Editor's Note: This article was originally published in the Oliver Wyman Health Innovation Journal: Volume 3.

Healthcare transformation. It’s what so much energy and so many initiatives have focused on over the past decade in the US. Every sector has experimented with innovative models that promise an improved industry outlook: new value-based payment paradigms, new ways of engaging consumers, new access and care hubs, new digital and tailored therapies, and new ways of sharing information. The innovation economy has funded hundreds of businesses attempting to redefine healthcare’s status quo. And many incumbents have increasingly realized traditional business models are no longer compatible with demographic realities, consumer needs, and – if they were to hold up a mirror – their company’s mission. When we take a step back, we see a US healthcare industry saturated with breakthrough solutions – but have we really succeeded in moving the needle on impact?

HERE’S THE CATCH

Despite this wave and many individual success stories, these isolated transformations have had an almost unnoticeable effect on Institute for Healthcare Improvement (IHI) Triple Aim metrics of cost, outcomes, and experience. Impact for each of these micro innovations – new therapies, new knowledge, and new best practices – has been narrow. In fact, we continue to trend in a worrisome direction, with premiums nearly quadrupling for families over the past 20 years, deductibles growing eight times faster than wages in the past decade, declines in overall life expectancy in consecutive years (for the first time since 1963), and an industry that ranks below nearly every other in net sentiment. Somehow, collective impact is much less than the sum of our innovative parts.

Some say our hands are tied and that we have intractable issues because of US healthcare’s unique structural configuration: its largely not-for-profit supply, heavily fragmented distribution, highly variable state-based regulation, and limited price control or clarity. However, we can’t keep waiting for a systemic, silver bullet answer that remains perpetually on the horizon.

A YARDSTICK FOR IMPACT

The IHI Triple Aim has offered the industry a useful framework for defining what we’re trying to achieve. What we’re missing is a clear yardstick for how high we should set our sights and what’s needed to create step-change improvements. An important starting point is cost – where healthcare spend approaches 20 percent of US GDP and comparable percentages of household income. The unrelenting growth in the cost burden of care has triggered an urgency that can no longer be ignored. While cost is only one leg of the Triple Aim, the necessary actions to dramatically lower system AND consumer costs will also have a marked impact on outcomes and experience.

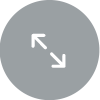

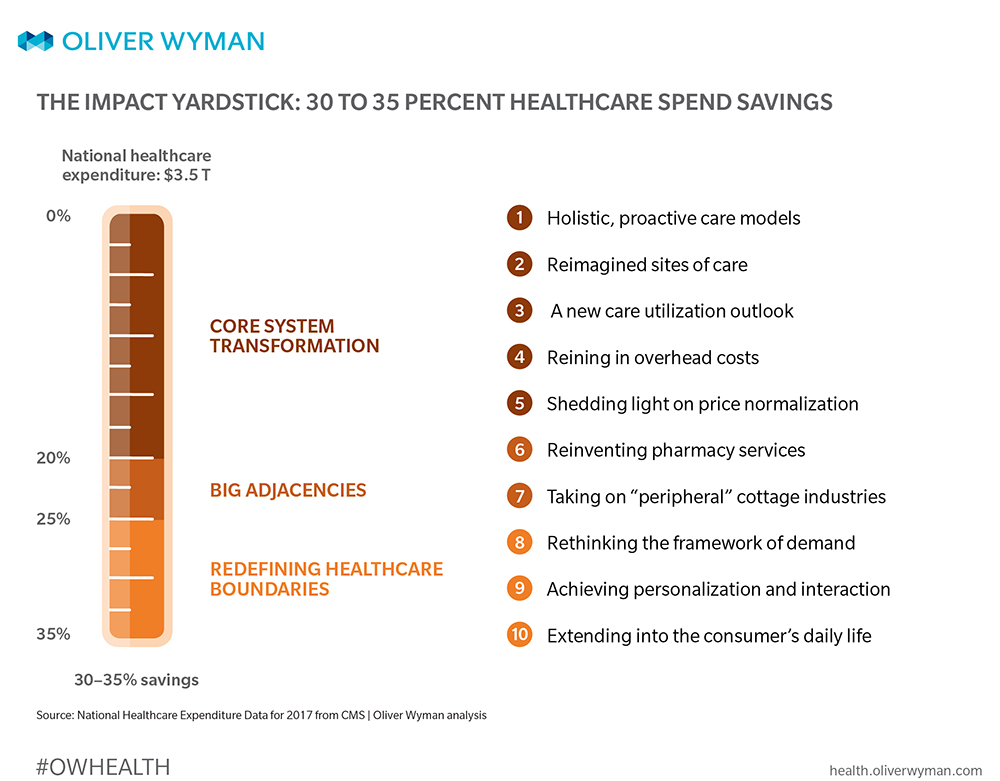

By dissecting today’s $3.5 trillion healthcare economy and mapping potential opportunities to specific areas of spend and consumer hassles, as much as 30 to 35 percent total cost improvement opportunity can be credibly identified.

