The Administration announced on July 7th it would suspend collections and payments under the risk adjustment program for the 2017 benefit year. The Centers for Medicare and Medicaid Services (CMS) indicated this action was the result of a ruling issued in the United States District Court for the District of New Mexico on February 28, 2018, ordering CMS vacate the use of the statewide average premium in the risk adjustment transfer formula for the 2014 to 2018 benefit years.

The court case was filed by New Mexico Health Connections, a consumer operated and oriented plan (CO-OP), contesting items such as the use of a statewide average premium instead of carrier-specific average premiums. The case claimed the use of the statewide average premium penalized carriers offering lower premium plans, while benefiting higher premium plans. The court’s ruling found CMS had not adequately justified their assumption that the Affordable Care Act (ACA) required risk adjustment payments to carriers equal risk adjustment charges collected from carriers within each state, and therefore CMS’s decision to use the statewide average premium rather than a carrier’s own average premium in the calculation was “arbitrary and capricious.”

CMS filed a motion for reconsideration of the decision, and a reconsideration hearing was held on June 21, 2018. A ruling related to the reconsideration hearing has not yet been issued. Once a ruling is issued, further appeals could be made. Therefore, it’s unclear what, if any, adjustments will ultimately be made to collections and payments that have already been calculated for plan years 2014 to 2016.

On July 30, 2018, CMS issued a final rule related to its risk adjustment methodology for the 2017 plan year, and indicated this rule would allow them to proceed with assessing charges and making payments for that plan year, as announced in a report released on July 9, 2018. Subsequently on August 8, 2018 CMS issued a proposed rule outlining their proposal to use the statewide average premium in the risk adjustment transfer formula for the 2018 plan year, and are currently seeking public comment.

Given the court case and the public comment period, we thought it might be instructive to evaluate what could happen if each carrier’s charge or payment were recalculated by replacing the statewide average premium with the carrier’s own average premium for the market in each state, while leaving all other aspects of the formula unchanged. As noted in the final rule, this would have required a balancing item by increasing charges, reducing payments, or splitting the difference between charges and payments, since the ACA did authorize and funds were not appropriated to pay any shortfall between calculated payments and charges.

Analysis

To examine the potential financial impact this type of change in methodology could have, we utilized 2016 financial experience at the carrier level for the individual market within each state, and recalculated the transfer amount for each carrier by substituting the carrier’s average premium for the statewide average premium. (We excluded Vermont and Massachusetts, which have merged individual and small group markets for purposes of risk adjustment, and eight other states for which we could not reconcile our various data sources within a reasonable tolerance.) After these exclusions, our analysis included roughly 90 percent of nationwide membership in the individual market.

