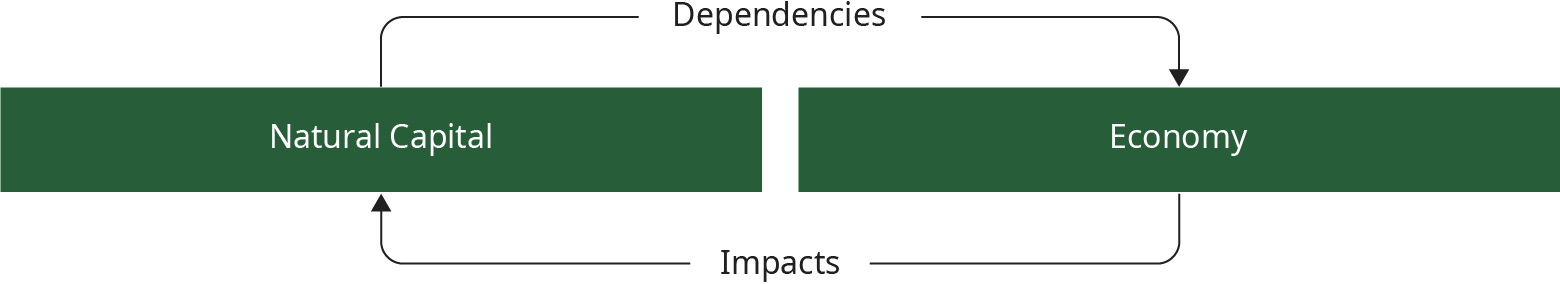

The degradation of our natural ecosystems poses a significant risk to our financial and economic stability. A significant portion of our global gross domestic product relies on nature and natural systems. According to the World Economic Forum, it is more than 50%, or the equivalent of $44 trillion of global economic value generation.

As human activity and climate change continue to deplete these systems, we need to create a regulatory agenda that better manages nature-related risks and the societal harms they can create. Our report The Emerging Regulatory Agenda: Improving transparency of nature-related risks in Africa offers up next steps, specifically in the context of Africa, illustrating why transparency should be an important component of any regulatory agenda and how African regulators can support stable nature-positive economies.

Meanwhile, regulators around the world are starting to establish financial initiatives to respond to nature-related risks. Our research has found that transparency was a cornerstone of ensuring strong risk management. Enhanced transparency of nature-related risks is fundamental to managing them effectively. Individual financial institutions need visibility of the nature-related risks in their lending, underwriting, and investment portfolios. Regulators could also benefit from identifying nature-related risk concentrations for regulated entities and assess whether they are being managed effectively.

African economies depend on nature

Africa is home to 65% of the world’s arable land, and 20% of the global tropical rainforest area. These natural endowments offer large natural-capital opportunities. African economies are highly exposed to nature-related risks because they are especially dependent on nature and quickly losing natural capital. These nature-related risks are defined either as "physical risks", "transition risks", or " systemic risk".

The dependence of Africa’s economy on natural capital exceeds the global average, with over 70% of people living in sub-Saharan Africa depending on forests and woodlands for their livelihoods, compared to about half of the worldʼs total GDP generated in industries that depend on nature. Africa’s loss of natural capital also exceeds the global average, having seen a decline in its Biodiversity Intactness Index (BII) score of 4.2% between 1970 and 2014, considerably higher than the global BII score decline of 2.7% over the same period.

An agenda for nature is evolving

Today, the newer Taskforce for Nature-Related Financial Disclosures (TNFD) is applying some of the same transparency principles to the preservation of nature and the reversal of nature loss. African regulators could benefit from engaging with this new nature agenda rather than risk losing some of the natural capital that underpins the region’s economy.

With the TNFD set to release v1.0 of its disclosure framework in September 2023, African regulators could either adapt or adopt the TNFD to promote transparency in the integration of nature risks. The learnings offered by the upcoming TNFD disclosure framework can be taken into consideration by African regulators in responding to the nature agenda through the integration of nature-risks into their financial systems. One of the first steps regulators should consider is the development of a roadmap for integrating nature-related disclosure. This entails consultation, voluntary disclosure, and mandatory disclosure.

The Role of Nature In Africa's Financial Future

Read the full report to learn more about the no-regret actions African regulators can take:

The report was commissioned by the African Natural Capital Alliance.