THE INDUSTRY’S NEW TARGET? OUR AMBITION FOR CHANGE

While we’ve achieved limited aggregate impact so far, there’s incredible opportunity to make progress across an array of levers:

A. Fully executing the transformation playbook for the integrated healthcare industry. The waste, inefficiency, and misalignment of how health plans and health systems work together to deliver care today are the sources of at least 20 percent in cost-savings opportunity. These levers are a familiar agenda for the industry – but remain largely unaddressed by isolated, tepid efforts to restructure how the industry delivers care and engages people in their health.

B. Confronting the big adjacencies. Adjacent to the core structures between health plans and health systems are key areas that must move to the foreground: pharma services and the spend that happens in post-acute, long-term care, and home settings. These have been separated from most industry transformation efforts and represent important drivers of both costs (20 percent of total spend) and outcomes. Transformation in these domains represents at least five percent of total cost savings opportunity.

C. Redefining the “sick care”-healthcare boundary. Transforming healthcare can’t stop at improving how the industry treats people who are sick or in need of care. It must also extend to how people live their lives, affecting the dynamics that shape our healthcare needs and health-seeking behaviors. These levers, while notoriously stubborn to move, can deliver an additional five to ten percent cost savings and, importantly, change the pace at which healthcare spend is growing.

Changes in supply structure have muted impact if demand patterns don’t concurrently evolve. Siloed innovation, although a good start, will leave us well short of the potential impact this portfolio could deliver.

THE CORE TRANSFORMATION PLAYBOOK: FIVE LEVERS WE CAN PULL TO SPARK IMPACT

Analysis of the current healthcare system’s failures – customer frustration, uneven quality, escalating costs, and deterioration in the health of our communities – has yielded a set of transformations many in the industry now view as inevitable. These plays have been the focus of innovation investment – both from within the industry and from newcomers. We have discussed necessary innovation and have celebrated innovators who have developed proven solutions. And yet impacts have mostly been limited to narrow pilots. The potential is there – adding the levers described below can drive cost savings above 20 percent – but getting there requires dramatically improved innovations and much wider diffusion and adoption.

Aggressively pulling the following ten corresponding levers below can trigger transformation: (And their combined interaction makes each lever more effective!)

1. HOLISTIC, PROACTIVE CARE MODELS

Purpose-built models against specific cohorts (especially high-risk, complex cohorts) can deliver incredible results. The likes of CareMore Health, Iora Health, ChenMed, and Oak Street Health have shown us the way. They integrate multiple disciplines, including behavioral health, nutrition, and pharmacy. They build treatment plans for the “whole person” rather than a specific symptom or event. They are proactive in touching patients on an ongoing basis. And they work – dramatically changing both cost and outcomes for patients with the greatest needs. But we need faster, bigger adoption – we should have at least 25 million complex patients managed under these models, and we can’t wait for innovators to build one clinic at a time, when collectively they only touch around 400,000 lives today. So, what can help us close the gap? Incumbent providers must start segmenting their clinical and operating models to tackle this challenging top-of-the-pyramid head-on. We must be intentional in delivering different kinds of care to different population cohorts. We need more partnerships that serve as scale multipliers – such as Walgreens and Humana delivering high-intensity care models across a retail footprint, or Oak Street and Advocate collaborating on an “extensivist” clinic. Where there isn’t sufficient population density, we need to lean into digital, closed-loop alternatives that can support advanced chronic disease patients, limit disease progression, and prevent costly complications. While additional care model advances will certainly emerge with advances in genomics and related technologies, we already have proven models that need to find their way to scale implementation.

