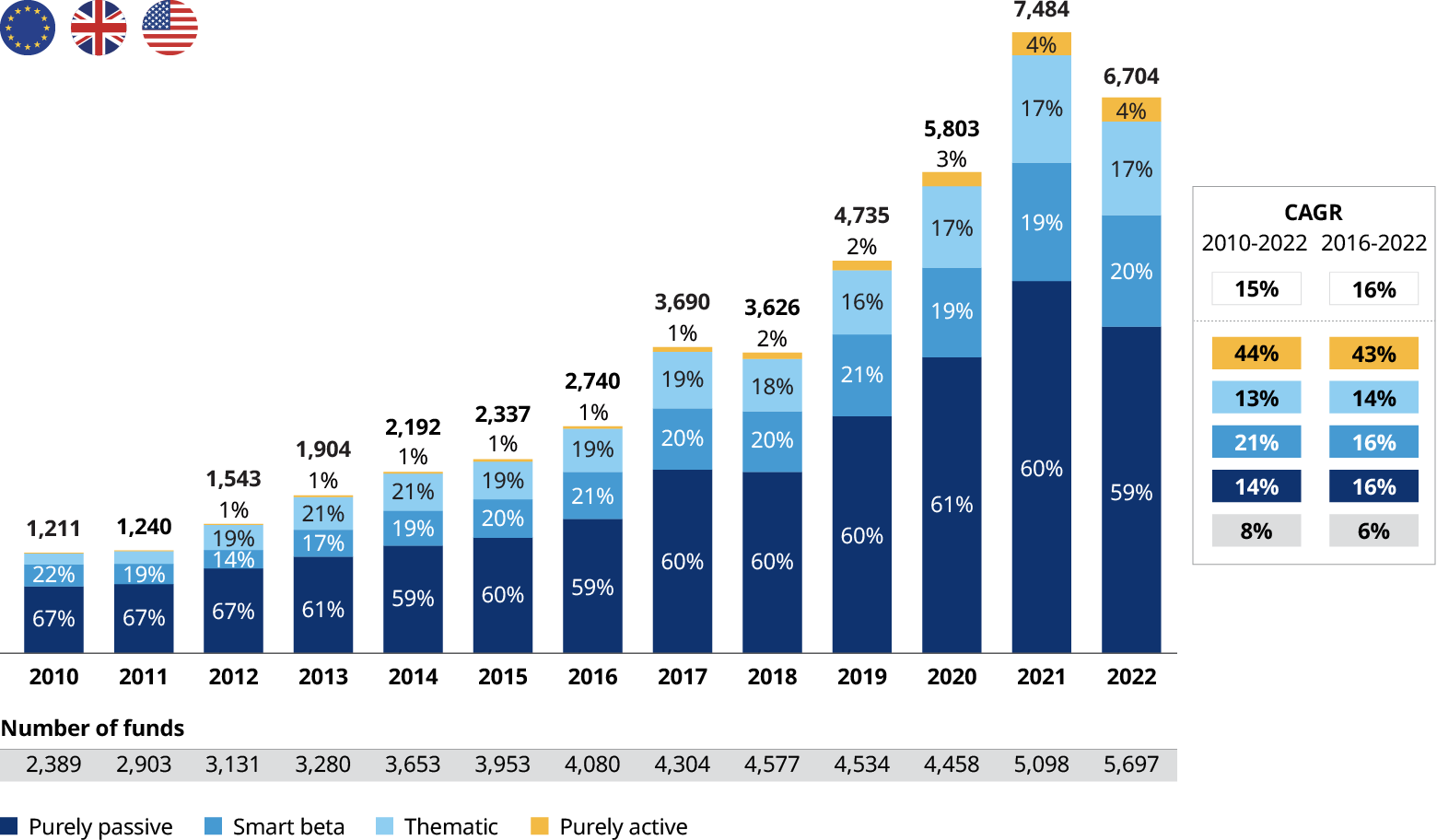

The growth in exchange-traded funds (ETFs) has been the single most disruptive trend within the asset management industry over the last 20 years. As of the end of December 2022, total ETF assets under management (AUM) have reached $6.7 trillion across the US and Europe, growing at approximately 15% compound annual growth rate (CAGR) since 2010. This is almost three times faster than traditional mutual funds. Historically, ETFs have been predominantly associated with passive investments — most often replicating performance of broad equity indices. We believe the ETF landscape is just embarking into a next stage of growth — this time fueled by the rise active ETFs.

We expect a significant part of this growth to come from active ETFs, creating a revenue opportunity for the industry that asset managers cannot ignore — irrespective if they are active in the ETF space today or not. Those who are big enough and believe in this strategic opportunity will bear the investment and build an active ETF franchise on their own, while others will rely on support from white-label platforms which provide a cost-efficient infrastructure for fund initiators to launch their ETFs.