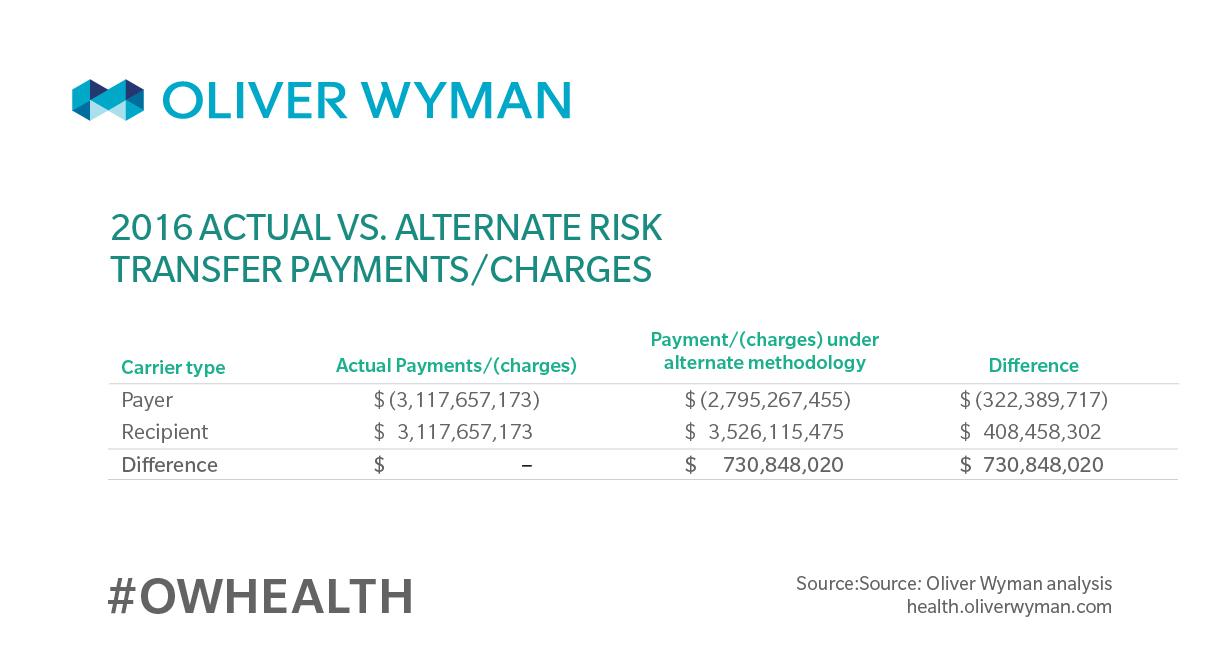

As summarized in Table 1, our analysis shows carriers assessed risk adjustment charges for benefit year 2016 would generally be assessed a smaller charge under the alternate methodology, while carriers that received payments for 2016 would generally have a larger calculated payment under the alternate methodology. In total, charges paid into the risk adjustment program would be roughly $731 million less than the calculated payments received under the alternate methodology for these states.

Even if risk adjustment payments were not required to equal risk adjustment charges by law, the unfunded shortfall would require appropriations at either the state or federal level. In our estimation, this would be unlikely. Based on the 2016 modeling, the appropriations would likely need to be greater than $731 million, as our analysis does not include ten states or the small group market.

To understand the potential impact of the lack of an appropriation, we developed estimates of risk transfer payments and charges under two alternatives. Under Alternative 1, we assume payments would be scaled back to equal total charges. Under Alternative 1, carriers that were recipients of risk transfer payments for the 2016 plan year would have their payments scaled back by roughly $322 million relative to what they actually received. Under Alternative 2, we assume charges would be increased to equal total payments. Under Alternative 2, carriers assessed charges for the 2016 plan year would have the charges increased by roughly $408 million relative to what they actually paid for 2016. Analysis of splitting the difference was not performed since results would be roughly similar in aggregate to the current methodology.