2. REIMAGINED SITES OF CARE

There’s been significant industry-wide focus on “downshifting care” to lower-cost delivery environments – from inpatient to outpatient to ambulatory to clinics. The emergence of convenient, retail, and tech-driven access points has pushed the shift a step further – moving care outside of traditional channels and making it more on-demand. Pulling this lever to the max requires a reimagining of care hubs and educating consumers in three specific ways: (1) embracing more digital-first approaches to both transactional and chronic care – digital first needs to be the default status, not the innovative “new thing” (an estimated 30 percent of ambulatory visits could be delivered through virtual care); (2) advancing self-guided care that eliminates the need for downstream interactions – using more sophisticated technology interfaces as a “free” substitute for many avoidable visits; and (3) harnessing the home as delivery hub – not just for front-end-of-care needs, but also acute and post-acute management. These innovations can create impact across the entire population pyramid, from managing complex patients toward more cost-effective, consumer-friendly high-touch settings, to the large volumes of transactional care among today’s healthy (and largely unmanaged) population. With these newly configured assets, the regulatory, benefit design, and payment structures will then need to realign to deliver value to consumers. The industry’s massive fixed investment in expensive hospital campus infrastructure slows progress on this lever, but the economic advantages of new sites are providing relentless pressure.

3. UTILIZATION OF CARE

Care delivery’s reduction of unnecessary variation, overuse, and duplication was once primarily up to payers’ antiquated utilization-management programs. These frequently strain consumers (especially disenfranchised consumers), warping both incentives and outcomes. There must be a shift towards proactive, tailored approaches. This can happen by rooting out and improving care appropriateness at the clinician level where variation of care leads to $210 billion of unwarranted spend. Or, by completely rethinking how and when to target individuals – not populations of individuals – to better align interventions like disease management programs that reduce the likelihood of major health events.

4. REINING IN OVERHEAD COSTS

An astounding 60 percent of healthcare workers aren’t involved in care delivery. Huge swaths of resources simply manage complex system interactions – from coding to claims processing to prior authorizations. Most healthcare organizations are conscious of reining in overhead costs, but they tend to rely on labor efficiency. Step-change improvements require very different administrative processes – automating or eliminating steps or even whole processes, underpinned by technology and new operating models. Should coverage verification involve office staff? Should network credentialing and directory management be an entire department? There’s a long list across the value chain. Industry after industry has realized redefinition of core processes as they move toward digitization and industry-level utilities – it’s time for healthcare to begin that journey.

5. SHEDDING LIGHT ON PRICE NORMALIZATION

Healthcare is plagued by highly variable pricing caused by complex and opaque contracting, reimbursement, and supply-chain structures. This variability is hidden from consumers and employers within complex benefit structures. But there’s evidence deeper price transparency can prove useful to consumers when shoppable services with clear price points and quality data drive decision-making. Some examples include the disruption stand-alone radiology centers are bringing to Houston’s healthcare market or Walmart’s recent announcement of narrowing their contracts to a small number of cost-effective radiology centers. But transparency’s only effective in standard economic units – a radiology exam is relatively easy. We’re painfully short on developing and disseminating a standard taxonomy and on helping consumers understand why there’s an Explanation of Benefits waiting for them in the mail, anyway. Shedding light on an opaque process will spark new market-based behaviors in pricing and underlying operations. But we need a competitive spirit to drive change – one that ignites better control, for sure.

CONFRONTING THE BIG ADJACENCIES

The above playbook is centered on industry integration – where large contracts, expensive procedures, and the highest-risk patients drive disproportionate impact. But when we step back to examine the $3.5 trillion industry, we see two big pools of activity and spend areas not well addressed in that core playbook. Each is significantly contributing to the industry’s rising costs, customer frustration, and poor outcomes – and must become a central part of our impact playbook:

6. REINVENTING PHARMACY SERVICES

Pharmacy represents 13 percent of today’s total healthcare spend and is growing at a worrisome rate. Traditional formulary management, consumer out-of-pocket, and rebate approaches are ill-equipped to handle pharmacy spend growth currently on a trajectory to rival acute spend over the next decade. A robust specialty drugs pipeline is challenging traditional financing and coverage models. Integration of pharmacy and medical services is an important foundational move. But we still need to flip the cost-management model on its head by embracing pharmacy “pyramid management” principles akin to segmented population health. For the very top-of-the-pharmacy pyramid (0.3 percent of people drive over 20 percent of pharmacy spend), we need new classes of purpose-built care models and digital solutions in conjunction with tailored therapies. We must dramatically impact the pricing, utilization, care-management sites, and patient experiences around specialty medications – but not just “throw the kitchen sink” at every patient for every disease. We must get patients to take their medications as prescribed – approximately 50 percent of all prescriptions taken in the US aren’t taken according to written instructions. We need greater patient-level pricing transparency and access to “best price” programs. Taken together, we can slash pharmacy spend by nearly 35 percent – with specialty pharmacy as the major driver. This could have a meaningful impact on healthcare’s bottom line while helping avoid medical costs from unchecked disease progression.

