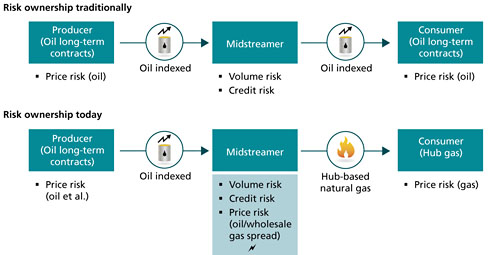

At present, many midstream players are being forced to bear risk capital requirements that will significantly exceed the size of their earnings, because the gap is widening between long-term gas contracts based on oil prices on the procurement side and wholesale gas market pricing on the sales side. All members of the gas value chain need to create a new paradigm—one that will redefine roles and interfaces to make the overall risk-return distribution more efficient and sustainable.

About Global Risk & Trading:

Oliver Wyman's Global Risk & Trading practice enables the world's top industrial corporations and commodity trading organizations to gain competitive advantages by assisting them with managing risk across their businesses more effectively. By working with global leaders in a broad range of industries, our practice has developed unique capabilities that help industrial corporations and commodity trading organizations create value and maximize their performance by making risk-adjusted strategy, investment and capital allocation decisions.

.pdf/_jcr_content/renditions/cq5dam.thumbnail.319.319.png)