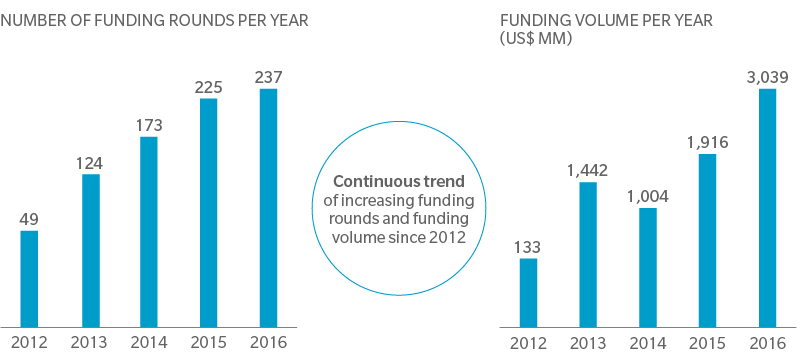

In 2016, 237 funding rounds were carried out, according to Oliver Wyman research – five times as many as in 2012 – in technology clusters ranging from cybersecurity to cloud computing. Their funding volume for the year was more than 20 times as high, and the total investment over the five-year period was US$7.5 billion. (See The Exhibit.)

Funding flows into startups

Source: Crunchbase, Oliver Wyman analysis. Considering startups that were founded in 2012 or later, which received funding >US$ 1 million

Startups as enablers and partners

Many of the new enterprises could be enablers and partners for plant-engineering incumbents, making them potential investment targets. Partnering with and funding the right startups early on will lead to competitive advantages in the short-to-medium term. On the other hand, the new platforms could enable competitors to sharply increase their levels of technology and innovation, presenting a threat to established companies. To understand the disruptive potential of startups, take a look at the plant-engineering value chain and the impact digital startups can have at each stage.

In business development and sales, firms that can anticipate customers’ needs before they are even aware of them, can then approach those customers proactively with tailored proposals. Tools such as 6sense’s Buyer Intent Network capture data from search engines, trade publications, blogs, and other sources, and use advanced analytics to establish buyer intent and find new potential orders. Platforms like this also help understand customers’ businesses better, improving cooperation. Consequently, plant engineers can increase their hit rate with customers, boosting revenues and reducing the cost of business development and sales.

Better Collaboration Through Technology

Technology and engineering processes, the largest source of value creation in plant engineering, will benefit from new kinds of cloud-based collaboration. Open platforms will transform the way engineers – including suppliers and freelancers – work together. They will allow fresh eyes to develop and exchange ideas openly in agile, cross-functional teams that share big-data analyses to spark innovation. Such platforms will help augment the value of plant-engineering firms’ products and also reduce costs – for example, by integrating with low-cost engineering centers.

One startup, Pivotal, has raised US$1.7 billion from investors including General Electric, Ford, and Microsoft. It offers a platform-as-a-service that enables teams to update and scale applications in the cloud. Another, Onshape, has developed a 3D computer-aided design system in the cloud. That means design teams can work more flexibly and in remote locations, expanding their horizons for collaboration. Already Scotrenewables Tidal Power, the world leader in floating turbines, is planning to move its next-generation design process online using Onshape’s system.

Procurement and supply-chain management will be influenced by new technologies that help stronger integration with suppliers. Today, manual processes in purchasing, logistics, and expediting still require large numbers of employees, who add limited value. Many processes will be automated in the near future, allowing better integration with suppliers. Smart glasses, for example, let a remote expert look at goods to be expedited through the eyes of the supplier or local representative. The expert can thus handle multiple cases in parallel. Atheer, another digital startup, provides a virtual-reality platform for smart glasses so that remote experts can inspect supplies and send precise visual instructions based on real-time augmented reality, live video, and other inputs.

As a result, plant-engineering companies could have a more strategic and collaborative relationship with their suppliers, enabling them to shift their attention to purchasing and negotiation.

Every fifth day a digital startup relevant to plant engineering is founded.

The Many Uses of Drones

Construction will be affected by the more-physical digital developments, such as drones, which can be used to surveil sites. They can perform pre-feasibility studies to provide georeferenced and orthorectified maps, as well as 3D models that incorporate geological characteristics. Drones can also track work on-site, providing input for progress curves and deviation analyses, which will make construction more efficient. In addition, they will contribute to health and safety compliance. One startup in this field is DroneDeploy, a provider of cloud-control software for drones, which carries out automated flight-safety checks, workflows, and real-time mapping and data processing.

However, the overall digitization of construction work – through building information modeling (BIM) and eventually robots that perform physical construction work – will strengthen the position of construction companies. So, while drones will help plant-engineering firms increase efficiency on increasingly complex construction sites, they are also part of a trend that could jeopardize incumbents’ share of the value chain.

As investment in new plants declines, enhanced service represents an opportunity for plant engineering companies to generate new and profitable business. Digital technology can transform some aspects of service by overcoming the distance to remote locations. Israeli startup Fieldbit Hero has developed an interactive visual collaboration platform for field services that enables real-time augmented reality interactions between experts and field technicians. Remote experts can see a physical machine and then guide a local technician step-by-step through complex fixes. This increases remote resolutions and the first-time fix rate. It also reduces the need to train local technicians and improves the profitability of the overall service.

After-service, too, will be facilitated by drones that inspect remote assets. US startup SharperShape uses light detection and ranging – which measures distances using a laser pulse – to manage remote assets using drones, thus reducing the costs and risks of manual inspection. This technique is already used by electricity companies to inspect power lines. Drones also have the potential to inspect plants in industries such as oil and gas, wind power, and chemicals.

Time to Strategize

As well as partnering and acquisitions, established plant-engineering firms will have to improve their internal processes to prepare for the short-term future. That could mean increasing cross-functional collaboration, acquiring new competencies, and developing talent and workforce strategies to boost expertise in fields such as data analytics.

But digital startups will be an important part of the future. So far, most are concentrated in the United States, which accounts for 77 percent by number and 85 percent by funding volume. However, European startups such as Darktrace and Graphcore are also in operation after attracting significant funding. Plant engineering firms should keep a lookout as more sprout up.

About Authors

Wolfgang Weidner is a Munich-based partner in Oliver Wyman’s Automotive and Manufacturing Industries practice and focused on plant engineering organization and cost and efficiency optimization.