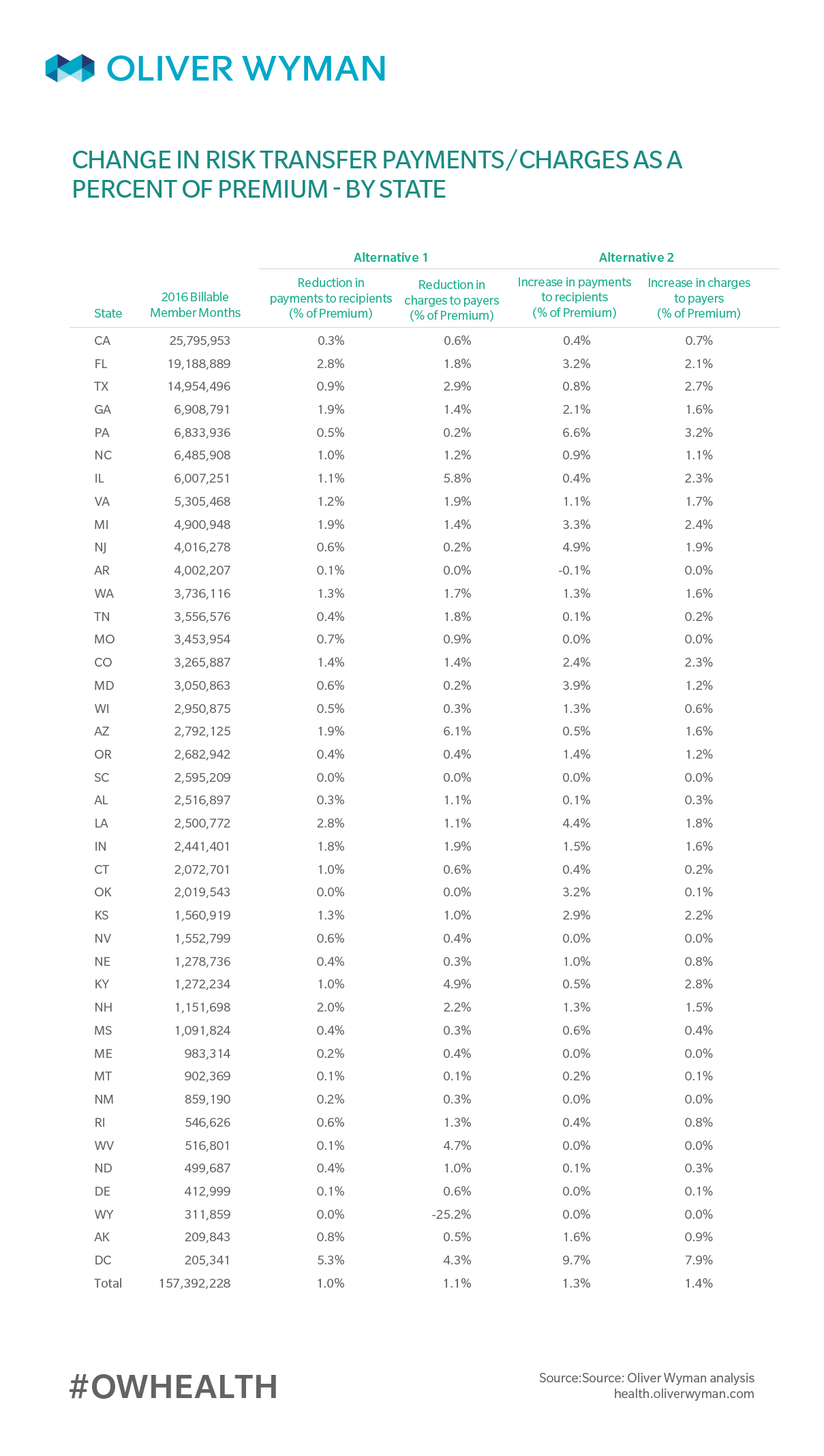

As shown in Table 4 (at the end of this article), the impact of these alternate methodologies would vary by state, ranging from no impact in Wyoming and South Carolina to significant changes in the District of Columbia. On average, across all states we examined, the impact on charges and payments to carriers is estimated to be roughly 1 percent of premium under Alternative 1 and slightly higher under Alternative 2.

