Update: August 24, 2017

With health reform on pause, many states are exploring options to stabilize the individual insurance market within the parameters of the Affordable Care Act (ACA). And that is leading to increased interest in state waivers.

Under the ACA, states can apply to change some elements of the law related to private health insurance. Specifically, Section 1332 gives states the ability to waive provisions of the ACA and deploy their own health insurance strategies, but still receive full federal funding. Several states have already pursued this strategy. Hawaii’s waiver application was approved in late-2016 and Alaska’s waiver was approved in July. 1332 waivers have been touted by the Trump administration as a way to help stabilize the individual health insurance market, and a number of additional states are testing the 1332 waters. Just this week, Iowa submitted its final waiver application, and on August 16 Oklahoma submitted its waiver application. Both states are seeking expedited review and approval process.

For payers in the states considering waiver applications, there is an opportunity to work with policymakers and influence the state’s approach to stabilizing the individual health insurance market. But first, payers need to understand the process, pitfalls, and possibilities of the 1332 waiver, as it exists under current law. Oliver Wyman Actuarial Consultants were behind the modeling that supported the 1332 waiver applications of both Hawaii and Alaska. Here, Tammy Tomczyk, FSA, FCA, MAAA, and Ryan Mueller, FSA, MAAA, of Oliver Wyman Actuarial Consulting give an insider’s view of the 1332 process and detail how states might use the waiver as it exists today.

What are 1332 waivers, exactly?

Under Section 1332, states can apply to alter or waive the following provisions of the ACA and the Internal Revenue Code (IRC):

Qualified Health Plans: States may revise the list of benefits that typically must be covered by plans sold through the Marketplace, including essential health benefits, cost sharing limitations, metal-tier (Platinum, Gold, Silver, Bronze) requirements, and definitions related to markets and employer size.

Health Insurance Marketplaces: States can put in place alternate ways for individuals and/or groups to enroll in coverage and receive financial assistance, revise enrollment periods, define risk pools, and revise limitations on coverage to citizens and lawful residents.

Financial Assistance: States can alter both the ACA rules and IRC provisions related to tax credits and cost sharing reduction subsidies. These include required family contributions, the benchmark used to calculate the amount of the subsidies, and the definition of minimum essential coverage.

Individual Mandate: States can modify the IRC requirement that most individuals have minimum essential coverage or pay a financial penalty.

Employer Mandate: States can modify the IRC requirement that employers with 50 or more employees must offer coverage to employees working 30 or more hours per week.

What are the 1332 requirements?

As part of the waiver application, states must demonstrate that key requirements of the ACA will still be met. The waiver “guardrails” include:

Premium and cost-sharing levels are as affordable as they would have been absent the waiver

Coverage is at least as comprehensive as would have been provided absent the waiver

Coverage is provided to at least a comparable number of residents as would have been absent the waiver

The federal deficit may not increase under the waiver

How does a state receive a waiver?

First, legislation must be enacted authorizing the state to pursue a 1332 waiver. States must then draft an application identifying the provisions of the law they intend to waive and the rationale for the request.

The application must include a detailed 10-year budget, including actuarial analyses and certifications, economic analyses, data and assumptions, and other necessary information to support the state’s estimates that the waiver will comply with each of the required guardrails. The application must also include a detailed plan outlining how the state will implement the waiver, including a timeline.

The time required to complete these analyses will vary based on the type of waiver being requested by the state. Oliver Wyman’s work to complete the actuarial analyses for Alaska and Hawaii, which included detailed microsimulation modeling, took about six weeks to complete. Other more complex waivers, especially those that are combined with an 1115 waiver, could take longer to model. (Section 1115 Medicaid demonstration waivers give states considerable flexibility in how they operate their Medicaid program.)

Prior to submitting their application, states must provide public notice and hold a public hearing. Once the application is submitted, an additional federal public comment period occurs. HHS and the Treasury Department then have 180 days to issue their final decision. Waivers may be approved for up to five years.

What are states trying to achieve with 1332 waivers?