7. TAKING ON “PERIPHERAL” COTTAGE INDUSTRIES

Most health systems define scope through things like the hospitals, clinics, and physicians at the core “continuum of care” for many health episodes. But there’s a large, growing care portion that falls into the “other” category – in post-acute settings, rehab and therapy centers, long-term care, and at home. These sectors are notoriously fragmented, often with small operators across a single geography. They have widely variable practices (and therefore widely variable quality). As we seek inexpensive acute care settings across the board, costs and outcomes across these settings will only become more important. The play to create structure and standardization in these sectors will be critical. Whether through consolidation into larger regional and national entities, greater alignment and integration with local health systems or payers, or the impact of scrutiny, measurement, and industrialization – bringing these cottage industries into the 21st century is essential. The economic impacts of these inefficient, unmanaged delivery models contribute to our cost and outcome challenges. Across these settings, we spend more than $300 billion. Savings of between 10 and 15 percent can materialize through a shift towards innovators’ effective economic models. And as organizations such as Humana make moves – like its Kindred acquisition, for instance – the benchmark of what “good” looks like will keep rising.

These siloed categories represent real savings opportunities – almost five percent of total spending. Failing to address them leaves the whole system vulnerable to ongoing outcome and cost deterioration.

IS IT HEALTHCARE, OR JUST “SICK CARE?”

The healthcare industry has fundamentally been a “sick care” industry – organized to finance and deliver care in response to consumers with needs. Within this $3.5 trillion context, we can see a path (albeit a challenging one) to reduce healthcare spend by 20 to 25 percent and transform both experiences and outcomes described in the above playbook. This cannot just be a supply side agenda. We need consumers who are aware of, confident in, and ready to adopt more efficacious models. For example, scaling new front-end care models won’t change care patterns if consumers still seek care in expensive hospital settings. Changing care consumption patterns inside the “sick care” system isn’t enough. We must affect underlying drivers of healthcare demand – and reach beyond traditional boundaries to do so.

This is our next frontier:

8. RETHINKING THE FRAMEWORK OF DEMAND

A big factor that shapes how everyone seeks and accesses care is how health insurance – both private and government – structures decisions. This framework, for reasons of risk aggregation and administrative simplicity, has largely been one-size-fits-all. Large groups of people receive the same benefits, regardless of needs and preferences. We must better align how healthcare (not just “sick care”) is packaged, purchased, and mediated with people’s true needs. Sophisticated risk adjustment and predictive models are primed to help players tailor risk pools and unlock more sophisticated pricing. This can, and should lead to different segmented or truly mass-customized products (such as lifetime value products, subscription models, or health and wealth convergence) – and unlock growing consumer choice market segments.

9. ACHIEVING PERSONALIZATION AND INTERACTION

In the context of a patient/doctor encounter, the physician is trained to discover, contextualize, and interpret someone’s unique needs. By contrast, all other aspects of how a consumer interacts with the system largely lack context, knowledge, and intelligence. Advances at the intersection of big data, advanced analytics, machine learning, and genomics are enabling marked improvements in customized solutions. We’ve likely only scratched the surface of what’s possible in the next half decade – especially in terms of pooling demand/risk, the specialization of care models, targeting therapies, and streamlining processes to reduce consumer frustration. A key industry impact battleground will be won through increased levels of consumer-centric personalization – especially as people assume the burden of more healthcare costs. In our increasingly data rich and data accessible society, making the system “smarter” about the consumer can have profound impact.

10. EXTENDING INTO THE CONSUMER’S DAILY LIFE

Healthcare’s supply side has been positioned as largely reactive. The consumer presents herself to the system at point of need, like a symptom or event. Most consumers would likely prefer their healthcare providers not become involved beyond that model. However, we know the most effective care models extend their reach beyond episodic encounters, using monitoring, coaching, and engagement to effectively drive compliance and change. Early evidence of digitally supported monitoring and coaching platforms in chronic disease management shows promise. As our mobile platforms become more health aware and more deeply integrated into, well, everything, this always-on, ubiquitous connectivity offers great promise for a level of activation and behavior modification once impossible through infrequent, in-person mechanisms.

