The bankruptcy of the major Californian utility PG&E, dubbed “the first climate-change bankruptcy” by The Wall Street Journal, is the most recent example. Banks cannot afford to ignore this global issue.

With the growing recognition of the financial stakes, rising external pressures, and upcoming regulations, how should banks and specifically their risk management teams manage climate risks?

Our paper, Climate Change: Managing a New Financial Risk, provides industry perspectives from a climate risk awareness survey we conducted in partnership with the International Association of Credit Portfolio Managers (IACPM), across 45 global financial institutions. We present how institutions can integrate climate considerations and opportunities into their financial risk management frameworks and provide guidance on implementing the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

KEY TAKEAWAY 1: Banks should treat climate risk as a financial risk, not just as a reputational one

The impact of climate change will prompt substantial structural adjustments to the global economy. Such fundamental changes will inevitably impact the balance sheet and the operations of banks, leading to both risks and opportunities. While mortgage portfolios in coastal areas may be exposed to the physical impact of climate change through rising sea levels and flooding, massive amounts of capital and new financial products will be required to fund the transition and finance climate resilience, creating demand for bank services. Meanwhile, regulators are beginning to act, and investors, clients, and civil society are looking for actions, mitigation, adaptation, and transparency on the issue.

Historically, banks have approached climate change through the lens of Corporate Social Responsibility (CSR). With increasingly high financial stakes, growing external pressures, and new regulations, the pure CSR approach is no longer sufficient. Climate change has become a financial risk for banks and must be treated as such.

KEY TAKEAWAY 2: Banks should integrate climate considerations into financial risk management

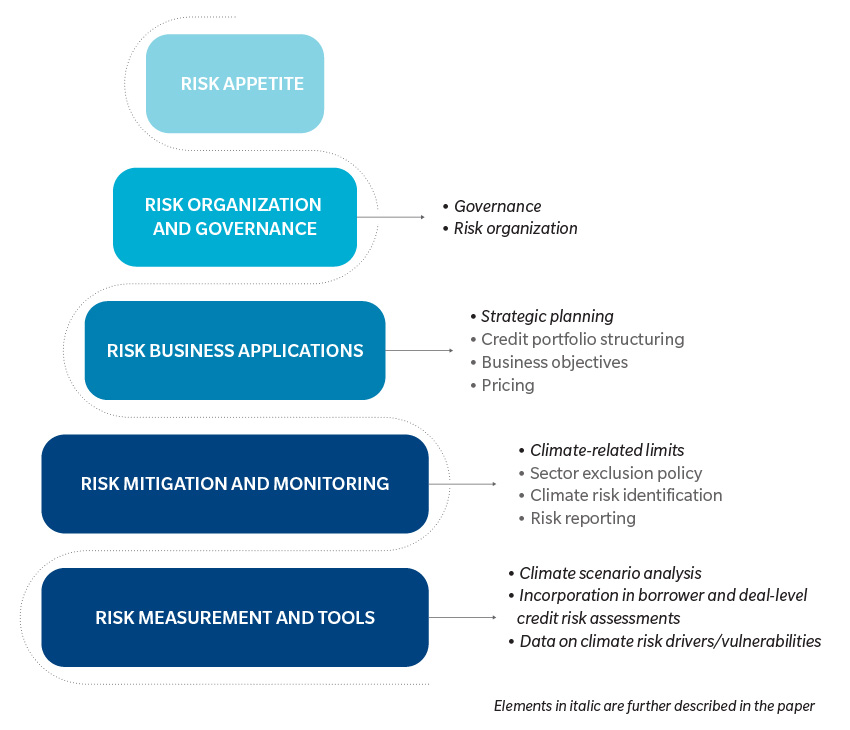

To effectively manage climate risks and protect banks from its potential impact, institutions need to integrate climate risk into their financial risk management frameworks, as described in the exhibit below.

RISK MANAGEMENT FRAMEWORK AND INTEGRATION CONSIDERATIONS

CLIMATE RISK AWARENESS SURVEY

Below are select highlights from our survey in partnership with the IACPM, across 45 global financial institutions. The full results can be found in our paper, Climate Change: Managing a New Financial Risk.

