Angelo Rosiello and Luca Giavazzi

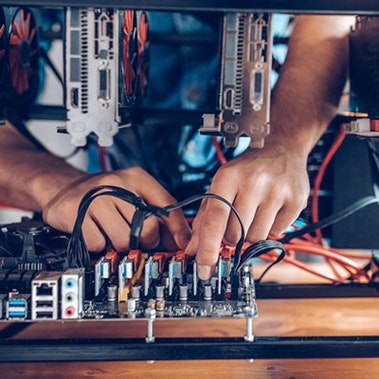

The issues related to cryptocurrencies’ security, sustainability, and scalability (as described in Cryptocurrency Unmasked Parts 1, 2, and 3) are structurally linked to the distributed, “trustless,” architecture of blockchain technology. In this scheme, the verification and validation mechanism is based on the rule that “everyone knows everything, in every moment.” This rule implies the absence of any hierarchical principle in the structure of the network—nodes are flat and with the same authority level. Thus, the validation cannot derive from a single trusted authority, but must be the result of a cryptographic riddle (“proof of work”) that puts many miners in competition, and which is finally validated by the node’s whole network.

It’s clear that the open, technocratic, secure validation of information afforded by blockchain technology could bear immense value beyond cryptocurrencies, securing supply-chain and other data that has multiple touchpoints. Regarding cryptocurrencies, however, the system may, in fact, be more efficient as a trust-based system. Today, many resources are competing to solve the same problem, and most of them are going to lose the game and accrue a loss. At the end of the day, the technocratic concept is actually not that open and equal. In fact, the miners’ dynamic doesn’t reflect a perfect market; without authoritative regulation, mining tends to become more and more concentrated in the hands of larger players.

Looking forward, we believe that the pure open, distributed, and flat architectural (somewhat utopian) application of cryptocurrency will hardly be competitive against other digital-payment solutions, given the current spectrum of choices. Even in the current scenario, it is very important to find clear and shared governance mechanisms to ensure that issues of “market-power abuse” will not undermine the system.

The real promise is as a unified unit of storage by large players under a trusted authority

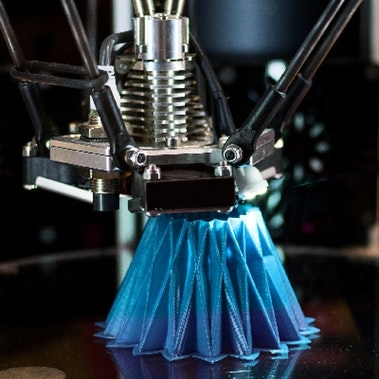

A future scenario under consideration is the use of crypto assets as a potential means for storing and transmitting value along the backbone of today’s financial exchanges. Consider it this way: In the past, we had phone lines, radio waves, and cable TV signals; today, everything is transmitted through the internet infrastructure. Similarly, all today’s complex and fragmented value exchanges between banks, securities depositaries, commodity markets, and other financial intermediaries could potentially be unified through a single unit of universally recognized value that can be transferred instantly. Given their intrinsic characteristics, crypto assets have this potential.

Indeed, we believe finding the right trade-off between distributed (decentralized) and concentrated (centralized) principles in blockchain technology will allow the development of sustainable solutions. In fact, experiments are in progress in the form of consortia among private banks, applying the logic of distributed-ledger consensus to today’s fragmented financial exchanges. Such architecture, at a larger scale, could involve central banks as super authorities delegating private banks or consortia to verify blocks of transactions and store the ledgers—but without requiring a brute-force algorithm, as central banks are trusted authorities. Indeed, central banks could play the role of orchestrators of the workloads (blocks to be processed) to be distributed in the network in an efficient and reliable way.

We definitely expect much more evolution in the application of blockchain technology to payments, but the real promise is as a unified unit of storage by large players under a trusted authority. Compromises (between distributed and concentrated principles) will need to be reached, to ensure the security, sustainability, and scalability of the system. Once people move away from the utopian notion of a non-hierarchical but inefficient system, and focus on making a valid business case for cryptocurrencies, many of the sustainability and scalability issues (such as making block sizes larger) evaporate. In the end, the trust-based, efficiency argument is likely to win out.