Impacting Demand: A Case Study

From 1980 to 2000, treatment improvements and better education on risk factors cut heart disease-related mortality by half (from 543 deaths per 100,000 to 267). However, the US continues to lead the G7 nations (Canada, France, Germany, Italy, Japan, the United Kingdom, and the US) in cardiovascular mortality. There remains significant headroom to materially impact the demand side, especially long term. The Centers for Disease Control and Prevention’s (CDC) Million Hearts® initiative found less than half of hypertension sufferers have their condition under adequate control and just 61 percent take their recommended daily aspirin. Only 55 percent of those with high cholesterol are receiving adequate treatment. There’s ample room for Americans to improve their lifestyle and diet choices – nearly one-third report engaging in less than 10 minutes of weekly physical activity, and average sodium intake in adults was 50 percent higher than recommended. These factors drove 415,000 preventable deaths in 2016 and resulted in $32.7 billion in cost (that’s one percent of total healthcare spend). The CDC has targeted a six percent reduction in these events (or, $2 billion in savings) by encouraging traditional intervention strategies. Personalization and proactive influencing of patient behaviors can magnify this impact – potentially preventing 25 percent of these deaths and saving $8.6 billion. Such improvements would bring US cardiovascular mortality on par with the G7 nations.

Implementing these plays can significantly hinder disease progression across multiple conditions. Across the G7 nations, the US sees the highest mortality rates overall and the highest death rates from major chronic conditions like cardiovascular disease, endocrine/metabolic diseases, and pulmonary disease. A whopping $300 billion (nine percent of healthcare spend) was caused by non-adherence to drug treatments. Dropping the incidence rate of metabolic disease and diabetes to align with the G7 average would save $26 billion. It’s impossible to know how much future influence we’ll have on people’s behaviors and how much potential these drivers can deliver. However, given the available headroom in many of these conditions and digital and personalization advances, we believe addressing these demand side drivers can reduce overall spend by an additional five to ten percent, better aligning our lagging health outcomes with that of other developed nations’.

FINDING THE ACCELERANTS TO IMPACT

Driving 30 to 35 percent cost improvement and similar experience and outcome step-changes won’t occur with campfires of innovation. We need hundreds, if not thousands, of organizations promoting and executing this impact playbook, changing the face of supply and demand. But what are the catalysts for systemic improvement at scale? What are the ways to accelerate requisite shifts beyond the regulatory pen? We see several important initiatives that require multi-stakeholder energy:

- Creating taxonomy for an expanded definition of “healthcare.” We’ve built a “sick care” industry with a corresponding benefit stack, network structure, formulary, and set of rules (episodes, encounters, and codes). When solutions don’t cleanly fill into a claim (such as digital/engagement models that are “always on”), it can take months – if not years – to work through the red tape of getting consumers access to effective models. As the industry expands to include factors like nutrition, stress, sleep, and companionship – not to mention alternative ways of receiving care and support – the lack of a common, structured framework to categorize both factors and the associated interventions has been a big impediment.

- Breaking down community silos. While healthcare can still be based on competitive principles, we must move beyond local market structures of leverage, share, and negotiating power as the axis of success. There’s valuable opportunity for the many actors in a given community to rally around shared action and impact targets – deploying integrated approaches to mental health access, collaboratively launching care models for high-risk populations, unifying the front-end experience, addressing health drivers such as housing, food security, and more. We need much greater coordination and integration of efforts like West Side United in Chicago or what ProMedica has helped catalyze in Toledo to root out major inhibitors of health improvement in impoverished areas. This likely requires employers to band together to set heightened expectations – marrying supply with demand to foster new ecosystems and promote wide-scale adoption of innovative models.

- A new leadership and accountability model. When growth and margin performance are facing off against the IHI Triple Aim, business objectives tend to speak the loudest. But the two need not be mutually exclusive. Boards and leadership teams that embrace an impact and innovation mindset will be successful stewards of investor, community, and consumer responsibility. They will become part of a sustainability legacy for generations to come.

Even within the constraints of the US healthcare structure, achieving North Star impact would put the country on sustainable footing. It’s time to move towards an ambitious playbook and hold the industry to a quantifiable yardstick.