The exchange-traded funds landscape is just embarking into a next stage of growth — this time fueled by the rise active ETFs. By 2027, ETFs will account for 24% of total fund assets, up from 17% today

The exchange-traded funds landscape is just embarking into a next stage of growth — this time fueled by the rise active ETFs. By 2027, ETFs will account for 24% of total fund assets, up from 17% today

How should asset managers navigate transformation in both the ETF market and greater asset management industry? In our report, The Renaissance of ETFs, we share our research, analysis and perspectives on how to capitalize on the ETF opportunity, including an evaluation of two primary routes to market — launching in-house active and thematic ETF products vs. leveraging white-label service providers. We discuss the increasing importance of ETFs, market size and the rise of active ETFs, as well as market trends and the growth outlook. Below is an excerpt of our report, for the full version, please click the PDF below.

The ETF opportunity

1. The increasing importance of exchange-traded funds

ETFs are increasingly gaining share of all funds volume across the US and Europe, with growth at 16% per annum (p.a.) over the period 2016-2022. This growth far exceeds that of mutual funds, which have been growing at 5% p.a. over the same period.

Growth in the ETF market has been particularly strong in the US, where adoption has been driven by local tax advantages. Recently, European investors have been following US investors’ footsteps — as increased visibility and accessibility of ETFs are driving adoption in Europe.

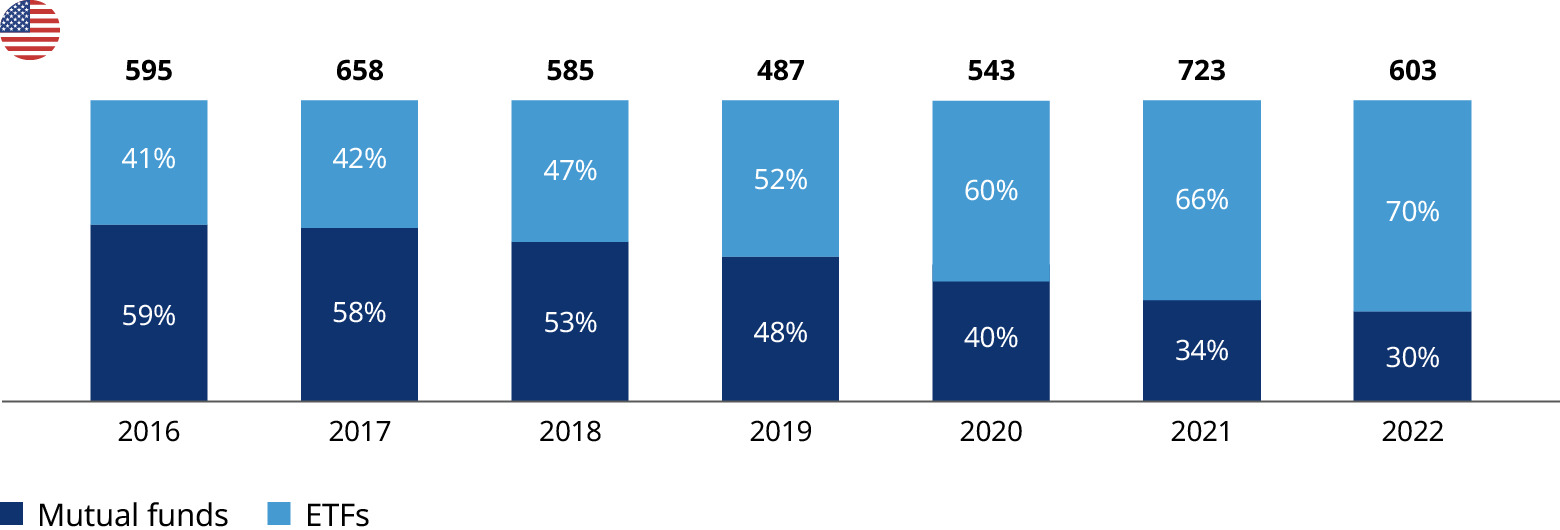

The advent of ETFs is further evidenced by the distribution of new fund launches, visualized in the exhibit below. The US has experienced a particularly high penetration of ETFs in the total number of new fund launches. In 2022, an estimated 70% of new fund launches were ETFs. The regulatory environment in the US facilitates tax advantages for ETFs compared to mutual funds; ETFs are less exposed to capital gains tax.

2. Market size and the rise of active exchange-traded funds

Active ETFs are on the rise. While ETFs are generally known in the market as a passive investment vehicle, active ETFs are on the rise and increasingly gaining traction amongst investors. Not only are investors looking for differentiated strategies to beat the market, but they are also increasingly looking for products that meet their needs for environmental and socially responsible investing, as well as allow them to connect with contemporary themes. This is driving significant growth in a theme-based and innovation-focused part of the ETF market. Smaller fund providers that dominate this part of the market are outgrowing the large, traditional fund providers, which historically were able to leverage their scale to dominate a market that was driven by passive, low cost, plain vanilla investing products.

Although European regulations do not offer the same tax advantages for ETFs, the rising visibility and accessibility from widespread US investor adoption is driving growth in European markets. In 2022, 23% of all fund launches occurred in ETFs, up from only 5% in 2016.