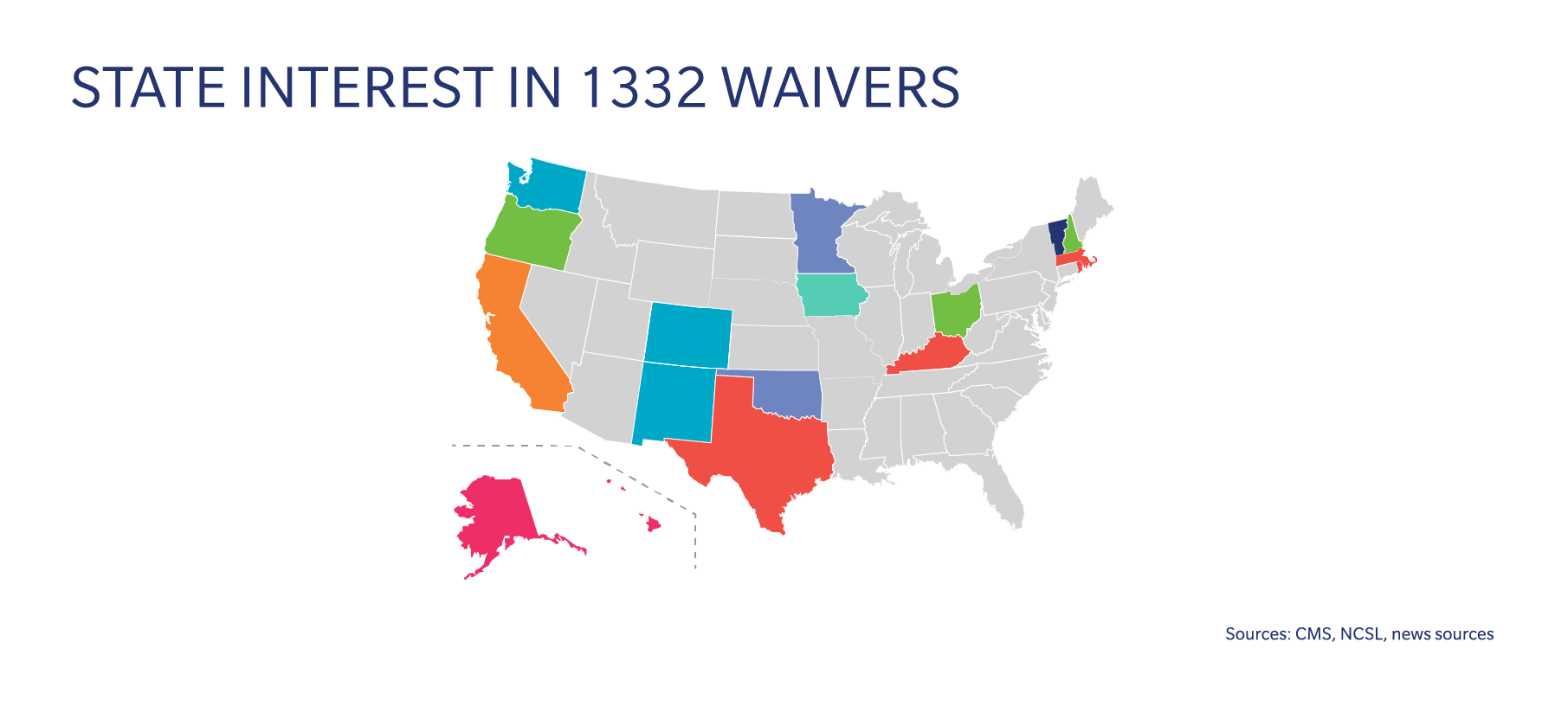

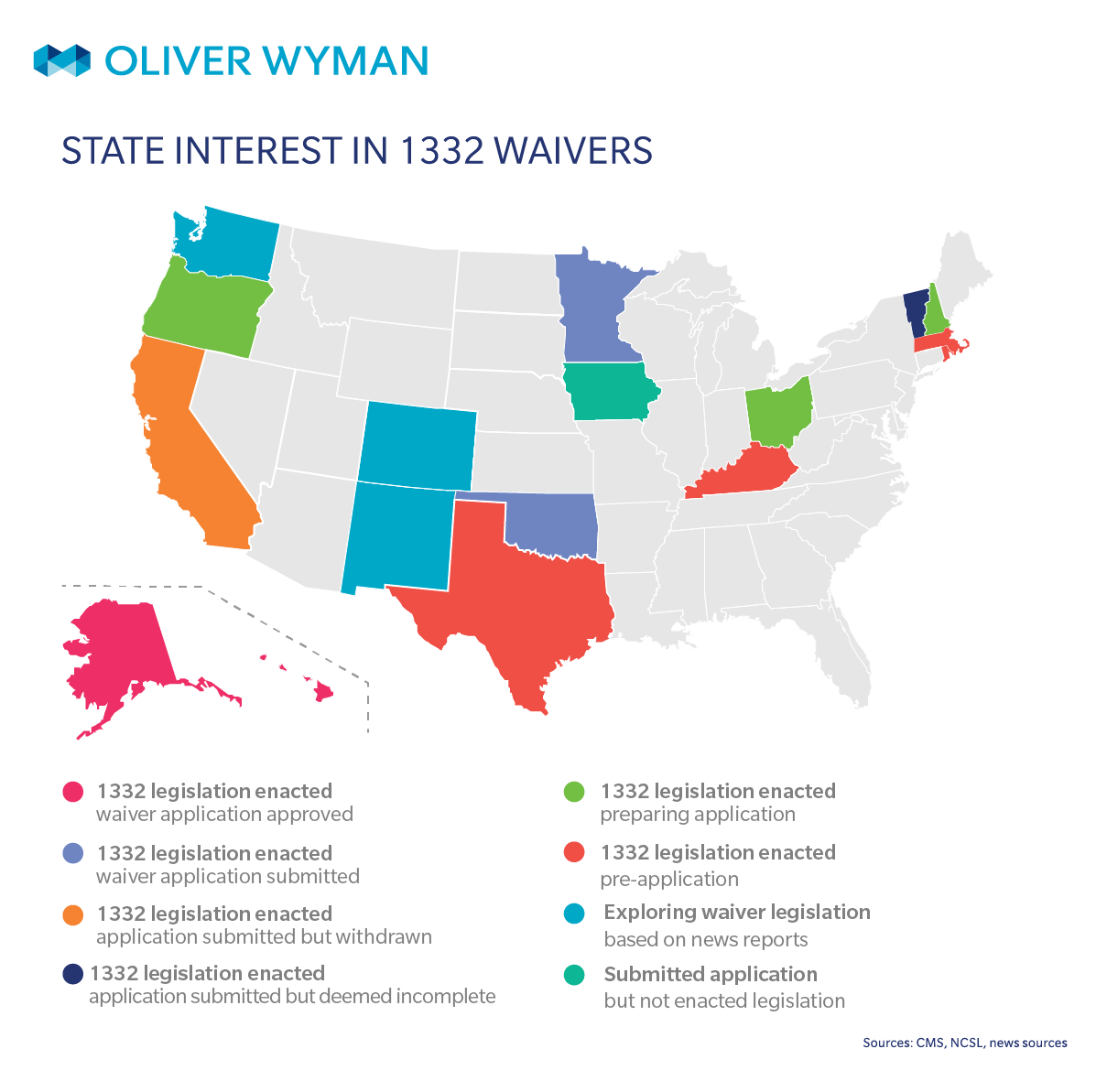

Fourteen states so far have passed 1332 legislation. The states are pursuing a variety of strategies via their waivers and are in varying stages of the process. Alaska’s waiver is based on federal support for a state-managed reinsurance program. The rationale behind their waiver is that relieving payers of costs associated with high-risk individuals will serve to reduce premiums in the individual market. Under the waiver, the federal government will contribute (roughly) the amount it will “save” on premium subsidies to the State’s new reinsurance program. (Read more about Alaska’s 1332 waiver here.)

