Some of the most compelling health insurance products being launched today are based on a partnership between a payer and a provider. Oliver Wyman’s Tomas Mikuckis, with the health services team, explains in a new report “Payer-Provider Partnerships: The Future of Insurance Products” why partnered products matter—and how both healthcare providers and payers can make them a core part of their strategies:

The concept of a health insurance product built around a single provider system, multi-specialty group, Accountable Care Organization (ACO), or Clinically Integrated Network (CIN) may still be in its infancy, but it has already proven its worth. These “partnered products,” as we think they should be called, may look at first like little more than just another flavor of a traditional narrow network. But in fact they are much more. The single system dynamic creates the opportunity for deep partnership around the clinical and financial model, member experience, and marketing that a multi-system approach cannot provide.

Some of the early-mover partnered products have been strikingly successful:

- In New Hampshire, ElevateHealth, developed by Dartmouth-Hitchcock, Elliot Health System, and Harvard Pilgrim, is achieving cost savings of 15 to 20 percent and passing them on to its customers in the form of lower premiums.

- Align, a partnership between Kaleida Health and Blue Cross Blue Shield of Western New York set out to wrap a health plan around a clinically integrated network and lower costs by at least 6 percent.

Innovation Health, a partnership between Inova and Aetna, has developed commercial and Medicare Advantage HMO and PPO products in Northern Virginia, as well as self-insured group products. The first year of product launch in 2013 was a success, achieving growth of 140,000 members.

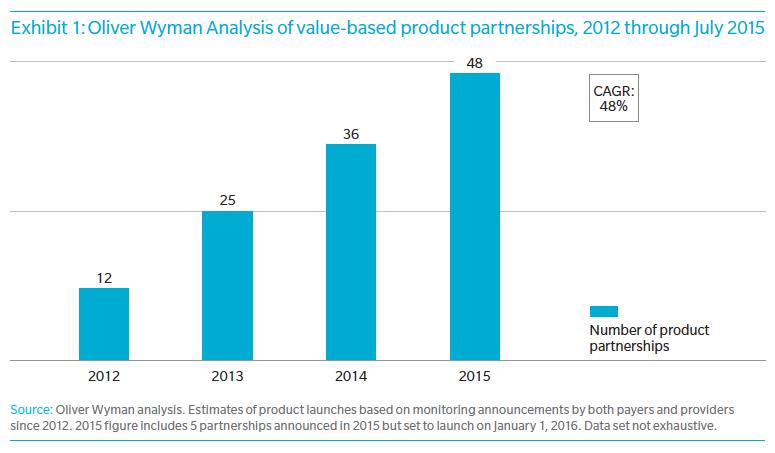

We could cite many more success stories, and based on Oliver Wyman research, value-based product partnerships are accelerating, having doubled in last two years and growing at an annual rate of 48% since 2012 (See Exhibit 1 below). Yet we still encounter payers and providers that balk at the idea of partnered products. Payers tend to regard ACO or CIN productization as too complex a process to be rolled out broadly, requiring near-perfect clinical partners, exclusive (or at least first-mover) relationships, and an unachievable level of collaboration. Providers, for their part, share similar concerns about selecting the right partners—or finding a way to negotiate with payers that doesn’t fall into familiar, unproductive, antagonistic patterns.

There may have been reason to feel this hesitancy two or three years ago, when payers and providers alike were uncertain about how partnered products differed from traditional narrow network products and few players had experience in solving the challenges they pose. But now ACO- and CIN-based products have become more sophisticated and the problems are much better understood. In our work with both payers and providers, we have seen an emerging consensus on how to build, market, and manage partnered insurance products. Productization is becoming a transformation tool that can and should be used by a much broader group of ACOs and CINs than would have been practical only a few years ago.

Learn more about how partnered products create value and how to successfully structure a partnered product arrangement in our full analysis here.