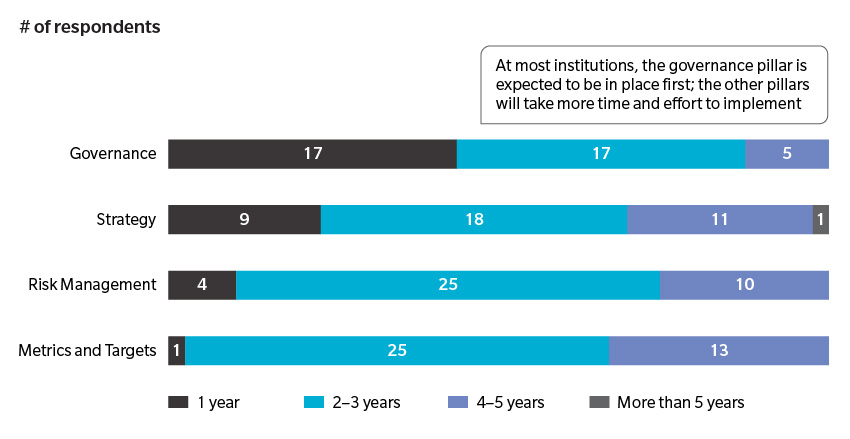

Implementing the TCFD recommendations is a multi-year journey.

HOW LONG DO YOU EXPECT IT WILL TAKE FOR YOUR COMPANY TO IMPLEMENT

THE

TCFD RECOMMENDATIONS (EXCLUDING ONGOING ACTIVITIES)?

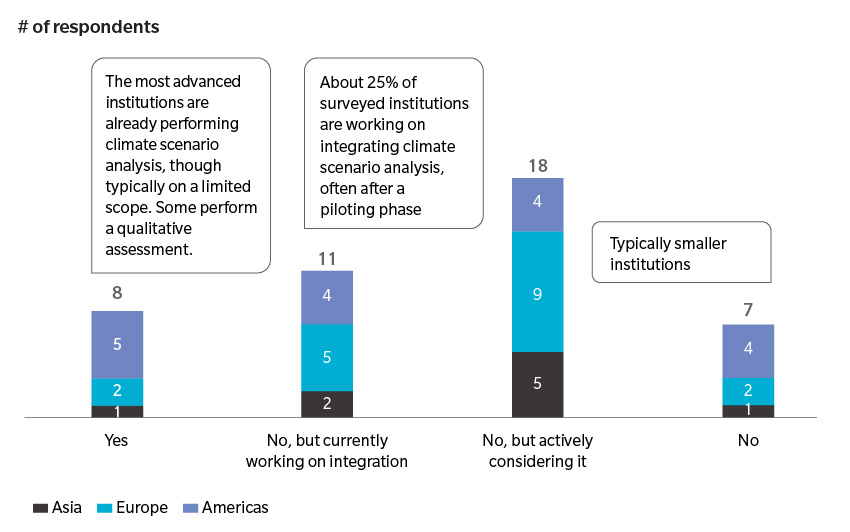

Many institutions are developing climate scenario analysis capabilities or plan to do so.

DOES YOUR INSTITUTION PERFORM CLIMATE SCENARIO ANALYSIS AND/OR CLIMATE STRESS TESTING?

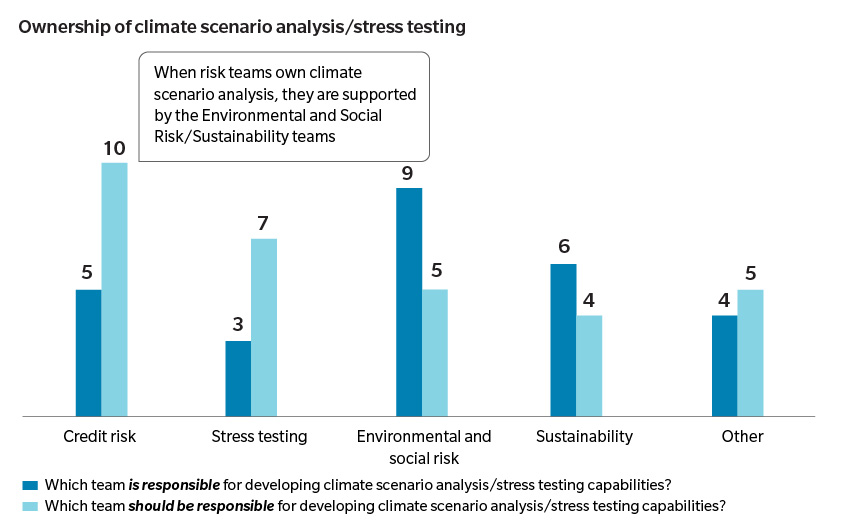

As climate is recognized as a financial risk, the responsibility for managing that risk should shift to financial risk management teams.

READ OUR REPORT

RELATED INSIGHTS