Iowa, which submitted its final application on August 21, is proposing a stopgap measure for plan year 2018. The stopgap measure is designed to provide a short-term insurance solution, and it proposes restructuring federally funded premium and cost sharing subsidies through a reinsurance program and a state-specific premium subsidy structure. Specifically, it proposes:

- A single, standard plan be made available by each carrier participating in the individual market

- A flat per member per month premium credit, with credits based on age and income

- A reinsurance program that reimburses payers for high-cost claimants

According to the application, 15,000 additional individuals will be enrolled under the stopgap measure. However, if the stopgap measure is not approved by CMS and thus the pass-through funding is not authorized, Iowa will not move forward with the stopgap measure.

Minnesota, Oklahoma, Oregon, and New Hampshire have all passed 1332 legislation and are in the process of preparing their waiver applications. Each state is using an approach similar to Alaska’s, and are making implementation of the program contingent upon approval of the waiver application.

Minnesota and Oklahoma have already submitted their waiver applications to CMS, while Oregon and New Hampshire have released draft applications. The expected impact of these reinsurance programs varies widely by state, from a roughly 7 percent decline in average premiums in Oregon and New Hampshire, to as much as a 20 percent decline in average premiums in Minnesota and a 34 percent decline in average premiums in Oklahoma. All four states are projecting that the waiver will lead to an increase in the number of insured individuals.

Hawaii, the first state with an approved 1332 application, received approval to waive the requirement for a SHOP exchange (small group exchange, separate from an exchange for individuals). Hawaii’s waiver is unique in that it is not aimed at stabilizing the individual market. Their waiver modifies the coverage requirements of the ACA to align with the state’s Prepaid Health Care Act, a long-standing state law that sets minimum benefit requirements in the employer market. These minimum benefit requirements are actually greater than those that apply to plans sold through a SHOP.

Vermont also sought to alter SHOP requirements. Their waiver would have exempted the state from establishing a SHOP exchange so that small employers could continue to purchase coverage directly from payers but the application was deemed incomplete by HHS.

Ohio, Massachusetts, and Maine enacted legislation and are exploring options for their waiver application. Meanwhile, Kentucky, Texas, and Rhode Island have passed legislation, but do not yet appear to be preparing an application.

Finally, California submitted a waiver application that would have provided undocumented immigrants with unsubsidized coverage through its state exchange. However, the state subsequently withdrew its application.

What are the obstacles to 1332 waivers?

The path to a 1332 waiver is not without challenges. In some states, legislative resistance will stall progress. (Over the past few years, a number of states introduced, but failed to enact 1332 legislation.)

In all states, the 2015 federal guidance on waivers, which established the guardrails for vulnerable classes, currently adds a layer of complexity to the application process. As written, the guidance makes it uncertain that some types of waivers, such as those that revise premium subsidies to vary by age or allow for coverage with lower actuarial values, would be approved. These types of waivers could help attract younger and/or healthier individuals into the market, yet may face obstacles on the way to approval because they would likely result in higher rates for older individuals or higher cost sharing for individuals with serious health issues.

Even if the 2015 guidance is relaxed by the Trump administration, states may struggle to implement certain waivers. HHS previously indicated that the federally facilitated exchange was not able to accommodate state-specific premium tax credit structures, nonstandard enrollment periods, customized plan management review, or changes to the display of plan options.

So, are waivers worth pursuing?

We think that 1332 waivers could serve as a successful vehicle for states trying to stabilize their markets, and we are encouraged by the number of states exploring innovative approaches. It is true that uncertainty exists around the ACA markets and it is unclear how quickly Washington might be able to enact legislation that would stabilize the market. In the meantime, 1332 waivers provide states with a mechanism to take action and implement reforms targeted to their unique socioeconomic make-up, risk pool, and other circumstances.

The waivers also provide payers an opportunity to influence health reform. By educating state agencies and legislators on the potential benefits that a 1332 waiver could bring to their state, and sharing ideas of specific reforms and estimates of the impact that they could have, payers can play an important role in the future of their states’ individual health insurance markets.