Update: August 3, 2017

As uncertainly over the funding of CSRs continues, we are re-publishing this article originally published in May. In it, Dianna Welch, FSA, MAAA, and Kurt Giesa, FSA, MAAA, of Oliver Wyman Actuarial Consulting argue that issuers are likely to build the cost of unfunded CSR plans into their 2018 on-exchange silver offerings and that this could result in free bronze plan coverage and relatively low-cost gold plans in many markets. We’ve now seen several states (California and Michigan) provide guidance that this is how issuers should reflect unfunded CSRs; and we’ve seen a number of issuers (but not all) take this approach where the state has not been proscriptive, for example BlueCross Blue Shield of Wyoming.

About CSR

The ACA provides tax credits to individuals with low and moderate incomes to help make health insurance premiums more affordable. Under the ACA, premium subsidies are calculated using the difference between the cost of coverage (which is based on the second lowest-cost silver plan available in a market) and affordability (which is based on a percentage of an individual’s income).

To help people with low and moderate incomes manage out-of-pocket costs, the ACA requires payers to provide cost sharing reductions (CSR), which serve to lower deductibles, copayments, and out-of-pocket limits. CSR are only available under silver-level exchange plans, and they are only available to people earning 250 percent or less of the federal poverty level (FPL). Nearly three-quarters of the people (6.8 million) who purchased 2017 health insurance via the federal exchanges had incomes meeting that threshold and thus could qualify for CSR.

Under the ACA, the federal government is supposed to reimburse payers for their cost of providing CSR. For the 2016 benefit year, the government provided $7 billion; for the 2017 benefit year the payments are expected to hit $10 billion, assuming funding continues through year-end. These payments are viewed by some as critical to payers’ continued participation in the ACA exchanges.

Uncertainty of CSR funding

In 2014, House Republicans sued the Obama administration, claiming Congress never appropriated CSR funds. In 2016, a lower federal court agreed with House Republicans and ordered the government to stop making CSR payments, but it allowed the payments to continue while the government appealed the decision.

Industry groups lobbied Congress to incorporate permanent appropriation for CSR payments into the recent spending bill. And many cautioned that not including it would lead to a spike in premiums and seriously damage the exchange market.

However, the $1 trillion spending bill passed by Congress last week did not include permanent appropriation. The decision to continue CSR payments now rests with the executive branch, and the administration has not stated definitively whether or not they will continue.

Payers’ likely reaction to CSR defunding

Payers now find themselves approaching the rate-filing deadline not knowing if they will receive CSR payments in 2018. Many are likely to plan for CSR defunding and attempt to build that into their rates, or file two sets of rates where the regulators will allow it.

Kaiser Family Foundation estimates that defunding CSR payments would cause premiums in silver plans to increase by 19 percent. Payers could raise premiums across all plans, but we think that is unlikely because raising the price on other metal-level plans could price exchange plans out of the market and cause consumers to seek less-expensive off-exchange plans.

Of course, payer responses to CSR defunding will be influenced by local market dynamics. For example, payers that face a difficult regulatory environment, or are unwilling (or unable) to accept a large influx of new members if other insurers leave the market may choose to exit the exchanges themselves. So might those that view the overall uncertainty of this market as being too much risk to bear.

However, we can assume that some payers will respond to CSR defunding by significantly raising rates on their exchange silver plan premiums. For the purposes of this illustration, we have assumed that payers would price their silver plans using a weighted average of the 94 and 87 percent CSR plans—an actuarial value (AV) of roughly 91 percent. This is based on the assumption that individuals eligible for CSR plans with a more moderate cost-sharing element (73 percent AV), as well as those who are enrolled in silver plans but not eligible for CSR, would move to bronze or gold plans rather than subsidize those enrollees eligible for higher CSR.

The twist

Because subsidies in 2018 will be based on the cost of the second lowest-cost silver plan, any increase in those premium rates will cause subsidies to increase in parallel.

In fact, according to our projections, subsidies could increase to the extent that they would actually exceed the cost of a bronze plan for many lower-income enrollees. A substantial portion of the nearly 7 million marketplace enrollees eligible for CSR could receive a bronze-level plan for no cost, or upgrade to a gold-level plan at very low premiums.