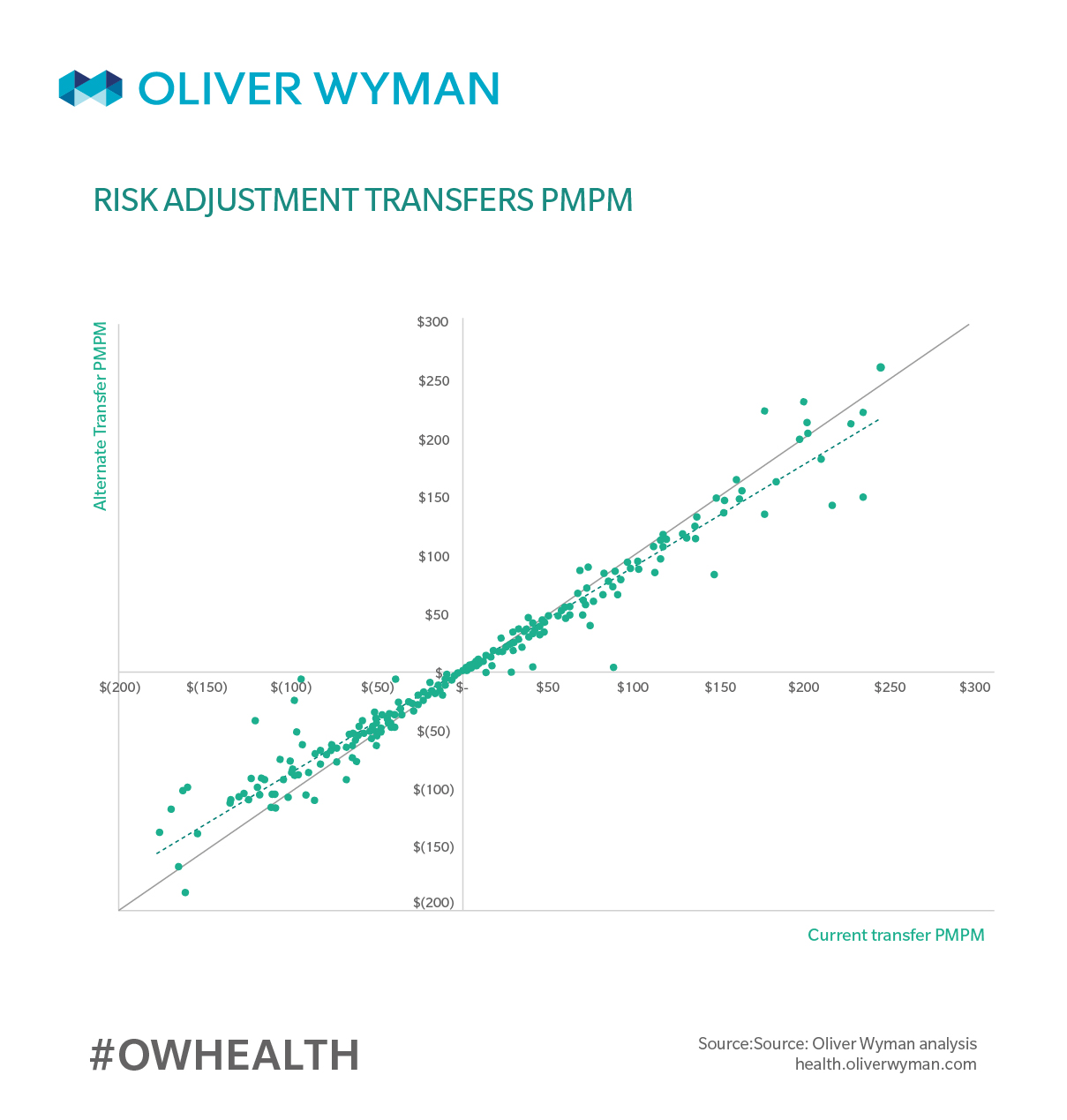

Not only would the impact vary by state, but it would also vary by carrier within each state. The below chart, Table 2, compares the 2016 risk transfer payments and charges for each carrier under CMS’s methodology (x-axis) to the risk transfer payments and charges for each carrier under Alternative 1 (y-axis), where risk transfer payments to carriers are capped at the total risk transfer charges in the state as calculated under the alternate methodology.

While most carriers assessed charges for 2016 would be assessed smaller charges (those points that fall above the solid line in the lower left quadrant) and most carriers that received payments in 2016 would receive smaller payments under Alternative 1 (those points that fall below the solid line in the upper right quadrant), there are a number of carriers for which this result does not hold true. The results under Alternative 2 are similar – however, most carriers assessed charges for 2016 would be assessed larger charges, and most carriers that received payments in 2016 would receive larger payments.

