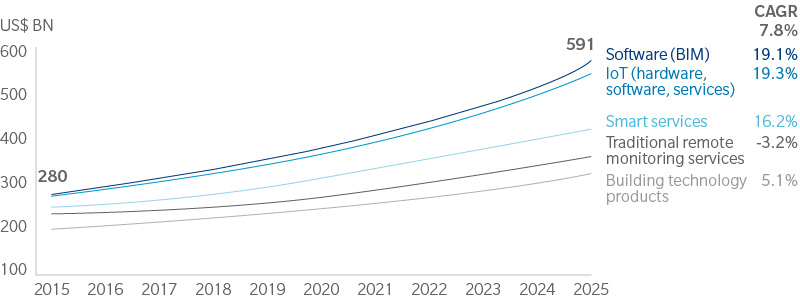

Building technology includes the automation systems, electrical distribution, HVAC (heating, venting, and air conditioning), lighting, and safety/security in buildings. The sector is now undergoing a fundamental transformation that will severely challenge traditional industry structures and businesses. “Enhanced building technology” is currently in an explosive growth mode, with the market projected to reach US$600 billion in 2025. By that year, we expect that nearly half of the industry’s market value will migrate to new emerging markets beyond products and hardware, including smart services, software, and the IoT.

Ten years from now, the building technology business will look completely different: Software and services will increase in relevance and in some cases replace hardware; products will in many instances become commoditized as increased functionality moves into the cloud; and traditional channel structures will break up.

As a result, from an incumbent’s perspective, the competitive landscape will become far more complex and dynamic. Incumbents will face off against novel business designs, including giant digital disruptors such as Google and Amazon, large-scale telcos and software companies, and smart-services startups. All will be competing for customer access, channel or strategic control, and new value spaces.

Not all incumbents are prepared to address these fundamental challenges and to drive their own destiny. But the rapid pace of development means that there will be no time to sit and ponder. Incumbents will need to master digital strategy and capabilities and enhance their commercial effectiveness, organizational flexibility, and operational excellence in short order.

$600 billion market size for enhanced building technology by 2025.

The Past Decade

The building technology sector has been fairly stable over a long period, with a well-established industry structure comprising product providers, service companies, and wholesalers. The sector rebounded from the financial crisis of the late-2000s and has grown moderately, driven primarily by the residential building construction segment. There have been substantial differences in regional growth rates, however, with virtually no growth in Europe, moderate growth in the Americas, and high growth in Asia. Historically, the global market has been relatively “protected” from external threats thanks to geographic technical norms that ensure good practices and safety, strong relationships between equipment manufacturers and specialized wholesalers, and prescription power for electricians.

Overall sector profitability is high, with profit margins averaging 11 percent over the past five years. However, there is a significant range in performance across companies, indicating differences in strategic position and levels of operational and commercial excellence. One key contributor to corporate growth has been high levels of mergers-and-acquisitions (M&A) activity, with the goals of sector consolidation through portfolio enhancement, regional expansion into new geographies, and moves toward emerging technologies.

Thus it appears that incumbents should be in a fairly good position to embrace new growth opportunities and continue improving operating performance and financial returns. The breakneck speed of emerging technology trends, however, will force incumbents to move much faster than they may desire; indeed, they will need to rethink everything if they are to play a significant role in the industry a decade from now.

New Customer and Technology Trends

Disruptive technologies and changing consumer expectations around connectivity, energy efficiency, and security are the drivers of the fundamental changes now occurring in the building technology sector. These drivers are leading to the creation of sizable new value spaces and strategic control points, and the emergence of new business designs. Within the next few years, many traditional rules of the business will no longer be valid.

We expect that the sector will grow tremendously through 2025, but the vast majority of growth will come from areas outside of traditional building technology products. In particular, IoT products and services, building information management (BIM) software, and smart services are poised for stellar growth. (See The Exhibit.)

Potential value migration in the enhanced building technologies market, 2015–2025

Source: Memoori, Freedonia, IHS, Navigant, Transparency Market Research, Oliver Wyman analysis

Enhanced building technology will attract new types of companies: Digital disruptors and software companies, telcos and utilities, and smart-services startups all have potential points of entry that will enable them to challenge traditional industry structures and established strategic control points. This new breed of competition poses a serious threat to incumbents. That more than half of the traditional building technology market will be in Asia adds to this challenge.

The Path for Incumbents

Thus the nature of the business will be radically different ten years from now. Software and smart services will gain significant share as they take over traditional hardware functionality and replace traditional on-site services. Increased cloud functionality will enable cheaper solutions and replace some traditional hardware and products.

Furthermore, the changing purchasing patterns of younger generations, combined with compelling offers from digital disruptors, will likely lead to the breakup of traditional channel structures. Online business will become the dominant channel both for B2C and B2B and will erode the traditional boundaries between the two universes.

What this means is that the business models that enabled building-technology incumbents to grow profitably in the past no longer guarantee future success. While some areas are better protected, we believe that traditional B2B equipment manufacturers, facility management, and wholesale channels will face significant pressure.

To fend off emerging competitors, incumbents will need to master four interlinked areas: digital business design, commercial effectiveness, organizational agility, and operational excellence:

Digital business design: Incumbents will need to tailor their business designs to capitalize on emerging trends, find new sources of profit, and maintain strategic control in the face of new competitive threats. New offers will need to be personalized to specific uses, such as less product push and more customer-centric focus on usage in the building. These proposed solutions will need to be increasingly sophisticated, and data management and cybersecurity will be increasingly important.

Commercial effectiveness: Incumbents will need to respond to the commercial models of digital distributors and multi-channel challengers. This could involve redesigning their pricing models and go-to-market systems. Creating and maintaining customer loyalty and managing the leading generation of user “communities” will become key goals.

Organizational agility: Incumbents will need to embed elements common to fast-moving organizations, as they will have to increase their speed and agility in areas such as customer-facing interaction and product development as well as product launches. Interdependence between actors on the value chain will rise in importance with the increased use of collaborative tools within and without the company (such as BIM) as well as strategic partnerships.

Operational excellence: In-house cultural change will be required to foster innovation, entrepreneurial spirit, engagement, and retention. Product commodification and the need to defend against lower-cost players will make flawless execution a priority as well as the competitiveness and differentiation of offers.

The building technology industry is still highly fragmented. Thus M&A and partnerships could be a way to build up both the scale and capabilities across these four areas quickly and meet the industry’s bold new future head on.

About Authors

Wolfgang Weger is a Munich-based partner in Oliver Wyman’s Automotive and Manufacturing Industries practice. He is an expert for growth strategies, commercial effectiveness, and pricing. Xavier Ruaux is a Paris-based partner in Oliver Wyman’s Automotive and Manufacturing Industries practice and focused on construction industry such as promotors, contractors, building materials and equipment manufacturers.