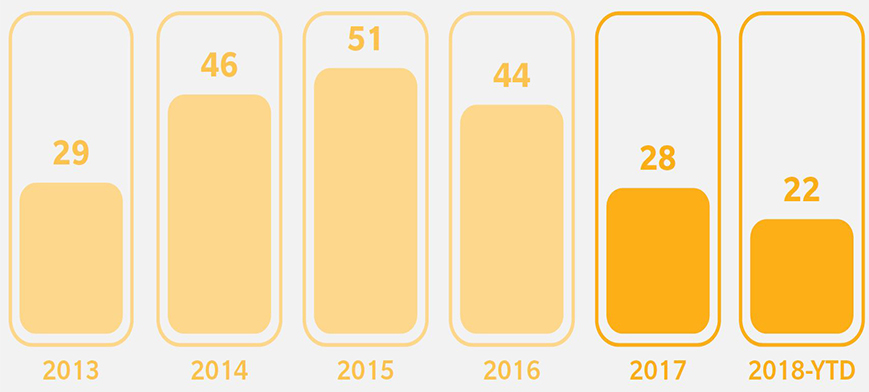

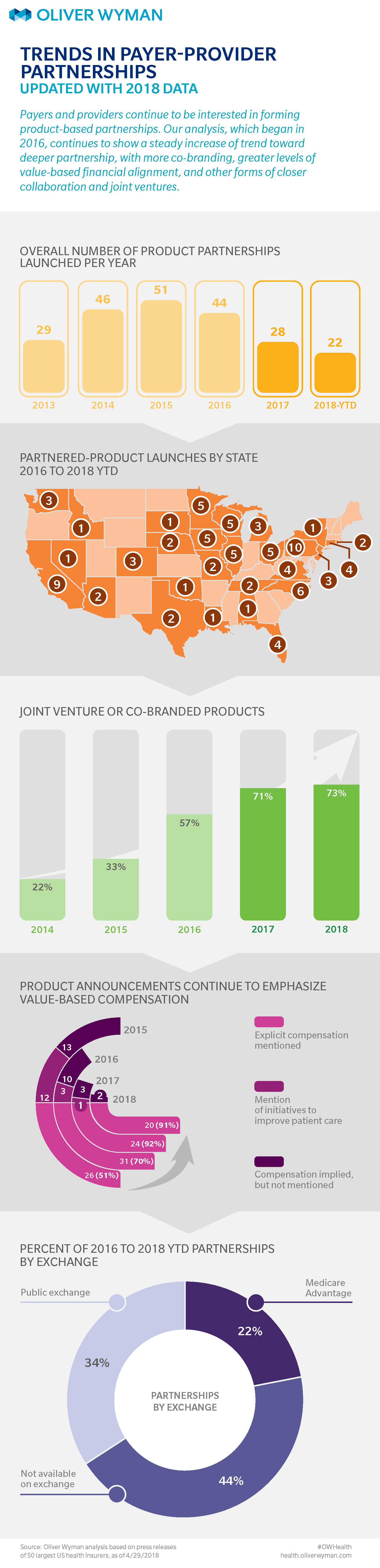

Over the past six years, Oliver Wyman has been tracking payer-provider partnerships and reporting on trends in the space. This infographic includes new data from Q1 2018. To-date, 22 partnered products have launched since 2018, with 73% launched partnerships being fully co-branded or JV insurance products.

Notable recent updates:

A few “new entrants” to the game: Blue Cross Blue Shield Rhode Island (with Lifespan on Public Exchange); Security Health Plan (with Mayo Clinic and Marshfield Clinic Health System for group employers) and WellCare (with UNC Health Alliance in Medicare Advantage). These payers’ initiatives signaled continued interest in payer-provider partnership.

National payers Aetna and Cigna continued their push in this space, with two JVs (with Sutter health and Allina) and a Medicare product being launched by Aetna in 2018 in addition to five new Whole Health partnerships. Cigna will also launch two products, in Phoenix with Arizona Care Network and in San Jose, with Good Samaritan health system and Santa Clara County IPA. On the provider side, Cleveland clinic launched 3 partnerships in 2018, with Humana, Anthem and Oscar.