Two market scenarios

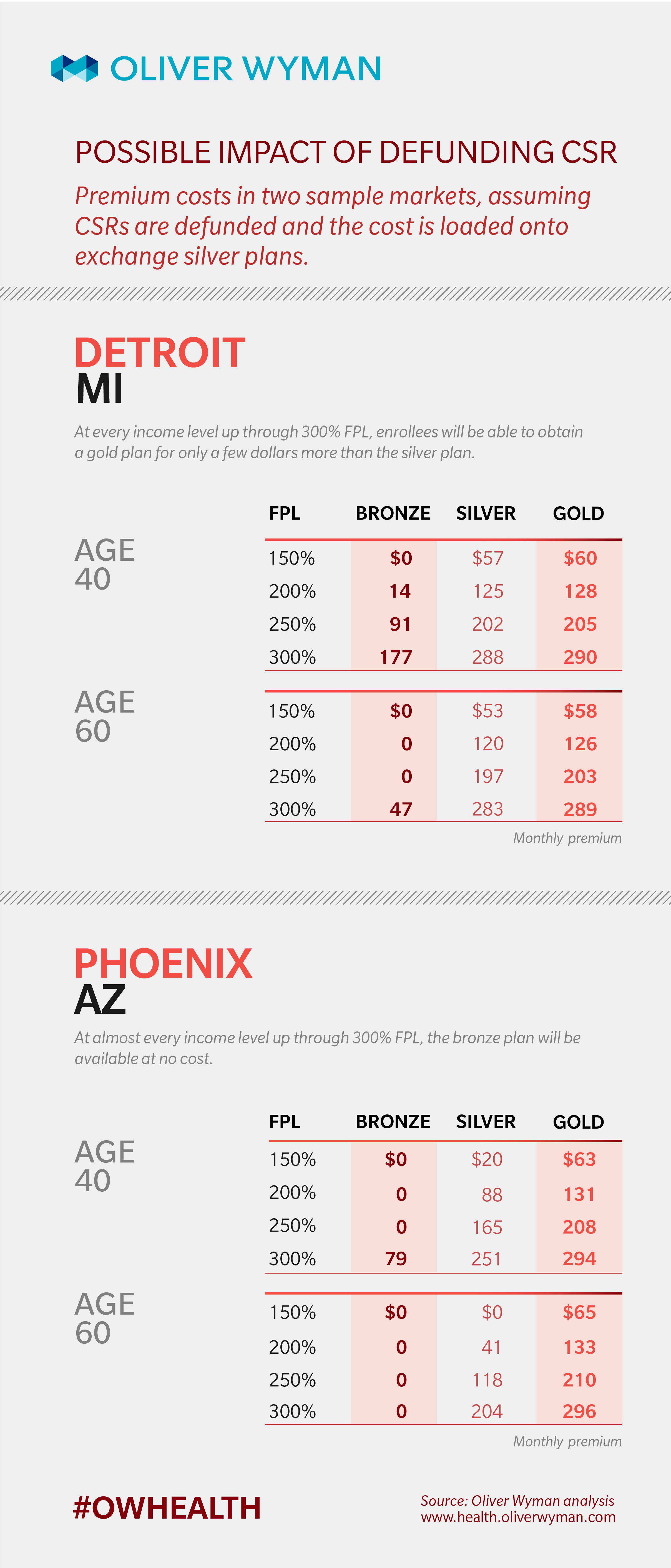

In the table below, we show how premium levels could change using actual 2017 premiums for a 40-year-old and a 60-year-old in Phoenix, Arizona, a relatively high-cost area; and a 40-year-old and 60-year-old in Detroit, Michigan, a relatively low-cost area.

The projection shows that if CSR is defunded and payers load the cost onto silver plans assuming a 91 percent AV, the structure of the premium subsidies would translate to very low-cost or no-cost plans for most low- and middle-income consumers.

According to our projections, a 40-year-old in Phoenix earning up through 250 percent of FPL would be able to obtain a bronze plan for no cost. Meanwhile, a 60-year-old in Phoenix earning up through 300 percent FPL would be able to get a bronze plan for no cost; and a 60-year-old earning 150 percent FPL could get a gold plan for just $65 per month.

In Detroit, both 40-year-olds and 60-year-olds earning up through 300 percent FPL could obtain a gold plan at essentially the same cost of a silver plan.

Market impact

With or without CSR payments, profitability and growth in today’s complex market will only come from identifying key consumer segments and then targeting products that engage consumers in meaningful ways. The availability of no- or lower-cost bronze and gold plans could lead to a shift in enrollment between metal-level plans. It might also encourage some subsidy-eligible people who have not previously purchased plans to enroll. Payers may want to revisit their product portfolio to ensure that the plans they will be bringing to market in 2018 reflect the possibility that CSR will not be funded. They should also be prepared for the possibility that competitors could react to defunding by raising rates on silver plans, and that could dramatically change consumers’ preferences.

At the very least, payers will want to carefully consider how they build the cost of unfunded CSR into their own 2018 premiums.

As we noted, payers are facing tremendous uncertainty in setting premiums and strategy for the individual market. The potential lack of CSR funding—and how a payer’s enrollees and competitors will respond to it—is one of the greatest. Yet as our analysis shows, CSR defunding may also create opportunities, and payers should be prepared to capitalize on these.