Investors are looking for differentiated strategies to beat the market and for products that meet their needs for environmental and socially responsible investing

Investors are looking for differentiated strategies to beat the market and for products that meet their needs for environmental and socially responsible investing

3. Market trends and growth outlook

The total size of the US and Europe ETF market is estimated at approximately $6.7 trillion AUM in 2022, and can be differentiated by four main strategies: (1) purely passive, (2) smart beta, (3) thematic, and (4) purely active.

As shown below, there has been a massive rise in active ETFs. From 2016 to 2022, the number of purely active ETF launches increased by 30% p.a. in the US and by 92% p.a. in Europe. European fund providers are following in the US’s footsteps. In the US, the SEC’s ETF rule allows for non-transparent and semi-transparent structures in which ETF managers can shield their holdings to large extent.

Purely passive ETFs, which mirror designated index holdings, have historically dominated the ETF market. Actively managed ETFs deviate from their benchmark index with a manager or team changing the portfolio allocation and selecting individual stocks. Smart beta and thematic ETFs are a hybrid between purely passive and actively managed ETFs, anchored respectively by rules-based systems and particular themes.

We observed a range of trends powering the ETF market, outlined in the table below. These trends are disproportionately triggering growth in innovative, active ETFs, which are characteristic with smaller market segments. Tier 3 providers (with $10-$50 billion AUM) and Tier 4 providers (with <$10 billion AUM) are expected to outgrow their larger, more traditional counterparts. We forecast the ETF market to grow at 13 to 18% p.a. from 2022 to 2027, which is a slight acceleration from the period 2017 to 2022.

A driving force behind forecasted market growth is cost; ETFs on average tend to be cheaper than mutual funds. Looking at average management fees across strategies, the largest difference is observed in purely active funds, with ETFs having nearly 50% lower fees than mutual funds. It is important to note that the sample size of active ETFs remains significantly lower (approximately 500 ETFs) as compared to mutual funds (>14,000). A like-for-like comparison of active mutual funds and their corresponding ETF replications show that the price difference is far smaller, typically in single basis points, reflecting the difference in the fund infrastructure between the two investment vehicle types.

How asset managers can capitalize on the ETF opportunity

As active ETFs gain traction amongst investors, asset managers are launching new, innovative, ETF products. However, those who want to launch an ETF face several challenges, including the high cost of setting up an ETF infrastructure, the high risk of failure, and difficulty in finding the right people with expertise in ETFs. An effective marketing and distribution strategy and speed-to-market are critical to market success, both of which are particularly challenging for smaller funds.

These challenges have given rise to a new trend in the ETF market — the emergence of white-label ETF service providers. This relatively new business model allows fund providers to quickly bring their strategies to market. White-label ETF providers offer their investment trust, custody, fund administration, portfolio management, and marketing and distribution services, thereby creating economies of scale and reducing the financial risk and operational challenges for small fund providers in launching an ETF. Our report offers perspectives on the advantages, challenges, and financial and non-financial considerations on two main routes to market:

- Develop an in-house ETF franchise: This route requires setting up the ETF creation, launch, and management capabilities in-house or acquiring an existing ETF provider. This route is particularly suitable for fund providers who want to launch a wider range of funds and already have some pre-existing capabilities in-house, as well as the required financial power and brand.

- Leverage support from white-label service providers: This route requires engaging with a white-label ETF provider that facilitates the creation, launch, and ongoing management of the ETF while the fund provider merely has to generate the idea and investment strategy. This route is particularly suitable for fund providers who want to launch a select number of ETFs and do not want to commit to the costs of creating capabilities in-house.

Get started

Particularly in the last 5 years, more innovative ETF products have been launched to meet the environmental and socially responsible mindset of the current investor — and allow investors to connect with contemporary themes.With the ETF market becoming less about scale and more about the idea or strategy, white-label ETF service providers are becoming increasingly relevant. White-label services offer market issuers (especially those that are new to the ETF market) a cost-effective solution for launching ETFs. White-label advantages include minimizing risk and optimizing speed-to-market.

At Oliver Wyman, we are collaborating with asset managers and ETF providers to take advantage of unprecedented ETF market growth. We can help your firm determine the most effective route to market.

Going forward, we expect a continued pivoting of the ETF market, particularly in the innovation-focused segments of active and thematic ETFs. This will result in and increasing share gain of white-label ETF providers to serve this segment

Going forward, we expect a continued pivoting of the ETF market, particularly in the innovation-focused segments of active and thematic ETFs. This will result in and increasing share gain of white-label ETF providers to serve this segment

Endnotes and sources: 1. ©2023 Morningstar. All Rights Reserved. The information contained herein is proprietary to Morningstar and/or its content providers. See report PDF for full disclosure. 2. Broadridge Global Marketing Intelligence 3. Oliver Wyman research and analysis. Please note this report was independently authored by Oliver Wyman and commissioned by Waystone, a leading provider of institutional governance, risk and compliance services to the asset management industry.