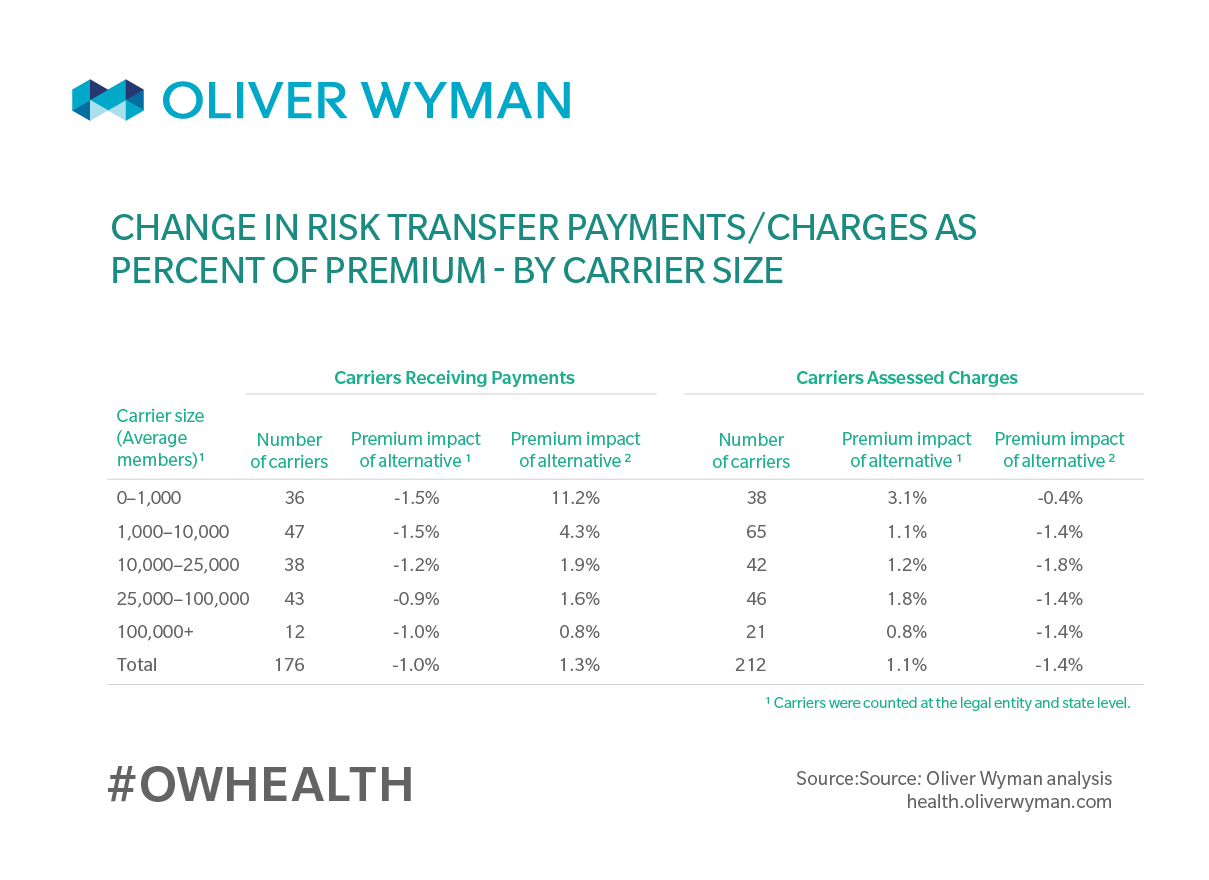

Finally, we examined the results by carrier size within a state. As Table 3 shows, the alternate risk transfer methodologies would generally have a greater percentage impact on smaller carriers than it would for larger carriers. Among the smaller carriers, those that received payments from the risk transfer program for 2016 would have a greater shortfall under the Alternative 1, but receive substantially more under Alternative 2.

The estimated impact of the alternate methodologies examined would vary by state and by carrier. Generally, carriers that are assessed charges under the risk adjustment program today would be expected to be charged less under Alternative 1, and charged more under Alternative 2, while carriers that receive payments from the risk adjustment program would be expected to receive less under Alternative 1, and receive more under Alternative 2. On average, the change in risk transfer amounts under the alternatives would not have dramatic financial ramifications for the market as a whole, at least for 2016, but analysis shows the financial implications are greater for carriers with fewer members. The PMPM difference for some outlier carriers can be dramatic. Further financial pressure on some of the smaller carriers could increase their risk of insolvency or withdrawal from the market, further affecting enrollees in the individual market.